One of the main reasons I am sure @0xfluid will take over the lending space is its unbeatable parameters

such as Max LTV, Liquidation Threshold, and Liquidation Penalty

Let's compare Fluid vs Aave/Compound/Maker for $ETH collateral

Fluid:

• 85% LTV

• 90% Liquidation Threshold

• 1% Liquidation Penalty

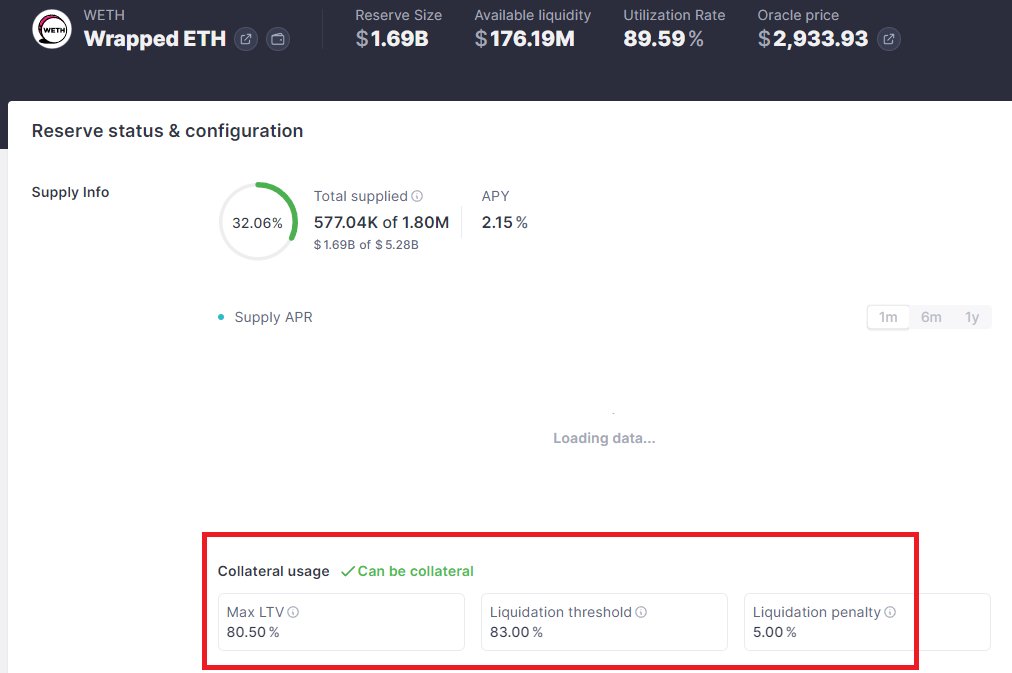

Aave:

• 80.5% LTV

• 83% Liquidation Threshold

• 5% Liquidation Penalty

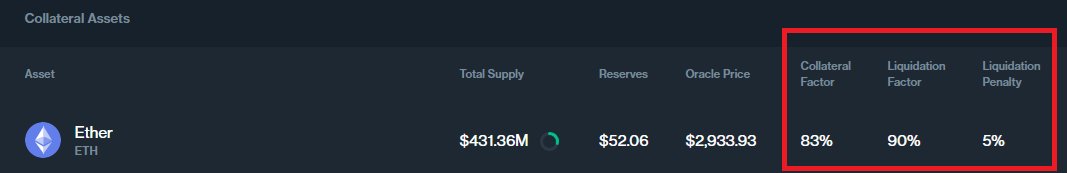

Compound:

• 83% LTV

• 90% Liquidation Threshold

• 5% Liquidation Penalty

Maker:

• 77% LTV

• 77% Liquidation Threshold

• 13% Liquidation Penalty

As you see, Fluid is up to 5-13 times more efficient than other protocols and has as low as 0.1% liquidation penalty for wstETH <> ETH pair.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。