Original Authors: Wyz Research, DetectiveTON

How can a public chain without listing on Binance and with an underdeveloped ecosystem rank high in market value? This may be a question that many practitioners want to ask.

On March 13th, after a slight overall decline in the 312 market, the TON public chain token Toncoin surged to 4.5U before falling back, and TON ecosystem projects also rose in response, with the TonUP token reaching a high of 0.95U, a 20% increase.

Since TON was listed on the OKX exchange, within the small cycle from 2022 to 2024, the K-line trend of the Toncoin token formed a clear "W" shape, which has become the favorite bottom pattern for K-line enthusiasts.

In addition, from the trading data, TON's price has risen by over 200% within 2024, and by over 400% within six months. As the price rises, the token trading volume has surged, with the trading volume in the past three weeks being approximately four times that of a month ago.

More notably, with the price surging to 4.5U, TON's total market value has exceeded 15 billion US dollars, ranking 11th in the cryptocurrency rankings (excluding stablecoins and pegged coins), highlighting its value performance.

When comparing these tokens in the top 30 rankings, it is also worth noting that TON is the only token not listed on Binance. Without the liquidity support of the world's largest exchange, TON has already occupied a high market value using its current circulation.

In comparison to other ecosystems, TON has a relatively small number of ecosystem projects. What exactly has driven the token price surge and led TON and its ecosystem to rise unexpectedly?

Finding the Analytical Entry Point from the Token's Price Surge Logic

We attempt to find the reasons to explore its subsequent development space. According to basic logic inference, the rise in token price is due to a high demand from buyers, continuously driving up the price of individual transactions, which is clearly evident from the recent trading volume.

In this process, external buying is one factor, and the other is the market-making of TON tokens. In the cryptocurrency trading market, market makers can sense market buying and selling trends at any time through market-making data, actively driving the price with market heat and maintaining the price within a relatively stable threshold.

Under this line of thinking, market makers' price manipulation is proactive. In comparison, external buying investors will make purchases after their own judgment, which can be influenced by external factors and certain influencers.

Finally, TON's characteristics, compared to other ecosystems, may have the ability to attract users and investors, or the ecosystem may be able to generate a trend of self-driven ecosystem valuation.

Therefore, we attempt to find the reasons from three aspects.

They are:

1. Who are the influencers in the bull market?

2. Who are the market makers?

3. What is supporting TON's market value and liquidity?

Influencers of TON

When searching for TON on X, most of the recent news is related to TON and Telegram's founder Durov. However, when you open Durov's account, you will find that his tweets stopped in 2022, but his Telegram account continues to be updated and currently has over 20 million subscribers. It is evident that Durov's influence has grown despite leaving the Twitter platform. Along with Durov's increased influence, Telegram's user base has also been growing. According to the latest official disclosure, Telegram has over 900 million monthly active users.

Around the time of writing, most users were discussing the recent exposure of Durov's wallet address holding a large amount of TON tokens.

In addition, there have been two major news clues recently. One is Durov's statement that he may lead Telegram to an IPO. From an external perspective, TON is closely linked to Telegram, and Telegram is the biggest trump card for TON users and commercial potential. If an IPO is conducted, it will provide tremendous support to the value capture of the TON ecosystem from a value perspective.

The second piece of news is Durov proposing a solution to address the centralization impact and investment returns of TON. After Telegram used TON tokens as advertising payment tokens, some users were concerned that Telegram holding too many TON tokens would have a detrimental impact on decentralization.

To limit Telegram's holdings of TON to no more than 10% of the supply, Durov proposed a plan to sell excess TON at a price lower than the market price, with a lock-up period of 1-4 years, to long-term investors in TON to stabilize the ecosystem and reduce volatility.

The above performance clearly indicates that each project founder is the center of the entire ecosystem's dissemination and represents the orthodoxy of the ecosystem. Durov's calls are the core of TON's strong performance and a strong needle in the development trend of the ecosystem. From Durov's subjective behavior, it can be predicted that TON and Telegram will not be divided under any circumstances in the future, and they will be closely related, just as Telegram and TON have completed the integration in the Web2 and Web3 models.

When using Web3 assets or wallets for the first time in Telegram on Web2, you will be surprised to find that your personal account page will have a Wallet option. In the Wallet, you can seamlessly exchange cryptocurrencies (using fiat currency or stablecoins, or trading between other tokens), and in any Telegram chat page, you can fully experience Web3 games using Web2 interaction methods, or operate on the chain.

This may be the most important and disruptive step for Durov in pursuing the ideal establishment of Telegram.

Who are the TON Market Makers?

