DeFi market demand for native crypto assets continues to grow, despite user attrition and decreased activity on the Ethereum L1, its Layer 2 ecosystem remains thriving.

Author: Zack Pokorny / Source

Translation: Plain Blockchain

Abstract

More than 50 days have passed in 2024, and we have seen the market capitalization of on-chain asset securitization reach a historic high, with the number of addresses participating in DeFi on some major Layer 1 and Layer 2 networks hitting a two-year high. The Layer 2 ecosystem of Ethereum remains consistently active. This report highlights some key trends in the industry from the perspective of on-chain data.

Key Points

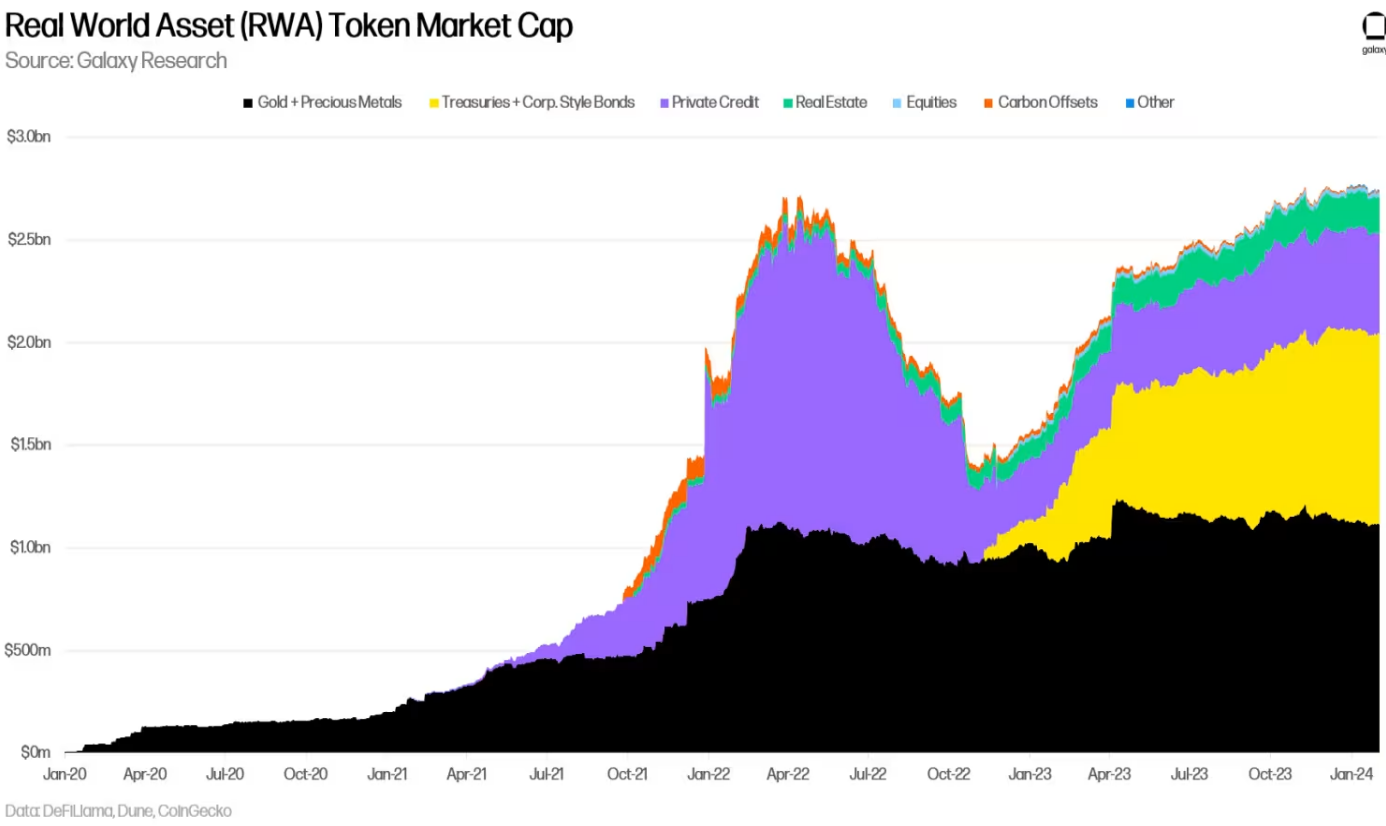

On February 2, the total market value of RWA Tokens reached a historic high of approximately $2.774 billion, while the market for tokenized financial assets (such as treasury bonds and other bonds, private credit, and real estate) also hit a new high on February 8, reaching $1.614 billion. Despite the milestone of RWA Token market value, native crypto assets are gaining market share in key areas of DeFi.

The number of addresses interacting with DeFi on major Layer 1 and Layer 2 networks has reached nearly a two-year high of 445,000 addresses. Decentralized exchanges are one of the most common DeFi applications for first-time users.

In the Ethereum ecosystem (Layer 1 and major Layer 2), the number of daily active addresses has reached an all-time high, and daily transaction volume continues to rise. Layer 2 income has also seen substantial growth over the past month.

