Today's Headlines

It is rumored that the sovereign wealth fund of Qatar will purchase $50 billion worth of Bitcoin.

JPMorgan: Retail investors and institutions have been buying gold and Bitcoin futures.

Tunisian Prime Minister: Tunisia will allow the use of cryptocurrencies in foreign exchange reform.

Dutch cryptocurrency derivatives exchange D2X completes $10 million Series A financing.

Judge rules that Craig Wright is not Satoshi Nakamoto, nor the author of the Bitcoin whitepaper.

Musk: Tesla will "at some point" enable DOGE payments.

ether.fi releases product roadmap, will launch DeFi strategy library Liquid and expenditure account Cash.

Popular Projects (DeFi Projects)

- Idle Finance

- Introduction: An automated asset management platform designed to provide users with the best interest returns.

- Investment rationale: By algorithmically optimizing asset allocation across different DeFi protocols to achieve the highest interest returns.

- Harvest Finance

- Introduction: An automated yield farming platform where users can deposit assets and receive FARM tokens as rewards.

- Investment rationale: By pooling user funds and automating investment strategies, it aims to provide higher yield for users.

- Rarible

- Introduction: A decentralized NFT marketplace and issuance platform that allows users to create, sell, and collect digital artwork.

- Investment rationale: With the rise of the NFT market, Rarible provides a decentralized platform to facilitate NFT trading and circulation.

- Pickle Finance

- Introduction: A DeFi protocol focused on stablecoins, stabilizing the price of stablecoins through providing liquidity mining incentives.

- Investment rationale: Through innovative economic models and incentive mechanisms, Pickle Finance aims to maintain the value of stablecoins and provide returns.

- Akropolis

- Introduction: A DeFi platform aimed at providing retirement solutions for users.

- Investment rationale: By building a decentralized financial ecosystem, Akropolis offers new possibilities for long-term savings and retirement planning.

