I am Zhang Lihui, born for trading. If you have any questions, you can always follow me. Recklessly entering the market is foolish, finding the right person is wise. A small boat drifts in the sea. If you don't hoist the sail, you will drift in the sea forever. Lihui currently has deep and unique insights into various currencies in the currency circle. Each analysis is not an emotional game or a release of emotions. Each opening and closing is a professional performance. Lihui strictly demands himself to write each analysis report carefully, and conveys valuable investment thoughts, hoping for value and gain!

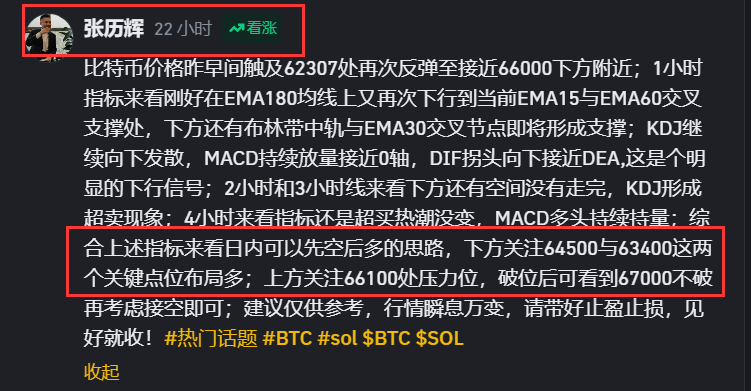

The price of Bitcoin yesterday morning once again provided the idea of shorting first and then going long within the day. Pay attention to the key points of 64500 and 63400 for long positions below; pay attention to the resistance at 66100 above, and consider shorting only after breaking through 67000. The situation is consistent with the basic reference and suggestions. Congratulations to the friends who have realized both short and long positions. As of early this morning, the price of the currency once again broke through to 66430 and formed a slight pullback. Looking at the hourly chart, the Bollinger Bands are opening upwards, KDJ turned upwards and crossed in the early morning, and MACD continues to increase in volume. Looking at the 4-hour chart, the price of the currency is stabilizing above the EMA60 moving average, KDJ is severely oversold, and DIF and DEA are approaching the zero axis upwards. Looking at the daily chart, the price of the currency is between the EMA30 and the middle track of the Bollinger Bands, and the Bollinger Channel is in a forming state. Taking all the above into consideration, the bullish sentiment is quite strong. It is recommended to pay attention to shorting if the upper range of 67500-68200 is not broken; and to go long if the lower range of 65000-64400 is not broken. It is recommended not to chase long positions at high levels, and to beware of being trapped! The suggestion is for reference only, as the market changes rapidly. Please set stop-loss and take-profit levels and take profits when appropriate!

Ethereum's article yesterday mentioned paying attention to the range of 3300 to 3330 for long positions on the 1-3 hour chart below; on the 4-hour chart, pay attention to the positions of EMA15 and EMA30. As of now, the price of the currency is exactly at the EMA30 position on the 4-hour chart, perfectly matching the expected target. Congratulations to the friends who got in, as they could gain more than 100 points. However, compared with the 4-hour chart of the overall market, Ethereum's indicators appear slightly inferior, with EMA60, 120, 180 moving averages all above the price of the currency. We must be cautious, especially in the event of a situation similar to the last time. It is recommended to continue to pay attention to the key points of 3442, 3482, and 3510 above, and consider entering short positions based on real-time market conditions. Pay attention to going long if the range of 3365-3345 below is not broken. The suggestion is for reference only, as the market changes rapidly. Please set stop-loss and take-profit levels and take profits when appropriate!

The operation suggestions for BNB and SOL should continue to follow the train of thought in my previous article!

I interpret world economic news, analyze the global trend of the currency circle, and have conducted in-depth research on currencies such as Bitcoin, Ethereum, Litecoin, DOT, EOS, BAB, and SOL during my studies in the United States. For those who do not know how to operate, feel free to comment and leave a message!

This article is exclusively published by (WeChat Official Account: Zhang Lihui) and does not represent any official position. The publication and review of the article have a time delay. The above points are for reference only, and the risk is at your own. Investment is a practice. Knowing how to choose is the key to success. Lihui is willing to walk with you on this road, becoming stronger and happier!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。