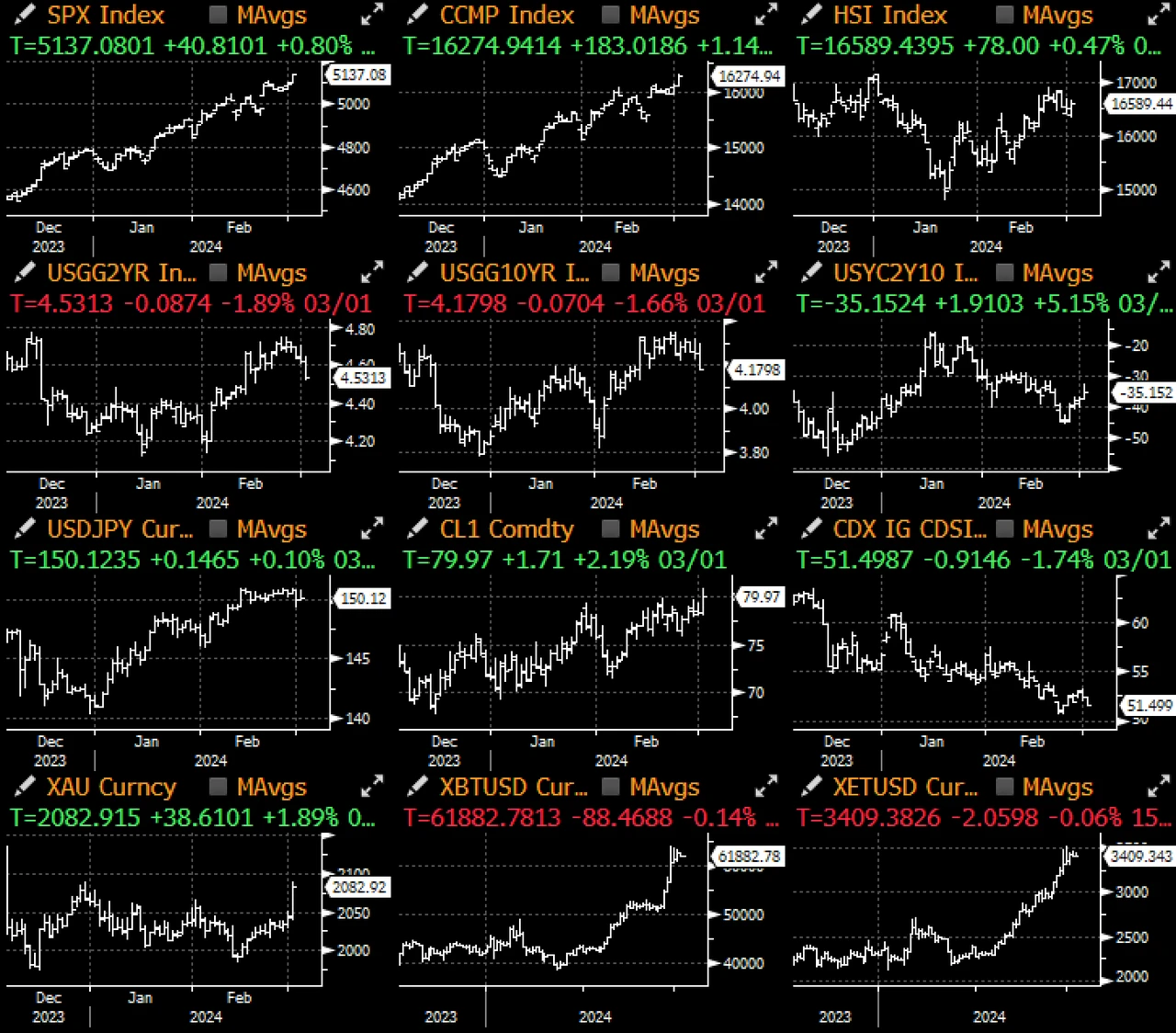

Risk assets continued to rebound last week, even as a regional bank reported credit issues and a prominent economist claimed that the Fed would not cut rates in 2024. According to data from Deutsche Bank, the SPX index has risen for 16 out of the past 18 weeks, a trend unseen since 1971.

On the one-year anniversary of SVB's collapse, New York Community Bancorp management stated that the bank had identified significant flaws in its internal loan review process, resulting in a 100% impairment of goodwill ($2.4 billion) and a restructuring of the management team, leading to a sharp drop in its stock price last Friday. However, unlike the widespread panic of last year, Wall Street seems to view this as an isolated case. The softness of the stock's price-to-book ratio (about 0.5) largely reflects these concerns. Even though NYCB's stock price plummeted by 20% last Friday, the KBW Regional Banking Index only saw a slight adjustment (about 0.3%).

