News

On March 21st, the BitVol (Bitcoin Volatility) index launched by financial index company T3 Index in collaboration with Bitcoin options trading platform LedgerX rose to 83.66, close to the highest level of 87 in nearly a year.

BlockBeats Note: The BitVol index measures the 30-day expected implied volatility derived from tradable Bitcoin options prices. Implied volatility refers to the volatility implied by actual option prices. It is calculated using the B-S option pricing formula to derive the volatility by inputting actual option prices and parameters other than the volatility σ into the formula.

On March 21st, according to Lookonchain monitoring, a whale has been buying BTC since March 14th, with a total of 4451 BTC (approximately $294.6 million) withdrawn from Binance at an average price of $66,195 in the past week. With the rise of BTC, the whale has started to realize a profit of approximately $3.35 million.

On March 21st, according to Farside Investors data, the Bitcoin spot ETF saw a net outflow of $261.5 million, marking the third consecutive day of net outflows.

Market Review

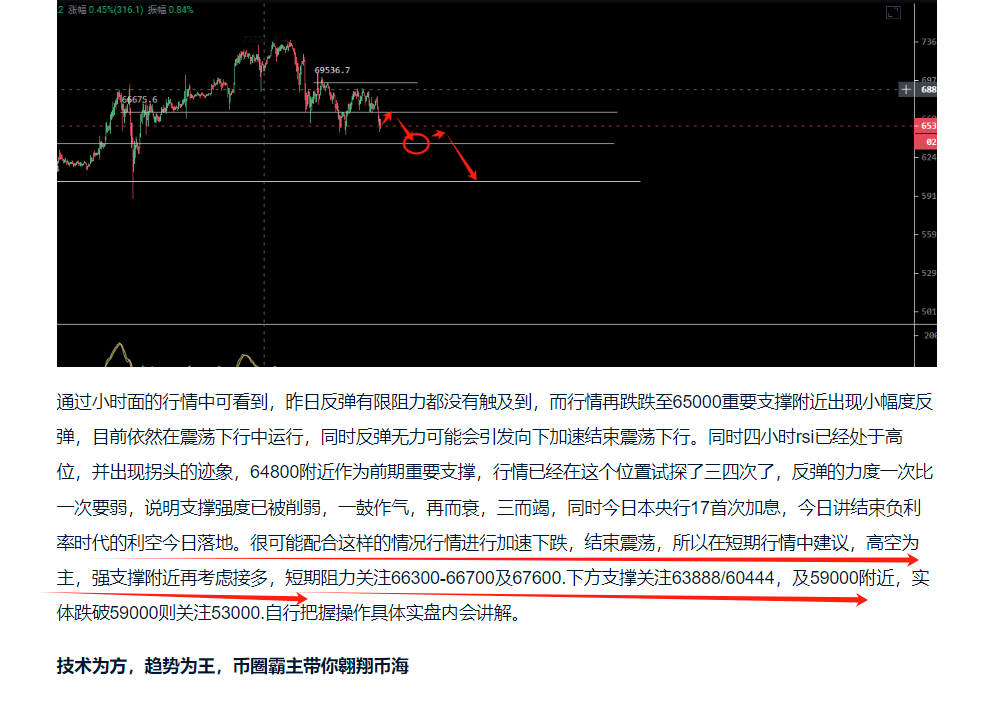

In the previous article on the 19th, it was mentioned that the possibility of the Bank of Japan raising interest rates could lead to an accelerated decline in the market, and short positions were also deployed in real time in the article. There were profits near the support level below. The market hit a low point near 60800 and rebounded, falling a few hundred points short of our expected level, which was a bit regrettable. However, real-time guidance was given to enter long positions near 61500-61300 and exit in the 64500-65000 range. The subsequent rebound to 68000 was unexpected. The 7000-point rebound yesterday, is it a rebound or a reversal?

Market Analysis

Macro Analysis:

The Coinbase premium index price was rejected from the 0 area of support-resistance reversal. To rise safely, we need to stay above zero. The price retraced, with the open interest support level at 59,000. This support level is very important for us. We should observe it carefully. The high funding rate is starting to cool down. We see players who think the price has risen too high turning to short positions. Big players may leave small players behind, so we should be careful. Long liquidation a large number of long positions were closed. Positive data supports bullish sentiment.

