○/文: Mr. Li's Mortar

This week's research report directory:

I. Key events preview of macroeconomic data and the cryptocurrency market this week;

II. Review of key news in the cryptocurrency industry;

III. Community interaction and sharing;

IV. Important events, data, and interpretation;

V. Institutional perspectives and overseas views;

VI. Top gainers in the cryptocurrency market last week and selection of hot community coins;

VII. Attention to the unlocking of project tokens;

VIII. Top gainers in the cryptocurrency market concept sectors;

IX. Overview of global market macro analysis;

X. Future market judgment.

I. Key events preview of macroeconomic data and the cryptocurrency market this week:

March 4th (Monday): Eurozone Investor Confidence Index; Aevo's proposal for updating TGE time voting; SHFL airdrop distribution;

March 5th (Tuesday): South Korea's GDP for the fourth quarter; Japan's CPI for February; Speech by the Governor of the Bank of Japan; Eurozone Composite PMI; US Non-Manufacturing Index, month-on-month factory orders; Speech by the President of the Philadelphia Fed; Super Tuesday for the US elections. Approval date for Fidelity's spot ETH ETF delayed;

March 6th (Wednesday): Speech by Fed Governor Bostic; Eurozone retail sales for January; US ADP Employment Change for February; Testimony by Fed Chairman Powell;

March 7th (Thursday): Speech by the President of the San Francisco Fed; Fed's Beige Book; Interview with the President of the Minneapolis Fed; Japan's cash earnings for January; ECB deposit and lending rates; US trade balance for January; Press conference on monetary policy by the ECB President; Testimony by Fed Chairman Powell; US President Biden delivers State of the Union address; ECB March interest rate meeting. Avalanche mainnet activates Durango upgrade;

March 8th (Friday): Speech by the President of the Cleveland Fed; Japan's trade balance for January; Eurozone GDP for the fourth quarter; Speech by the President of the New York Fed; US unemployment rate for February, US non-farm payrolls change for February; CoinList launches decentralized data network Masa public offering;

To be determined: Frax Finance may launch a proposed token staking reward mechanism; SEC delays approval date for BlackRock's spot ETH ETF.

II. Review of key news in the cryptocurrency industry (exclusive summary):

Data aspect:

Recently, there have been a series of noteworthy data changes in the global cryptocurrency market. Bitcoin's market cap has surpassed Meta, rising to the 9th position in the global mainstream asset market value, marking a further elevation of its position in the global financial field. At the same time, the total open interest of BTC contracts across all exchanges has reached $32 billion, indicating strong market interest in Bitcoin. On the other hand, MicroStrategy's stock price has also surpassed $1334, reaching its highest level in the past 24 years, reflecting market recognition of the company's strategy. In addition, the Fear and Greed Index has reached 90, indicating a bias towards optimism in the market. The price of Ethereum has also surpassed $3600, setting a new high since January 2022, further consolidating its market position.

Project and platform aspect:

As a staunch supporter of Bitcoin, MicroStrategy's soaring stock price has also attracted widespread attention in the market. In addition, the inflow of funds into spot Bitcoin ETFs from BlackRock and Fidelity accounted for 79% of the total inflow of nine Bitcoin ETFs, demonstrating deep involvement of traditional financial institutions in the cryptocurrency market. ARK Invest reduced its holdings of Coinbase and Robinhood stocks this week, which may be related to its investment strategy adjustment. On the other hand, the Ethereum mainnet is expected to undergo the Dencun upgrade on March 13, which is expected to further enhance its performance and security. Meanwhile, Justin Sun announced that the balance of his HTX account exceeded $1.624 billion, also becoming a focus of market attention.

Macro policy and regulatory aspect:

Remarks by Fed's Bostic suggest the end of normal interest rate hikes, which may be a positive signal for the cryptocurrency market. However, a report from Bank of America indicates that US debt is increasing by $1 trillion every 100 days, which may pose certain challenges for the global financial market, including the cryptocurrency market. In addition, the release of the Grayscale report also revealed that stubborn inflation and delayed or hindered interest rate cuts are hindering the rise in cryptocurrency valuations, prompting further consideration of the relationship between cryptocurrencies and the traditional economy in the market. Swap market pricing shows that the Fed's easing magnitude in 2024 is 75 basis points, equivalent to three interest rate cuts, which may have far-reaching effects on the global financial market and the cryptocurrency market.