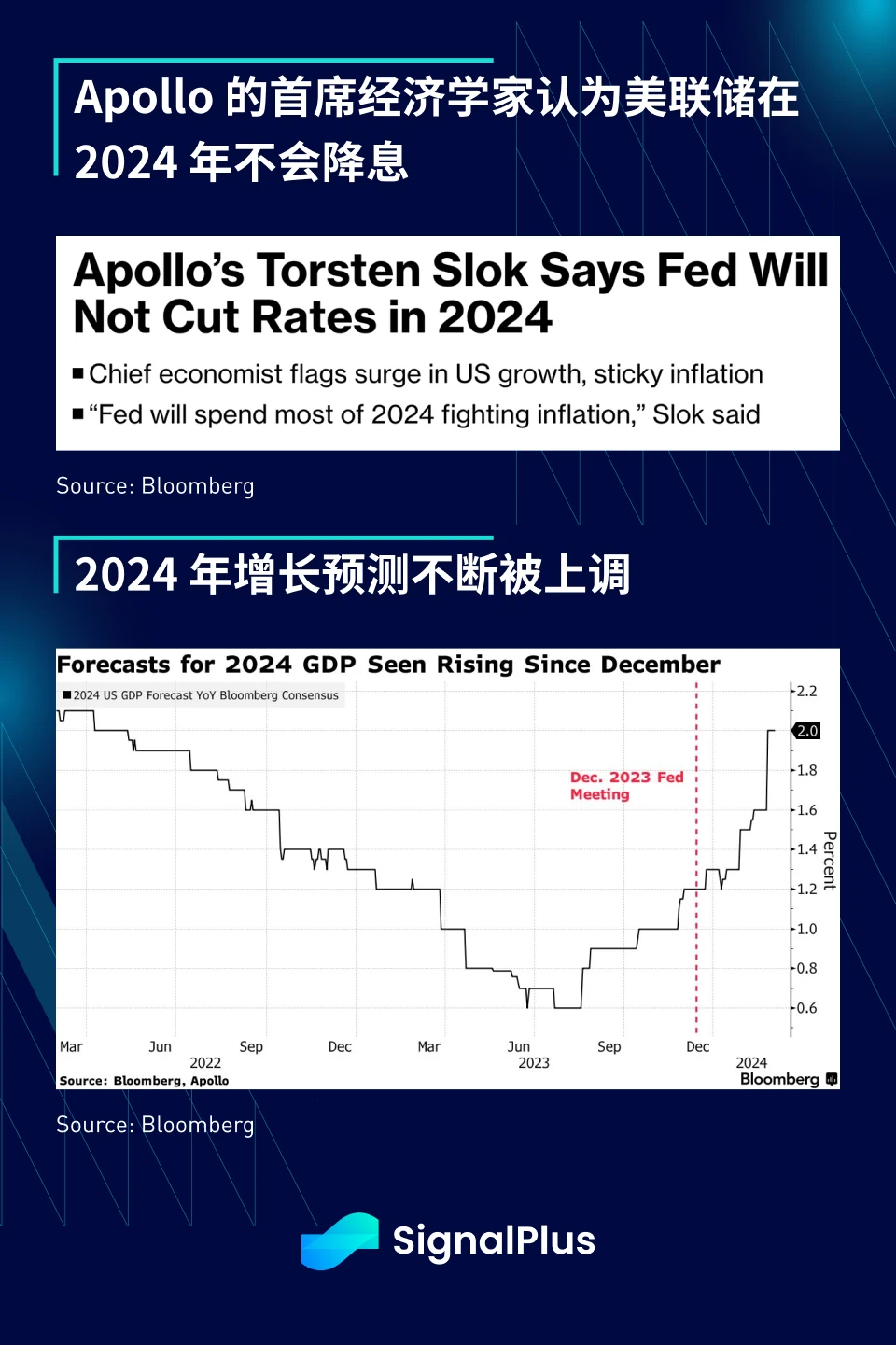

The U.S. economic recession seems distant (the Atlanta Fed estimates first-quarter GDP growth at about 3%), and U.S. consumers remain quite strong (Bank of America mentioned that consumer spending in February grew by over 3%). Employment/wage/inflation growth remains stable. Apollo's chief economist stated that due to the central bank's focus on inflation and maintaining high yields in 2024, the Fed will not cut rates in 2024. Slok pointed out that U.S. growth expectations have risen significantly, the job market remains tight, core inflation remains high, and the overly loose financial conditions will collectively suppress easing expectations. In addition, the Fed's verbal policy shift since the fourth quarter of 2023 has provided enough impetus for asset prices.

