Author of the original text: AARON XIE

Original translation: Deep Tide TechFlow

Introduction: The beginning of permissionless lending on the chain

The story of permissionless lending platforms began with Rari Capital and its Fuse platform. Fuse was launched in the first half of 2021, during the previous DeFi summer boom, marking a period of explosive growth for DeFi. The platform, a creation of Rari Capital, quickly gained attention by allowing users to create and manage their own permissionless lending pools, bringing revolutionary changes to the DeFi space in line with emerging yield optimization trends.

During its rise, Rari Capital adopted the (9,9) narrative promoted by Olympus DAO, a strategy aimed at leveraging OHM yields. The merger of Rari Capital and Fei Protocol further amplified the growth and community development during this period. In November 2021, the merger of Rari Capital and Fei Protocol revolved around a specific vision: to establish a comprehensive DeFi platform integrating Rari's lending protocol with Fei's stablecoin mechanism.

However, everything came crashing down in April 2022 when Fuse fell victim to a reentrancy attack, resulting in staggering losses estimated at around $80 million. This event triggered a rigorous review of Rari Capital's security practices and raised broader concerns about the susceptibility of DeFi platforms to such attacks. Following this crisis, the management entity formed after the merger of Rari Capital and Fei Protocol, known as Tribe DAO, faced difficult decisions. The pressure and challenges from the hack ultimately led to the closure of Tribe DAO and Rari Capital later that year. This closure marked a significant moment in the DeFi space, highlighting how even the most innovative platforms are vulnerable in the face of security threats and emphasizing the importance of secure and robust protocols in decentralized finance.

The revival of permissionless lending

Following the hacker attack on Rari Capital in April 2022 and the significant Euler hacker event in 2023 (involving $200 million in losses), the DeFi industry faced continued skepticism about security. Euler, known for its innovative permissionless lending protocol allowing users to borrow various crypto assets, became another stark reminder of vulnerabilities in the DeFi ecosystem. These major security flaws exacerbated pessimism within the industry, sparking serious concerns about the security and reliability of decentralized finance platforms.

However, the DeFi lending sector quietly revived in the latter half of 2023 with the launch of Ajna in mid-July. The revival continued with the release of Morpho Blue on October 10, 2023. These emerging protocols stood out in the revitalized DeFi lending sector for their shift from a purely "permissionless" narrative to a distinct "modular" approach. Platforms like Ajna and Morpho Blue began emphasizing their "modular" nature, focusing on providing unrestricted access for third-party developers to build and customize lending use cases. This shift towards modularity highlighted the flexibility and adaptability of these platforms, encouraging innovation and specialization in lending solutions. In addition to this modular narrative, emphasis was also placed on security. For example, Ajna set itself apart by operating without oracles, eliminating reliance on external price feeds and reducing vulnerabilities. Morpho Blue introduced the concept of "permissionless risk management," delegating responsibility to third parties to select the highest risk-adjusted return lending markets.

Current situation: The return of DeFi liquidity

As we enter 2024, the entire cryptocurrency and DeFi industry is experiencing a noticeable resurgence. This revival is often attributed to new token distribution mechanisms, a theory advocated by Tushar of Multicoin. His theory posits that each crypto bull market is triggered by innovative token distribution methods. In the current market, the concept of "points" has become a significant driving force, with platforms like Eigenlayer leading the way through their re-staking ecosystem. This approach not only reignited interest but also shaped the dynamics of the market. Meanwhile, the diversity of on-chain asset types continues to expand, adding depth to the DeFi ecosystem.

That being said, in a landscape where institutions and "degen" alike seek on-chain leverage, it is imperative to ensure the necessary lending systems and infrastructure. While established protocols like Compound and Aave have facilitated transactions worth billions of dollars, their limited capacity cannot accommodate diverse collateral types, necessitating the emergence of new on-chain lending platforms. Over the past year or two, the field has witnessed the rise of new lending protocols such as Morpho, Ajna, and Euler, each competing for a share of the on-chain lending market. Additionally, the development of NFT lending protocols like Metastreet and Blur has also been witnessed. This article aims to explore the narratives and functionalities of these projects, providing readers with an in-depth understanding of their differences and contributions.