Institutional research reports and perspectives:

Tether co-founder's optimistic prediction for Bitcoin has attracted widespread attention in the market. He believes that Bitcoin could reach $300,000 in the next bull market peak. At the same time, analysis indicates that spot Bitcoin ETFs are game-changers, providing stable and recently accelerated demand for BTC, further emphasizing the close connection between the cryptocurrency market and the traditional financial market. In addition, data from Glassnode shows that retail investors now hold an unrealized profit of 114%, indicating a positive long-term outlook for the cryptocurrency market. The remarks of Tether's CEO also suggest that more fund managers may include Bitcoin in their investment portfolios, which may further drive the development of the cryptocurrency market.

III. Community interaction and sharing:

Regarding the Bitcoin halving, the current Bitcoin block height is less than 50 days away from the next halving, which is expected to occur in April 2024 when the block height reaches 840,000, reducing the block reward from 6.25 BTC to 3.125 BTC. The expected rebound before the Bitcoin block reward halving is a good opportunity to achieve short-term profits. Optimism, institutional buying demand, and historical returns related to the halving event are driving Bitcoin to break the historical high of $69,000 in March.

Some recent analyses have pointed out that based on its operational data, the current Bitcoin bull market has only run for half the time and predicts that Bitcoin may reach $125,000 by the end of 2024. In addition, monitoring by Lookonchain shows that since Bitcoin entered a bear market in July 2022, smart money has accumulated a large amount of Bitcoin at low prices, with unrealized profits exceeding $900 million. Since February, US-listed Bitcoin ETF products have been purchasing a large amount of cryptocurrency every day, far exceeding the daily creation of Bitcoin by the network. Therefore, supply and demand dynamics are driving the price increase. In addition, with the upcoming halving event, the new currency supply will decrease, potentially exacerbating supply issues.

At the same time, data from HODL15Capital shows that although GBTC has seen a large outflow of BTC since the approval of the US Bitcoin spot ETF, other ETFs have completely covered and increased their BTC holdings. Advanced ETF analysis by Bloomberg suggests that due to large ETF trading volumes and low supply, Bitcoin may exhibit a spiral-like rise. However, this may also bring the risk of a pullback. The founder of Galaxy Digital predicts that Bitcoin may experience a correction before rebounding to record levels and may pull back to around $50,000. In addition, analysts at JPMorgan predict that after the halving, the price of Bitcoin will drop to $42,000 due to reduced miner rewards and rising production costs.

On the other hand, the SEC has proposed to amend rules to allow options trading and listing for Bitcoin ETFs, Grayscale GBTC, and any trusts holding Bitcoin. This move aims to provide more opportunities to gain exposure to the Bitcoin market and meet investment demand. Data from HashKey Exchange shows that the net flow of spot Bitcoin ETFs has reached $44 billion, almost half the size of all gold ETFs. Analysis by Bitfinex predicts that by the fourth quarter of 2024, the conservative price target for BTC will reach $100,000 to $120,000. CNBC states that the rise in BTC seems to be driven by institutions rather than retail investors, as Google searches for BTC remain extremely low.

According to statistical data, as the price of Bitcoin reached nearly a two-year high, in the past week, the price of Bitcoin against the Japanese yen, Malaysian ringgit, Indian rupee, New Taiwan dollar, South Korean won, Chilean peso, Australian dollar, Chinese yuan, South African rand, Norwegian krone, and Turkish lira all reached historical highs. This week also set new highs for Bitcoin priced in euros and pounds.

In summary, the current cryptocurrency market is showing active trends, with institutional investors' participation driving price increases. However, it is also important to note the risks of a potential pullback and the impact of the halving event on miners' profitability. Additionally, changes in regulatory policies and market supply and demand dynamics will continue to influence the price trends of Bitcoin.