Chairman Powell will provide a semi-annual monetary policy update to the Senate Banking Committee on March 7, where he will have the opportunity to discuss the recent rebound in U.S. inflation data and be questioned about the reasons for the dovish turn in December. In addition, the earnings season has passed, and corporate profits are substantial, which has already been reflected in stock prices. According to Bloomberg, SPX earnings exceeding pre-season forecasts have the potential to be the largest since the fourth quarter of 2021. The continuously growing profits have undoubtedly caught Wall Street off guard, with strategists hastily raising SPX year-end targets. Media reports have mentioned over six forecast upgrades in the past two weeks alone.

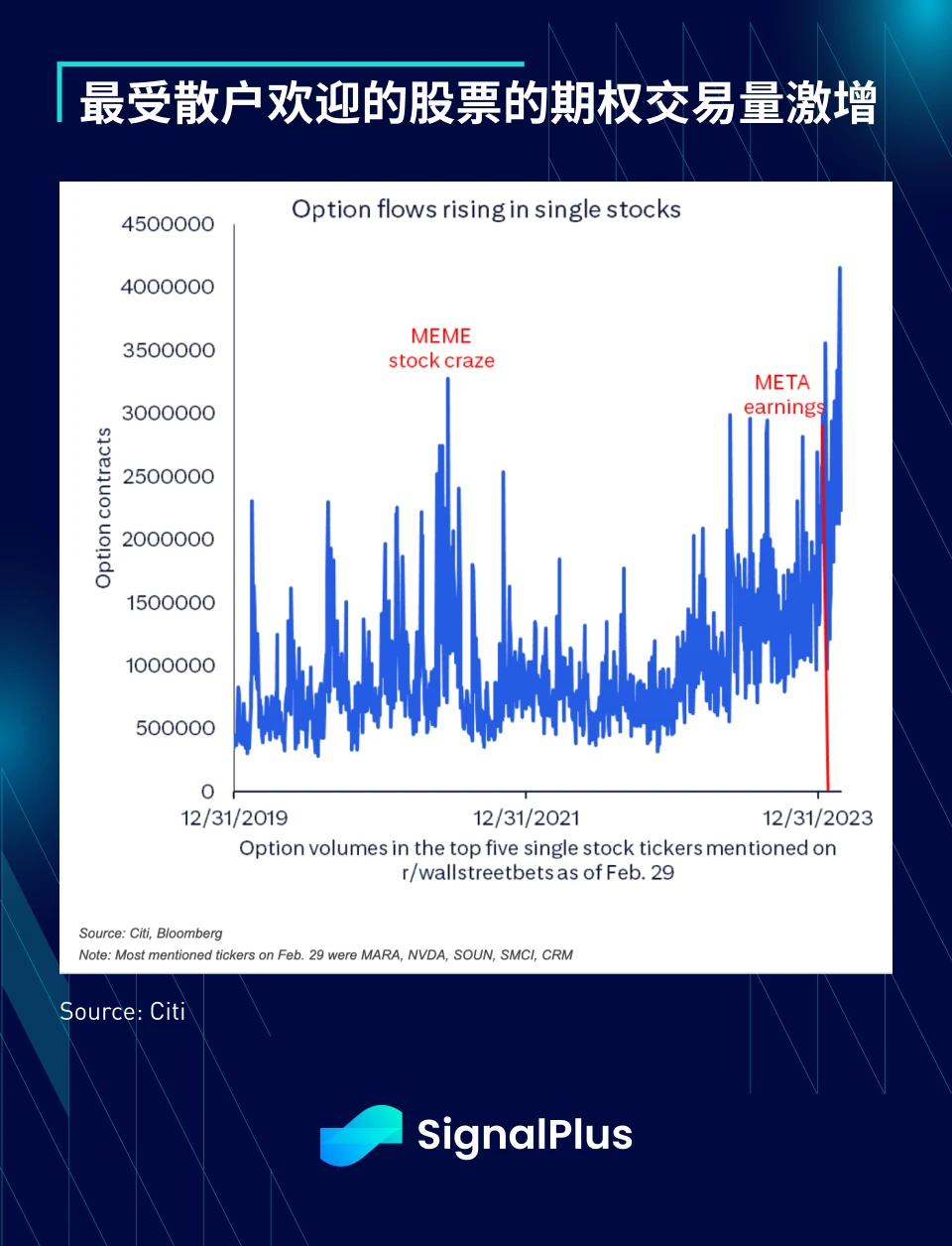

Similar to cryptocurrencies, retail trading activity has surged, with trading volumes of individual stock options continuously increasing, even surpassing the highs of 2021, and accelerating further after positive earnings results for NVDA and META.

