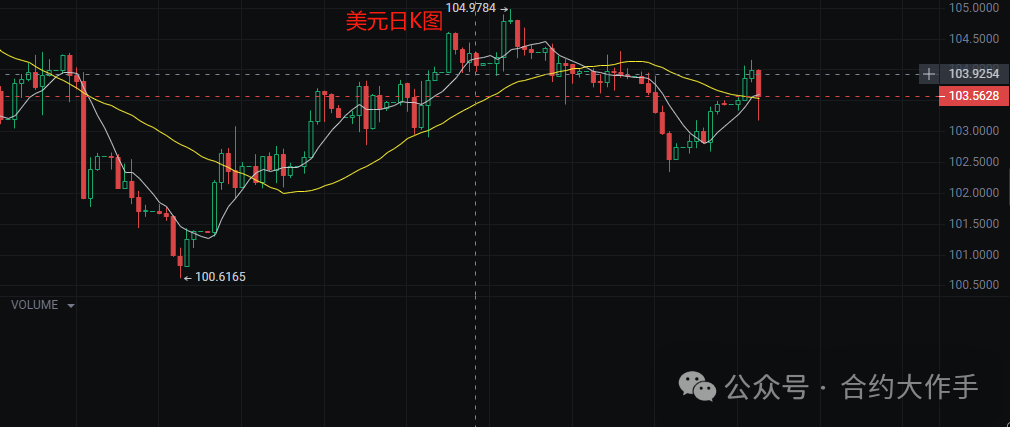

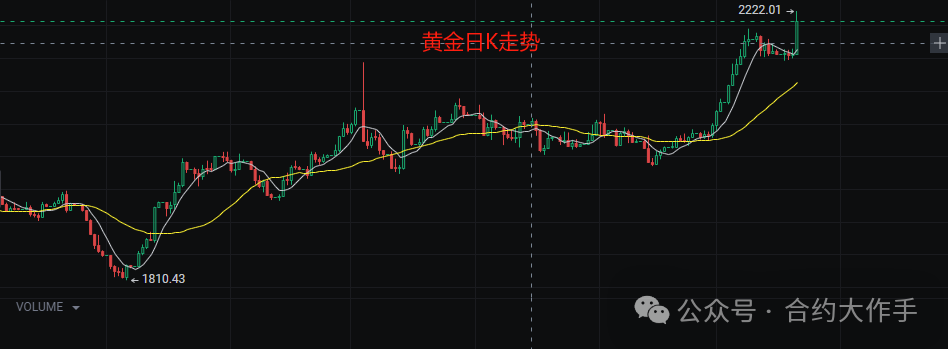

In our previous analysis "The battle of the quarterly futures has begun, and the US dollar index points the way," we almost guessed the movements of the US dollar index and Bitcoin: first, the US dollar index rebounded due to the impact of CPI/PPI data, causing non-US assets including Bitcoin to rise and then fall; the US dollar index reached the previous high and then returned to the downtrend of the larger cycle, while non-US assets hit new highs again. Last night, with Powell's assistance, the Nikkei 225 and gold hit new highs again, and Bitcoin rebounded after hitting bottom.

The USDJPY trading pair touched near historical highs for the third time

The Nikkei index hit new highs after a deep retracement

As the US interest rate cut approaches, Bitcoin returns to an upward trend on the 4-hour chart

Last night, the Federal Reserve held its fifth consecutive meeting without making any changes. The dot plot maintained its forecast of three interest rate cuts this year, but lowered the estimate for next year's interest rate cuts. Powell hinted at the possibility of slowing down the pace of balance sheet reduction in the near future. As a result of this news, the US dollar deviated from the expected downtrend, and precious metals led by gold hit historical highs. Cryptocurrencies such as Bitcoin stabilized and reversed with a strong single-day rally, regaining the upward trend!

The market is beginning to factor in the logic of trading the US interest rate cuts. With the dot plot expecting three interest rate cuts within the year, the US dollar is entering a weakening trend over time, and gold is also entering a trend of easy rise and difficult fall during the new high process. The future trend of the "gold" of digital assets, Bitcoin, is promising. From a technical perspective, Bitcoin is stabilizing and rebounding above the 30-day moving average. Therefore, we predict that after a period of consolidation at the hourly level, Bitcoin is highly likely to launch another rally, with the potential to break through the previous high and rise above the 74000 price level.

In the context of trading certainty expectations, the process may be unpredictable, but the results are certain. Reviewing every certain event and trading retracement is a good opportunity to enter the market. This time, the price increase of precious metals and digital assets triggered by the US interest rate cut is no exception. All we need to do is to position ourselves well during the retracement!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。