IV. Important events and data and interpretation by Deepcoin Research Institute:

Regarding the unrealized profits of new Bitcoin whales reaching $7.3 billion, setting a new historical high, while the unrealized profits of old whales are at $40 billion, still lower than the peak of $145 billion in 2021.

Our research institute believes that the new historical high of $7.3 billion in unrealized profits for new Bitcoin whales is a remarkable figure and sets a new historical high. At the same time, although the unrealized profits of old whales are at $40 billion, it is still lower than the peak of $145 billion in 2021. This comparison reflects the profit status and changing trends of different whale groups in the Bitcoin market.

Firstly, the new historical high in unrealized profits for new whales may indicate that new large investors are entering the Bitcoin market, and these investors have held Bitcoin for a relatively short time but have already realized significant unrealized profits. This may reflect the market's attractiveness to new investors and the increasing recognition of Bitcoin as a store of value.

Secondly, although the unrealized profits of old whales have decreased, they are still at a high level. This indicates that large investors who have held Bitcoin for a long time have accumulated significant unrealized profits over the past few years, and even in the current market environment, their profitability remains strong. This further demonstrates the potential of Bitcoin as a long-term investment tool.

Ki Young Ju's definition of long-term whales provides valuable insights. The average UTXO age exceeding 155 days, a balance of over 1000 BTC, and no association with CEX or miners collectively constitute the characteristics of long-term whales. This definition helps us better understand the large investor groups in the Bitcoin market and their roles and influence in the market.

Regarding CNBC's report that the current BTC rally seems to be driven by institutions rather than retail investors, as Google searches for BTC remain extremely low.

Our research institute believes that when explaining the Fear and Greed Index, we previously mentioned that it includes a weight for Google search volume, accounting for 10% of the index. The index focuses on Google Trends data related to Bitcoin-related search queries, providing insights into market sentiment. Although the Fear and Greed Index has fallen from a high of 90, it is still some distance from the historical high of 95. The reason for this may be that the current rally is institution-led, with less participation from retail investors.

Google search volume can serve as an indicator of investor interest and activity. When retail investors become interested in an asset, they may use search engines to find related information, leading to an increase in search volume for relevant keywords. Therefore, if Google BTC search volume remains low, it may indicate that the interest of retail investors in BTC has not significantly increased.

However, this does not mean that the momentum of the market rally is entirely driven by institutions. The participation of institutional investors is undoubtedly an important factor, as they typically have more capital and more professional analytical capabilities, capable of significantly influencing the market. However, the role of retail investors should not be overlooked, especially in a relatively young and volatile market like cryptocurrency.

Furthermore, other factors such as the global macroeconomic environment, changes in regulatory policies, technological innovations, etc., should also be considered, as they may all affect the price trends of BTC. Therefore, when analyzing the reasons for the market rally, it is necessary to consider a variety of factors, not just the interest of retail or institutional investors.

V. Institutional perspectives and overseas views:

Overview: The cryptocurrency market has shown active trends recently. Net inflows into Bitcoin ETFs have significantly increased, driving the total Bitcoin held by global Bitcoin ETP products to surpass 1 million coins, setting a new record. The market is optimistic about Bitcoin's halving event every four years, expecting it to push up prices. However, miners need to prepare for the halving event to avoid bankruptcy. In addition, the influx of funds into the cryptocurrency market has reached a new high, indicating high market enthusiasm. Bitcoin prices have set new highs against multiple currency pairs, and the market predicts that Bitcoin prices may soon exceed $100,000. However, JPMorgan estimates the mining cost to be $27,000, setting a bottom line for Bitcoin prices. Despite the strong upward momentum in prices recently, this situation may not be sustainable, and production costs should start to decline after the halving. Therefore, the market needs to be vigilant about the sustainability of the price increase. The following are detailed contents:

Fidelity Digital Assets reports that BTC holders have always welcomed the halving event every four years, as they expect it to push up prices, but miners must constantly plan for this event, which will reduce the Bitcoin they earn by 50%, to avoid bankruptcy. Analysts state that miners not only need to maintain their existing computing power, energy, and real estate, but also constantly compete with the entire network trying to do the same thing.

Omkar's report states that Deribit's BTCDVOL index (measuring expected price volatility in the next 30 days) has soared to an annualized 76%, the highest level since November 2022.

