News

On March 14th, according to the event video shared by DogeDesigner, Elon Musk stated at an offline event that Tesla will support DOGE payments in the future "at some point," allowing DOGE to "go to the moon."

According to Farside Investors data, the net inflow of Bitcoin spot ETF was $683.7 million yesterday, Belad IBIT had a net inflow of $586.5 million, Fidelity FBTC had a net inflow of $281 million, and Grayscale GBTC had a net outflow of $276 million.

On March 14th, according to CoinDesk, Judge Edgardo Ramos of the Southern District of New York has rejected Genesis and Gemini's motion to dismiss the lawsuit filed by the U.S. Securities and Exchange Commission (SEC), stating that the SEC "reasonably alleges" that these two companies violated securities laws, including allegedly providing and selling unregistered securities to retail investors through the now-dissolved Gemini Earn program.

Market Review

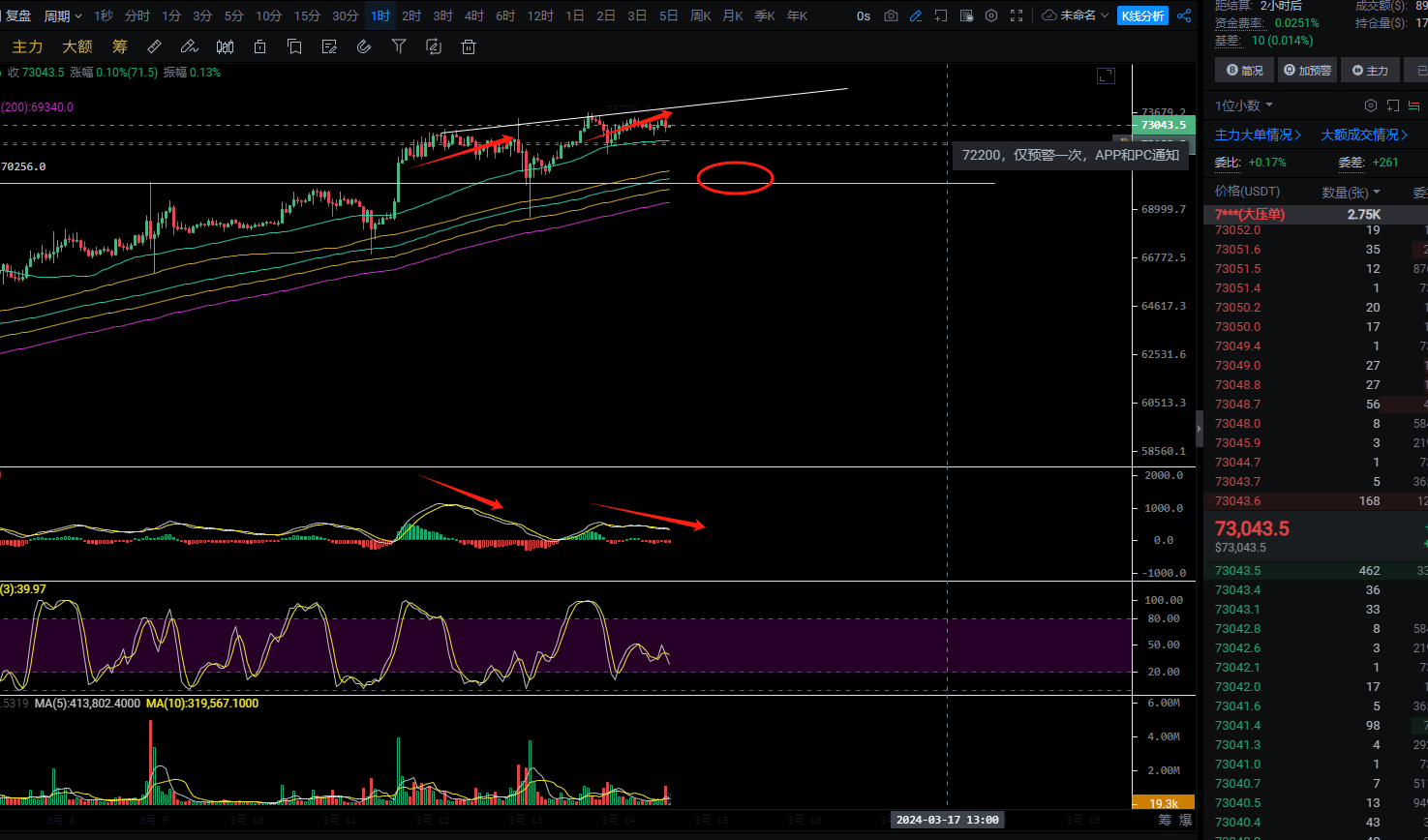

As mentioned in the previous article, as long as the market does not fall below 69000, it can open long positions after a pullback. Unfortunately, after a breach, it quickly recovered and set a new high again. However, the market has not yet stabilized around the 73000 level. If the daily opening price stabilizes around 73000 for two consecutive days, and considering the record-breaking inflow of ETFs yesterday, will the market continue to rise?

Market Analysis

Macro Analysis: In the field of commodities, demand shock refers to a sudden and significant change in the demand for basic commodities or raw materials caused by unforeseen events. Positive demand shock arises from an increase in demand, which may be due to technological innovation, policy changes, or changes in consumer preferences leading to price increases. The economic prosperity of China in the early 21st century, along with the accelerated development of real estate, created a demand shock for commodities, leading to a 793% increase in steel prices from 2000 to 2008. Reacting in the form of increased production led to an 80% decline in steel prices over the next decade.

I believe that Bitcoin is currently experiencing a positive demand shock. The U.S. Securities and Exchange Commission (SEC) approved spot-based ETFs, allowing people to access over $14 trillion in assets, although this is well known, the timing is not clear, and the scale of resulting capital inflows has not been widely agreed upon. So far, the launch of ETFs on January 11th has led to a daily demand for 4500 bitcoins (only on trading days), while an average of only 921 new bitcoins are mined each day. This has led to a significant increase in the price of Bitcoin in recent weeks, as the supply of newly mined bitcoins cannot keep up with demand, leading ETF issuers to primarily purchase from the secondary market. This can be seen in the data, where the OTC market holdings have decreased by 74% since their peak in 2020, likely due to recent ETF demand.

