News

On February 6th, according to Lookonchain, within just 21 days, a certain address made a profit of about 1.39 million US dollars with only 0.7 ETH (approximately 1848 US dollars), achieving a return of 755 times. On February 14th, the individual spent 0.7 ETH to purchase 4.26 million GPUs, which had been online for over two months. Subsequently, they sold 3.37 million GPUs, earning 102 ETH (approximately 336,000 US dollars). Currently, there are still 891,000 GPUs remaining (approximately 1.06 million US dollars).

On March 6th, according to Blockworks, US authorities applied to modify the bail conditions for CZ, hoping that CZ and his defense team would disclose his travel plans due to concerns about him traveling to the US-Canada border. The US also requested CZ to surrender his Canadian passport to a "third-party custodian employed and supervised by his recorded lawyer."

On March 6th, according to Coinglass data, the current grayscale ETH trust fund (ETHE) has a negative premium rate of 8.72%; the ETC trust has a negative premium rate of 40.87%.

Market Review

In the previous article, it was mentioned that the market was expected to oscillate in the range of 64,000 to 60,000 for a week before breaking through. However, it only oscillated for two days before breaking through and reaching near the new high yesterday. After reaching the new high, the market quickly retraced, once again holding near the previous support. The current rebound price is around 66,100. There was a significant washout, likely causing many people to exit, while Ethereum performed as expected, accelerating after breaking through near 3640. However, it is still a step away from 4000, reaching a high of around 3825. After yesterday's washout, Ethereum gradually showed strength, with a very strong rebound. So, how should we proceed in the future?

In the previous article, it was mentioned that the market was expected to oscillate in the range of 64,000 to 60,000 for a week before breaking through. However, it only oscillated for two days before breaking through and reaching near the new high yesterday. After reaching the new high, the market quickly retraced, once again holding near the previous support. The current rebound price is around 66,100. There was a significant washout, likely causing many people to exit, while Ethereum performed as expected, accelerating after breaking through near 3640. However, it is still a step away from 4000, reaching a high of around 3825. After yesterday's washout, Ethereum gradually showed strength, with a very strong rebound. So, how should we proceed in the future?

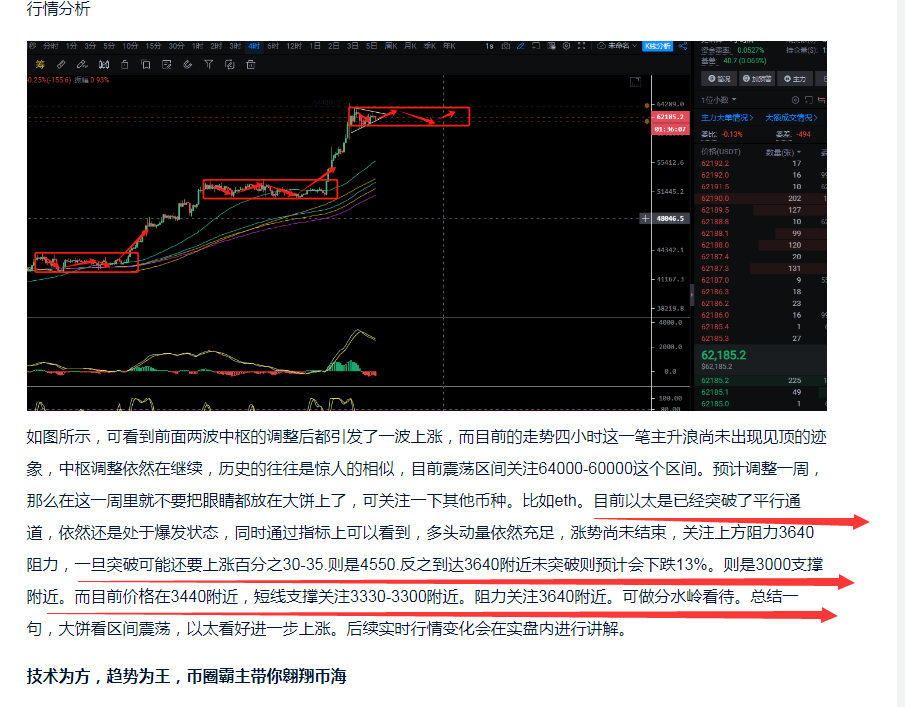

Market Analysis

Macro Analysis: The percentage of investors holding coins for 1 day to 1 week has surged to 10.62%, similar to the situation in October 2020 when the last bull market began or during the peak of the bull market in October to November 2021. Additionally, last week, the bitcoin price reached its peak in 30 countries, indicating that more new investors are interested in bitcoin and may enter the bitcoin market. Importantly, the increase in the proportion of short-term investors indicates that we are at a critical moment. Therefore, a significant washout in the short term is a normal situation. Personally, I believe that our current situation is similar to the start of the bull market in October 2020. With the continuous influx of new capital and the continuous rise in prices, overheating will be the default setting for futures and on-chain data. Of course, due to overheating, a 15-30% pullback could occur at any time, but the price of bitcoin may rise to nearly $100,000 after the pullback. Therefore, when a temporary pullback occurs, it is important to be bullish rather than consider betting on a downturn due to overheating. This bull market is different from the previous one. The previous one was driven by internal innovation within the crypto industry, bringing external additions, such as the rotation of hotspots like DeFi and NFT. This time, the main buying volume comes from Wall Street, commonly known as the mainstream entering the market, leaving little dividend for retail investors. They will naturally follow the major trends in the stock market and crypto memes, rotating through various cryptocurrencies, including bitcoin, meme coins, and NFTs. NFTs will also be sought after in meme form.

Looking at the market, yesterday's decline has not successfully broken through the trend area, and the final drop was completed in a pin-like form. The intraday decline reached 15% yesterday, which is a normal pullback. Currently, it has recovered nearly half and is back near 66,000. The bulls are still very strong, with a market share still at 51, and the altcoin season still needs to wait. Currently, after breaking through the moving average in the early session, the current price is in the retracement stage, so in the short term, pay attention to support around 65,200-65,000, and resistance above at 67,500-68,500. The current volatility is relatively large, so a replenishment mode can be adopted, specific actions should be decided individually. The current price of 66,000 is suitable for entering the bottom position. On the Ethereum side, it is particularly strong, basically recovering all the losses from yesterday. There's not much to say, 4000 will be broken sooner or later. In the short term, pay attention to support at 3710-3680 and resistance at 3900-4070. Similarly, it is suitable for entering the bottom position. Decide individually.

As for how to choose altcoins, here are a few points for reference: 1. Whether the currency is a leading coin in a popular and strong sector or a popular coin. 2. Whether the currency is a new coin, with potential for greater gains as it is not highly valued in the market. New coins are favored in a bull market, not old ones. 3. Whether the narrative of the currency's ecosystem is still being updated and whether there are subsequent positive news to follow. 4. There are also many old coins with great potential. Observe where the high point of the coin was in the previous bull market. It is very likely that this bull market will reach that high point or break through to an even higher one. Still, it is important to choose strong coins, and specific explanations will be provided in actual trading.

Technology is the means, and the trend is the king. Let the dominant force in the crypto world take you soaring through the sea of coins.

Caution is needed when entering the market, as trading carries risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。