News

On March 2nd, according to Farside Investors data, the net outflow of Bitcoin spot ETF was approximately 140 million US dollars yesterday, with Grayscale GBTC experiencing a net outflow of 492 million US dollars, and BlackRock's IBIT seeing a net inflow of 225 million US dollars.

Bloomberg analyst James Seyffart stated that the significant outflow of GBTC is related to the principles and settlements reached by Genesis and Gemini with other creditors in the bankruptcy case.

According to Yu Jin monitoring, a whale who successfully bought ETH at an average price of 2420 US dollars has purchased 5 million US dollars worth of UNI in the past 18 hours.

Furthermore, the whale started transferring 25 million USDT to Binance yesterday and may continue to buy UNI.

On March 2nd, Andrew Kang, co-founder of Mechanism Capital, posted on X platform, stating that meme coins have become a global speculative liquidity focus. Compared to traditional equities, global users now have easy access to meme coins. This is why Dogecoin's increase exceeds the increase in Gamestop's stock price.

Market Review

As mentioned in the previous article, various indicators have reached high levels, and a pullback or oscillation is inevitable. The current uptrend has temporarily paused, and an adjustment is approaching. This aligns with the expectations outlined in the previous article. Currently, 60,000 has become an important support. How should we proceed in the future?

Market Analysis

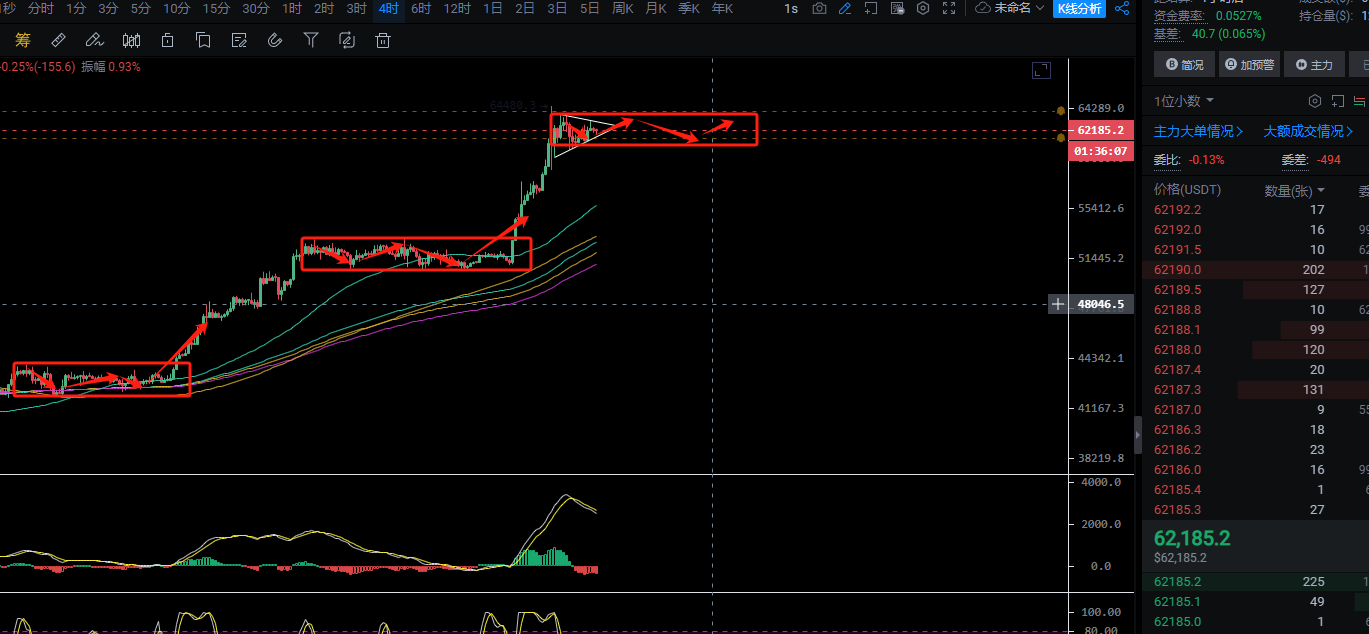

As shown in the image, it can be observed that the adjustments after the previous two waves of consolidation have triggered an uptrend. Currently, the trend on the four-hour chart shows no sign of a peak in the primary uptrend, and the consolidation of the central trend is still ongoing. Historical patterns are often surprisingly similar. The current oscillation range to focus on is 64,000-60,000. A one-week adjustment is expected, so during this period, attention should not be solely on Bitcoin; other currencies can be considered, such as ETH. Currently, Ethereum has broken through the parallel channel and is still in a state of eruption. At the same time, from the indicators, it can be seen that the bullish momentum is still sufficient, and the uptrend is not over. Pay attention to the resistance at 3640; once broken, there may be a further increase of 30-35%, reaching 4550. Conversely, if it reaches near 3640 without breaking, a 13% decline is expected, around the support of 3000. The current price is around 3440, with short-term support around 3330-3300 and resistance around 3640. This can be viewed as a watershed. In summary, Bitcoin is expected to oscillate within a range, while Ethereum is anticipated to continue to rise. Real-time market changes will be explained in the live trading.

Technology is the means, and the trend is the king. Let the leader of the cryptocurrency world guide you through the sea of coins.

Exercise caution when entering the market; trading involves risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。