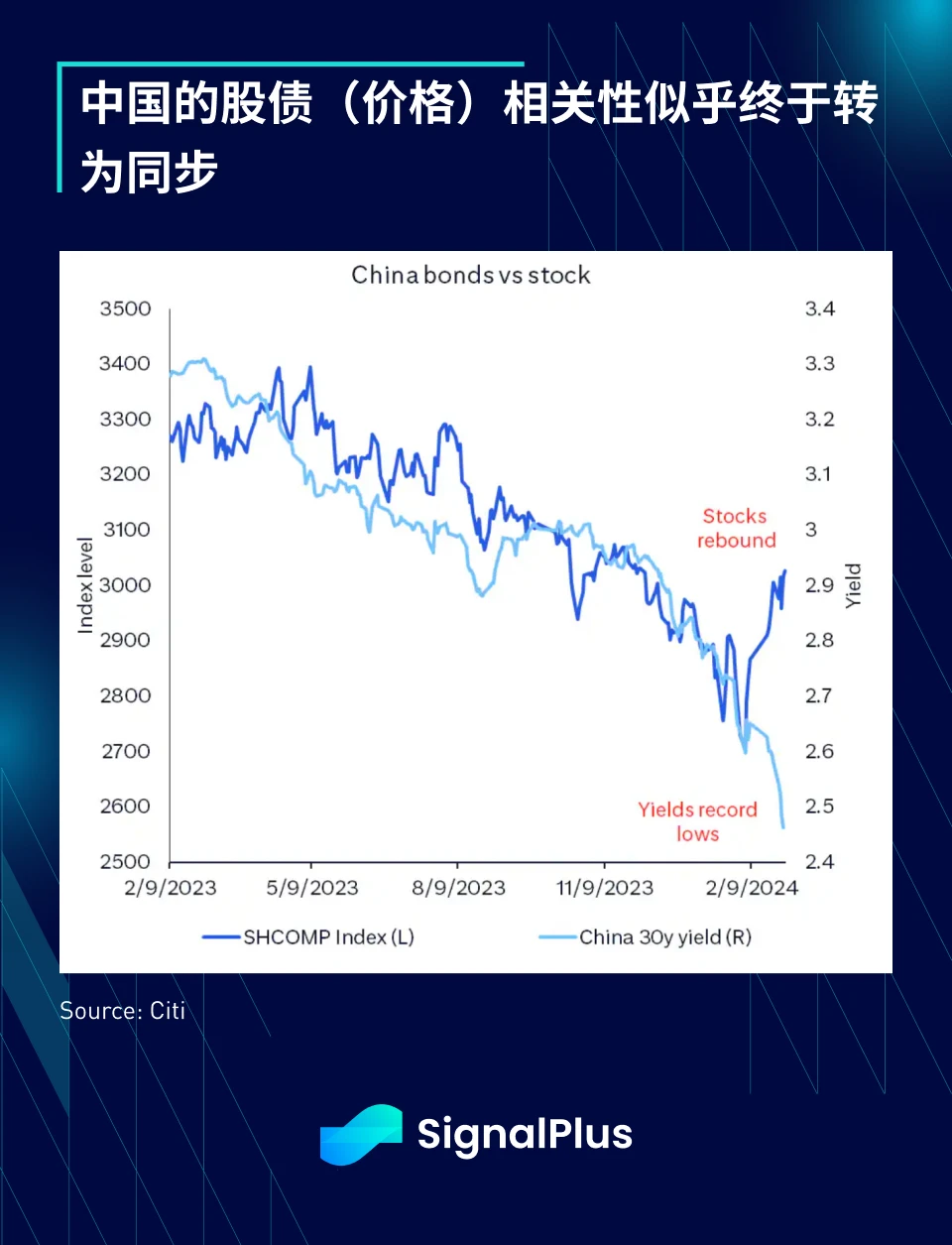

In China, the stock and bond markets have finally seen an encouraging change in correlation, with prices of both asset classes finally starting to move in sync (falling interest rates = rising bond prices). Have Chinese assets reached a turning point? Is the PBOC's loose policy finally beginning to be reflected in stock prices? Hopefully, positive price trends can be sustained…