1. RWAs

On February 2, 2024, the market value of tokenized real-world assets reached a new historic high of $2.774 billion. It is worth noting that the market for financial assets, including treasury bonds and other bonds, private credit, and real estate, also hit a new historic high of $1.614 billion on February 8, 2024. Please note that these values only consider the value of RWA Tokens themselves on public blockchains, such as Ondo's OUSG and Tether's XAUT, and do not include stablecoins or issuer tokens such as ONDO and CFG. As of February 26, 2024, the proportion of government bonds/bonds in the market value of financial assets RWA has decreased by approximately 110 basis points to 58.1% from its historic high.

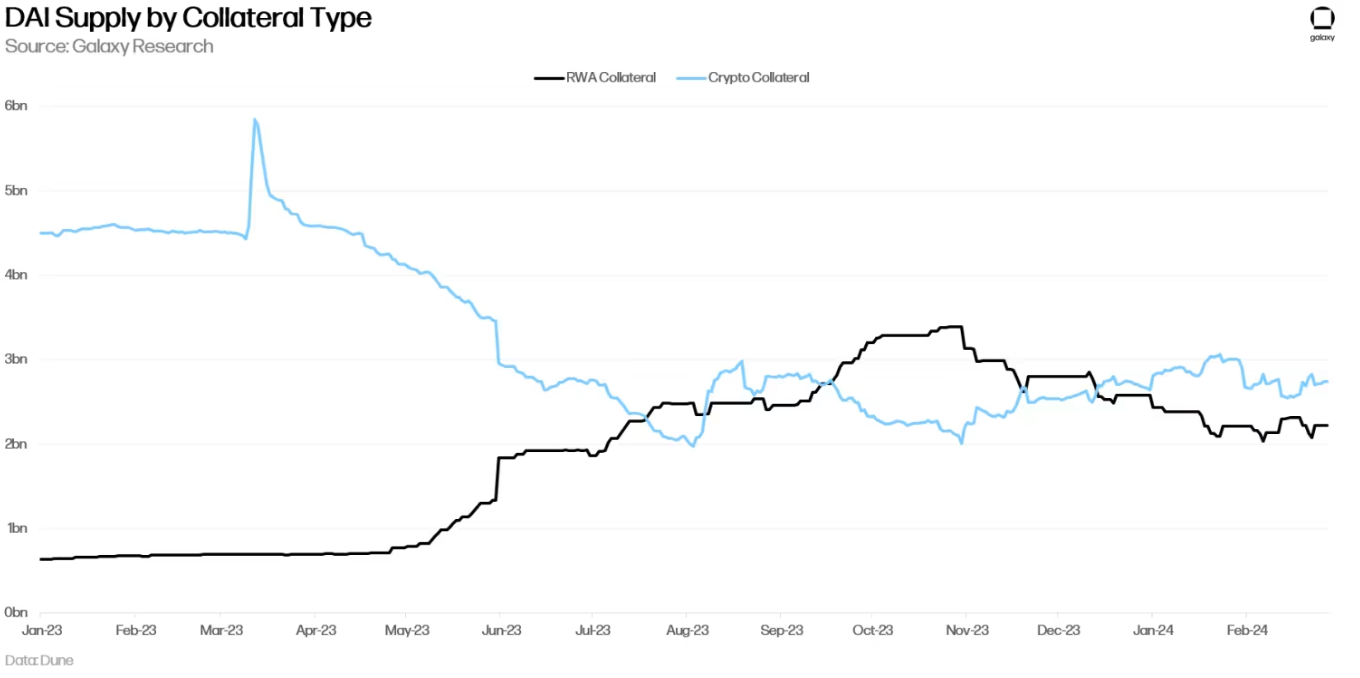

Despite the record high market value of RWA Tokens on-chain, their dominance and usage in on-chain products are gradually weakening. This is most evident in the collateralization of DAI, which has been steadily declining since the end of October 2023. This is a key sign that people are more inclined to use native crypto assets on-chain rather than RWAs, thereby increasing the demand for cryptocurrencies. The recent growth in stablecoins supported by LST further reinforces this point and indicates a strong trend.

In addition, the productivity of native crypto assets has in some ways surpassed that of RWAs. We mentioned this in the news brief on December 1, citing Maker and DAI as examples, where the stable fee rate for crypto collateralized loans is higher than that of RWAs. This dynamic still exists and became more apparent after MakerDAO voted to increase the stable fee rate for certain collateral in its on-chain vaults.