Morpho Protocol

Origins of Morpho

The origin story of Morpho and the decision to develop Morpho Blue are rooted in the initial success of the protocol and a deep understanding of the limitations in the DeFi lending sector. Introduced by Paul Frambot and the Morpho Labs team, Morpho quickly gained prominence as the third-largest lending platform on Ethereum, with over $1 billion in deposited assets within a year. This impressive growth was driven by the Morpho Optimizer, which operates on existing protocols such as Compound and Aave, enhancing the efficiency of interest rate models. However, Morpho's growth was ultimately constrained by the design limitations of these underlying lending pools.

These realizations led to a rethinking of decentralized lending from the ground up. The Morpho team, drawing on their extensive experience, recognized the need to transcend existing models to achieve new autonomy and efficiency in DeFi lending. This evolution gave birth to Morpho Blue. The vision for Morpho Blue was to address several key issues in DeFi lending:

Trust assumptions: The protocol reduces trust assumptions by allowing more decentralized and dynamic risk management, addressing the need for constant monitoring and adjustment of numerous risk parameters, which may be a primary cause of security vulnerabilities.

Scalability and efficiency: By moving away from DAO-style management, Morpho Blue aims to improve scalability and efficiency, including addressing inherent capital efficiency and interest rate optimization issues in the current decentralized lending model.

Decentralized risk management: Morpho Blue focuses on permissionless risk management, achieving a more transparent and effective way of handling risk in lending platforms.

The development of Morpho Blue represents a significant shift towards building more unbiased and trustless lending primitives in DeFi. This transformation complements the potential to build abstraction layers on top of these primitives, establishing a more resilient, efficient, and open DeFi ecosystem at its core.

