Strong counterattack, will the bull return quickly?

Short-term public indicator section:

3.20 11:52-3.21 8:40

The Double ATR+smooth Heikin Ashi strategy had 4 trading opportunities, with 3 take profits and 1 stop loss.

The SSL+capital momentum+volatility strategy had 3 trading opportunities, with 3 take profits and 0 stop loss.

The NMACD+5IN1+MA strategy had 3 trading opportunities, with 2 take profits and 1 stop loss.

The Donchian Channel+VOL+LWTI strategy had 5 trading opportunities, with 3 take profits and 2 stop losses.

The indicators and instructions for the above four sets of strategies can be found in the YouTube video. You can choose any of the strategies for operation.

Internal group strategy section:

Short-term contracts (mainly Ethereum):

There were 2 strategy signals, with 2 take profits and 0 stop losses.

Medium and long-term contracts: TIA (average price 14.16, stop loss 12.9, currently floating profit 52%), new position PEPE (average price 0.00773, break-even loss, currently floating profit 146%, small position)

Currently holding spot: JUP (average price 0.7, floating profit 95%, already recovered the cost, continue to hold for profit), DATA (new position yesterday, average price 0.089, currently floating loss -2%)

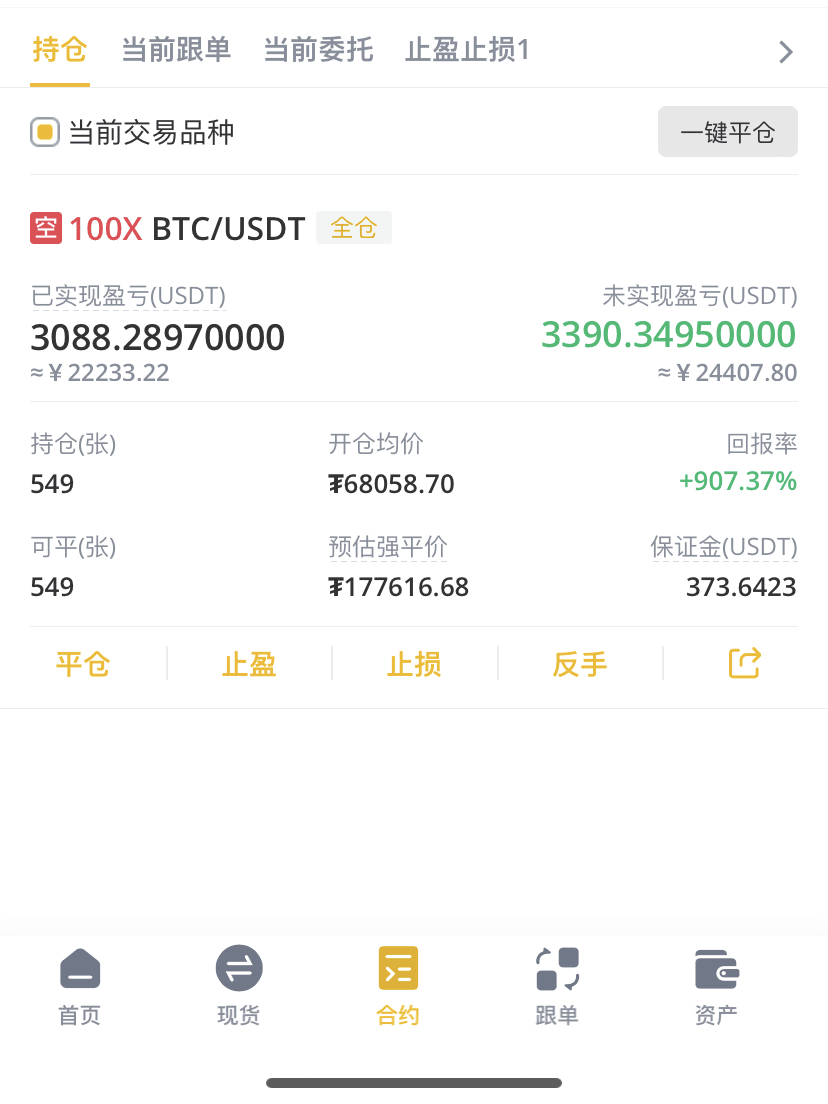

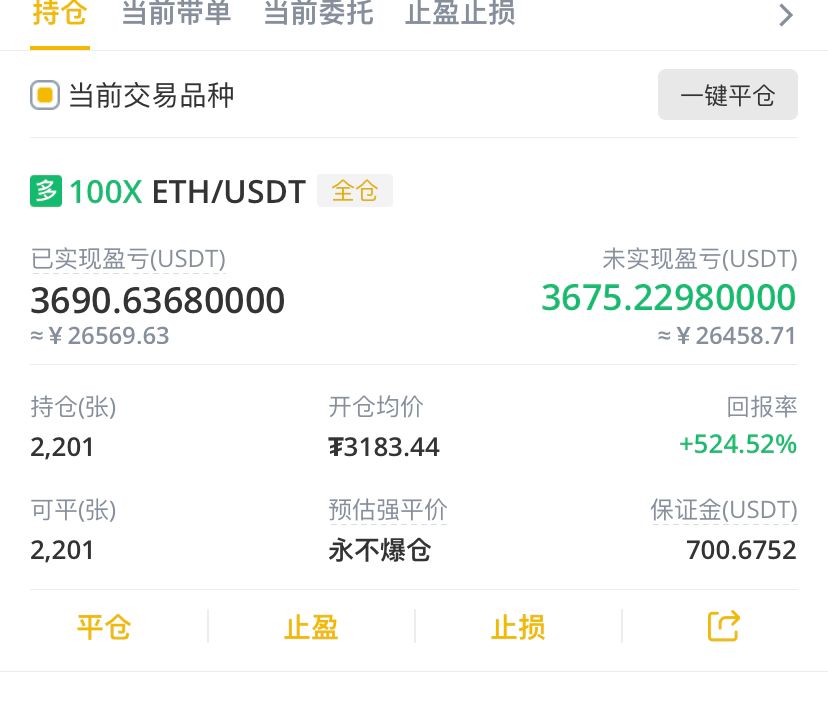

Today's account balance: Ethereum 493231, Bitcoin 79892, compared to yesterday's account balance of 485466 and 77896, Ethereum increased by 1.5%, Bitcoin increased by 2.5%.

Ethereum account started on 4/8/2023 with an initial 50000, currently accumulated growth of 886.4%.

Bitcoin account started on 2/24/2024 with an initial 50000, currently accumulated growth of 59.7%.

