Original Author: Nian Qing, ChainCatcher

On March 19th local time, the U.S. Securities and Exchange Commission (SEC) announced in two notices that the decision time for two Ethereum spot ETFs has been postponed again. The decision time for Hashdex Nasdaq ETH ETF has been extended to May 30, 2024, and the decision on ARK 21Shares Ethereum ETF application has been delayed to May 24, 2024.

In the announcement, the SEC stated: "The Commission believes that designating a longer period to issue an order approving or disapproving the proposed rule change is appropriate so that the Commission has sufficient time to consider the proposed rule change and the issues raised therein."

As previously reported, on March 4th, the SEC postponed the decision on the iShares ETH Trust application from BlackRock and Fidelity's application for its Ethereum ETF.

Although this delay was expected, it still had a certain impact on market sentiment and trends. According to RootData market data, Ethereum fell below $3200, with an intraday decline of over 10%.

According to Bloomberg ETF analyst James Seyffart on social media, at least three more Ethereum ETFs will be postponed in the next two days, including VanEck, Ark/21Shares, Hashdex, and Grayscale, all within the next approximately 12 days. He previously stated that all ETF review decisions may continue to be postponed until May 23.

Furthermore, he also stated: "My cautiously optimistic attitude towards ETH ETF has changed in recent months. We now believe that these applications will ultimately be rejected in this round on May 23. The U.S. SEC has not communicated with the issuers about the specifics of Ethereum. This is completely different from the situation during the Bitcoin spot ETF application last fall."

In recent weeks, optimism about the approval of Ethereum spot ETF applications has been steadily declining. Bloomberg ETF analyst Eric Balchunas recently lowered the likelihood of Ethereum spot ETF approval in May from about 70% to 30%. Data shows that Ethereum's one-month skewness has turned negative, implying relative strength in put options. Previously, the 60-day indicator for Ethereum leaned towards put options, while the 90-day and 180-day indicators remained positive. QCP Capital explained in its latest market insight article that investors' interest in recent Ethereum put options may stem from the decreasing likelihood of the U.S. SEC approving Ethereum spot ETFs in May.

