Original Author: Frank, Foresight News

In the world of cryptocurrency, "Pixiu" and "bull market engine," Grayscale before 2021 can be said to have been unmatched until January 10 this year, when the good times came to an abrupt end.

According to SoSoValue statistics, since January 11, GBTC has cumulatively flowed out more than 10 billion US dollars, and the net asset value has dropped to 27 billion US dollars, making it the only product among the 10 spot Bitcoin ETFs with continuous net outflows.

Positive factors during the upswing will be magnified, and only the choices during the ebb tide are more representative. It is in this context of huge changes in the past two months that Grayscale has clearly accelerated its pace, beginning to speed up the launch of new products and layouts. This article aims to provide a simple overview of this and explore the truth behind it.

Opening 5 altcoin trusts for private placement

On February 15, Grayscale's email notification showed that it had opened private placements for some cryptocurrency trusts to accredited investors, including Grayscale Bitcoin Cash Trust, Grayscale Chainlink Trust, Grayscale Litecoin Trust, Grayscale Solana Trust, and Grayscale Stellar Lumens Trust, with subscriptions based on net asset value (NAV).

In summary, it is opening private placements for BCH, LINK, LTC, SOL, and XLM, these 5 cryptocurrency trusts for qualified investors to subscribe to—according to the process disclosed on Grayscale's official website, the product lifecycle of its trusts currently includes private placements, public quotations, Securities and Exchange Commission (SEC) quotations, and ETF-type, which means except for the Bitcoin trust GBTC, all other cryptocurrency trusts are still closed-end funds and cannot be redeemed in the market.

However, Coinglass statistics show that after the private placement subscription was opened on February 15, in less than a month, these 5 cryptocurrency trusts showed a significant net inflow in Grayscale's entire fund holdings:

Among them, LTC increased by over 44,300 coins (over 3.5 million US dollars), BCH increased by over 4,062 coins (about 1.6 million US dollars), XLM increased by over 4.92 million coins (about 680,000 US dollars), and LINK increased by over 100,000 coins (about 2 million US dollars).

Only SOL is a discontinued existence—increasing by over 97,500 coins, worth over 13.5 million US dollars.

Clearly, only GBTC has been converted to an ETF, so why did a large amount of off-market funds participate in the private placement subscription of these 5 altcoin cryptocurrency trusts after they were opened?

Arbitrage and game behind the subscription

The reason lies in the large premium in the primary and secondary markets + the unique arbitrage space created by the special redemption mechanism.

Premium of over 130%

As shown in the above figure, it is obvious that these 5 altcoin cryptocurrency trusts all have large premiums—old PoW coins like LTC and BCH generally have premiums of over 130%, with SOL having a premium of over 870%, and LINK also reaching 830% (of course, the total holding volume of the LINK trust is only 8 million US dollars).

This premium specifically refers to the difference between the market price of the underlying cryptocurrency (considered as the primary market) and the corresponding US stock share (secondary market price). Taking LTC as an example, a premium of 161.79% means that the secondary market trading price of each ETCG share is 161.79% of the actual value of the corresponding ETC share it represents.

Therefore, in this context, combined with Grayscale's cryptocurrency trust's "naked long trust" mechanism, it perfectly forms an arbitrage path that flattens the premium space.

"Naked long trust" mechanism

Here we need to briefly introduce the creation/redemption mechanism of Grayscale's cryptocurrency trust, which is almost a "naked long trust."

Taking GBTC before it was converted to an ETF as an example, Grayscale's cryptocurrency trust cannot directly redeem its underlying assets—there is no clear exit mechanism, and there is currently no "redemption" or "reduction,"

This means that these cryptocurrency trusts themselves are "naked long trusts"—they can only enter and not exit in the short term (although Grayscale currently charges management fees in proportion and the form is indeed asset-based, which is also the reason why its holdings are periodically reduced in small amounts).

Specifically, still using ETCG as an example: the channel for investors to obtain ETCG shares, besides directly purchasing them on the secondary market of US stocks, is to participate in the private placement by depositing the corresponding ETC tokens, and after the lock-up period, they can unlock and obtain the corresponding proportion of ETCG shares (according to public information, the lock-up period is 12 months).

So there is an arbitrage opportunity here, for example, investors can participate in the private placement of ETCG with ETC in the primary market, and based on the net value of the assets submitted, obtain equivalent shares, while hedging with an equivalent ETCG short position in the futures market (if you bet that there will still be a premium after 12 months, you can even skip the step of hedging with a short position).

