If you want to create a liquidity pool on Raydium, you must first have an OpenBook Market ID. This market ID is usually created on the Raydium page, but the cost of creation can be as high as 3 to 4 Sol, which is difficult for many people to accept.

In response to this demand, PandaTool has developed a tutorial for creating market IDs at a low cost, with a minimum cost of only about 0.55 Sol.

What is OpenBook?

OpenBook is an open-source, permissionless public infrastructure in the Solana ecosystem, where the central limit order book connects many of the largest protocols in Solana DeFi (including Raydium, Orca, JUP, etc.), providing a unified liquidity layer that can match buyers and sellers throughout the ecosystem, enabling lightning-fast on-chain price discovery and trade matching.

In simple terms, it is a protocol that provides liquidity to major exchanges. After different swaps connect to OpenBook, they can share liquidity, thereby completing trades at more suitable prices and lower friction costs.

Why do you need an ID?

The OpenBook Market ID is a unique identifier that allows your token to be traded on DeFi platforms. Through this ID, major trading platforms can recognize your liquidity, so one ID can only correspond to one trading pair (such as USDT/SOL). If you need to create an AMM liquidity pool on Raydium, having an ID is a necessary prerequisite.

So why doesn't Orca need an ID to create liquidity? This is because Orca currently uses a method similar to Uniswap V3, which allows you to add pools without an ID. However, this type of pool has a drawback, which is that the price fluctuation should not be too large. After you make several consecutive purchases, you will not be able to buy anymore. Someone must sell a few before you can continue to buy. Therefore, trading bots on the Solana chain basically cannot trade on Orca. In addition, similar to this, there are also Raydium CLMM pools, which do not require an ID, but still have similar issues.

In order for your token to be able to trade normally without major issues, we still recommend that you apply for an OpenBook Market ID and create an AMM pool on Raydium.

Why do ID costs vary?

PandaTool provides ID creation channels, which are roughly divided into 3 levels: 0.55 Sol, 1.58 Sol, 3 Sol.

The price of the OpenBook Market ID depends on various parameters, including event queue length, request queue length, order book queue length, etc. You may not need to understand these terms, but what you need to know is: the higher the ID creation price, the smoother your token's trading will be, and the less likely it is to encounter problems.

When you create an ID through Raydium, it will automatically help you set the best condition parameters. However, by using PandaTool's tools for ID creation, we will give you multiple parameter choices so that you can reduce your own ID creation costs.

These parameters may have an impact, which may be concentrated in: congestion issues that may occur when multiple transactions occur simultaneously, abnormal slippage caused by significant token price fluctuations, and so on, which may cause some users to encounter failed transactions.

But overall, tokens with a market value of less than $500,000 should not have much of a problem. If you want your project to develop in the long term, we encourage you to choose the best ID configuration.

How to create an OpenBook Market ID?

Next, I will teach everyone how to create a low-cost market ID in a way that bypasses the Raydium official process.

