BTC soared to $57,000, just a step away from the $60,000 mark. At the same time, the short-term on-chain profit ratio has reached a new high. Similar short-squeeze situations occurred in 2017, 2020, and 2021.

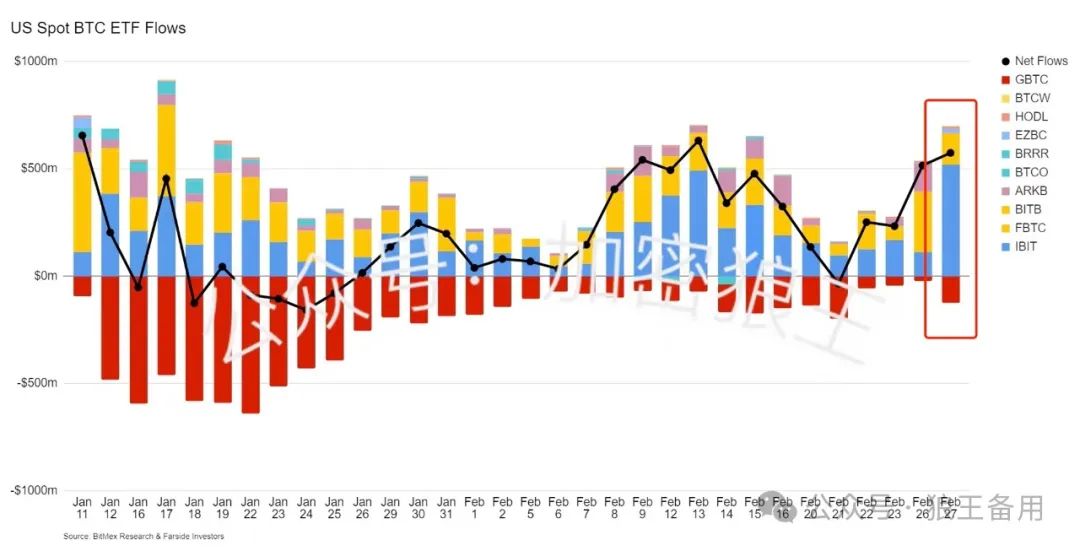

After the ETF went online, BTC holdings reached a new all-time high. Both new and old funds in the market have started to compete. Some believe it's suitable to take advantage of the current situation and then exit, rather than chasing higher prices. The inflow of funds into the ETF has become an indicator of market direction. Once the inflow weakens, a significant correction is likely to occur.

BTC:

On-chain addresses holding BTC have a positive impact on BTC's outlook. BTC rebounded at the 5-day moving average, with higher lows. The hourly chart indicates a short-squeeze situation, and the key level formed by the spike is at $57,567. Only by holding above $57,567 can the current consolidation be broken, initiating a new round of short-squeeze rally. Next, BTC will test the $57,567 level on the upside.

Resistance levels: $57,567, $58,122, $58,734

Support levels: $56,854, $56,258, $55,657

ETH:

With the upcoming London upgrade, there is a positive outlook for ETH. ETH has been strengthening along the 5-day moving average and is still in a bullish trend. The hourly chart shows a double spike pullback, confirming a "M" pattern, accompanied by bullish volume. ETH needs to test higher levels further and quickly rise above the $3,284 mark to enter a rally. Next, ETH will test the $3,284 level on the upside.

Resistance levels: $3,284, $3,306, $3,327

Support levels: $3,228, $3,192, $3,174

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。