Then after waiting for 12 months, the unlocked ETCG shares can be sold on the secondary market of US stocks, and at the same time, the corresponding short position can be closed out, thus netting the difference between the net value of Grayscale's ETCG trust and the ETCG on the secondary market of US stocks, completing the entire arbitrage process.

In summary, it is as if the arbitrageur is buying ETC in the cryptocurrency market and selling ETHG in the US stock market, so from the market's perspective, the current high premiums of ETCG and the like are more like a "call option" for a period of 12 months.

Of course, this huge call option for arbitrage space may be just an asymmetric game—ETCG is open to institutions and qualified investors in the primary market through private placements, allowing them to sell the shares obtained in the secondary market of US stocks, and those who buy at such a negative premium in the secondary market of US stocks undoubtedly are ordinary US stock investors with information asymmetry.

In fact, from 2020 to 2021, Grayscale's Bitcoin trust GBTC and Ethereum trust ETHE have experienced similar situations of positive premiums and arbitrage. However, with the series of impacts such as the bankruptcy of Three Arrows Capital and the crisis of DCG in 2022, the premium of GBTC not only turned from positive to negative, but at its highest negative premium, it even exceeded 50%, completely blocking this arbitrage path.

However, with the re-hype of the news of the spot Bitcoin ETF in mid-2023 and the progress of GBTC's conversion to an ETF, the negative premium of GBTC has given rise to a completely opposite arbitrage space: buying GBTC with a negative premium in advance, betting on the approval of the ETF, and waiting for the conversion of GBTC to ETF in the future to flatten the negative premium, thus gaining the arbitrage profit during this period.

Is Grayscale accelerating its shift to altcoins?

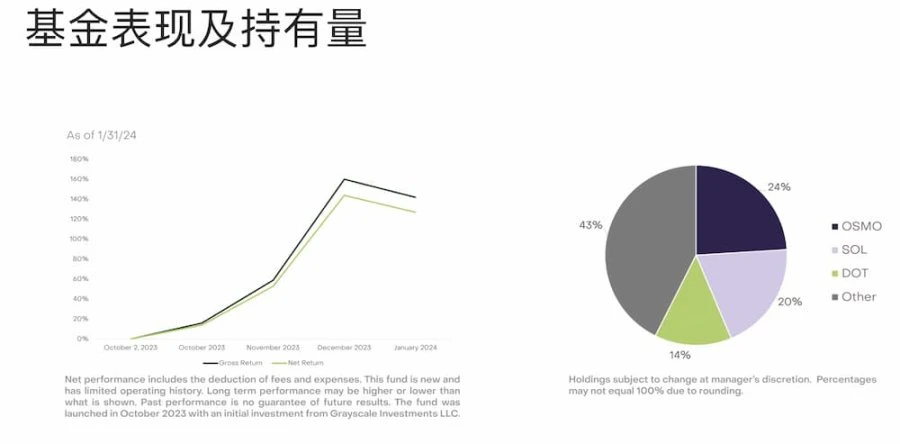

In addition, on March 5, Grayscale also launched its first actively managed fund—the Dynamic Income Fund (GDIF).

The fund will earn income through staking cryptocurrencies and initially support nine blockchain assets: Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), SEI Network (SEI), and Solana (SOL), and plans to distribute staking rewards in USD on a quarterly basis.

According to the official asset allocation of the GDIF fund, OSMO accounts for 24%, SOL accounts for 20%, DOT accounts for 14%, and the remaining portion accounts for 43%, undoubtedly lowering the barrier for institutional investors outside the circle to participate in PoS investments.

In a sense, this can be considered as Grayscale's biggest "product innovation" in recent years, gradually shifting towards actively participating in earning native cryptocurrency income, providing institutional investors with a simple way to obtain PoS rewards.

Necessity is the mother of invention. It's worth noting that since its inception in 2019, Grayscale has been a significant representative of institutional buying in the cryptocurrency world and one of the largest "whales" in the crypto space. Its greatest narrative value over the years has undoubtedly been providing compliant cryptocurrency investment channels for investors in the form of trust funds.

However, after the approval of the spot Bitcoin ETF on January 10 this year, Grayscale's role as the "institutional investor channel" has been met with sustained outflows of funds due to factors such as its high management fees, leading to the largest market selling pressure in the short term.