Analysis of Morpho Blue (and MetaMorpho) Protocol

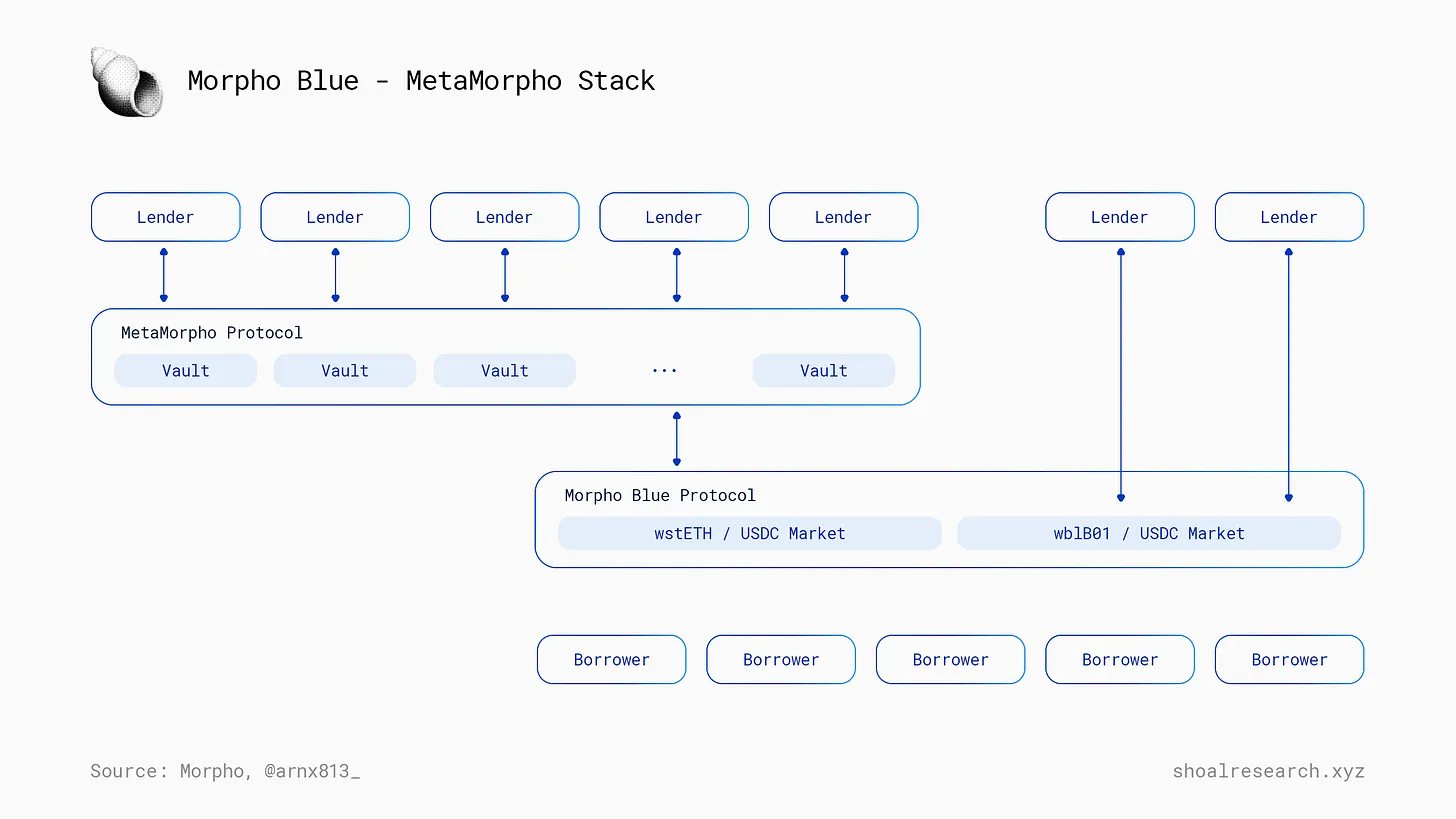

The Morpho protocol is divided into two distinct layers: Morpho Blue and MetaMorpho, each playing a unique role within the ecosystem.

Morpho Blue aims to allow anyone to deploy and manage their own lending markets without permission. A key feature of each Morpho Blue Market is its simplicity and specificity: it supports only one collateral asset and one loan asset, along with a defined loan-to-value ratio (LTV) and an oracle for a specified price source. This framework ensures that each market is simple and focused, making it accessible to a wide range of users. Morpho Blue also achieves minimal governance with a concise and efficient codebase, consisting of only 650 lines of Solidity, enhancing its security and reliability. Additionally, Morpho Blue includes a fee switch managed by $MORPHO token holders, adding a layer of community-driven oversight to the protocol.

On the other hand, MetaMorpho introduces the concept of a loan insurance pool managed by third-party "risk experts." In this layer, lenders deposit funds into the insurance pool, and the pool administrators allocate this liquidity to various Morpho Blue markets. This approach allows for more complex and dynamic fund management, leveraging the expertise of professional managers to optimize returns and manage risks. The core innovation of MetaMorpho lies in its product positioning and developer friendliness. It creates a platform for third-party developers to build on the Morpho Blue infrastructure, adding another layer of diversity and innovation to the Morpho ecosystem.

Case Study: Steakhouse Financial

Steakhouse Financial, led by Sebventures, is a prime example of effective utilization of the Morpho Blue ecosystem. This DAO-based financial advisory service has made significant strides in the DeFi space with its innovative lending approach. Since January 3, Steakhouse Financial has been managing a total locked value of $12.8 million in the USDC MetaMorpho insurance pool. The pool is primarily focused on stETH and wBTC. In the future, Steakhouse Financial has expressed interest in supporting real-world assets (RWA) as collateral.