In the first paragraph, we discussed that the main internal driving force for the rise in token prices lies in the hands of market makers. So, who are the market makers for TON? There is no accurate confirmation from external sources, but the direction can be confirmed from the disclosure of partnership relationships.

Currently, most market makers in the industry have capital attributes. In April 2022, the TON Foundation announced the establishment of the $250 million Toncoin Fund, which received investments from Huobi, KuCoin, MEXC, DWF, and others.

Apart from exchanges, DWF is a well-known Web3 market maker in the industry. In addition to this investment, DWF Labs has sponsored TON hackathons and deployed two verification nodes on the TON blockchain.

By studying the price performance of projects previously invested in or market-made by DWF Labs, corresponding market-making styles can be predicted. The project list includes CFX, Mask, YGG, SNX, ACH, RSS3, and others, but this is only a general inference in the market.

According to informed sources, the TON Foundation is also cooperating with other mainstream market makers, such as GSR. However, it is uncertain whether these market makers have the ability to actively drive up prices, so who is pushing up TON as a market maker remains a mystery.

TON's Ecosystem Performance

Influencers and market makers are the main external performances, but more importantly, substantial growth and development are essential for the public chain, which is internal improvement.

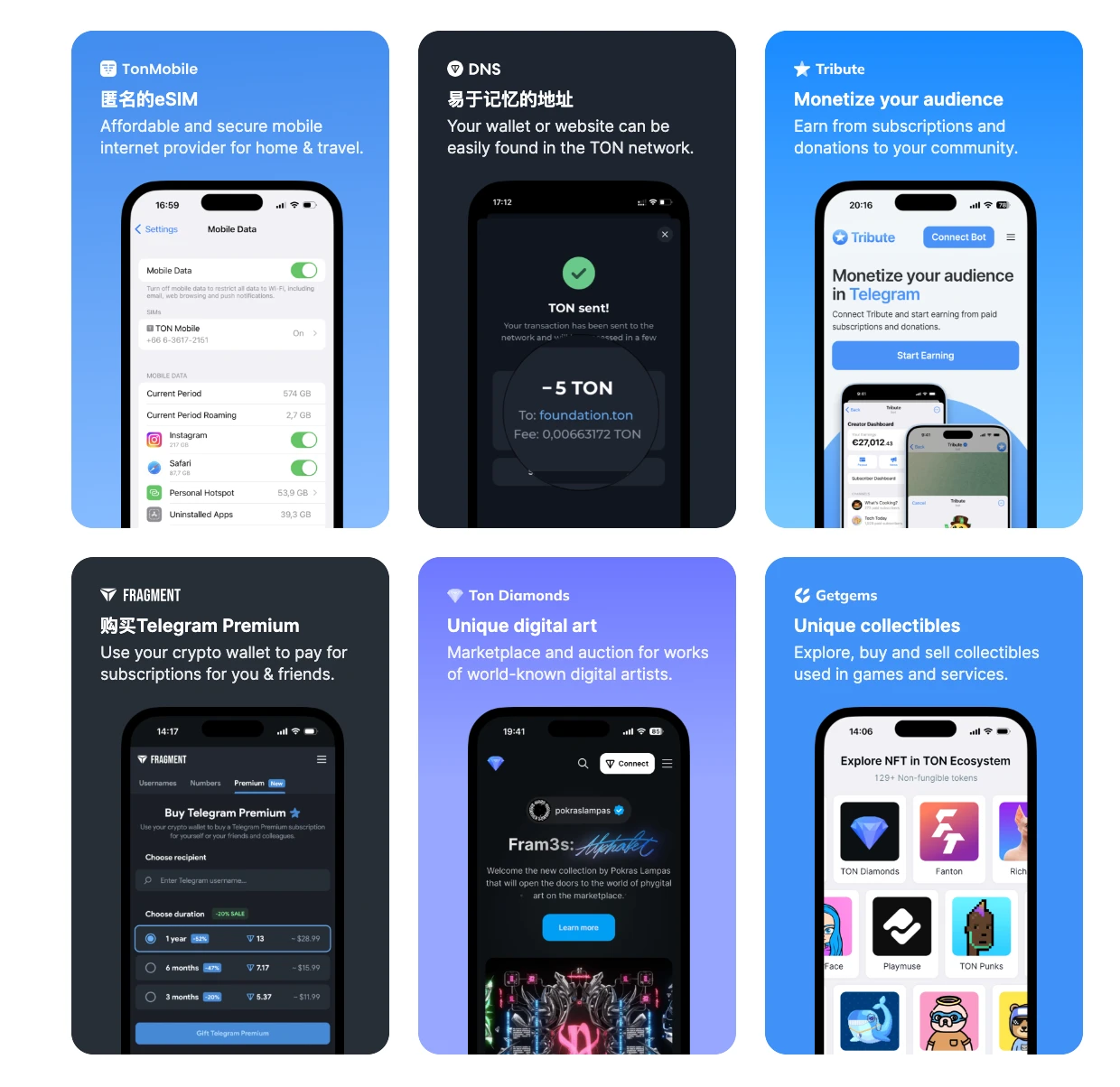

According to statistics from the TON official website, the entire ecosystem currently includes 602 application projects, divided into 19 categories such as centralized exchanges, decentralized exchanges, staking, wallets, browsers, bridges, public utilities, channels, NFT collections, chats, social media, gambling, games, Jettons, NFT services, VPN, development tools, shopping, and launchpads.

Example of a DApp promoted by TON

By specifically calculating the number of projects in each category, it can be concluded that exchanges, wallets, browsers, channels, public utilities, NFT collections, chats, gambling, and games account for a relatively large proportion. If we only calculate the number of on-chain applications in the ecosystem, the number is approximately around 300, with the main application types being games, bots, gambling, and DeFi.