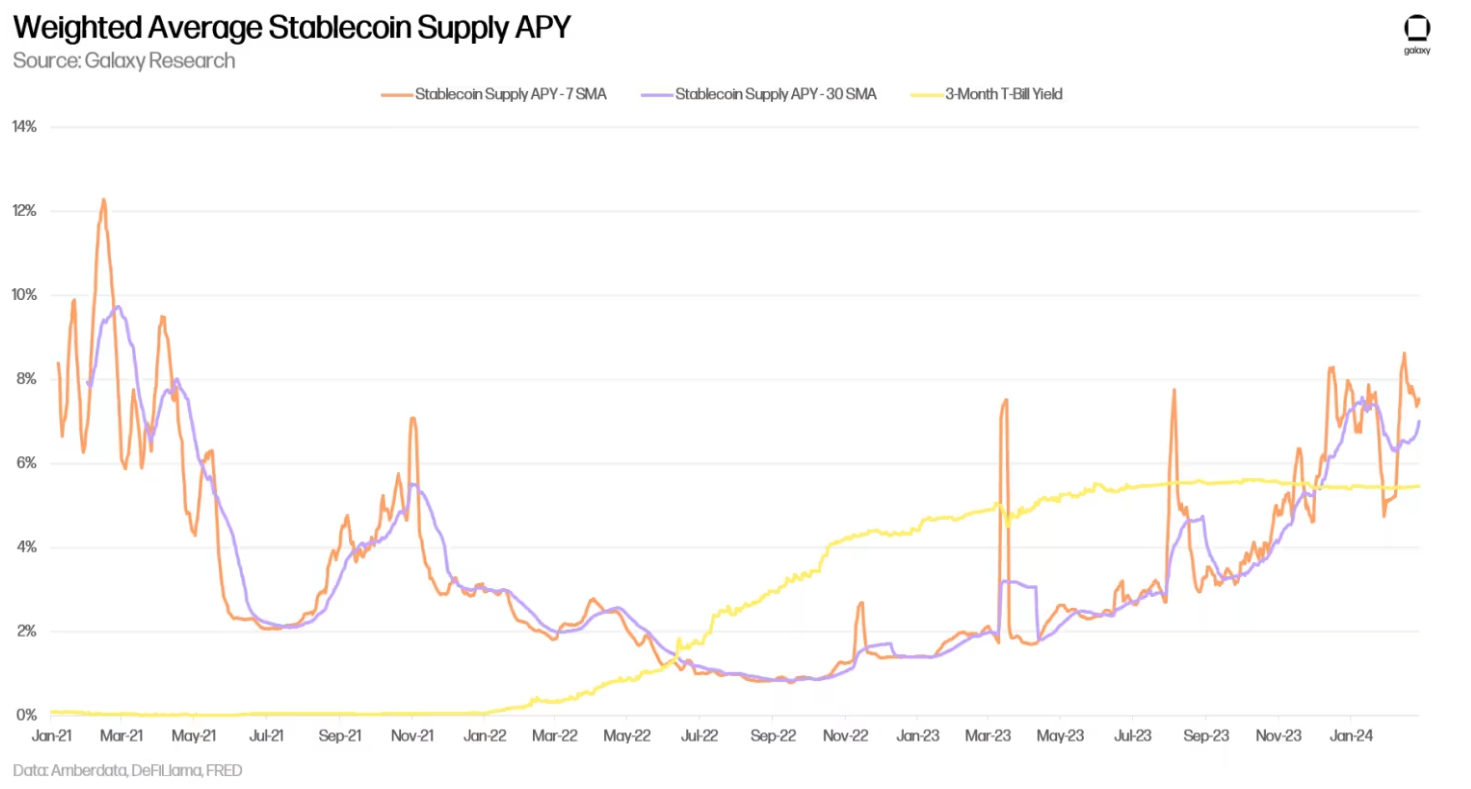

It is worth noting that it raised the fee rate for minting DAI through its stETH vault by 191 basis points. This is also reflected in the supply APY of major stablecoins compared to government bond yields. The chart below shows the weighted average supply APY for USDT, USDC, DAI, and FRAX across Aave v2/v3 and Compound v2/v3. Since late October/early November 2023, the yield on stablecoins has consistently exceeded the yield on 3-month government bonds, just before the decline in DAI RWA collateralization.