Four Roles in the Morpho Ecosystem

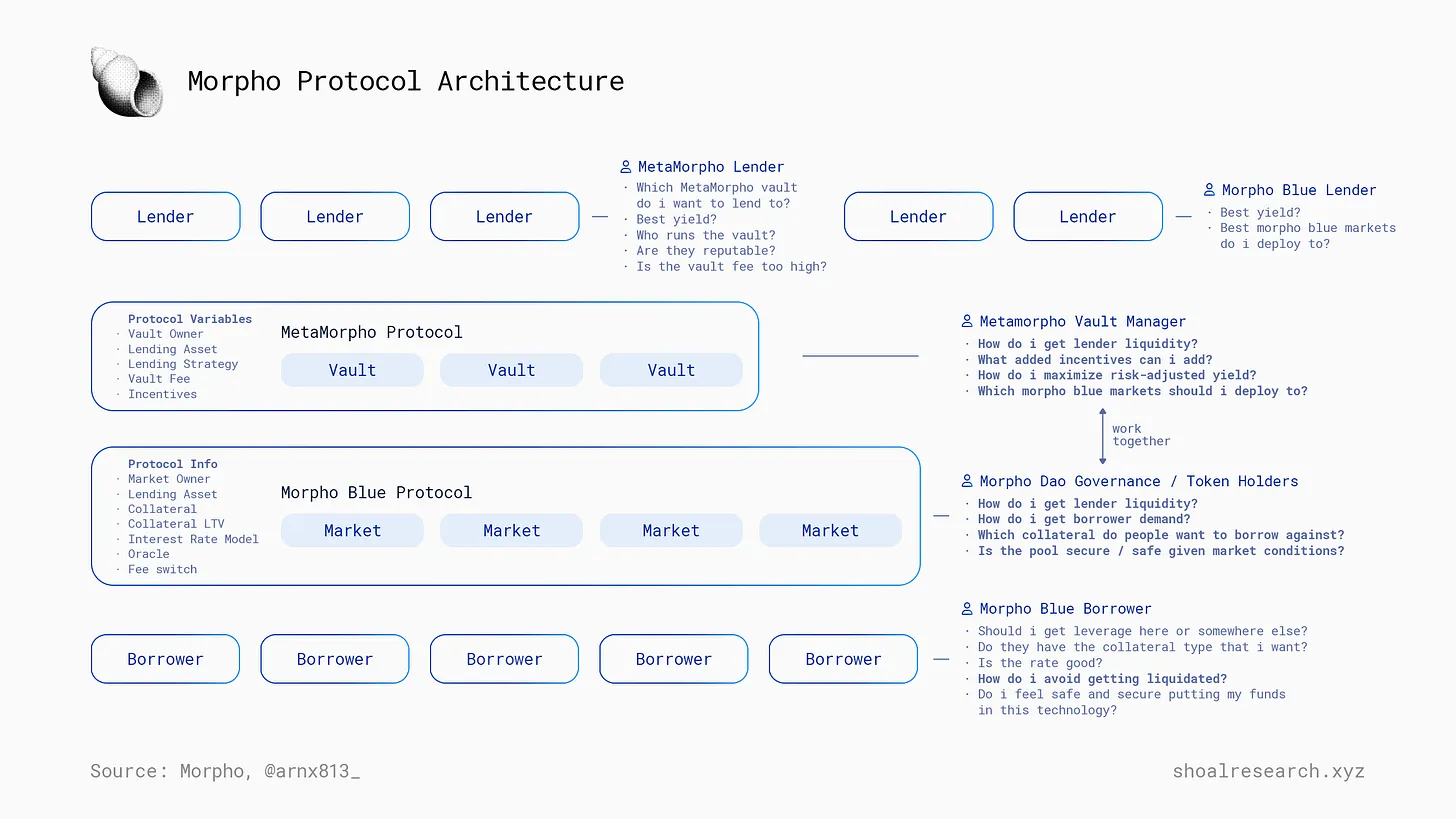

Given the current developments, there are four main roles in the Morpho ecosystem: MetaMorpho lenders, Morpho Blue lenders, borrowers, MetaMorpho insurance pool administrators, and Morpho governance/Morpho Labs.

Below is a chart of the complete Morpho protocol architecture, annotated with the participants and their objectives/thought processes.

Growth of Morpho

Morpho stands out through a combination of a strong brand and excellent business development execution. While other lending projects have emerged, including Ajna, Midas, Frax Lend, and Silo Finance, Morpho ranks at the top in terms of total locked value. Although the protocol is inherently permissionless, it is abstracted through a licensed Morpho UI. This planned user interface demonstrates the team's commitment to maintaining brand and trust by carefully showcasing only the best lending markets and partners. This subtle approach balances the appeal of a permissionless protocol with effectively connecting its frontend to reputable entities, ensuring that Morpho Blue sets the benchmark for quality and reliability in the DeFi space, despite the perceived risks and instability in the DeFi space.

Building on these points, Morpho has invested significant time and effort in user experience. Morpho has developed a clean and intuitive UI/UX, simplifying interactions for end-users and lending operators. This is not common in many DeFi lending protocols, as they still give a flashy feel. Additionally, the development of abstraction layers, such as MetaMorpho, simplifies the appeal. The subtle strategy of balancing permissionless innovation with a brand-centric frontend is impressive. This approach not only emphasizes the adaptability and flexibility of Morpho as a platform but also positions it as a leader in promoting specialized and secure lending solutions in the DeFi space.

What Does Morpho Do Well? What Needs Improvement?