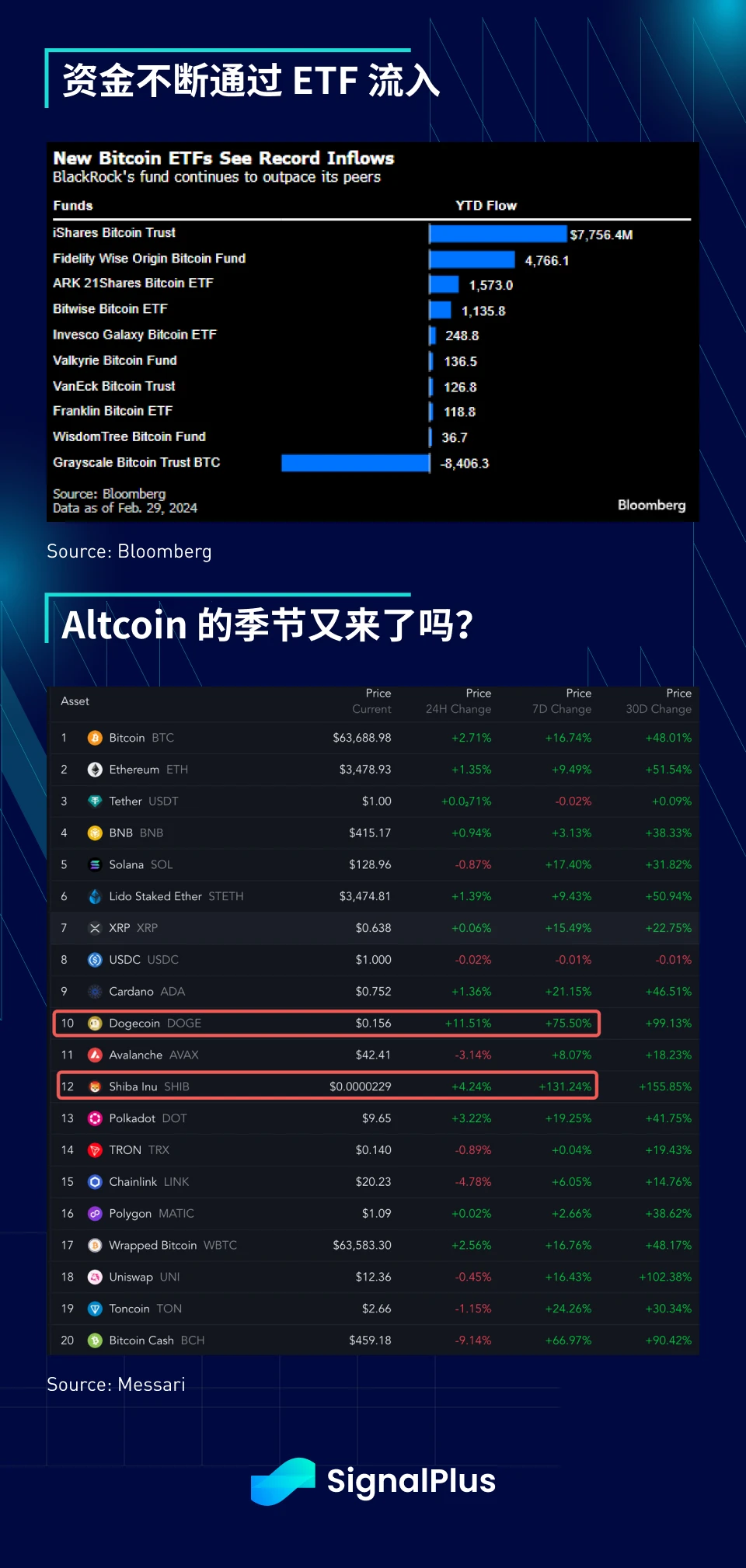

In the cryptocurrency realm, record funds continue to flow in through ETFs, and positive market sentiment seems to have spread to altcoins and memecoins. SOL (+17%), XPR (+16%), Cardano (+21%), Polkadot (+19%), Doge (+7%), and Shiba (+131%) have all accelerated in the past 7 days.

