News

On March 7th, according to HODL15Capital statistics, the net inflow of the US Bitcoin spot ETF on March 6th was $332 million.

On March 7th, Andrew Kang, co-founder of Mechanism Capital, posted on social media that some trading methods are suitable for PvP market conditions but not for PvE market conditions.

On March 7th, according to Lookonchain monitoring, 11 wallet addresses associated with PulseX and PulseChain bought a total of 97,296 ETH in the past 2 days, worth approximately $3.63 billion.

Market Review

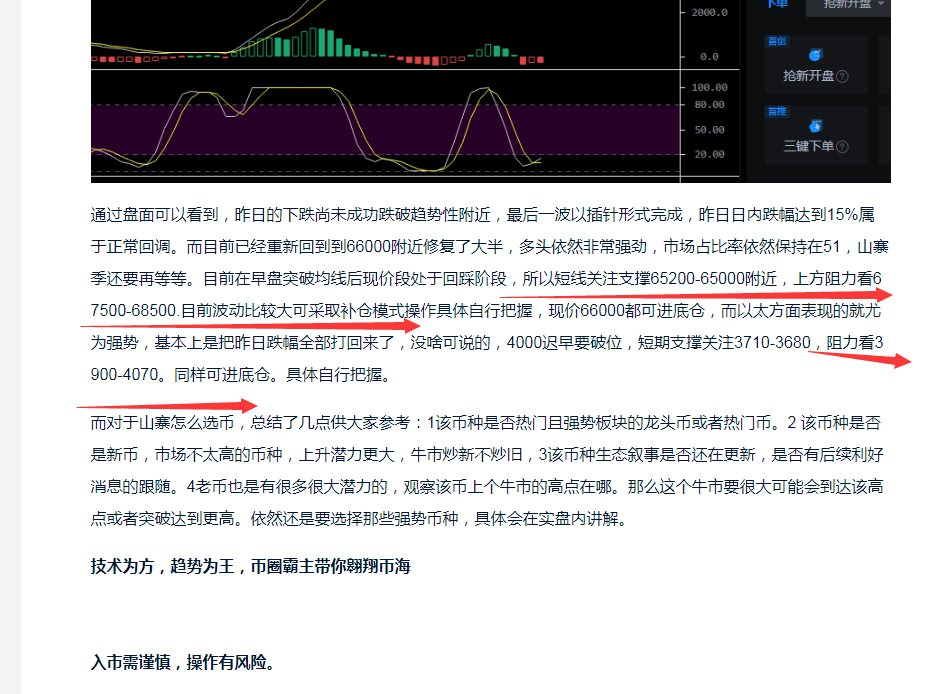

In yesterday's market, the price of Bitcoin rebounded to near 67500 at one point and quickly dropped to around 64500, consistent with the expectations mentioned in the previous article. The support and resistance levels are the highs and lows of yesterday. As for Ethereum, the resistance given was 3900, which was also the highest point yesterday, and the current price is around 3780. So the market is back to yesterday's position, how should we operate?

Market Analysis

Macro Analysis: Currently, the most significant incremental capital inflow for Bitcoin is undoubtedly the spot ETF. As of March 4th, the net asset value of the Bitcoin spot ETF was $52.45 billion, with an ETF net asset ratio (market value as a percentage of total Bitcoin market value) of 3.96%, and a cumulative net inflow of $7.91 billion. In addition, MicroStrategy announced yesterday that it plans to issue $600 million of 2030 convertible senior notes in a private offering, with the net proceeds intended for purchasing additional Bitcoin and general corporate purposes. At the same time, the market rates have significantly fallen, bringing back rationality after the previous round of panic selling. At least from a data perspective, the funding rate for BTC has dropped significantly to an annualized 24.85% (slightly higher than 10% a month ago), and the funding rates for most altcoins on trading platforms have returned to the normal level of 0.01%, releasing the leverage risk in the market. Therefore, the overall market has returned to normal fluctuations.

Looking at the four-hour chart, the high from yesterday has not been fully recovered. There was a pullback near 67500 after the surge to 67500. The overall bullish momentum is insufficient, and the previous sharp drop has closely touched the lower range of the previous oscillation range. Currently, attention needs to be paid to the upper range of the previous oscillation, which is around 63000-62500. At the same time, from the indicators, it can be seen that the MACD is still at a high level, showing signs of spreading downward. The short-term market may tend to oscillate. The upper resistance in the intraday is around 68000-67500, and the lower support is around 63000-62500, with 63000 being a watershed. If it does not drop below in a needle-like manner this time, it may test around 59000 again. The same is true for Ethereum, which has been oscillating around 3900 for a night, with no breakthrough in the market, increasing the probability of a pullback to the oscillation range. The lower support is around 3650/3520, and the resistance is around 3850-3880. In summary: the market still needs to be adjusted, it won't happen so quickly. Short-term contracts need to control risks. The subsequent real-time market changes will be explained in the live trading.

Technology is the means, and the trend is the king. The dominant force in the currency circle takes you to soar in the sea of coins.

Be cautious when entering the market, as there are risks in operation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。