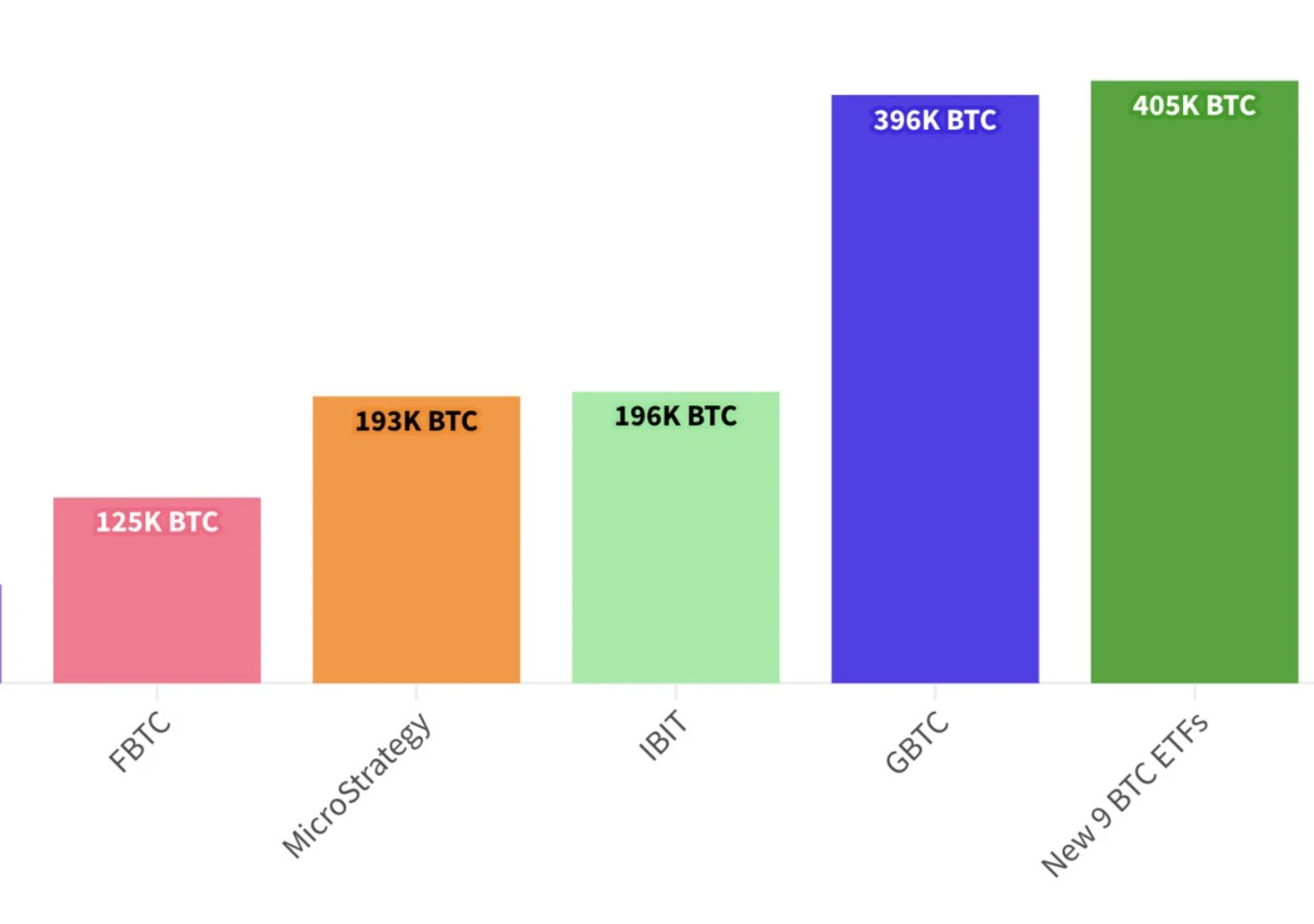

According to cryptocurrency trader Fred Krueger's monitoring, as of the last trading day, the BTC holdings of the other 9 spot Bitcoin ETFs have just completed a reversal of the GBTC holdings:

The BTC holdings of the 9 spot Bitcoin ETFs reached 405,000 BTC, surpassing the GBTC holdings of 396,000 BTC, a surge in the past 2 months, overturning GBTC's leading position over the past 5 years.

Summary

Perhaps because of this, Grayscale's recent moves in the past two months have all been focused on positioning around altcoins other than Bitcoin, hoping to explore new major income sources beyond the fallen Bitcoin trust, by shifting its focus to other Crypto trusts:

Replicating the almost exclusive compliant entry channel status of GBTC in the past, enjoying the "compliance premium" that institutional investors are willing to pay, and continuing to quietly make a fortune.

Good times during the upswing are always nostalgic, but for Grayscale, whether the good old days of earning without much effort in 2020 can come back remains an unknown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。