Research data shows that on March 4th, net inflows into Bitcoin ETFs increased by $562 million, with outflows from BTCO, HODL, and BTCW.

Recent data from ByteTree shows that the total Bitcoin held by global Bitcoin ETP products has surpassed 1 million coins, setting a new record. In the past 90 days, these ETFs have seen inflows of 133,000 BTC, mainly attributed to the success of the US spot Bitcoin ETF. It is worth noting that the surge in Bitcoin ETF inflows has occurred simultaneously with outflows from other ETFs, especially those related to gold and bonds. Data as of March 1st shows that some of the largest bond ETFs, including TLT, have seen negative returns since the beginning of the year. According to data from HODL15Capital, TLT has fallen by 4.5% this year.

According to on-chain monitoring, a whale bought a total of 285.8 BTC from exchanges such as Binance, OKX, and Kucoin at a cost-average price of $28,040 per BTC, at a frequency of every few days from July to November last year. With BTC prices breaking $65,000 again, the whale transferred all 285.8 BTC, worth $18.6 million, to Binance 2 hours ago, ending this 7-month-long BTC investment, with an expected profit of $10.58 million (+132%).

As Bitcoin broke $65,000, cryptocurrency-related stocks rose in pre-market trading, with MicroStrategy, Marathon Digital rising over 7%, Coinbase rising over 6%, and Proshares Bitcoin Strategy ETF rising 3.2%.

Matrixport's report states that the Bitcoin bull market is still ongoing. Institutional demand is intertwined with a reawakening of retail flow. Supply-demand imbalances continue to favor the rise in Bitcoin prices.

CryptoQuant indicates that we may see a BTC seller liquidity crisis this year. In addition to GBTC, the new funds for spot ETFs have grown by 95% month-on-month. At this rate, the amount of Bitcoin held this year may exceed several million BTC. Exchanges, miners, and their affiliated addresses currently hold 3 million BTC.

The Bitcoin Layer analysis states that so far, Bitcoin's absolute returns and risk-adjusted returns have been superior to all commodities, currencies, stock indices, and all 11 GICS stock market sectors. By participating in Bitcoin investments alone, one can achieve better returns than over 96% of portfolio managers.

Fed Chairman Powell will testify before the House Financial Services Committee on Wednesday. It is expected that Powell will further emphasize the lack of urgency to cut interest rates, especially after the latest inflation data showed continued price pressures. Powell and almost all of his colleagues have indicated in recent weeks that they have the ability to be patient in timing interest rate cuts, given the overall performance of the US economy. However, this may not satisfy Democrats, who are concerned that rate policies will affect the November presidential election. Economists expect Powell to maintain a tough stance in his testimony, sending a signal to the market that there is no rush to cut interest rates. But if this leads to a tightening of the financial environment, it will continue to put pressure on the economy and increase the possibility of further delayed effects of monetary policy.

Glassnode data shows that approximately $48.54 billion has flowed into the cryptocurrency market in the past 30 days, the highest capital inflow since October 2021.

According to the Financial Times, the price of Bitcoin has reached a new record high against many currencies. The approval of a Bitcoin spot ETF in the United States has fueled market enthusiasm. The upcoming halving of Bitcoin mining rewards at the end of April has intensified market fervor. The expected increase in buyer demand for the next halving explains why the cryptocurrency bull market is now optimistically predicting that the price of Bitcoin will soon exceed $100,000. However, a closer look at this bullish target seems somewhat suspicious. According to JPMorgan's estimate, the current production cost—mainly the cost of electricity for mining calculations—is about $27,000, setting a price floor for Bitcoin. After the halving, this price is expected to temporarily jump to around $50,000. However, the recent surge has pushed the price of Bitcoin far above the production cost, which is unsustainable for Bitcoin. Additionally, these costs are expected to start declining shortly after the halving, as inefficient miners will exit the market and the hash rate will decrease, leading to lower production costs. At some point, the upward momentum in prices will weaken. Assuming a one-fifth decrease in mining processing power, the production cost is expected to decrease to approximately $43,000, providing a useful guide for where the price may find support after the current fervor subsides.