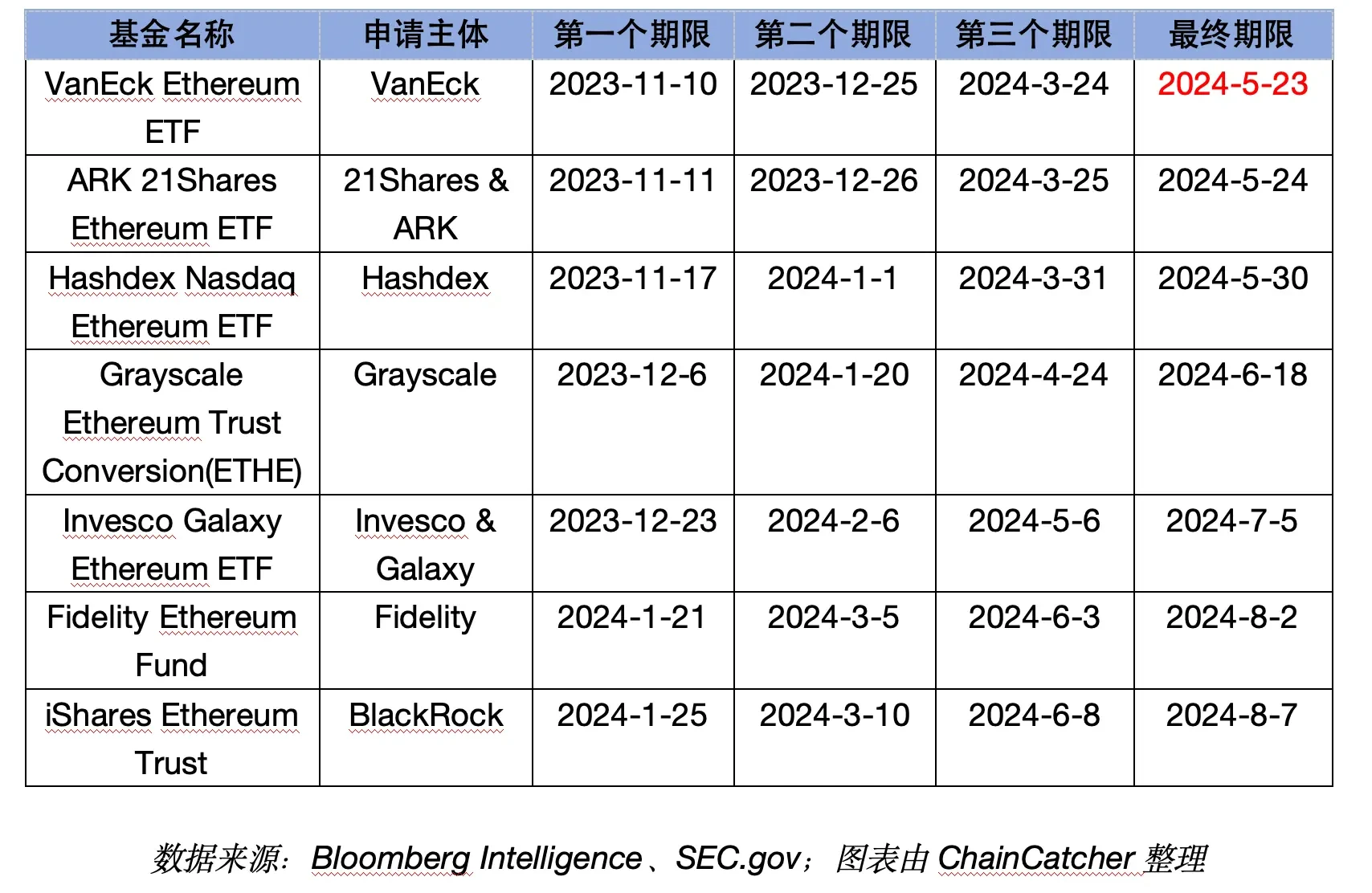

It is understood that there are four review periods for Ethereum spot ETFs (45 days, 45 days, 90 days, and 60 days). Once an institution submits a new ETF application, the SEC will register the application in the Federal Register, and the 240-day period begins from the day of registration. When each period's deadline approaches, the SEC must respond: approve, reject, or postpone the review. If there is no decision on the first date, it will be postponed to the second, until it is delayed to the final deadline, at which point the SEC must make the final decision. In other words, the final deadline of May 23 for the earliest Ethereum spot ETF application by VanEck will be a key date, and its approval or rejection will directly affect the decisions of other applications.

Currently, seven entities are applying for Ethereum ETFs, including: BlackRock, Fidelity, Invesco&Galaxy, Grayscale, VanEck, 21Shares & Ark, and Hashdex. The approval periods for each fund at the SEC are shown in the table below:

Although Matt Hougan, Global Head of Research at Bitwise, and other sources have predicted that the likelihood of Ethereum spot ETF approval in May is close to 50% or even higher, compared to the already listed Bitcoin spot ETF, there is still a certain "risk" for Ethereum spot ETF. In public documents, the SEC has stated: "Are there unique concerns regarding Ethereum and its ecosystem, including its proof-of-stake consensus mechanism and the concentration of control or influence by a small number of individuals or entities, that may lead to unique concerns about fraud and manipulation of Ethereum?"

As mentioned in the recent article "Should We Prepare for the Rejection of Ethereum Spot ETF?" by BloFin, the negative impact of the PoS mechanism, price manipulation risks, and securitization risks have significantly reduced the probability of approval for spot ETH ETF compared to spot Bitcoin ETF.

The recent continuous rise in the cryptocurrency market may have raised our expectations for this result, and this decline may help us to return to a more calm state and at least prepare for the rejection of Ethereum spot ETF.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。