(The internal group has self-developed trend strategies. If you need real-time push of opening and closing signals, or need personalized trading strategy customization through quantitative programs, you can send a private message).

Comprehensive market analysis section:

Today's fear and greed index: 74 (rising), long/short ratio (d): rising, 1.16, long preference, contract open interest (d): rising, funding rate: 0.0126%, total market value ratio: 52.25% (rising)

Recommended focus today: DATA (stop loss 0.077), PYTH (stop loss 0.079)

Market analysis and trading plan:

Sugar orange: Yesterday's daily chart showed a shrinking volume and a counterattack candlestick, with the lowest point at 60800 not reaching our target, but temporarily stopping the decline. For the medium and long term, today we need to see if the support at 64880 is effective before considering a continued upward momentum. The 4-hour chart broke through the upper channel and completed 3 breakthroughs, but the hourly chart's bearish arrangement has not changed, so it is not advisable to chase after highs. It is recommended to wait for a pullback to around 65450 to enter the market.

Ethereum: There was a surge in volume forming a counterattack but it did not reach the MA21 line, which will become a resistance for the rebound (3690). At the same time, the morning rebound began with shrinking volume, indicating a weak market willingness to chase after highs. In the short term, it tends to oscillate and accumulate strength before choosing the right time to move upward. The strategy is consistent with Bitcoin, looking to go long near 3400 on a pullback.

BNB: Formed a counterattack at MA21 to confirm effective support, can add positions or enter the market with an initial position, for short-term long positions, you can enter near 537.

For analysis of other altcoins, please refer to the video.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。