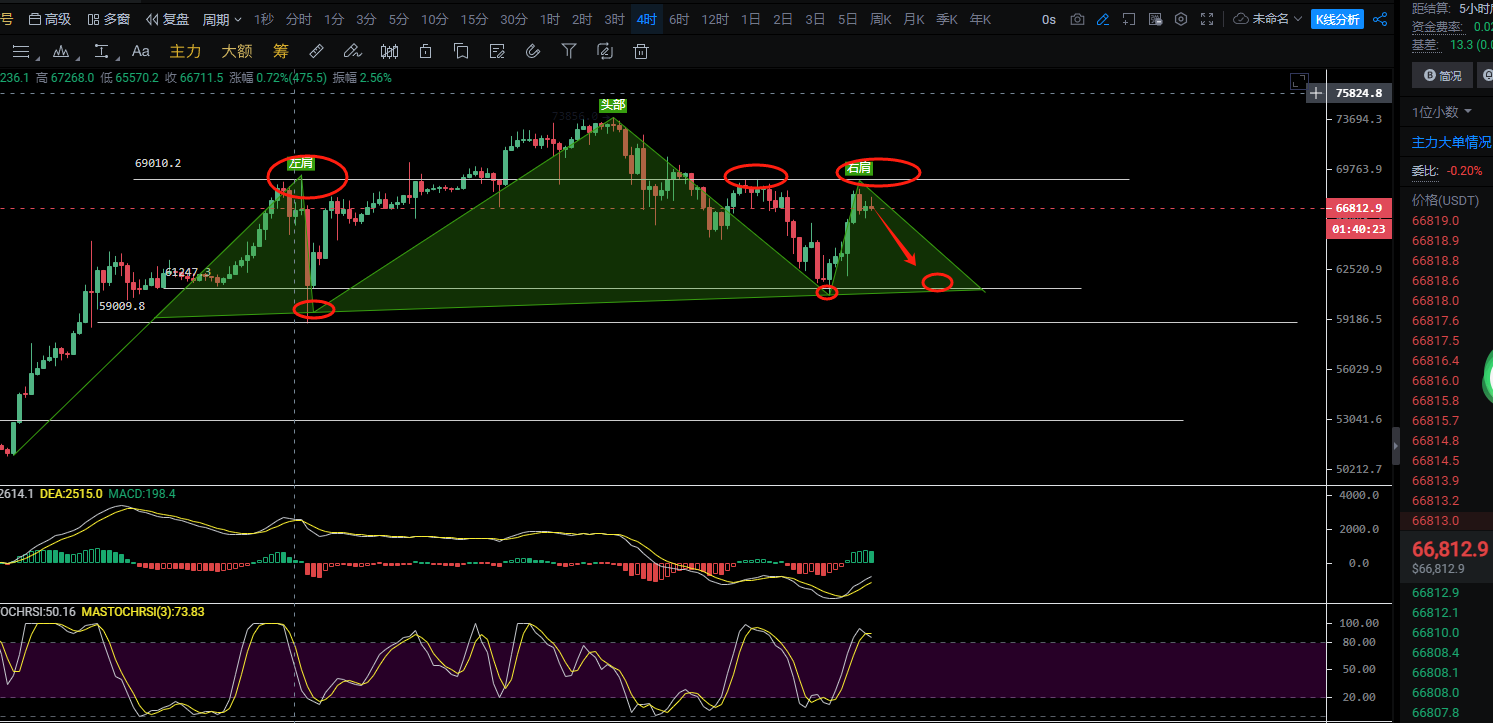

Looking at the four-hour chart, although the market rebounded to near 68000, it did not break through the strong resistance near 69000-69500, which is the watershed position. Not breaking through this position can still be considered a rebound, while breaking through would indicate a reversal. At the same time, a large head and shoulders pattern has formed on the four-hour timeframe. Since the market has not yet reversed, the possibility of another downward test of the neckline cannot be ruled out. Therefore, in overall operations, it is recommended to go short near the watershed. Pay attention to whether the support levels at 64500/62300 and 61000 can be effectively broken below. Specific operations should be at your own discretion. Details will be explained in real-time guidance.

Technology is the means, and trend is the king. The dominant force in the currency circle takes you to soar in the sea of coins.

Exercise caution when entering the market, as trading carries risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。