From the overall application types, most applications are a fusion of Web2 and Web3, with the functional boundaries being distinguished. It can be said that the TON ecosystem applications integrate the properties of Telegram and Web3.

If you have experienced using applications and the built-in wallet function in Telegram, you can clearly see that Telegram is the external entry point for TON, and entering Web3 through this entry point is extremely smooth.

All applications within the ecosystem are consistent in using Telegram as the entry and interaction method, with the wallet as the interactive tool.

The wallet also supports two transaction methods, Web2 and Web3, allowing smooth exchange of USDT for TON and independent account transfers, as well as interaction with other applications. Additionally, it supports various calls and invocations.

In conclusion, TON has achieved complete integration within the Telegram ecosystem. Telegram exists in the form of Web2 but with the spirit of Web3 and the decentralized core of TON, making it a super app. Within Telegram's nearly 1 billion global users, the TON token will become an absolute value performance outlet, and it is these applications that support TON's value.

After TON's native token demonstrates value, with the support of applications for the native token and ecosystem development, DeFi applications will carry the same value performance, such as Dex, Launchpad, lending, etc. The most obvious example is the TonUP token, which, during the time of TON's token surge, also achieved a short-term increase of about 300%, showing a quick response and worth paying attention to. As for games, social media, and other ecosystem projects further from the native token business, they will be the target of backend rotation in the associated response.

Furthermore, the TON Foundation has recently been actively promoting the ecosystem development in areas such as Meme, and has launched the liquidity incentive program Open League, which plans to provide support for core ecosystem projects including STON, DeDust, TonUP, and others, with a total of 50K TON. According to statistics, the number of TON ecosystem projects has increased by about 10% in the past 6 months, and after the price increase, more projects have joined TON, choosing launchpads such as TonUP for IDO, etc.