Matrixport's analysis, based on its data, indicates that the current bull market has only run for half the time. Based on past halving data, Bitcoin is projected to reach $125,000 by the end of 2024. An indicator observed in July last year showed that when Bitcoin first hit a new high within a year, there was a 300% rebound, which also suggests a conservative estimate of $125,000 by the end of this year or next year.

Lookonchain monitoring shows that since Bitcoin entered a bear market in July 2022, a savvy whale has accumulated 22,670 BTC at an average price of $21,629, totaling $1.39 billion. The current unrealized profit exceeds $900 million.

According to three analysts working for cryptocurrency fund management companies, since early February, US-listed Bitcoin ETF products have been purchasing an average of 3,500 to 4,300 cryptocurrencies per day, far exceeding the 900 coins created by the Bitcoin network each day. Zach Pandl, research director at Grayscale Investments, stated that there is simply not enough Bitcoin to meet all the new demand, and natural supply-demand dynamics are driving prices higher. With the planned halving in two months, there may be more supply issues. After the halving, the daily new coin supply will decrease from 900 to 450 coins.

HODL15Capital data shows that since the approval of the US Bitcoin spot ETF, GBTC has seen outflows of 190,290 BTC, but inflows from other ETFs have completely covered this and added 150,290 BTC.

Bloomberg's senior ETF analyst predicts that due to the large trading volume and low supply, Bitcoin will experience a "spiral rise." He said, "Because BTC is a scarce asset and not many people trade it, they just hold it, its circulation is very small. The more demand for ETFs, the greater the impact on circulation. The greater the impact, the higher the price will rise, creating more demand, and Bitcoin may experience a period of spiral rise." Balchunas warned that ETF trading volume may not be able to maintain its current level, and there is a risk of price correction.

The founder of Galaxy Digital stated that before Bitcoin rebounds to record levels and "significantly rises" by the end of the year, there may be some adjustments. He said, "I wouldn't be surprised to see some adjustments and consolidations. If there is a pullback, it may pull back to around $50,000 and then reach new highs." Novogratz also expects that a spot Ethereum ETF will be approved by the SEC at some point this year. Galaxy is collaborating with Invesco and is one of the applicants seeking to offer an Ethereum ETF. When asked about Galaxy's listing in the United States, he stated that the US has been "unfriendly" for the past four years and he does not believe this will change after the election.

JPMorgan analysts predict that after the Bitcoin halving, the price will drop to $42,000, citing the reduction in miner rewards and the increase in production costs. The Bitcoin mining industry is expected to further consolidate, with larger miners surviving. The halving event will reduce Bitcoin miner rewards from the current 6.25 BTC per block to 3.125 BTC, negatively impacting miners' profitability and leading to an increase in Bitcoin production costs. Analysts predict that the production cost will affect the price, with the post-halving price expected to be around $42,000.

The SEC has announced a proposal from the New York Stock Exchange to amend Rule 915 to allow options trading for Bitcoin ETFs, Grayscale GBTC, and any trust holding Bitcoin. This move aims to provide investors with more opportunities to gain exposure to the Bitcoin market and to meet investment demand as a hedging tool, while maintaining the same trading rules and procedures as existing ETF options. The SEC will make a decision within 45 days of the notice, which may be extended to 90 days. Previously, the US Securities and Exchange Commission (SEC) had sought public opinion on the possibility of introducing Bitcoin spot ETF options trading.

According to a post by HashKey Exchange, the net flow of spot Bitcoin ETFs is currently $44 billion. This means that in just over a month, the scale of BTC ETFs is almost half the size of all gold ETFs. Bitcoin is often referred to as "digital gold" because it shares scarcity, durability, non-counterfeitability, portability, divisibility, and verifiability with gold. In fact, Bitcoin is even scarcer than gold: for hundreds of years, the supply of gold has grown at a rate of 1% to 3% per year, while the supply of Bitcoin decreases by half every 4 years.