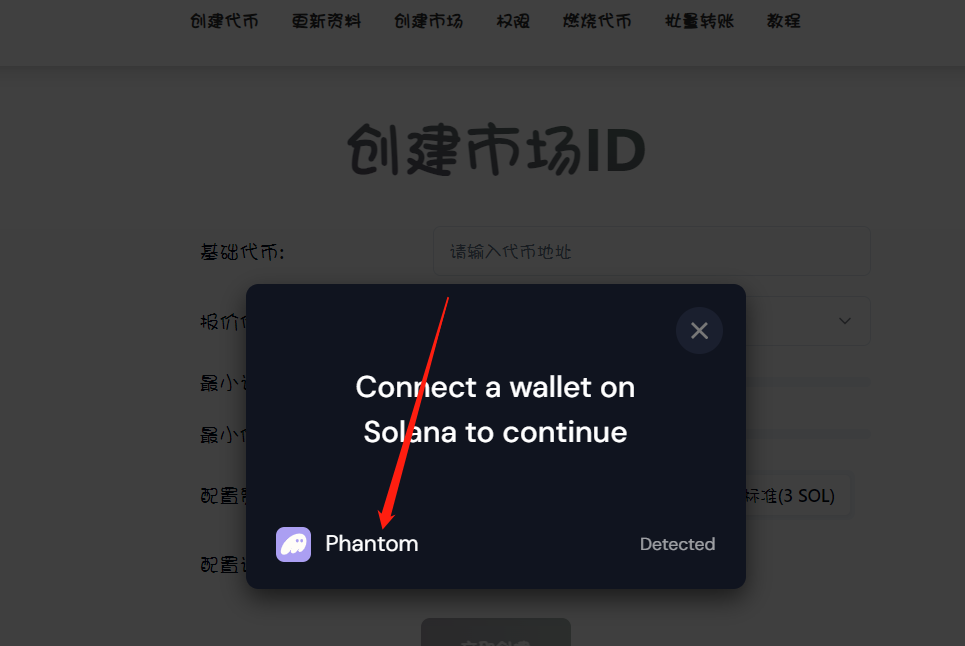

1. Connect Wallet

First, open the PandaTool ID creation tool page https://solana.pandatool.org/market, and click "Connect Wallet" in the upper right corner (if already connected, ignore this step)

2. Fill in ID Parameters

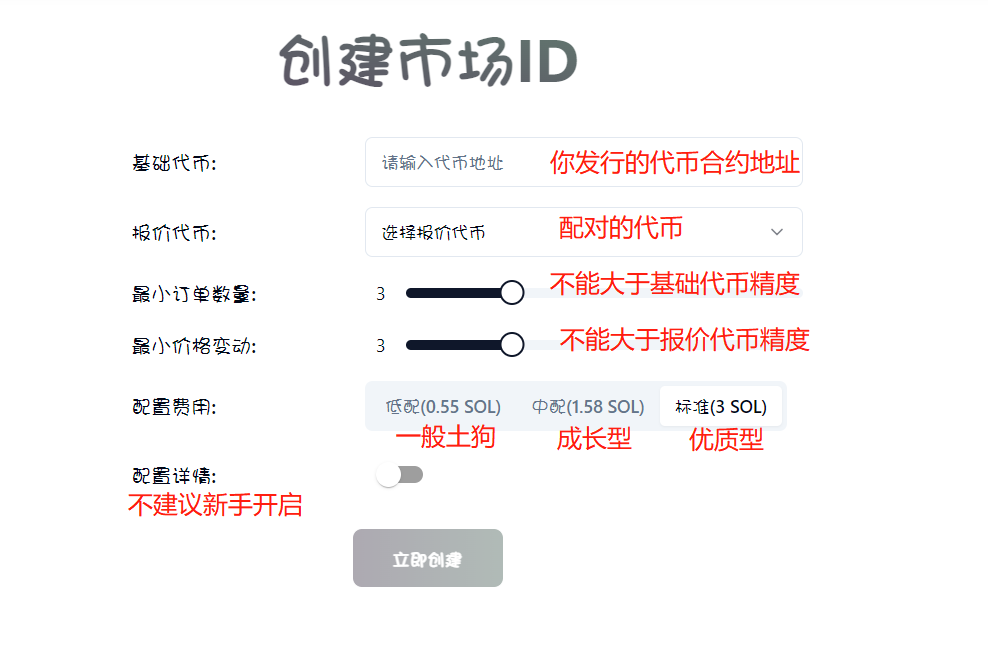

This step is relatively complex and important, so I recommend everyone to read it carefully

Base Token: Fill in the contract of the token you issued

Quote Token: Trading pair token, such as USDT, SOL, etc.

Minimum Order Size: The minimum order size precision in the order book. If you fill in 2, then the minimum trading volume is 0.01. If you fill in 4, the minimum trading volume is 0.04. And so on, this is actually the decimal precision.

Minimum Price Change: The number of decimal places for minimum price display/change. If you fill in 3, the token price is displayed with 3 decimal places, such as 11.123. If you fill in 5, the minimum token price is displayed with 5 decimal places, such as 11.12345.

Configuration Cost: Low configuration (suitable for general meme coins), medium configuration (suitable for growth tokens), standard configuration (suitable for high-quality value coins)

Configuration Details: This is an advanced option, beginners should not open this operation to avoid unforeseen problems

Most of these parameters should be fine, but the most likely problem to occur is with the minimum order size and minimum price change. When you create an ID on Raydium, you may have encountered some lag, and part of the reason is due to errors in these parameters:

The minimum order size cannot be greater than the decimal places of the base token, i.e., if your token precision is 5, you can only fill in 1 to 5, pay attention to your token precision

The minimum price change cannot be greater than the decimal places of the quote token, i.e., Sol's precision is 9, so you can fill in 1 to 9. But USDC's precision is 6, so you can only fill in 1 to 6, pay attention to the precision of the quote token

The sum of "minimum order size" + "minimum price change" cannot be greater than the decimal places of the quote token: that is, the maximum sum of the two numbers cannot exceed 9.

