Original | Odaily Planet Daily

Author | jk

Preface: On-Chain Data

Readers familiar with traditional financial markets know that there are various trading styles in the financial market. The traditional market mainly uses fundamental analysis and technical analysis, as well as algorithmic trading and other methods. Technical analysis mainly interprets price data through indicators and trends, while fundamental analysis is a method of evaluating the intrinsic value of securities by analyzing relevant economic, financial, and other quantitative and qualitative factors to predict their future market performance.

However, in the field of cryptocurrency, a unique analysis method has emerged—on-chain analysis. This is because unlike the closed systems of traditional financial markets, blockchain technology opens financial data to everyone, allowing people to clearly see two core pieces of information: transactions and token ownership.

On-chain data, as the name suggests, is data that exists on the blockchain. It can provide us with information about fund flows and ownership, such as where tokens are flowing, what is being purchased, and what tokens each address holds and how many.

This kind of data is not common in traditional financial markets, and ordinary people cannot know how many stocks and funds the counterparty has when buying and selling stocks. Therefore, on-chain analysis provides a new perspective and analytical tool for participants in the cryptocurrency market. Unlike technical analysis, which only focuses on price data, on-chain analysis allows us to gain a deeper understanding of the fundamental operation of the market, such as trading behavior and asset distribution, thereby providing a more comprehensive and in-depth basis for trading and investment decisions.

Getting Started: What On-Chain Information Is Available?

On-chain information is rich and detailed, revealing unique data dimensions and structures in the cryptocurrency market, contrasting sharply with the availability and types of information in traditional finance (TradFi) markets. On-chain data mainly consists of the following aspects:

Wallet Holdings: The blockchain records the token holdings of each address or wallet, allowing us to track the scale and changes of assets for individuals or institutions.

Transaction Analysis: Every transaction is recorded on the blockchain, including the parties involved, transaction amounts, timestamps, etc., providing a basis for analyzing market dynamics and participant behavior.

Token Whales: By analyzing on-chain data, it is easy to identify major holders of any token, thereby assessing market concentration and potential price manipulation risks.

Inflows and Outflows of Exchanges: Monitoring the inflow and outflow of funds from exchanges can reveal the potential selling intentions of market participants or their decisions to withdraw assets from exchanges for long-term holding or on-chain use. (Exchanges often use multiple addresses to store funds, and there are a large number of off-chain accounting activities, making internal exchange transactions often unknown.)

Macro/Ecosystem-level Data: On-chain data provides a perspective for observing the overall market behavior, enabling the analysis of collective actions of numerous market participants, such as network activities, mining dynamics, and interactions of decentralized finance (DeFi) protocols.

In contrast, information in traditional financial markets is usually more closed and limited. For example, although trading data for publicly traded stocks is available for analysis, detailed information on many trades such as private equity funds, derivative contracts, etc., is often not known to the public. Additionally, many data sources in traditional finance, such as credit scores and internal trading reports, are subject to strict regulation and control.

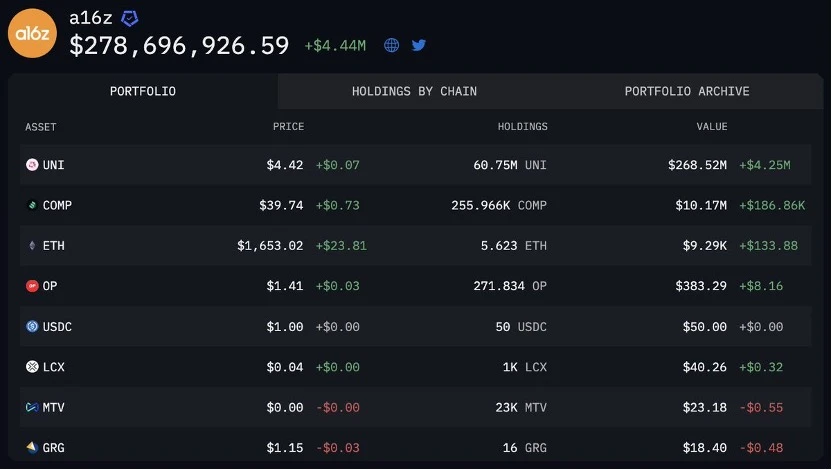

For example, on Arkham, you can view position analysis provided by on-chain analysts, including the positions of top private equity funds and institutions, revealing which entities have favored which assets in the past and present. The position of a16z is as follows:

