Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Saturday, March 2, 2024, and I am Yibo! We do not predict trades, but actually observe market fluctuations (narrowing, spreading), structure (market batch structure), and sentiment (external market stocks, US dollars, etc.). As a trader, you (through trading) not only influence prices but also let prices influence your emotions and behavior.

After the approval of the Bitcoin spot ETF by the US SEC in January, Grayscale Fund sold a portion of its chips, leading to a significant decline in BTC prices, followed by a rebound in the market. After February, the market has been rising in a short squeeze style, almost without looking back. After breaking through $64,000, it is just a step away from the historical high of $69,000. The most direct driving force of the Bitcoin market is the continuous buying by Wall Street institutions, resulting in demand far exceeding supply. Especially in recent days, institutions have been buying more than $500 million worth of BTC daily. On February 28, the IBIT fund inflow of BlackRock alone reached as high as $612 million, equivalent to the purchase of 10,140 BTC. Under the FOMO sentiment of the bull market, large holders are not selling, and the buying intensity of institutions has basically depleted the liquidity of Bitcoin, leading to a short squeeze style rise. After the approval of the Bitcoin ETF, the driving logic of BTC has changed from the previous miner production cost-driven to the demand-driven asset allocation of financial institutions. Currently, the daily production of Bitcoin is 900, and after the halving in over a month, the production will be only 450 per day. However, during this period, the daily buying volume of ETF institutions often exceeds 10,000.

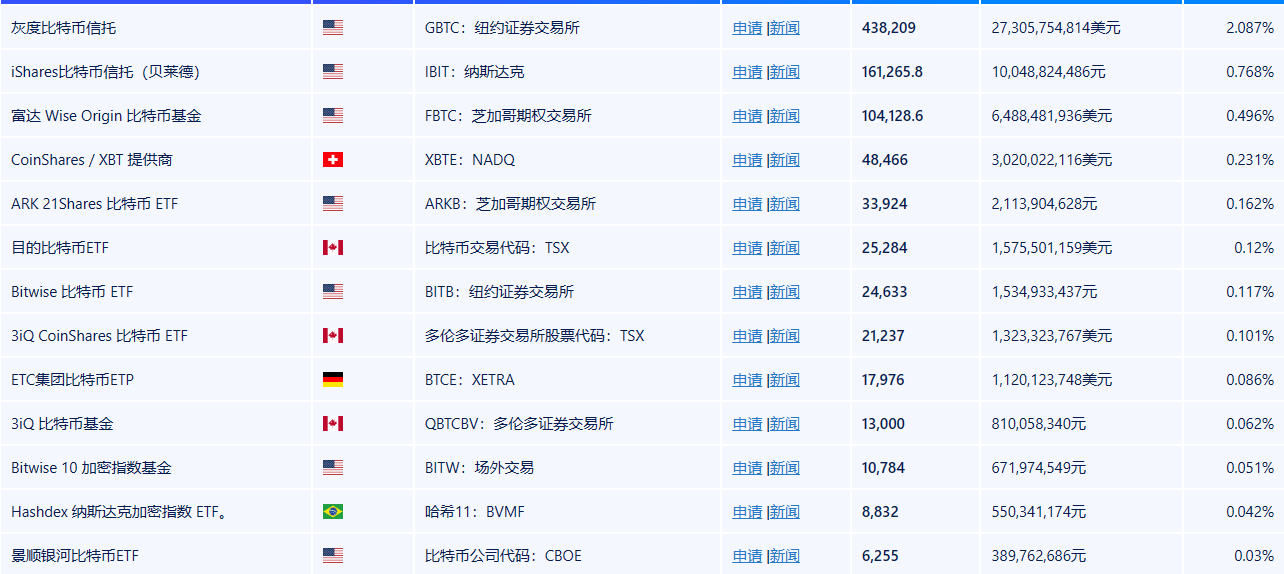

Currently, in addition to Grayscale, nine Bitcoin spot ETF funds have a total purchase volume of over 300,000 BTC, with a total value of over $18.3 billion, in just 48 days. The net increase exceeds 132,800 BTC, and the net purchase funds exceed $8.1 billion, in just 48 days! A simple calculation shows that the daily mining output of 900 BTC, even if all sold, at the current price is just over $50 million, which is completely insufficient compared to the easily over $100 million Bitcoin spot ETF funds. Not to mention that miners will definitely not sell all, plus the halving in two months, this round of the bull market in the crypto market will challenge everyone's imagination.