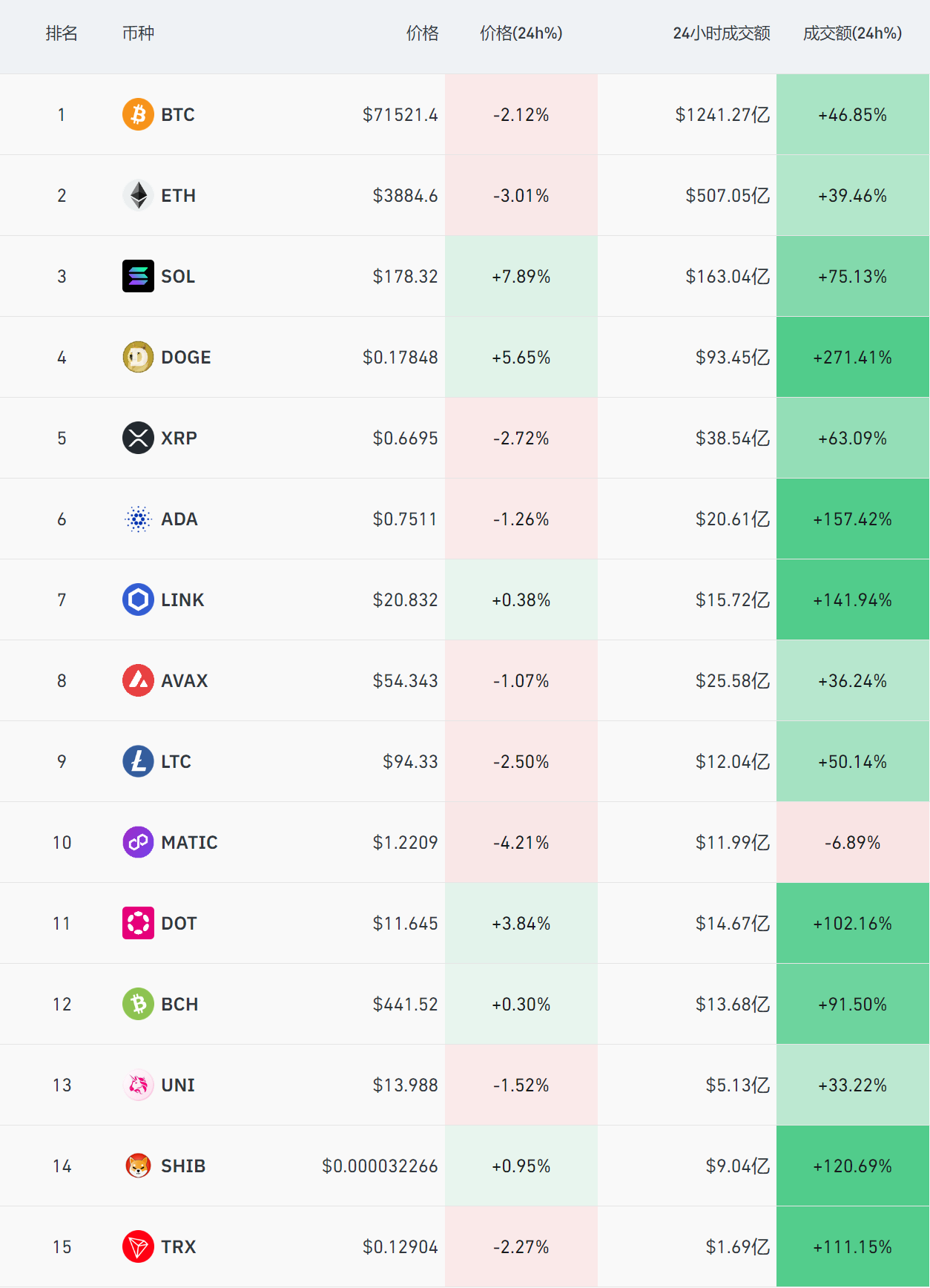

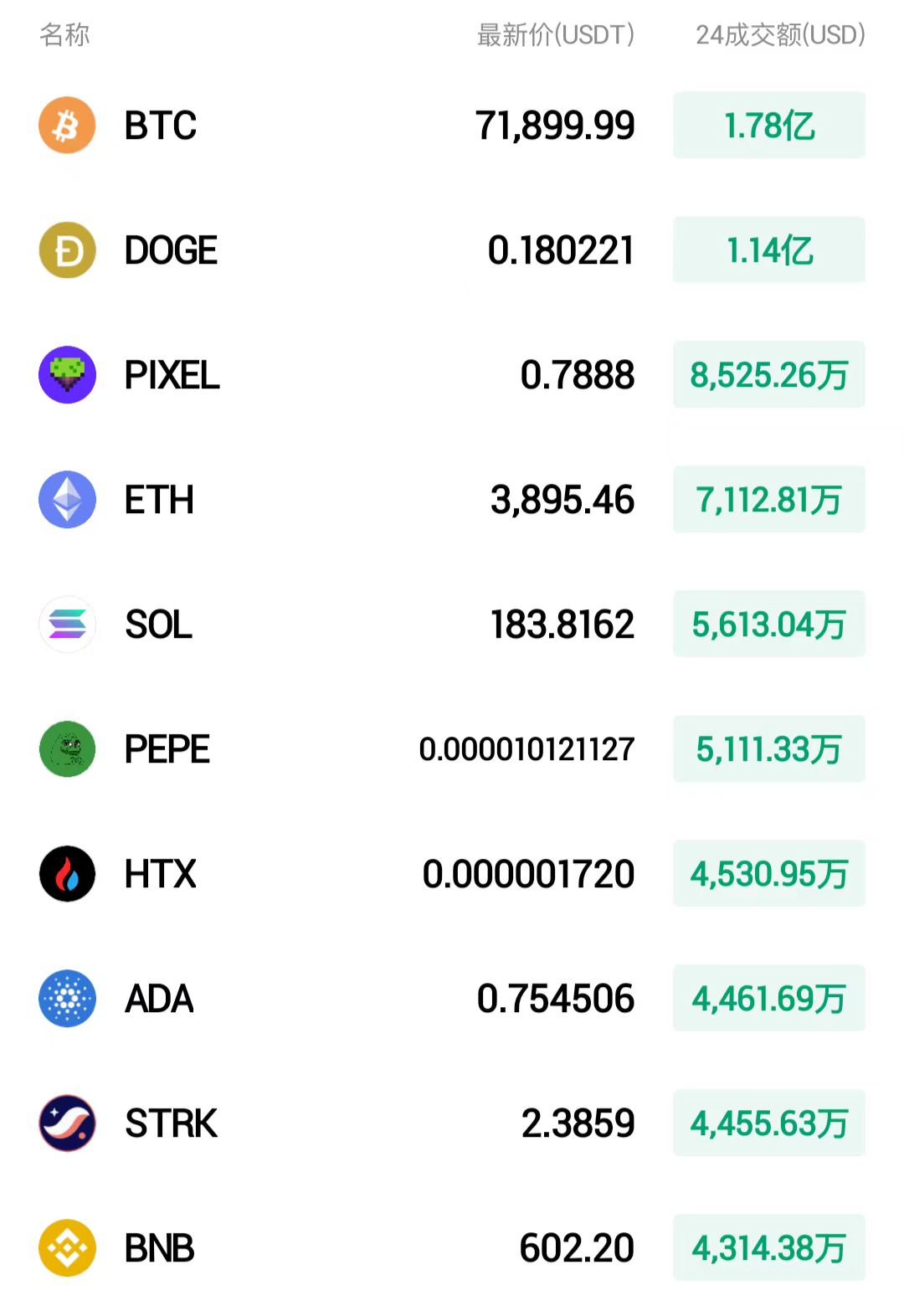

Market Overview

Bitcoin (BTC) experienced significant fluctuations in the past 24 hours, dropping by 2.12%, reaching a high of $73,764 and a low of $68,585, with a volatility of 3.74%. Ethereum (ETH) dropped by 3.01% in the past 24 hours, reaching a high of $4,011 and a low of $3,724, with a volatility of 5.87%.

Major coins saw more declines than gains, with SOL rising by 7.89% and MATIC falling by 4.21%. The total market capitalization of cryptocurrencies is $2.863 trillion, a 0.9% decrease from yesterday; the total 24-hour trading volume across all networks is $198.6 billion, showing a slight increase from yesterday.

The fear and greed index is at 83, a decrease of 5 points from yesterday, indicating extreme greed in the market sentiment.

The Huobi Dollar-Cost Averaging Index is at 13, an increase of 3 points from yesterday, indicating a holding and observing stance.

Market Opportunities

Analyst MAX: Yesterday, the cryptocurrency market once again exhibited familiar market trends, rallying, deep retracement, and rallying again. Due to the high opening and low performance of the US stock market, the rise in the US dollar index, and grayscale selling, the market experienced a deep retracement again. However, the trend has not changed, and the operating strategy remains the same. It is advisable to go long on retracements, while strictly managing risk and positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。