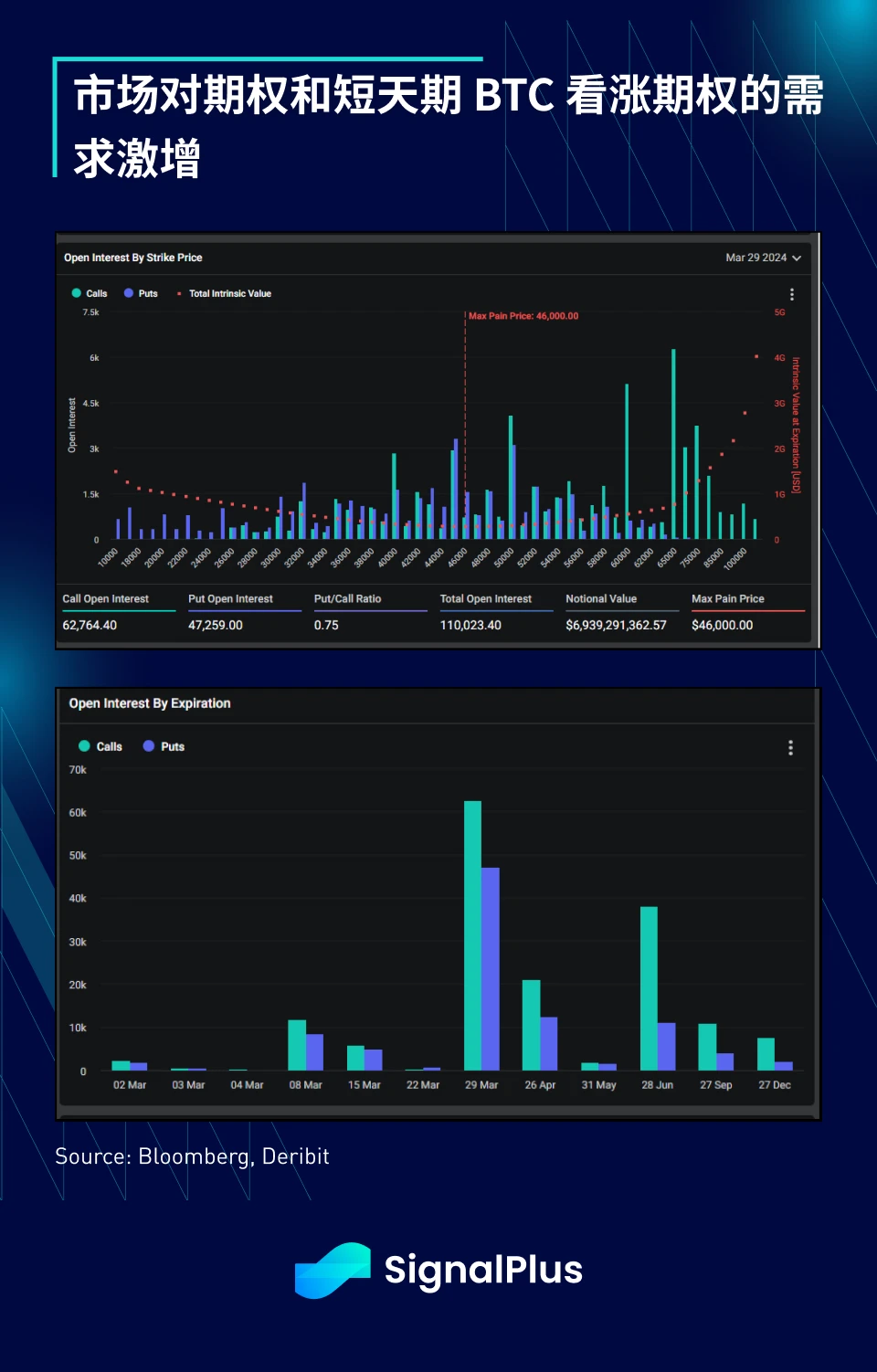

In terms of options, demand for short-term options has surged, with open interest concentrated around the $65,000 to $75,000 level. Deribit, an options exchange, announced record trading volume last week, with a 24-hour trading volume exceeding $12.4 billion and open interest exceeding $27 billion. The market's huge interest in short-term call options is pushing up implied volatility and leading to small-scale gamma squeezes by option sellers, with most positions set to expire on March 29. Therefore, it is expected that prices will fluctuate repeatedly (oscillate up and down) for most of this month, so please be sure to manage risks carefully while enjoying the rise.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto news. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。