a16z's position. Source: Arkham official Twitter

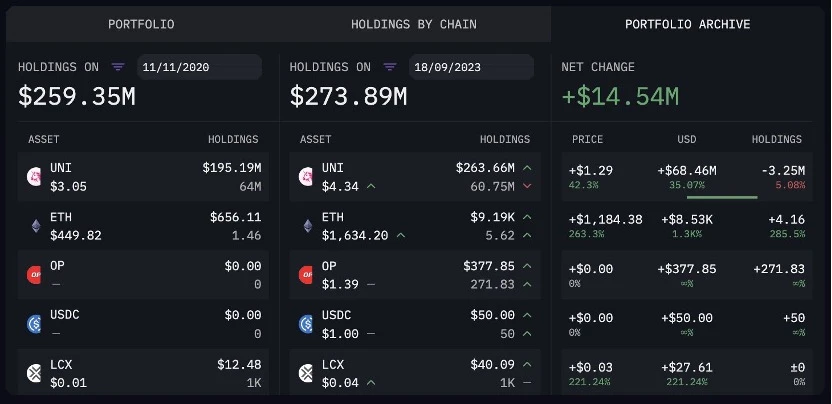

Similarly, in the use cases published by Arkham, you can even view historical positions and trading records, showing how the account's holdings have evolved over time. This analysis is of significant value for understanding the behavior patterns and investment strategies of market participants.

Historical position records. Source: Arkham official Twitter

In summary, the transparency and comprehensiveness of on-chain data provide a new analysis dimension for the cryptocurrency market, which is difficult to find in traditional financial markets. The openness of this data not only promotes market transparency but also provides a unique tool for investors and analysts to gain a deep understanding of market dynamics.

Advanced: On-Chain Analysis Tools

Although blockchain data itself is public and transparent, it is not easy for ordinary people to truly understand and utilize this data. The complexity and large scale of blockchain data mean that without the right tools and skills, it is almost impossible to extract valuable insights from this data. Accessing raw blockchain data requires the use of professional blockchain explorers, and even then, extracting valuable insights from this data requires a certain level of data analysis or data science skills.

Most traders or retail users do not possess this professional knowledge, so they need to rely on specialized tools or services to help them interpret the data and make wiser trading and investment decisions. There are some excellent free tools on the market to assist with on-chain analysis, providing user-friendly interfaces and powerful data analysis capabilities, making it easy for even non-technical users to access and understand blockchain data. Here are some free on-chain analysis tools:

Arkham: Provides a range of advanced on-chain analysis functions to help users track fund flows and identify market trends. In the recent Bitcoin ETF craze, Arkham identified and recorded the quantity, proportion, and inflows and outflows of major ETFs holding Bitcoin, providing a good perspective for price predictions.

DeFiIlama: Focuses on data from decentralized finance (DeFi) projects, providing comprehensive analysis of DeFi assets and protocols. Essentially, almost all well-known DeFi protocols and projects can be queried on this website, making it very useful for data metric analysis.

Dune: Allows users to conduct in-depth analysis of on-chain data through custom queries and visualizations, making it the preferred tool for data scientists and analysts.

Etherscan: As the primary blockchain explorer for the Ethereum blockchain, it provides basic functions such as transaction queries, smart contract analysis, and real-time gas fees. For other public chains, searching for "public chain name + explorer" will generally lead to the explorer for that chain, with similar basic functions.

These tools lower the barrier for users to conduct on-chain analysis by simplifying the process of accessing and analyzing data, enabling even non-technical users to gain insights into market dynamics and trends, and make wiser decisions in the cryptocurrency market.

Practical Application: Using On-Chain Data to Guide Trading

Common strategies for using on-chain analysis to guide trading and investment strategies include various methods and use cases, allowing investors to better understand market dynamics, identify potential investment opportunities, and mitigate risks. Here are some specific strategies and applications:

Tracking and Copying Elite Traders' Strategies: Through on-chain data, investors can track the trading behavior of successful traders or so-called "elite" traders, learn from their investment strategies, and even directly mimic their trading actions. This includes not only replicating their buy and sell operations but also setting alerts to be informed of these traders' future activities. This method allows ordinary investors to leverage the knowledge and intuition of high-level investors, gaining an advantage in their own trading.

Analyzing Top Holders of Specific Tokens: Observing and analyzing the major holders of a specific token, especially those "whale" accounts, can help investors understand whether the token supply is highly concentrated. For newly launched tokens, if a large number of tokens are concentrated in the hands of a few, this may indicate the potential for coordinated selling, which could quickly push down the token price. By identifying these potential risks, investors can make more cautious investment decisions and avoid entering manipulated markets.

These strategies demonstrate how on-chain analysis provides a unique perspective and data support for traders and investors, enabling them to make wiser decisions based on comprehensive and in-depth market insights. By using on-chain data, investors can not only identify market trends and potential investment opportunities but also gain insight into the behavior and intentions of other market participants, thereby gaining a competitive edge in the fiercely competitive cryptocurrency market.

