Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Wednesday, February 28, 2024, and I am Yibo! We do not predict trades, but actually observe market fluctuations (narrowing, diffusion), structure (market batch structure), and sentiment (external market stocks, the US dollar, etc.). As a trader, you (through trading) not only influence prices but also are influenced by prices as a factor affecting your emotions and behavior.

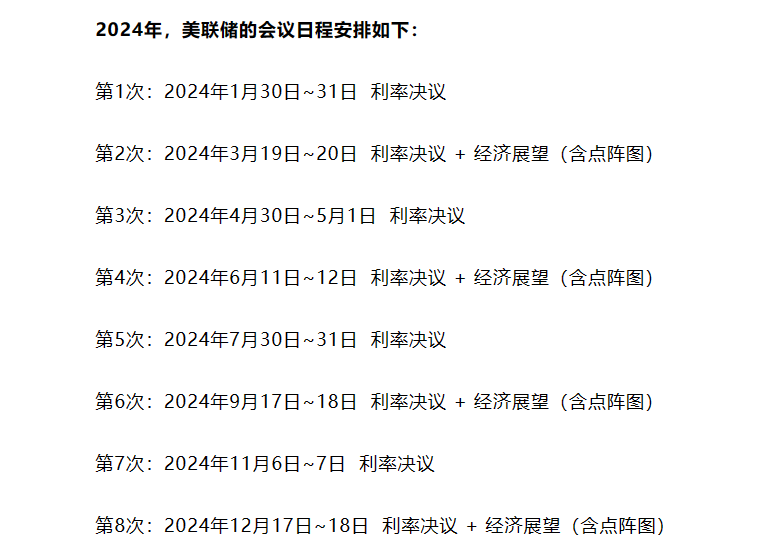

The latest news is that the probability of the Fed maintaining interest rates in March is 99%. According to the Fed's observation: the probability of the Fed maintaining interest rates in the range of 5.25% to 5.5% in March is 99%, and the probability of a 25 basis point rate cut is 1%. By May, the probability of maintaining interest rates is 79.7%, the cumulative probability of a 25 basis point rate cut is 20.1%, and the cumulative probability of a 50 basis point rate cut is 0.2%. In 2022 and 2023, the Fed raised interest rates at the fastest pace in forty years to curb soaring inflation. However, with the easing of price pressures and a still strong economy, Fed officials are preparing to cut interest rates in a slower and possibly more irregular manner. In recent days, several officials have hinted at a possible actual rate cut path, with most officials preferring a cautious and slow approach. Fed Vice Chairman Philip Jefferson mentioned that in the mid-1990s, the Fed achieved a soft landing for the economy by cutting interest rates, pausing three meetings, and then further cutting interest rates.

Bitcoin hit a low of 55530 yesterday, rebounded from the support level, and rose all the way, breaking through the previous high to around 57700 before being resisted and falling back. Currently, the daily level still shows a bullish trend, and the four-hour level also shows a similar bullish trend. The current price is around 56900. Although it has broken through a new high at the four-hour level, it has not been sustained. The market retraced and repaired the ma7 moving average, and the macd showed a bullish trend with shrinking volume and a golden cross of the two lines. In the short term, if the retracement falls below ma7, there are signs of oscillation and repair near the high ma14. Based on the current trend, the bullish trend is still strong. The oscillation range is focused on the 56000-58000 range. A direct breakthrough of 58000 will lead to a direct view of the 60000-62000 range. After a round of rebound trend structure, the four-hour closing line is a more obvious adjustment trend, a small retracement adjustment after the high, followed by a small negative adjustment after a big positive, and it is highly probable to continue with a positive trend. Therefore, after a short-term retracement, the inability to continue to probe downward, it is more likely to look upward! It is recommended to establish a bullish position near 56200-56500, with a target of 57500-57800, and a defensive position set at 55500. If the market trend is weak, consider adding positions near 55800.

Currently, Ethereum has reached a high of 3288, but compared to Bitcoin, this trend is much weaker. However, I think this is not a bad thing for ETH. Historically, Ethereum has always been slow to heat up at the beginning of a bull market. ETH will lead the way for other cryptocurrencies only after Bitcoin breaks through its ceiling. The reason why Bitcoin has performed so bravely this time is mainly due to the strong performance of spot ETFs. This is an advantage for Ethereum, as spot ETFs are favorable for coin prices. The greater the potential for Ethereum in the future, the better. In the short term, Ethereum still has the Constantinople upgrade, so it is a very good investment target in the long, medium, and short term. Based on the current trend stage, 3580 in March is a must-reach position. At the four-hour level, there is a small-scale oscillation based on the current trend, with 3280 as the current small high point at the four-hour level. After breaking through, it will directly target the 3360-3400 range. The market will step by step to touch the 3580 point. The current market has stabilized at the 3200 point. The current four-hour level support point is set at the 3160-3200 range, and a rebound is expected upon reaching this level.

As of now, Bitcoin has surged nearly 7% to a high of 57500, outperforming most altcoins. After Bitcoin stops bleeding, sector rotation will inevitably become apparent. The following sectors and their leading coins should be noted:

- Inscriptions: ordi, sats, bisoswap

- Distributed storage: stx, fil

- AI artificial intelligence: wld, rndr, agix, glm, ctxc, nmr

- Web3.0: mask, ens

- Layer 2 network: matic, op

- DEX: uni, dydx, sushi

- Metaverse: sand, mana, axs, magic

- DAO: people, ant

- DeFi lending: aave, comp

- DeFi oracle: link, band

- NFT: dego, bake, ape

- Anonymous: dash, zec, zen

In this market, ultimately it comes down to ability. If your ability is insufficient, the market will eventually take back what it has given you. Therefore, when your wealth exceeds your ability, you need to control the retracement. Although this control is futile, because that kind of profitable arrogance and arrogance will ultimately destroy a person's rationality. However, in the capital market, we do not have to worry about the situation where our wealth is lower than our ability, because this kind of imbalance will eventually be corrected by time. If it has not been corrected, there is only one reason, and that is your own lack of ability. If you are still in a state of confusion, not understanding the technology, not knowing how to read the market, not knowing when to enter the market, not knowing how to set a stop-loss, not knowing when to take profit, randomly adding positions, getting trapped at the bottom, unable to hold onto profits during market volatility, these are all common problems among retail investors. However, it's okay. You can come to me, and I will guide you in making the right decisions. A thousand words are not as good as one profitable trade. It's better to be precise than to trade frequently, making every trade valuable. What you need to do is find me, and what we need to do is prove that what we say is not empty. 24-hour real-time guidance, the market fluctuates quickly, and due to the impact of timeliness during review, for the subsequent market trends, real-time layout based on actual trading is the main focus. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。