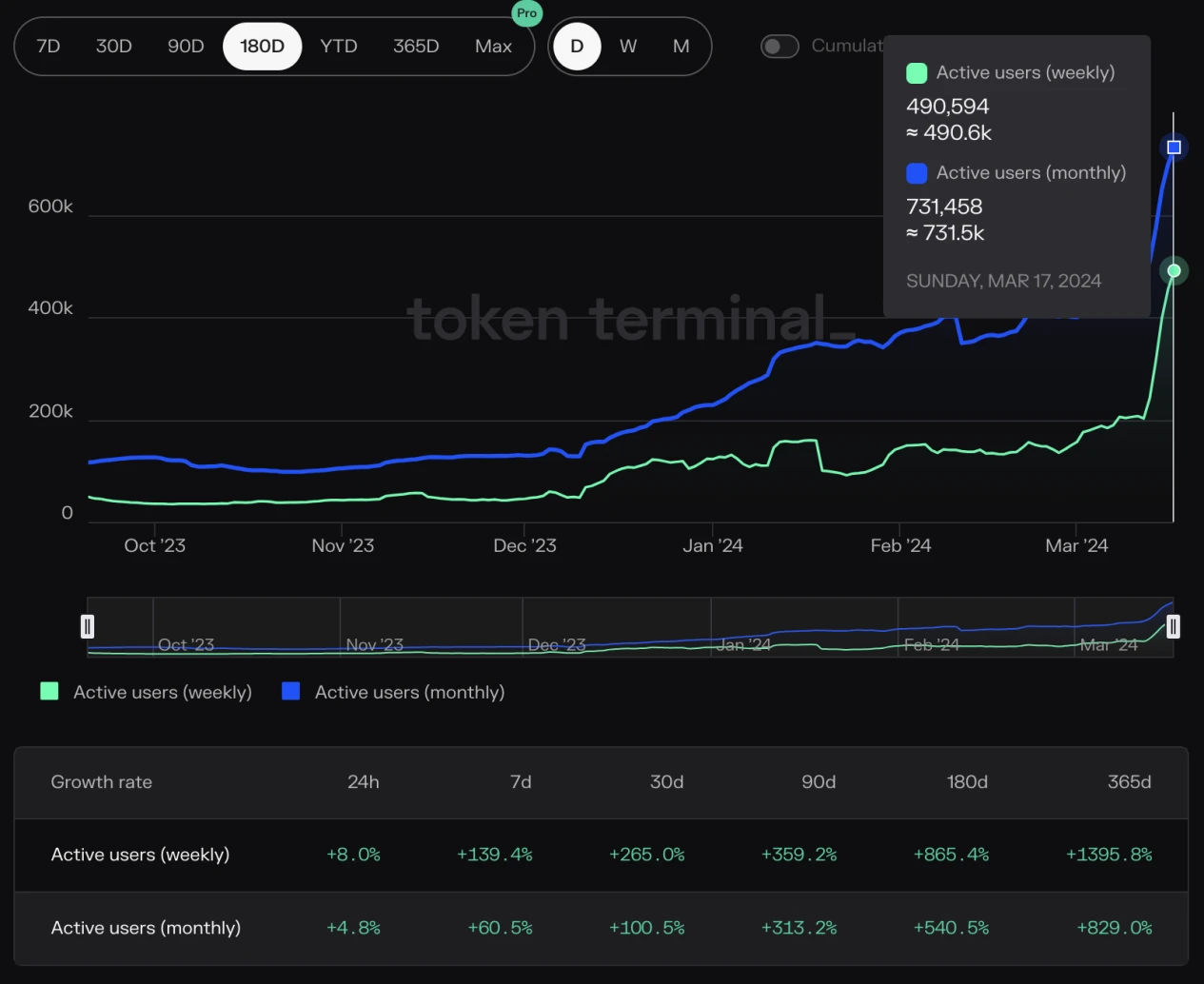

The on-chain data of TON verifies the current growth trend. Firstly, according to DeFiLlama data, TON's on-chain TVL reached a new high after the surge in TON's price, with a lock-up of approximately 13.86 million TON, valued at about $56 million. Secondly, according to token terminal data, TON's weekly active users and monthly active users have both reached new highs, with weekly active users surpassing 490,000 and monthly active users surpassing 730,000.

TON's on-chain active user data

Continued Value Capture for TON's Future

Although TON currently ranks high in market value, there are two obvious characteristics compared to other ecosystems.

Firstly, there is a lack of ecosystem projects, leaving great room for future expansion. Additionally, within the ecosystem projects, there are few projects related to the design of business based on native tokens and mainstream tokens.

Secondly, TON currently lacks significant trading potential release. Recently, the news of TON being listed on Binance has been spreading, and once confirmed, TON's trading potential will be even greater.

We are in a bull market, and expectations for tracks and ecosystems will be transformed into buying actions, that is, voting with our feet. TON's expectations, from Telegram's 1 billion users to the performance of the founding team, and to the ecosystem expectations, have whetted the market's appetite.

When we discard the easily misleading vocabulary and focus on the core of TON's value capture, it comes from the platform value of Telegram:

- Valuation of 1 billion internet users.

- Liquidity demand generated by using TON as advertising fees within the platform.

- Telegram's ability to smoothly and conveniently market and acquire customers.

- Product integration design that completely breaks the entry barriers of Web3.

Referring to any platform with such characteristics, TON's value capture will continue to provide a continuous stream of benefits. Businesses closely related to TON and the ecosystem, whether it's the previously mentioned TonUP, Dex STON, DeDust, or games like Notcoin, will all benefit infinitely.

Of course, long-term gains come from holding and building, but the biggest breakthrough in the short term is still the listing on Binance. Currently, Binance has listed perpetual contracts for TON, and the news of spot trading for TON is still fermenting. Judging from the recent actions of the foundation, it seems to be actively preparing, and similarly, both new and old investors in the market are eagerly awaiting.

PS: This article mainly presents to readers how to track the driving factors behind the surge in token prices, and does not constitute investment advice. This deconstruction logic is more suitable for a one-sided trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。