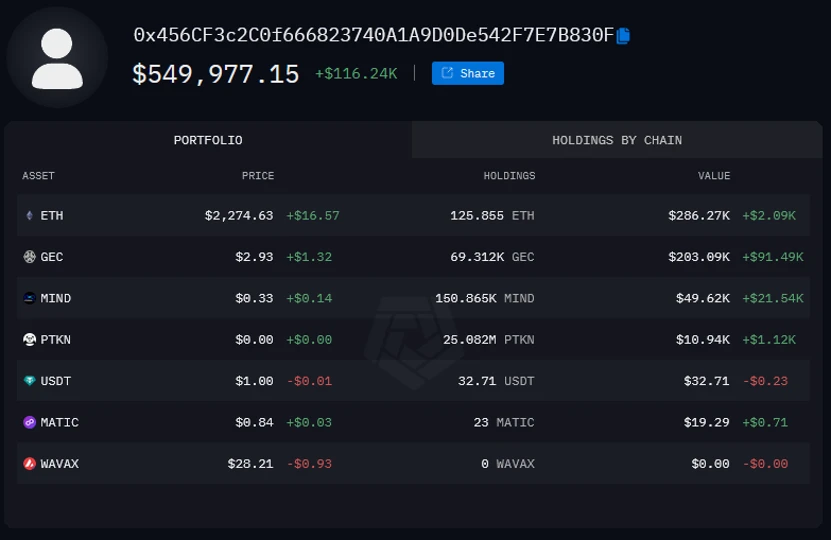

For example, according to examples published by Arkham, take trader 0x456 as an example, he turned 1 Ethereum into $550,000 in less than 3 weeks, achieving a return of 27,500%. Through in-depth analysis of his on-chain trading records, we can discover many detailed pieces of information. 0x456 demonstrates a highly dynamic and opportunity-driven trading strategy, from initially having 1 ETH to now having over $550,000 in assets. His success story includes several key steps:

Small, Rapid Trades: Initially, 0x456 made relatively small purchases on tokens such as BONK, CLIPPY, and ZUZU, holding them for only a few minutes, which helped him gradually accumulate a small amount of funds. This rapid trading strategy allowed him to gradually increase his funds without taking on a large holding risk.

Bold Investments: As his funds increased, 0x456 began making bolder investments. His first significant success came from the MORRA token, in which he invested at the token's initial listing and gradually sold over the following week, achieving a 17x profit. This demonstrates his keen insight into market dynamics and the ability to seize potential profit opportunities early in the listing.

Utilizing Market Information: Just two days later, he invested in the P3PE token, which was mentioned in the communication of the Euler attacker and KyberSwap hacker. 0x456 invested 3 ETH two hours after the news was released and profited as the news spread on Crypto Twitter, achieving a 16x return. This highlights the importance of trading based on market sentiment and information differentials.

Taking a Risk: His largest trade occurred five days later when he invested $6,600 in the GEC token at its listing. So far, he has not sold any GEC tokens, and their value has exceeded $200,000.

Diversified Trading: Overall, 0x456 traded over 300 token pairs, showing his broad and diversified trading strategy. His success was not only based on speculation on individual events but also achieved through diversified investments and leveraging various market opportunities.

0x456's position. Source: Arkham official Twitter

Imagine if you could use these tools to discover these smart addresses early on and replicate every one of their trades? Each of these trades is visible on the blockchain, emphasizing the analysts' ability to gather information.

In Summary: Long-Term Characteristics of On-Chain Data

Blockchain technology provides us with real-time and reliable access to trading data far beyond traditional financial markets. Thanks to the rapid development of blockchain intelligence tools, utilizing this data has become easier than ever, bringing significant competitive advantages to market participants. As more and more people begin to realize this, this new paradigm will fundamentally change the way financial data is used.

We are in the early stages of this transformation. The use of blockchain and on-chain data is gradually becoming a significant watershed in the financial field, not only changing how we access and analyze market data but also providing a new dimension and depth for trading and investment decisions. With technological advancements and deeper applications, we can foresee that the ability to use on-chain data will become a fundamental skill for financial market participants, just as important as technical and fundamental analysis are today.

In this ever-evolving world of blockchain finance, mastering and applying on-chain analysis not only helps investors capture more opportunities but also greatly enhances their understanding and predictive abilities of market dynamics, ultimately gaining a favorable position in the financial market. We are at a brand new starting point, and the possibilities for the future are endless. Now is the best time to explore and utilize these new tools.

Odaily Planet Daily will also combine the above tools to provide examples of data analysis and judgment on current hot tracks or specific investment targets, so stay tuned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。