The current trend of BTC is oscillating around 62,000. Looking at the weekly and monthly levels, it is a bullish trend. As mentioned yesterday, the support at 60,000 was tested, and the rebound occurred near this position. The current focus is on breaking through the new high of 64,000, and the direct market can be seen in the range of 72,000-80,000. This range is the previous high position, so everyone should pay attention to the current first position. The market in March can focus on the previous high point of 69,000, whether it can break through and stabilize at this position to reach a higher trend. From the market perspective, the short-term market has been in a slow oscillation, with a repeated correction and consolidation in the long and short positions. The larger the volatility, the longer the oscillation. The weekend is still in a range oscillation. Looking at the trend structure, the hourly Bollinger Bands have caught up with the trend structure. Looking at the four-hour chart, the candlesticks are running above the middle track of the Bollinger Bands and are in a trend of two positive and one negative, with the highest point in the early morning once again testing above 63,000, but it has not stabilized, and the current price is around 62,200. Looking at the hourly chart, after the rebound from the previous low of 60,450, it entered a stage of a step-by-step rise. Currently, the hourly chart has also formed a pattern of five consecutive declines, so shorting intraday is not stable, after all, the trend is still biased towards the long side. Therefore, our intraday strategy continues to revolve around the low long strategy arrangement.

Ethereum's current market is almost different every day. Last night's volatility was too intense, and there is still a downward trend after breaking through 3,500. The focus of Ethereum's market in March is on the current price challenging the previous high point. The four-hour trend is relatively slow. According to the current four-hour trend, 3,300 has formed a support level, and the first resistance level to look at above is 3,500. It is inevitable to stabilize at the 3,600 level this month, so the market will reach the 4,000 and above positions. It is recommended to go long around 3,400-3,380 on Saturday, with a target focus on the 3,500-3,550 level.

With the realization of positive expectations in March, the altcoins will also take off. Today, BCH is strong, and it is hoped that everyone has goods in hand. BSV and ETC still have incremental space in the production reduction expectation. The current rotation of the altcoin sector is now in the meme sector, including DOGE, SHIB, FLOKI, and PEPE. The next possible rotation is the increasingly popular chain game track. For chain games, you can pay attention to ACE, YGG, AXS, and SAND, which are all familiar and currently at relatively low prices, and are all worth entering. Waiting for the sector rotation to erupt!

In this market, ultimately it is about ability. If your ability is insufficient, what the market gives you will eventually be taken back. Therefore, when your wealth exceeds your ability, you need to control the drawdown, although this control is futile, because that kind of profitable arrogance and arrogance will ultimately destroy a person's rationality. However, in the capital market, we do not have to worry about the situation where our wealth is lower than our ability, because this kind of imbalance will eventually be corrected by time. If it has not been corrected, there is only one reason, and that is your own lack of ability. If you are still in a state of confusion, do not understand the technology, do not know how to read the market, do not know when to enter, do not know how to stop loss, do not know when to take profit, randomly add positions, get trapped at the bottom, cannot hold onto profits, and cannot seize the market when it comes. These are common problems among retail investors, but it's okay. You can come to me, and I will guide you in the right direction for trading. A thousand words are not as good as one profitable trade. Instead of frequent operations, it is better to be precise, making every trade valuable. What you need to do is find me, and what we need to do is prove that what we say is not empty. 24-hour real-time guidance, the market fluctuates quickly, due to the impact of timeliness during review, for the subsequent market trends, real-time layout is the main focus. Friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。