2. DeFi Users and Retention Rate

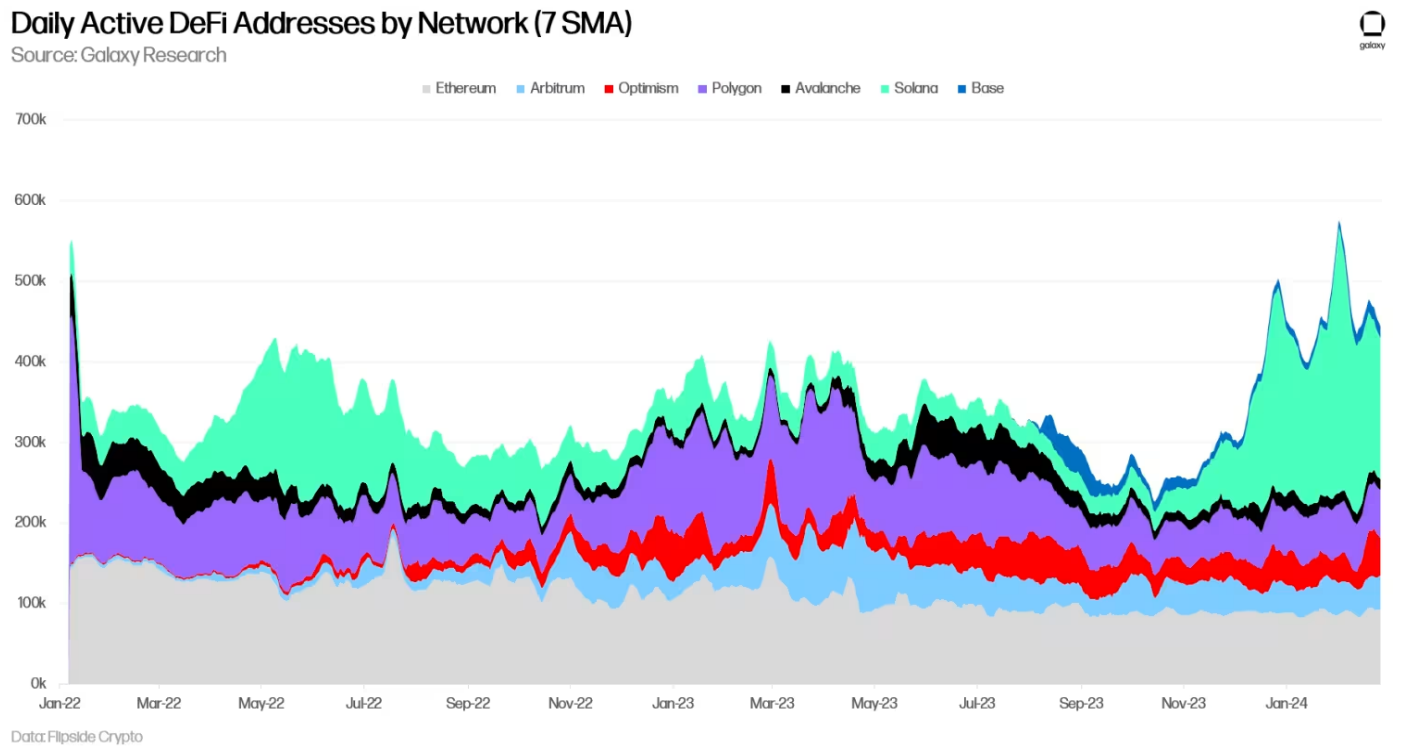

On major Layer 1 and Layer 2 networks, the daily active addresses (DAA) using DeFi reached a new two-year high of 576,000 addresses on a 7-day simple moving average (SMA) as of February 1, 2024. Solana has the highest number of daily active DeFi addresses, reaching 196,000 addresses as of February 20, 2024, down from the peak of 330,000 addresses on February 1, 2024 (the day after the Jupiter airdrop). In contrast, the number of DeFi users on Ethereum has been declining steadily over the past year (down 24% from 120,000 addresses on February 20, 2023). More details on Ethereum's activity and user numbers will be discussed in the next section.

