Cryptocurrency industry veteran, with over a decade of experience, I deeply understand the risks behind the profits in the cryptocurrency industry. While you pursue the lucrative returns brought by hundredfold leverage, I focus more on the potential abyss of risks. Our way of thinking determines our path, and the different perspectives on market trends determine whether you are risking for profits or prudently avoiding risks. The AICoin academic team has carefully designed a set of profit, break-even, and investment strategies, and looks forward to your participation, so that we can escort every penny of your profits together.

Here, I would like to remind everyone: there is no need to overly showcase strength; the key is to gain more recognition. It is more important to do well for yourself than to prove your strength to others. Whether it's a mule or a horse, you'll know once you take it out for a walk. As a professional, I have always been committed to guiding investors to take fewer detours and miss fewer opportunities in this market. Even though I advise earnestly, the path of investment still requires you to explore on your own. Learning is endless, and the experience accumulated is your true wealth!

Finally, the AICoin academic team wishes fans to achieve financial freedom in 2024. Let's go!

AICoin Academic: Ethereum (ETH) Market Analysis and Operation Guide on March 25

First, let's review the trend of Ethereum yesterday. In yesterday's article, we suggested a reference buying point of 3300 and a target price of 3450, successfully earning a space of 150 points. The current price is 3460, with strong bullish momentum, so risk control is needed. The short position accumulation point we mentioned before is 3520, with a stop-loss point near 3550 to prevent a comprehensive outbreak of the bullish trend. Please operate cautiously and closely monitor market changes.

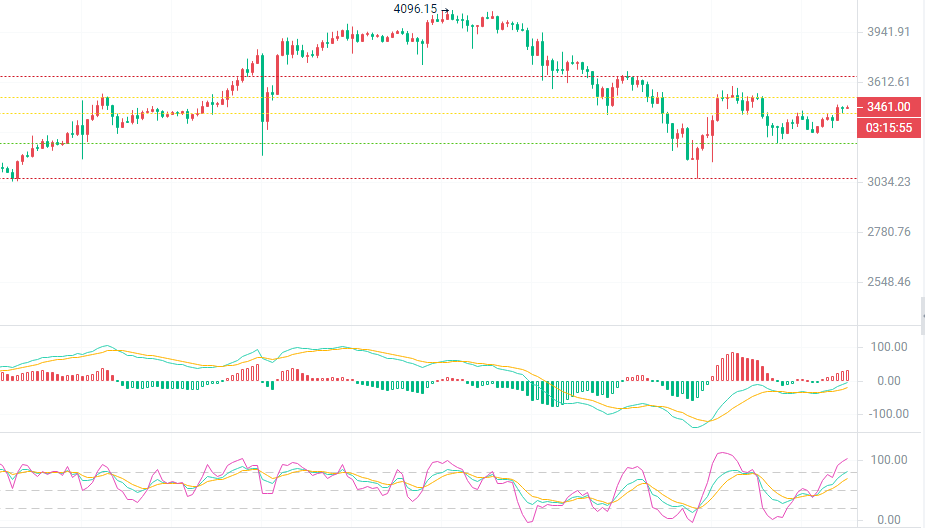

Next, let's analyze today's Ethereum market. The current daily K-line is still within the range of the EMA trend indicator and has not yet broken through the pressure level of 3520. The price is expected to consolidate around 3450 for a period of time, while paying attention to the downside retracement space. The MACD shows that the main force continues to increase positions, and the DIF may cross the 0 axis, which is a signal worth noting. The KDJ is forming a golden cross upwards, the Bollinger Bands show a sideways trend, and the K-line is still in a downward channel. The upper resistance level is 3675, and the important support level below is 3165. The overall daily K-line trend tends towards bullish.

From the perspective of the four-hour ultra-short-term trend, Ethereum may challenge the pressure level of 3520. However, it may be difficult to start a short-term bullish trend because the EMA10 and 15 overlap, increasing the pressure. In terms of MACD, it is necessary to pay attention to the occurrence of large and small volume. If the DEA and DIF alternate downwards, it will mean a trend reversal to bearish. Currently, the DIF and DEA are stretching upwards below the 0 axis. The KDJ is blocked near 3520. The upper resistance level of the Bollinger Bands coincides with the pressure level of the trend indicator EMA at 3520. In summary, the key points have been identified, and prudent investors can wait for a clear trend before operating in the same direction, making it easier to grasp the profit space.

Regarding specific operational strategies, it is recommended to focus on short-term bullish positions. The first buying point for long positions is 3420, the second buying point is 3380, and the stop-loss point is 3350. The first buying point for short positions is 3500, the second buying point is 3550, and the stop-loss point for short positions is 3580. Please note that the above pressure and support levels are for reference only. For actual operations, please refer to real-time market data. If you need more details, feel free to consult the author. The article may be subject to delays in publication, and it is recommended for reference only. Investors should manage their positions reasonably and avoid heavy or full positions. The academician hopes that investors understand that the market is always right. If you make a mistake, you should analyze the reasons and not let the potential profits slip away. There is no need to be smarter than the market in investment. When the trend comes, follow it; when there is no trend, observe and wait. It is not too late to act after waiting for the trend to become clear. Success comes from today's choices. Heaven rewards diligence, earth rewards kindness, people reward sincerity, business rewards trust, industry rewards precision, and art rewards heart. Gains and losses are both in the blink of an eye. Develop the habit of strictly setting stop-loss and take-profit for each trade. The AICoin academician wishes you a pleasant investment experience!

Friendly reminder: The above content is created by the author's public account. The advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。