The advantages include:

- Strong personal brands of team members (such as Paul and Merlin), enhancing credibility and visibility.

- Effective ecosystem building through selling simplicity, building abstraction layers like MetaMorpho, and locking in third-party lending operators like Steakhouse, B Protocol, Block Analitica, and Re7, as well as locking in token incentives (such as stETH).

- Its optimizer product has a strong existing product and brand, providing significant leverage for the success of Morpho Blue.

Areas for improvement include: The unit economics of third-party risk managers need improvement. Without considering engineering costs, legal costs, and risk management costs, Block Analitica, with an asset management scale of $45 million, can generate $70,000 in revenue.

Ajna, Oracle-Free Market

Origins of Ajna

Ajna was founded by several former MakerDAO team members who recognized scalability and risk issues in previous generations of lending protocols. Oracle dependencies and governance were limiting factors and major sources of risk. The key idea was to outsource Oracle functionality to lenders and liquidators themselves. Their vision was to create the Uniswap of lending, an immutable protocol that could scale to support almost any asset, including long-tail assets and NFTs. This original and innovative design was the result of over two years of development, including over ten code audits.

The origin story of Ajna Finance is closely related to the broader desire in the 2023 DeFi ecosystem for security and robustness. Dan Elizter's article on the need for Oracle-free protocols in DeFi emphasized this point (read it here). Elitzer, the founder of Nascent VC and a prominent figure in the DeFi community, outlined the ongoing security challenges plaguing DeFi and the billions of dollars in losses due to hacker attacks, emphasizing the need for a fundamental rethink of DeFi protocol design and security.

In this context, the Ajna protocol emerged as a notable solution. Launched in mid-July 2023, Ajna's design philosophy aligns with Elitzer's vision of DeFi: a protocol that operates with zero dependencies, hence without trust, including a lack of governance, upgradeability, and oracles. This approach reduces the theoretical attack surface and inherent risks within the protocol.