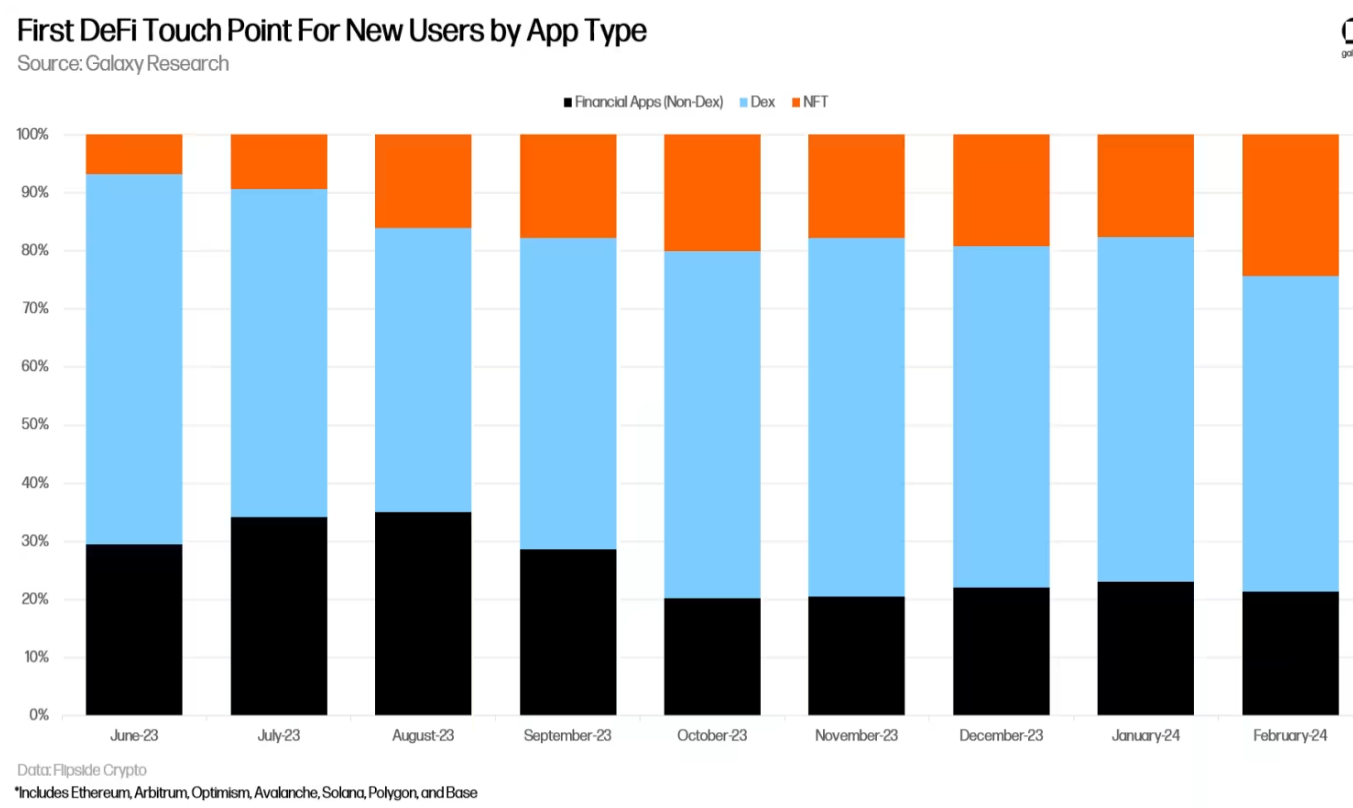

Decentralized exchanges (Dexes) have become a key component for DeFi users on the seven networks mentioned above. Refer to the chart below, where financial applications include applications such as lending platforms and yield aggregators. Nearly 60% of all new users on these seven networks have participated in DeFi, with the majority starting with decentralized exchanges since September 2023. This is consistent with the wave of airdrops and speculation surrounding DeFi over the past six months. Additionally, the increasing prominence of NFTs in attracting new users to DeFi over the past three months should be noted.

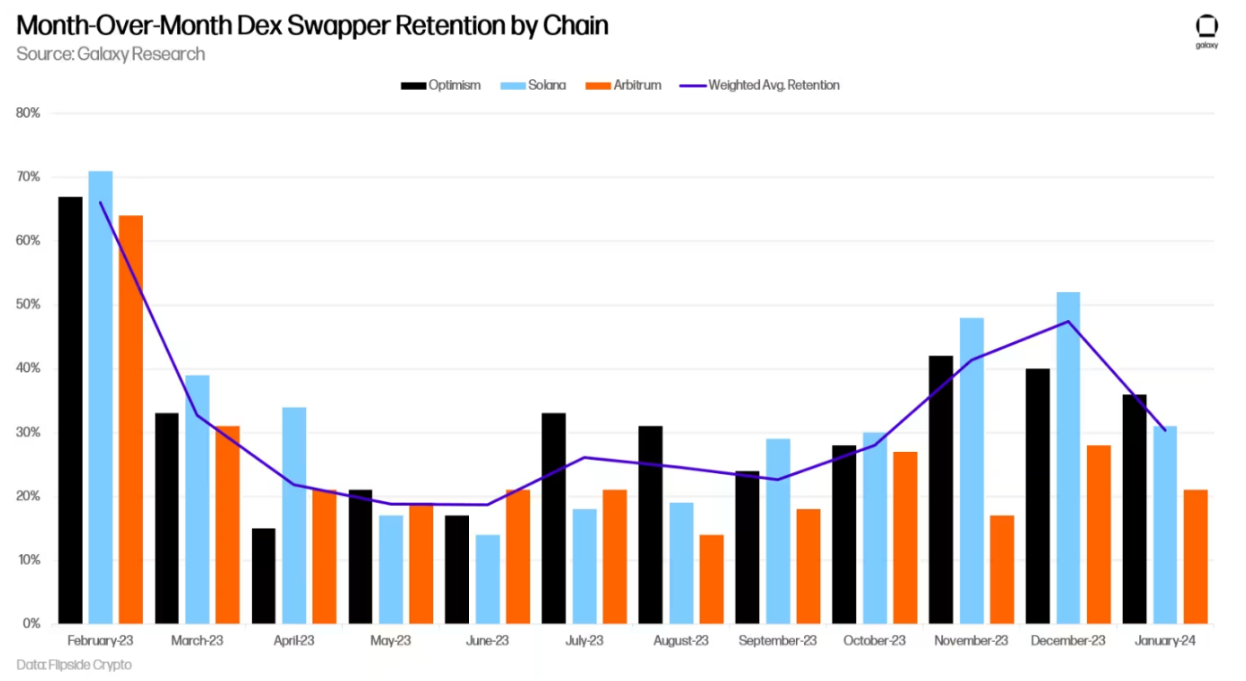

In the three months leading up to January, the retention rate of decentralized exchange (Dex) users has been significantly strong. Among the observed networks over the past five months, Solana has the highest Dex user retention rate, attributed to the Jupiter airdrop activity. The chart below tracks the monthly retention rates of Dex users on Solana, Arbitrum, and Optimism (users who joined in month x and were still trading in month x + 1). After rising for four consecutive months (six months in the case of Solana), the monthly retention rates of these users began to decline in January 2024. The weighted average retention rate is based on new monthly Dex users.