For example, if you pair token A with USDC. Token A has a precision of 5, and USDC has a precision of 6. Then, the minimum order size cannot be greater than 9, and the minimum price change cannot be greater than 6. The sum of "minimum order size" + "minimum price change" also cannot be greater than 6 (the decimal places of the quote token). Therefore, you can set the minimum order size and price change to 3 and 2 (a total of 5, less than 6). However, it cannot be 4 and 4, because the total exceeds 6.

Here is an example of the parameters I filled in:

Because my token precision is 7, I can fill in 5 for the minimum order size. At the same time, I am looking for the quote token Sol, which has a precision of 9, so as long as the sum of the two numbers does not exceed 9, it's fine. Also, this token is only for testing purposes, with no long-term development plans, so choosing the low configuration version is sufficient. If you really want to develop a high-quality project, it's better to choose the standard configuration.

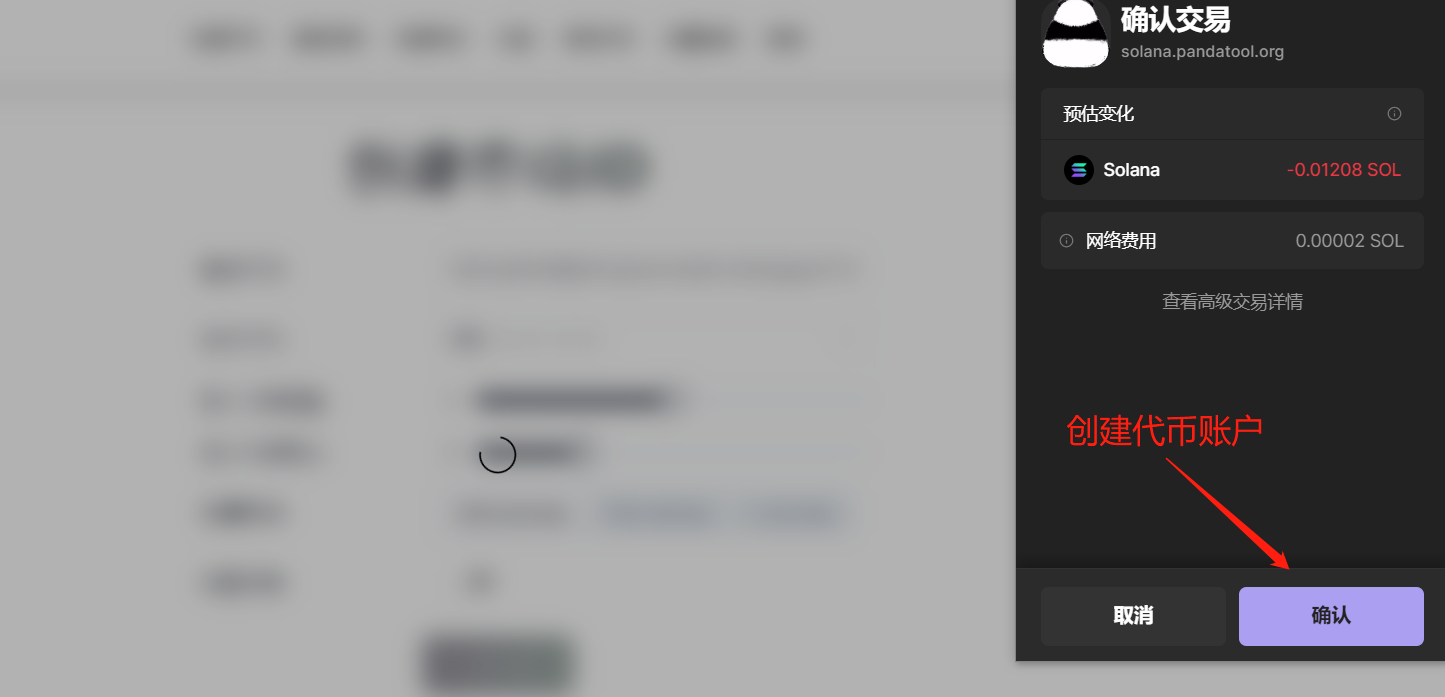

3. Create ID

