News

On March 11th, according to Lookonchain monitoring, 8 hours ago, the attacker of the cryptocurrency trading platform Bitrue sold 4207 ETH, approximately $16.34 million. The attacker currently holds 4650 ETH (approximately $17.68 million), 150 billion SHIB (approximately $4.7 million), and 756 million HOT (approximately $2.9 million).

On March 11th, according to BTC.com, the current block height is less than 40 days away from the Bitcoin halving time. Since a halving occurs every 210,000 blocks, the next Bitcoin halving is expected to occur when the block height reaches 840,000 in April 2024, at which point the block reward will decrease from 6.25 BTC to 3.125 BTC.

On March 11th, according to the summary of the 129th Ethereum core developer meeting, the Ethereum Cancun upgrade will be activated on the mainnet at Beacon Slot 8626176 (expected to be at 21:54 on March 13th, Beijing time). This upgrade mainly includes EIP-4844 (Proto-Danksharding), which aims to reduce Ethereum gas fees by using blobs to carry transactions.

Market Review

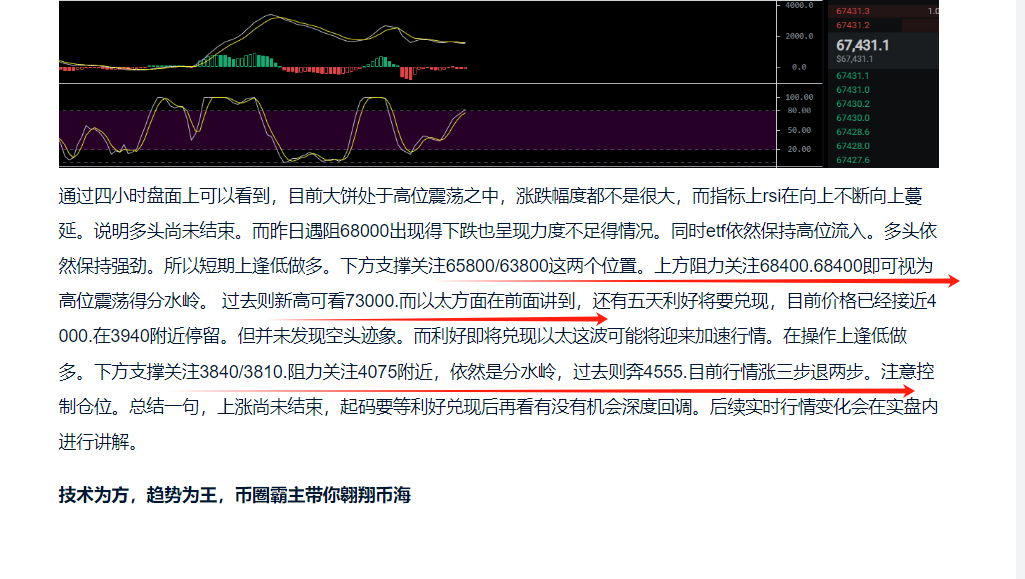

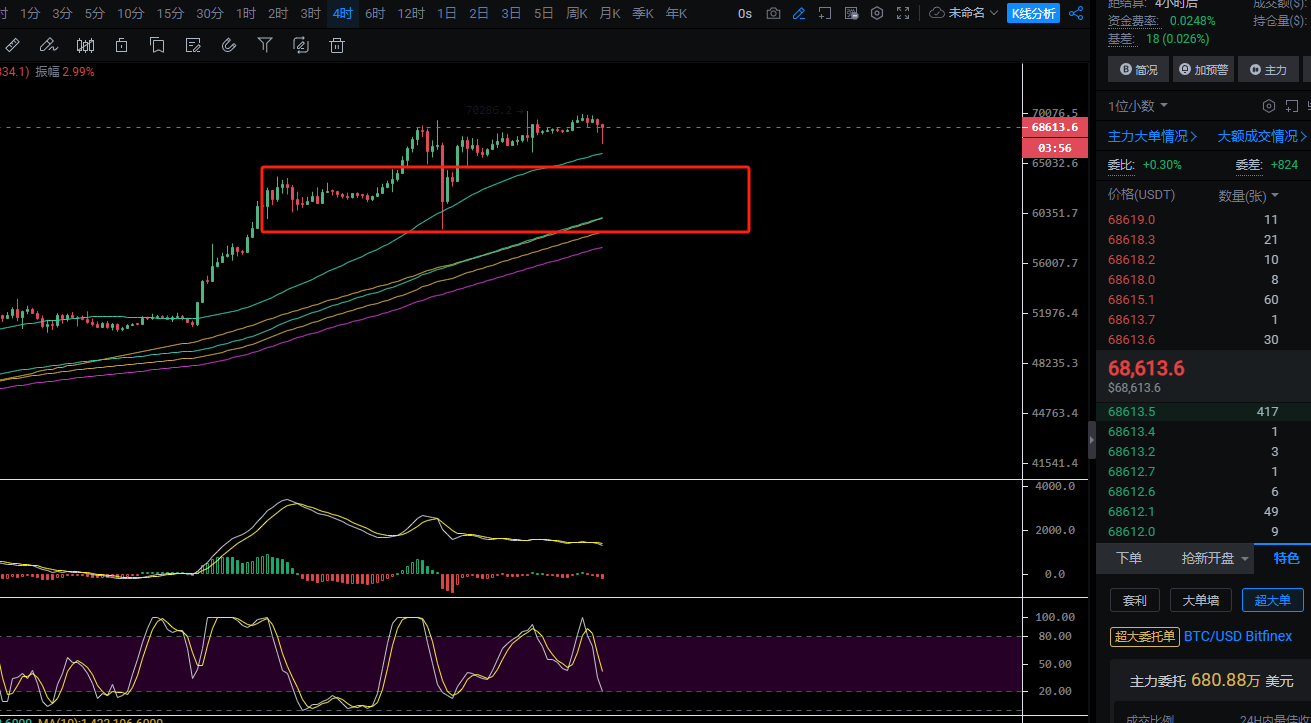

In the previous market surge, Bitcoin broke through to a new high, reaching around 70300, in line with the mentioned watershed of 68400 in the article. The breakthrough was followed by acceleration, but after breaking the new high, it retraced, indicating significant resistance above. At the same time, buyers below were aggressively buying, indicating a potential formation of an oscillating upward trend. So, how should we operate in the future?

Market Analysis

Macro Analysis: With Bitcoin hitting a new all-time high, various indicators within the industry have followed suit. The stablecoin USDT broke through a market value of $100 billion for the first time last week. In terms of assets under management (AUM), the size of the Bitwise Crypto Industry Innovators ETF (approximately $12.6 billion) has surpassed the largest silver ETF SLV (approximately $9.626 billion), ranking third among commodity ETFs. Another event worth noting is the meetings between Grayscale, Coinbase, and officials from the U.S. Securities and Exchange Commission (SEC) to discuss rule changes for launching a spot Ethereum ETF. As we have mentioned many times before, the Ethereum ETF is the most anticipated event of the year. Frequent meetings and negotiations between relevant institutions and the SEC are positive signs. Last week, the U.S. released significant non-farm payroll data. The seasonally adjusted non-farm employment increased by 275,000 in February, significantly higher than