3. Ethereum and Layer 2

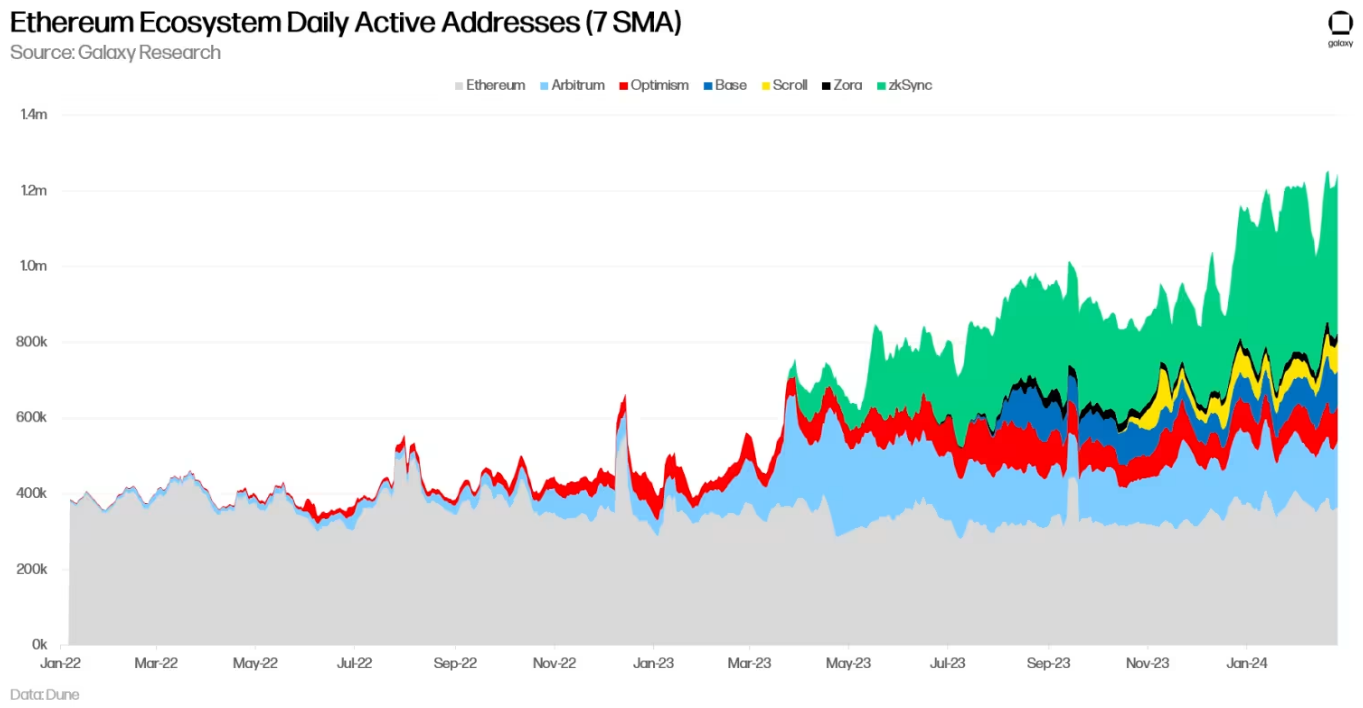

Ethereum has faced criticism on Crypto Twitter for declining user numbers and overall reduced activity. While the number of daily active addresses and activity metrics (such as transaction volume) has mostly remained stable or slightly declined over the past two years, it is unfair to measure Ethereum solely through its L1 perspective as it is focusing its future development on Rollups. Considering some top Layer 2 (L2) solutions, Ethereum's user growth and activity have reached all-time highs.

The chart below shows the combined daily active addresses on Ethereum L1 and some major L2 networks. As of February 21, these networks collectively have over 1.2 million daily active addresses, with Ethereum L1 accounting for only 360,000 addresses. Please note that this chart only includes some Ethereum L2 solutions.