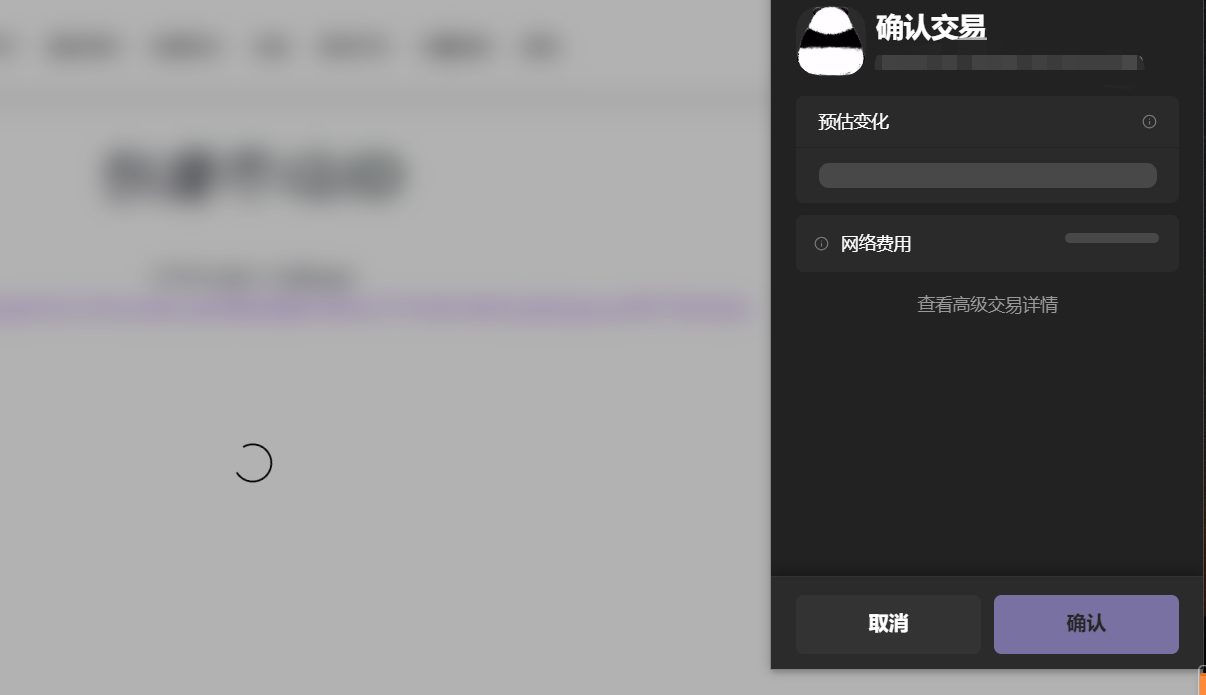

After filling in all the parameters, you can proceed with creating the ID. Creating the ID requires wallet confirmation twice, the first time is to create the token account, and the second time is to create the ID. After clicking the first step, remember not to close the page.

At this point, click "Create Now," and a wallet pop-up will appear for confirmation:

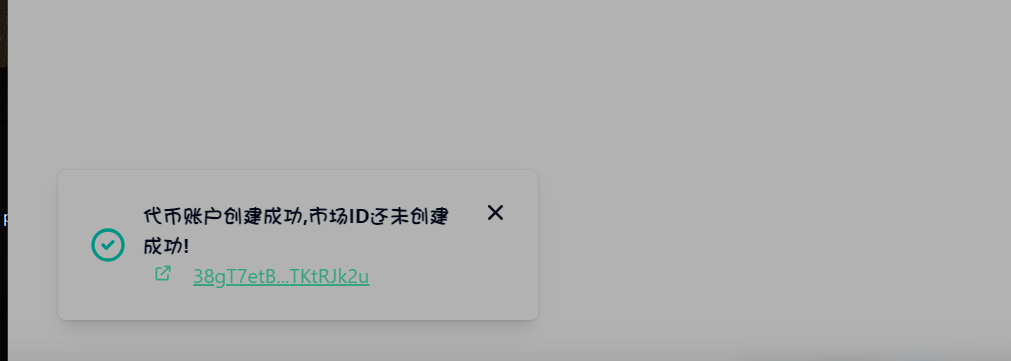

After confirmation, there will be a prompt telling you that the token account has been successfully created, something like this:

Note that the market ID has not been created at this point. Then the wallet will pop up for the second time, asking you to click confirm:

After confirming, wait a few seconds, and the ID will be successfully created. You will see a prompt like this:

At this point, the entire ID creation process is complete. Copy the ID and you can go to Raydium to add the pool. The whole process is not actually complicated, and I hope everyone can use this low-cost method to create an ID.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。