In the first two months of this year, U.S. ETFs witnessed a record $10 billion inflow, while in comparison, the first gold ETF launched by iShares in 2005 had a net inflow of only $28.8 million in the first two months. In the first two months of 2020, just before the halving, ETP inflows were $436 million, accounting for 11% of its total assets under management, which is very similar to today, with recent inflows also accounting for 11%, and even in nominal value terms, today's inflows are 23 times that of 2020. With the current supply unable to increase, only price equilibrium can be achieved, and the market will seek a new balance at the intersection of supply and demand. This adjustment process can be fast or slow, depending on the severity of the shock, and given that Bitcoin supply is not flexible, a new balance can only be sought at the price level. This is why we have seen such a rapid rise in the price of Bitcoin in recent months, as the demand for ETF issuance and the upcoming halving have exacerbated this issue.

Currently, on the one-hour chart, two divergences have appeared. In the early trading today, there was another attempt to test the resistance level, but it quickly retracted in a pin form. There have been four attempts to test the high level, all of which were suppressed, indicating that the resistance above is very strong. The probability of a short-term downward movement has greatly increased, but the buying pressure remains very strong. Each time there is a downward push, it can quickly rebound. Overall, the outlook remains optimistic. Therefore, in terms of operation, short positions are secondary, and long positions are primary. The upper resistance level to watch is 73300-73500. If it stabilizes above 73500 in the short term, it could reach 75500. The lower support is divided into two points: near 72200 and the range of 70500-69800. As long as it does not breach 68500 in the short term, the retracement is an opportunity to enter the market. Once it falls below 68500, the situation will not be very optimistic, and it is likely to test the support around 64000-63000. Therefore, how to operate in the future depends on your own judgment. Specific live trading explanations will be provided.

Technology is the method, and the trend is the king. Let the leader of the coin circle guide you to soar in the sea of coins.

Enter the market cautiously, trading involves risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。