the market's expectation of 200,000. The unemployment rate in February unexpectedly rose to 3.9%, reaching a new high since January 2022, as the market had initially expected it to remain unchanged at 3.7%. The average hourly wage in February rose by 0.1% month-on-month and by 4.3% year-on-year, both lower than the market's expectations of 0.3% and 4.4%, respectively. Compared to employment figures, the unemployment rate and average hourly wage have a greater impact on interest rate cuts and inflation. The significant non-farm payroll data clearly favors the expectation of maintaining the usual decline and interest rate cuts by the Federal Reserve. In last week's speech, Powell did not provide any new insights, so we can basically assume that the Federal Reserve currently has no plans to adjust its interest rate cut plan for the year. We won't list all the other data, but overall, the U.S. economy is in a relatively good state, and the downward trend in inflation remains unchanged, making an interest rate cut likely this year. In this context, it is clear that it is difficult to find fertile ground for a global black swan event. So, in summary: Bitcoin remains strong and will maintain an oscillating upward trend. We should expect a significant Bitcoin pullback to facilitate buying opportunities. Currently, the macro situation is good, and there is a lack of a macro environment conducive to global black swan events.

Looking at the market, the 15% retracement in the early hours of March 6th and the subsequent new high on Friday were quickly recovered to a high position within a few hours. The speed of the rebound and the strength of the buying force are remarkable. Meanwhile, the morning market continued to decline in the form of a pin bar, returning to around 68500, with the RSI also turning downward, approaching the bottom. Therefore, in the short term, the focus should still be on buying on the dip. Support below is around 67400/65800, while resistance above is around 69600/72000-73000, with 69600 being a key watershed. As shown in the chart, the previous oscillation range has become an important support, and the key support below is around 64500. Breaking this level would bring it closer to the lower boundary of the previous oscillation range, around 59000. Real-time market changes will be explained in the live market.

Technology is the means, and the trend is king. The dominant force in the cryptocurrency world will guide you through the sea of coins.

Exercise caution when entering the market, as there are risks involved.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。