Analysis of the Ajna Protocol

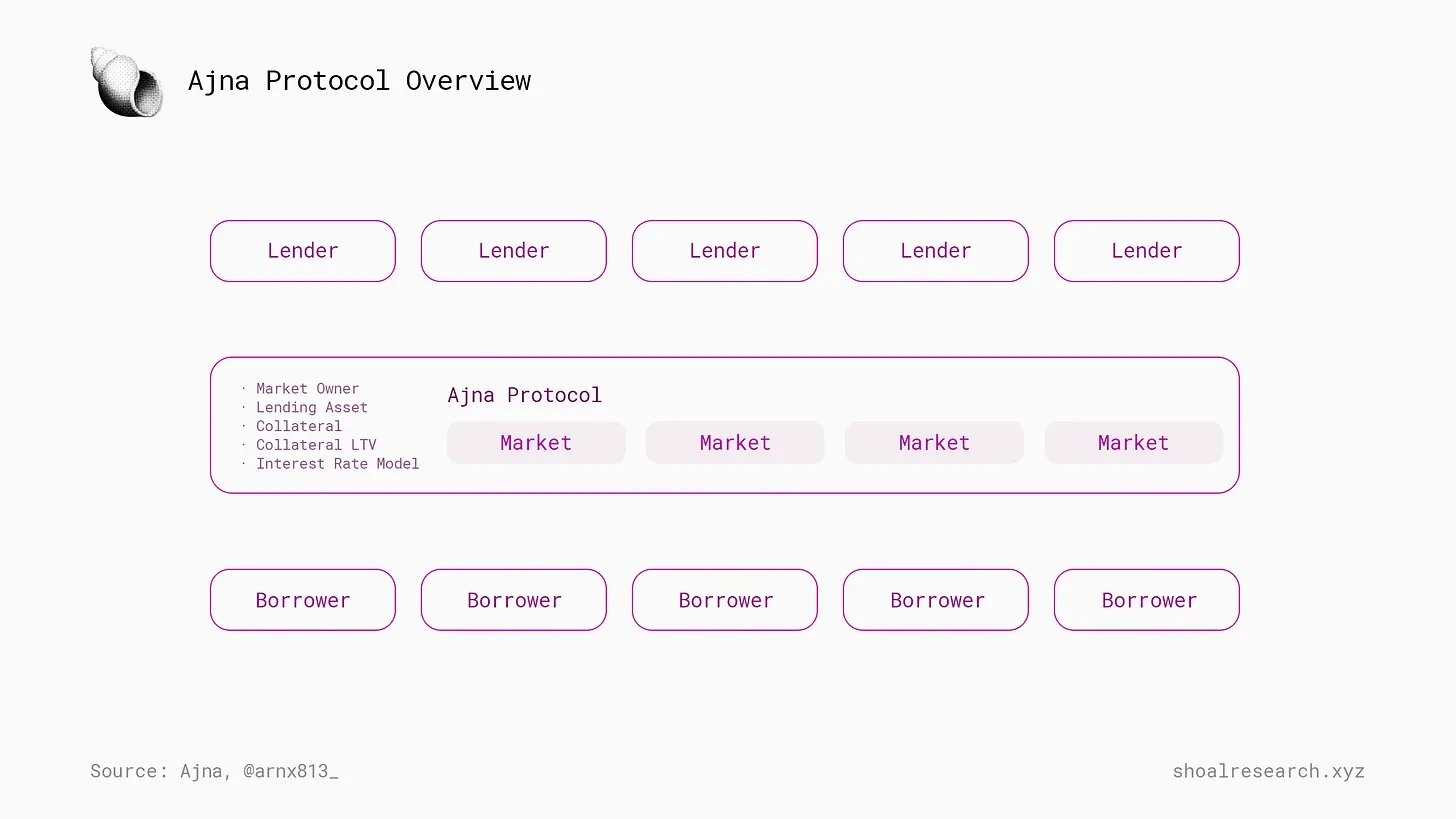

In the DeFi lending space, Ajna stands out with its unique lending approach. It is a non-custodial, permissionless system that requires no oracles or governance, ensuring a high level of decentralization and autonomy. Ajna allows the creation of markets with specific collateral and loan assets, streamlining the process and enhancing user accessibility. The platform supports a variety of assets, including fungible and non-fungible tokens, expanding the range of collateral types beyond what is typically seen in DeFi. Ajna's features include facilitating lending use cases such as NFT lending and shorting markets, unaffected by common restrictions on other platforms.

Three Participants in the Ajna Ecosystem

Given the current developments, there are three main roles in the Morpho ecosystem: Ajna lenders, Ajna borrowers, and Ajna governance/token holders.

Growth of Ajna

After a major security breach in the second half of 2023, Ajna suffered a significant blow to its security-oriented brand. Following the reboot, the project began to pursue complete decentralization, severing all ties with centralized lab companies. They are now a fully decentralized DAO and protocol.

Rebooting a DeFi protocol is difficult and has never been a good thing. While Ajna faced setbacks, they returned with a re-audited protocol and two clear selling points: complete decentralization and oracle-free. Ajna's strategy relies entirely on the native DeFi brand.

Now, the long-term questions are:

- What unique lending use cases has Ajna unlocked that differentiate it from Morpho and other competitors?

- How effective is the decentralized DAO coordination as Ajna attempts to execute its growth and business expansion strategies?

Euler, Rising from the Shadows

Origins of Euler

The emergence of the Euler protocol as the next generation of DeFi lending platforms represents a significant evolution from first-generation protocols like Compound and Aave. As a decentralized service, Euler addresses a key gap in the DeFi market: the lack of support for non-mainstream tokens in lending services. Recognizing the unmet demand for lending long-tail crypto assets, Euler provides a permissionless platform that can list almost any token as long as it is paired with WETH on Uniswap v3.

The Euler protocol stands out in the DeFi lending space through several key innovations:

- It employs a unique risk assessment method that considers collateral and lending factors, enhancing the accuracy of risk assessment.

- Euler also integrates the decentralized TWAP oracle from Uniswap v3 for asset valuation, supporting its permissionless spirit by enabling the listing of diverse assets.

- Additionally, the protocol introduces a new liquidation mechanism resistant to MEV attacks, as well as a reactive interest rate model that adjusts to market conditions.

- These features, along with the implementation of sub-accounts for user convenience, make Euler a complex and flexible platform in DeFi lending.

Unfortunately, on March 13, 2023, Euler Finance experienced one of the largest DeFi hacks in history. The flash loan attack on March 13 resulted in losses exceeding $195 million and triggered a chain reaction affecting numerous decentralized finance (DeFi) protocols. Apart from Euler, at least 11 other protocols suffered losses due to the attack.