Bitfinex's analysis predicts that a conservative price target for BTC will reach $100,000 to $120,000 in the fourth quarter of 2024, and in terms of the total market value of cryptocurrencies, the peak will be reached at some point in 2025. The introduction of "passive demand" through ETFs means that demand comes largely from investors who are not primarily concerned with the price. They view Bitcoin as a store of value rather than a tradable volatile asset, and this has been the case for the years leading up to the ETF launch.

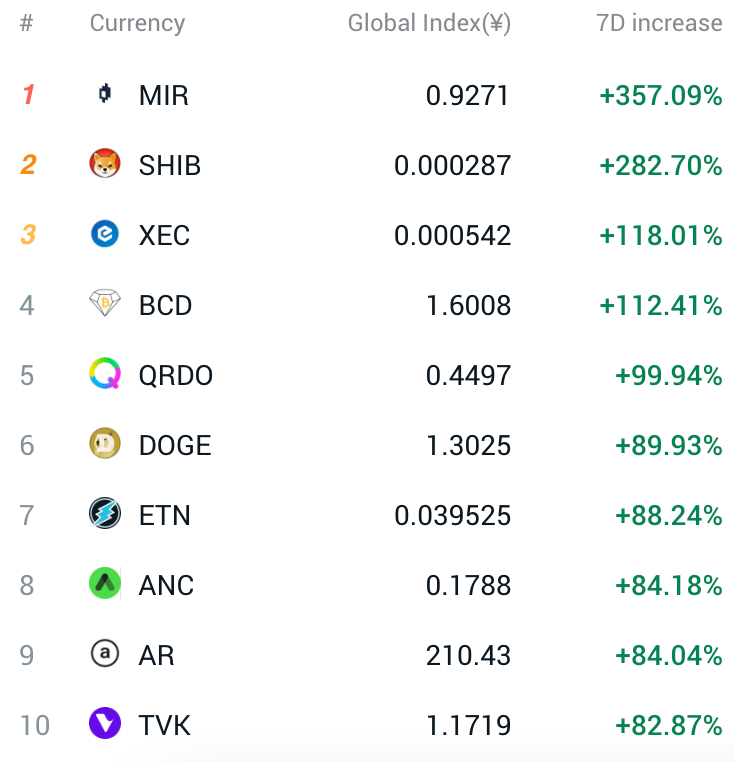

VI. Top gainers in the cryptocurrency market last week and selection of hot community coins:

In the past week, the altcoin market has shown a hot trend, with significant gains in multiple coins. Among them, MIR has performed particularly well, surging by 3.5 times and becoming the focus of the market. SHIB has also shown strong market performance, with an increase of approximately 280%. At the same time, coins such as XEC, BCD, and QRDO have seen gains ranging from 100% to 120%, also worthy of attention.

In the cryptocurrency market, the gains of altcoins are often closely related to market hotspots and speculative sentiment. Therefore, when investors pay attention to these leading gainers, they should be cautious of the shifting market hotspots and seize trading opportunities. For coins that have already surged significantly, investors should be cautious about chasing highs to avoid getting stuck at high levels. While continuing to focus on these potential trading opportunities this week, it is also important to pay attention to market trends and fundamental analysis, and make comprehensive judgments based on technical indicators. In the process of trading, it is important to follow risk management principles, allocate funds reasonably, and control risks. Additionally, it is important to maintain a calm mindset, not be swayed by market hype, and make rational investment decisions.

The following are the selected hot community coins for discussion, for reference only and not as a basis for trading decisions:

ArbitrumDAO's proposal to upgrade Arbitrum One and Arbitrum Nova to ArbOS 20 "Atlas" has been approved, and all node operators must upgrade their Nitro nodes to version 2.3.1 or higher by March 14, 2024, to avoid downtime.

In the past 24 hours, the global trading volume of meme coins has reached $6.261 billion. Among them:

DOGE has risen by 6.8% in the past 24 hours and by 12.4% in the past 7 days;

SHIB has risen by 9.5% in the past 24 hours and by 14.3% in the past 7 days.

VII. Project Token Unlock Negative Data Focus:

According to Token Unlocks data, this week, tokens such as LQTY, GAL, and HFT will undergo large one-time unlocks, including:

- Liquity (LQTY) will unlock 657,000 tokens on March 5th at 8:00, worth approximately $1.16 million, accounting for 0.69% of the circulating supply.

