Why do we want to bet on #SOL and its ecosystem #AI and #DePIN?

As investors, we are very concerned about the Total Addressable Market (TAM) of a track.

From the perspective of traditional public chain innovation, there are four directions that are the prelude to the outbreak of application classes in this round: AI, Depin, RWA, Gamefi. I have always advocated that this cycle will be the era of lean protocols and fat applications, and will give birth to top applications like WeChat, Alipay, and Facebook in the traditional sense. But there are still many public chains building their own protocols or modular solutions, which are relatively lagging behind. Many times when we conduct investment research meetings, we often discuss whether there is a need for so many L2s, so many modular layers, and so much staking logic?

Perhaps we should provide a more concise solution, convenient SDK or API interfaces for application developers, provide a well-scalable, high-performance, fully-featured, and spacious runway for these passionate young people to start their imaginative and creative work, rather than letting them choose between various protocols and suffer from trial and error. At the same time, rich applications will also contribute to the introduction of traffic from the traditional Internet market to the Web3 field.

SOL did not choose more solutions, but focused on its L1, providing a complete infrastructure, which naturally attracted a large number of application builders.

And #AI and #Depin are adding wings to the valuation of #SOL.

AI currently has a valuation of less than $23 billion in the overall Web3 field. The largest market value is currently #TAO, with a market cap of $3.6 billion and FDV of $12 billion, while #Messari estimates that by 2030, the overall market value of #AI in the Web3 field will reach as high as $28 trillion, a growth of 121 times.

Depin currently has a valuation of less than $40 billion in the overall Web3 field (some of which overlaps with #AI), and is estimated to reach a scale of $3.5 trillion by 2028, a growth of 88 times.

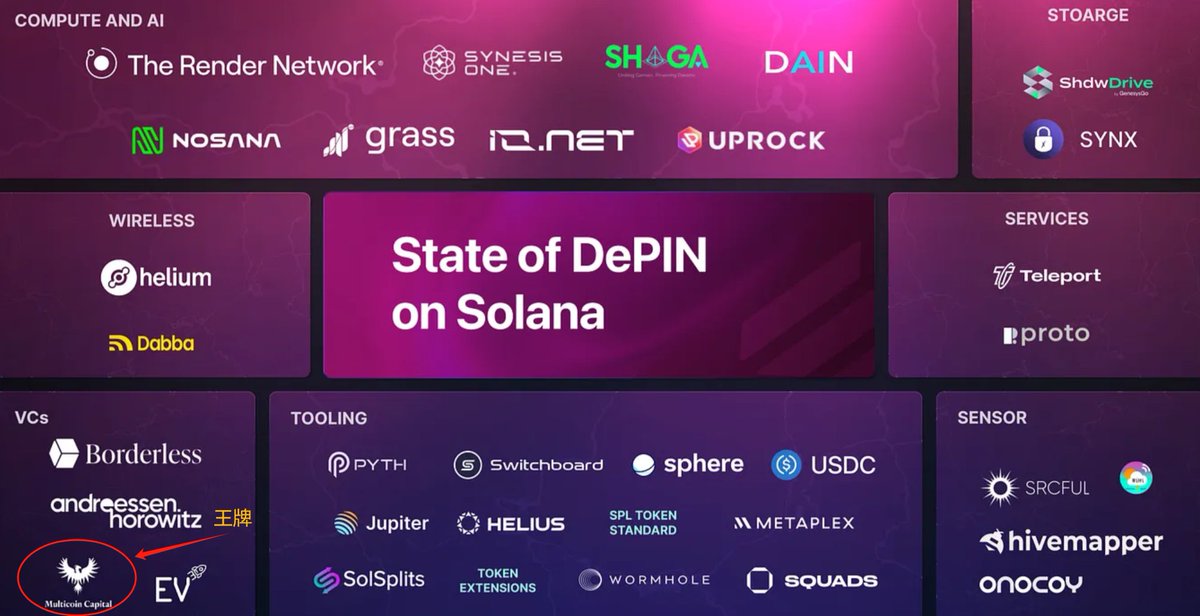

And currently, the leading players in the #AI and #Depin tracks are all building or migrating to the #SOL chain. For example: #RNDR @rendernetwork and #HNT @helium.

Why is this? Because of #SOL's chain performance and complete infrastructure.

AI and #Depin need to prioritize high throughput and low costs, especially for large-scale micro-payments to incentivize contributors. Solana's current conventional TPS is as high as around 5000, theoretically capable of handling 50,000-65,000 TPS on the mainnet, a feat that puts it on par with traditional global payment networks like Visa. And with the mid-term upgrade #Firedancer in 2024, the expected TPS will be 600,000-1,000,000 TPS, making it the first in smart contract public chains.

Strong token standards and ecosystem: A vibrant ecosystem with proven DEX, as well as established standards such as cNFT (providing NFT minting for #HNT's million hotspots at a cost of only 5 SOL), pNFT (programmable NFT), and token extensions, providing the basic components for #AI and #DePIN projects to develop and launch.

Examples (there are many, only listing some):

1️⃣ SPL token standard and token extension: Token extension is the next generation SPL (Solana Program Library) token standard, with advanced features such as confidential transfers, transfer hooks, transfer fees, non-transferable tokens, interest-bearing tokens, etc.

2️⃣ The GetCode protocol can implement large-scale micro-payments in the DePIN project.

3️⃣ Oracle and interoperability: Oracles are important real sources of off-chain asset data. Solana has two main oracles - Pyth and Switchboard, and cross-chain messaging protocols like Wormhole promote cross-chain interoperability.

Solana Mobile: Solana's uniqueness lies in having its own mobile phone, demonstrating a commitment to integrating the ecosystem applications. Solana Mobile 1 already has a user base of 20,000, and Solana Mobile 2 has over 50,000 pre-orders. Many SOL applications will be integrated, including free trials of #HNT 5G network, #SHDW personal cloud storage (similar to Dropbox), etc.

Solana Foundation + Multicoin @multicoincap: The value experience brought to traditional users in the era of fat applications has provided many beautiful ideas and taken practical actions in the field of large-scale investment-related applications.

At the same time, while public chains are building large applications, they will generate ecological returns, strengthen themselves, form a positive flywheel, and create strong barriers.

Large user traffic: Projects like Helium have greatly increased the number of active wallets. Helium alone reports over 60,000 monthly active wallets participating in activities such as claiming, staking, delegating, or burning tokens, and over 30,000 wallets using other SPL programs, highlighting Helium's impact on the Solana ecosystem.

Legitimacy and brand: From a regulatory perspective, DePIN demonstrates the practical application and value of Solana to regulators and policymakers, enhancing its legitimacy and brand.

Currently, #SOL, as a label for a US public chain, has become deeply rooted, especially in the minds of first and second-tier capital in the United States. This position will gradually deepen with the outbreak of the era of fat applications, and in this cycle, #SOL will surely shine!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。