Post-Hack: EulerV2

After a year of silence, Euler launched its v2 on February 22, 2024. EulerV2 is a modular lending platform primarily composed of two components: the Euler Insurance Kit (EVK) and the Ethereum Insurance Vault Connector (EVC). The EVK enables developers to create their custom lending insurance vaults; it can be described as an insurance vault development toolkit, making it easier to build insurance vaults using Euler's technical framework. The EVC is an interoperability protocol that allows vault creators to connect their vaults together, enabling developers to more effectively link vaults to pass information and interact with each other. These two technologies collectively serve as the foundational layer for lending infrastructure.

Euler's insurance vaults will have two main types:

- Core: Managed lending markets similar to Euler v1, governed by DAO.

- Edge: Permissionless lending markets with greater parameter flexibility. Aggregated lending experience, rather than a 1:1 approach like Morpho Blue or Ajna.

Euler's Brand Strategy

Similar to Ajna and Morpho, Euler strongly advocates for a "modular" lending narrative, aiming to build a permissionless foundational lending protocol that third parties can leverage. However, Euler has significant differences in its public-facing marketing and brand strategy. Unlike Morpho, which takes an extremely abstract and simplified approach, Euler tends to emphasize its feature-rich technology as the key selling point of its brand and technology. Some of the features it highlights are advanced risk management tools such as sub-accounts, P&L simulator, limit order types, and a new liquidation mechanism (fee flow).

Who Are Euler's End Users, and What Is Their End Product?

Euler offers a powerful and novel feature set that surpasses Morpho Blue (e.g., sub-accounts, fee flow, P&L simulator, etc.). The question remains: Is Euler selling its lending infrastructure to third-party lending operators, or are they building their own lending markets? These two opportunities have different customer bases. If Euler is competing with Morpho to attract third-party lending operators, how easy is it to build abstractions on Euler v2? Euler missed the concept of "pool manager" abstraction primitives equivalent to MetaMorpho, but they seem to want to replicate what Morpho did for third-party pool operators.

Is Charging a 1% Protocol Fee at Launch a Good Idea?

At launch, Euler enforces a minimum 1% protocol fee derived from vault managers. This could be a significant psychological barrier, as fees are a stumbling block in the growth stage. On the other hand, Morpho has a protocol where their business source license terms are linked to the fee mechanism: if fees are charged, the code becomes open source (and therefore freely forkable).

In Conclusion

Relative to other innovative aspects of DeFi (such as liquidity mining and rehypothecation), the lending space seems to have matured, leading to questions about where the innovation is and what the future of one of the more mature industries in DeFi might be. However, it is a fair argument to assert that lending is one of the few areas in DeFi that achieves true product-market fit and largely avoids Ponzi economics. That being said, innovation will almost inevitably follow where product-market fit is, so if the past can be a benchmark for the future, DeFi lending will certainly see evolution and adaptation in future cycles.

In this article, we discussed multiple projects in the lending space, including Ajna, Morpho, and Euler. The primary theme of all three lending projects is not only the creation of permissionless markets but the creation of permissionless markets in a user-friendly, user-centric manner. Yes, before these three protocols, one could launch their own lending pool/protocol, but that was not user-friendly. In the next DeFi lending cycle, we are not only looking at the permissionless side (which seems to be the clear direction of protocols' trends) but also the user experience side. Companies like Summer.fi are creating new lending experiences (and overall DeFi experiences) to achieve a more simplified DeFi experience. As their integrations increase, their experience is likely to continue to gain traction as it is simpler than directly accessing front ends hosted by various lending protocol creators. With the rise of intent-based protocols, intent-based lending or borrowing (similar to Morpho aggregating between Aave and Compound) may prove to be another narrative for the future of lending: simply input what you want to borrow, and this new narrative will find the best, risk-adjusted opportunity.

To some extent, creating markets in a permissionless manner is certainly becoming easier. Currently, Morpho is working with three complex entities (B Protocol, Block Analitica, and Steakhouse Finance) to operate their new permissionless markets, but soon, this will also become more user-friendly, just like the permissionless lending experience itself, where any user can do it. The ability for anyone to create markets will allow for a Cambrian explosion of lending market innovation, from new asset types as collateral (such as LRT, RWA assets) to new structured products focused on various yield opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。