- Galxe (GAL) will unlock 2.03 million tokens on March 5th at 8:00, worth approximately $6.98 million, accounting for 2.26% of the circulating supply.

- Hashflow (HFT) will unlock 13.62 million tokens on March 7th at 8:00, worth approximately $6.47 million, accounting for 3.77% of the circulating supply.

This week, the market's focus will be on the potential negative effects of token unlocks. Researchers generally believe that in such cases, investors should be cautious in the spot market and turn to the futures market to seek shorting opportunities. Of particular concern is the HFT token, with a relatively large unlock, so investors are advised to pay extra attention to it during trading.

From a professional perspective, token unlock events often have a certain impact on token prices. We need to closely monitor market dynamics to address potential risks. Shorting operations can be conducted in the futures market to hedge against this risk to some extent. However, shorting also requires caution and should be based on market trends and technical analysis to make wise decisions.

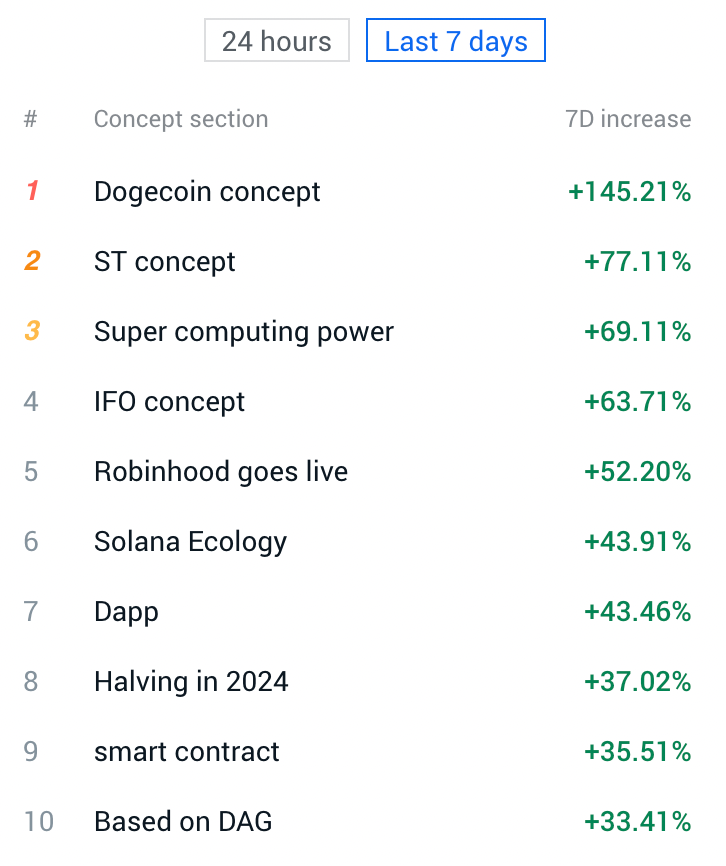

VIII. Top Concept Sector Gainers in the Cryptocurrency Market Last Week:

In the past week, looking at the specific performance of concept sectors based on the degree of increase and decrease, the concept sectors of Dogecoin, ST, Super Computing Power, IFO, and 5Robinhood Online have shown strong upward trends in the past seven days, leading the gains among other sectors. Investors are advised to closely monitor the rotational speculation trends of these high-growth coins in their respective sectors to capture market hotspots and investment opportunities. When making investment decisions, it is also important to consider market dynamics, technical analysis, and fundamental research to make rational judgments and choices.

IX. Global Market Macro Analysis Overview:

Last week, the US stock market showed a mixed trend, with the three major indices fluctuating. The Nasdaq Composite Index (Nasdaq) showed relatively strong performance, rising by 1.74%, the S&P 500 Index (S&P) rose by 0.95%, while the Dow Jones Industrial Average (Dow) fell slightly by 0.11%. This divergence reflects the performance differences among different sectors and stocks in the market.