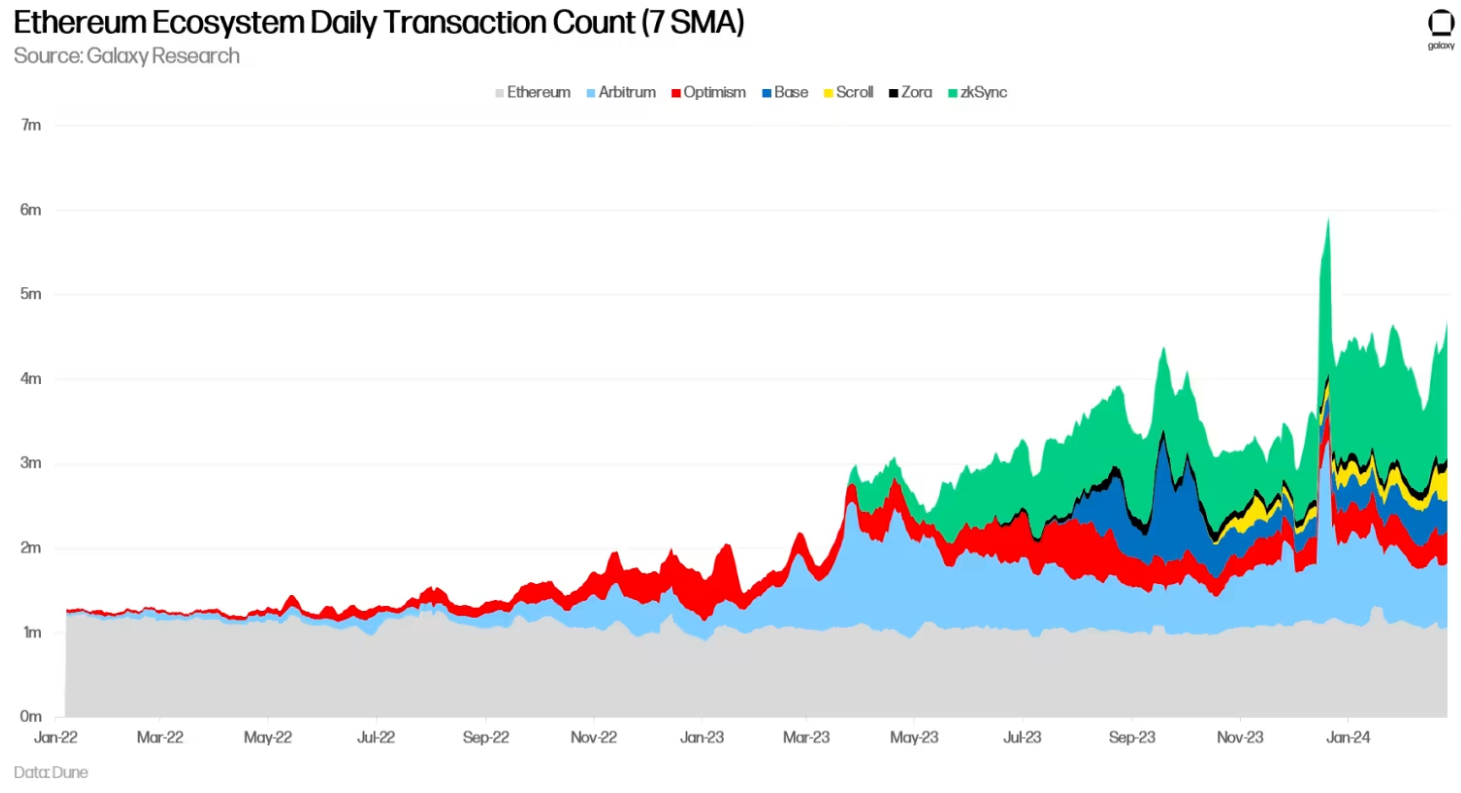

The transaction volume on Ethereum and the same Layer 2 (L2) solutions shows similarly high levels. Despite the slow transaction speed on Ethereum L1, the average daily transaction volume in its L2 ecosystem reached 3.14 million transactions in the 30 days ending on February 26, 2024.