At the individual stock level, most large-cap tech stocks rose, with tech giants such as Tesla, Nvidia, and Meta performing particularly well, with gains of over 5%, 4%, and 3% respectively. However, tech giants such as Google and Apple experienced declines, with declines of over 4% and 1% respectively. This performance reflects the divergence within the tech sector, with investors having different expectations for the performance and prospects of different tech companies.

Popular Chinese concept stocks rose across the board, indicating that Chinese concept stocks are favored by investors globally. This may be related to the strong growth of the Chinese economy and the good performance of Chinese companies in the international market.

On the macro level, there are two important events to watch this Thursday, March 7th. First, the European Central Bank will announce its latest interest rate decision, with market expectations for rates to remain unchanged, which will have an impact on the European currency market. Second, the Federal Reserve will release the Beige Book, which will provide detailed information about the US economic situation and is of significant importance for investors to assess market trends.

In addition, the US Department of Labor will release the February non-farm payroll report on Friday, which is a key indicator for measuring the health of the US economy. Investors will closely monitor the data in the report to evaluate the employment market conditions in the US and their impact on monetary policy.

On Monday, the US stock market saw a slight decline, with the cryptocurrency concept leading the market. Nvidia's stock price continued to hit new highs, while the Nasdaq Golden Dragon Index fell by nearly 4%. This performance may reflect investors' focus on the potential of cryptocurrencies and emerging markets.

The rise in US Treasury yields and the increase in the VIX fear index indicate some concerns about the future economic trend in the market. Meanwhile, the decline in Brent crude oil prices and the rise in spot gold reflect different trends in the energy and gold markets.

Geopolitically, the large-scale Israeli military assault on the Palestinian administrative capital may exacerbate regional tensions and have an impact on global financial markets. In addition, the largest US natural gas producer, EOG Resources, plans to cut production, which may affect global energy supply and prices.

Salvadoran President revealed a 50% unrealized profit on Bitcoin holdings and stated that he will not sell. This news boosted market sentiment for Bitcoin, pushing its price to a high of $68,680 per coin. This indicates the increasing recognition and acceptance of digital currencies globally.

In summary, the US stock market showed a mixed trend last week, with cryptocurrencies and gold attracting attention. This week, there will be several macro events announced, and investors need to closely monitor market dynamics and risk factors to develop reasonable investment strategies.

X. Future Market Judgment:

The BTC daily chart above shows that the market has entered an accelerated uptrend since February 7th, following the inflow of ETF speculation funds, and completely entered the FOMO stage on February 26th. Funds fearing missing out have poured into the market, leading to consecutive increases. The price almost reached the historical high of $69,000 per coin, with a 5% intraday pullback near this level. However, two data points need attention. On one hand, the total open interest of BTC contracts on the entire network has reached a record high of $32 billion, much higher than the $20 billion during the peak of the bull market in November 2021. Generally, after the open interest is closed, it will trigger significant market fluctuations, which we need to be aware of and guard against. On the other hand, this round of the market is more institution-led, as evidenced by the lead of the spot market, which can also be verified by the remaining BTC balance on the platform, which hit a historical low last week and more BTC was bought and withdrawn by ETF funds, and major players have been hoarding coins.

There are over 40 days until the BTC halving. Looking back at historical market trends, there have been significant pullbacks before each halving, such as a 20% pullback before the 2020 halving and a 38% pullback before the 2016 halving. It is possible that a deep pullback market will occur around April 20th this year before the halving. Even if the magnitude is smaller than before, due to the current large base, the potential for a pullback is significant. However, it is currently uncertain from which position the pullback will start, whether it will be after reaching a new high, after a significant increase from a previously unprecedented height, or before reaching a new high? These are the aspects we need to focus on to make a comprehensive judgment near the $69,000 level in the recent market performance.

The short-term resistance above is around $69,000. If it breaks through, there will be no reference resistance above, entering a vacuum zone, looking towards higher emotional highs, which may be very high or not as high as imagined. If under pressure, the current short-term support is around $63,100 and $58,100, with strong support around $50,525, the starting point of this FOMO sentiment, and the $48,000-49,000 area before the ETF launch, which is also the previous 61.8% Fibonacci resonance position.

Follow us: Lao Li Mortar

March 5, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。