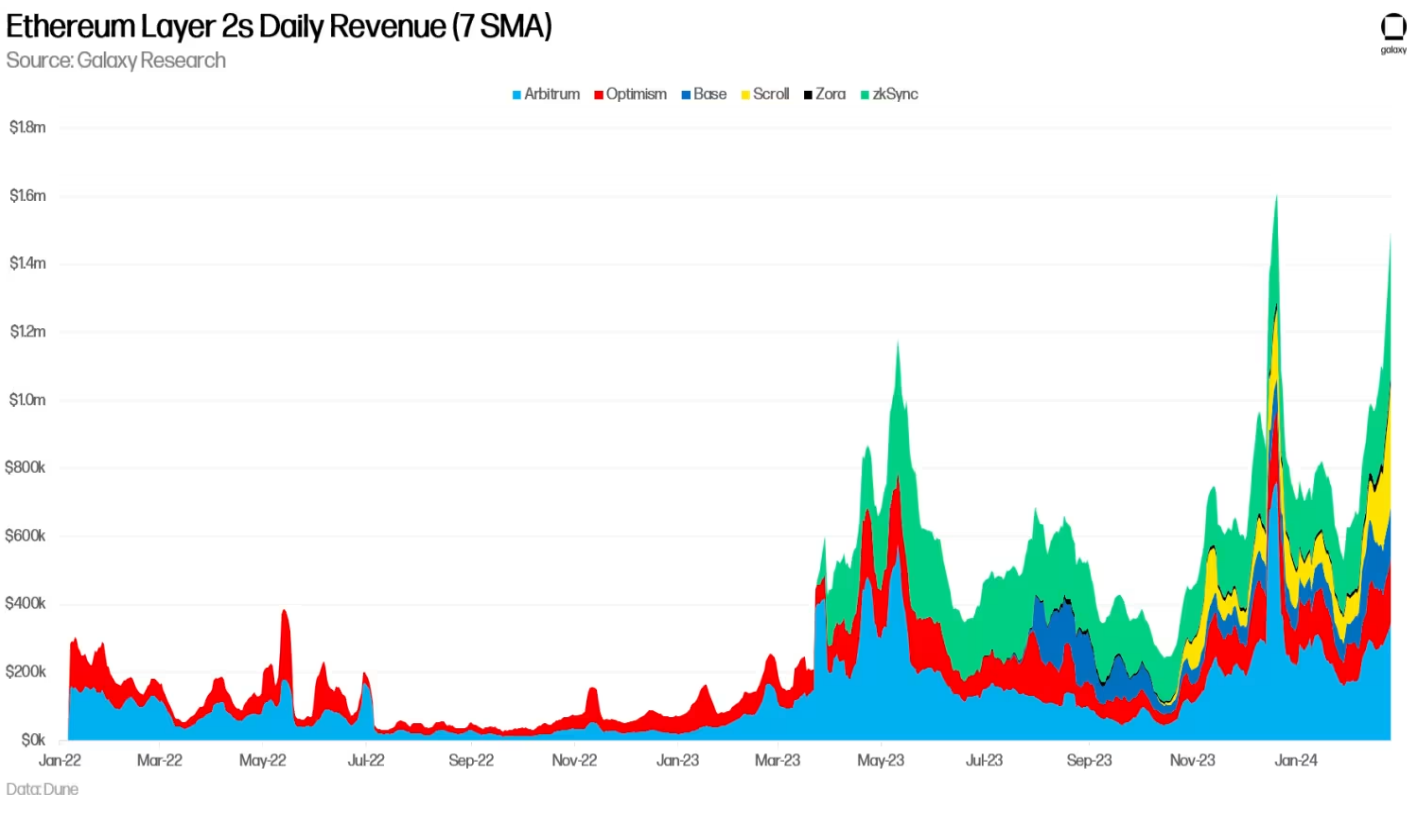

Consistent with the strong transaction volume is the continuously growing revenue. As of February 26, 2024, Arbitrum, Optimism, Base, Scroll, Zora, and zkSync generated an average of $1.5 million in revenue per day using a 7-day simple moving average (SMA) (these are fees paid by users to the Rollup sequencers). February 26, 2024 also marked the second-highest daily revenue observed on the chains.

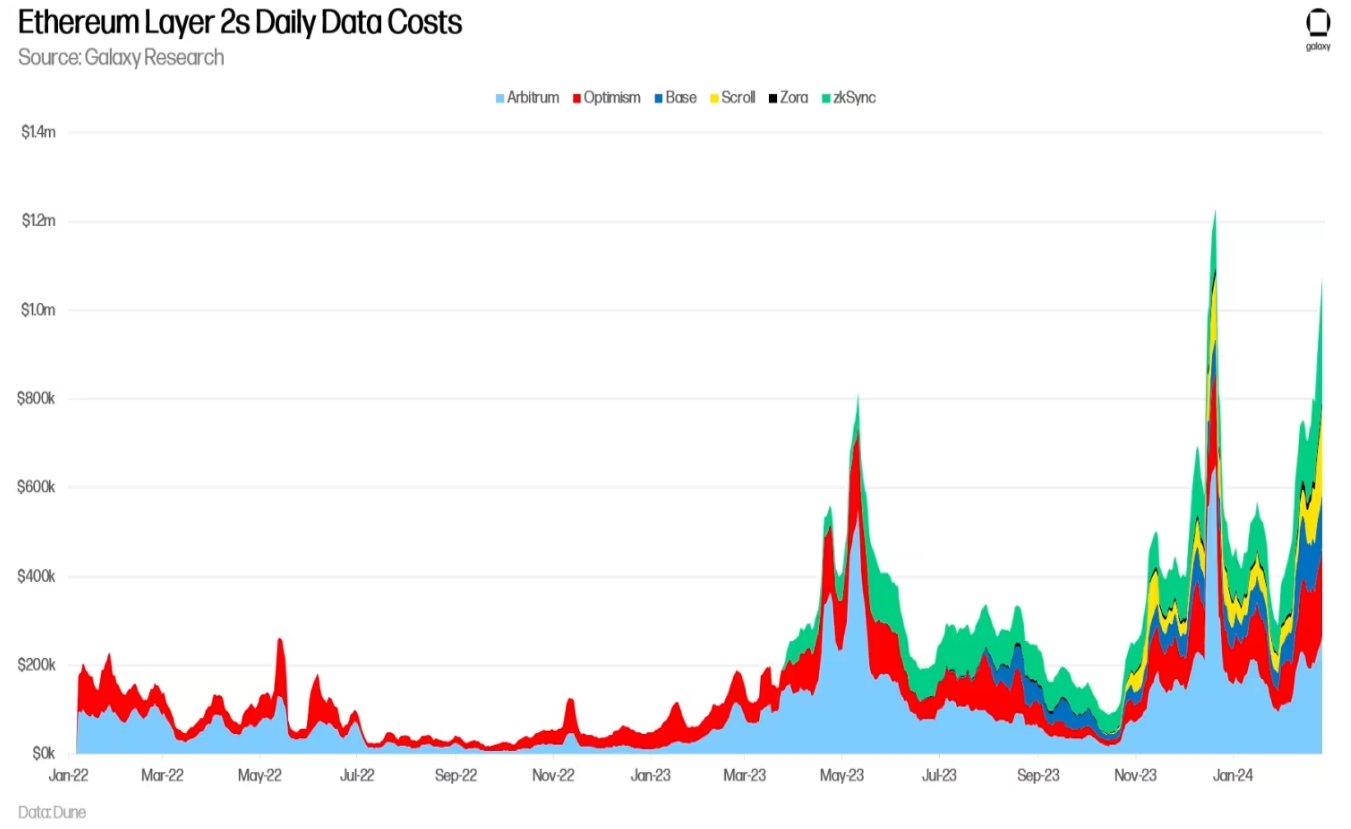

Similarly, the same L2 solutions paid over $21.6 million in data costs to Ethereum L1 in the 30 days ending on February 26, 2024. As activities previously performed on Ethereum L1 move to Rollups, this number will become increasingly important.

4. Signals and Key Points

The above data provides some key signals:

1) Persistent signs of continued demand for native crypto assets replacing RWAs in DeFi.

2) Despite the end of large-scale airdrops, users continue to flock to DeFi; however, the retention rate of decentralized exchanges declined in January. This indicates some user attrition or surrender in this area of DeFi.

3) Despite criticisms of declining activity and user numbers on Ethereum, its Layer 2 ecosystem remains vibrant, with transaction volume approaching all-time highs.

Source: Galaxy Insights

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。