Original Authors: PatrickBush, MatthewSigel

Original Compilation: Lynn, Mars Financial

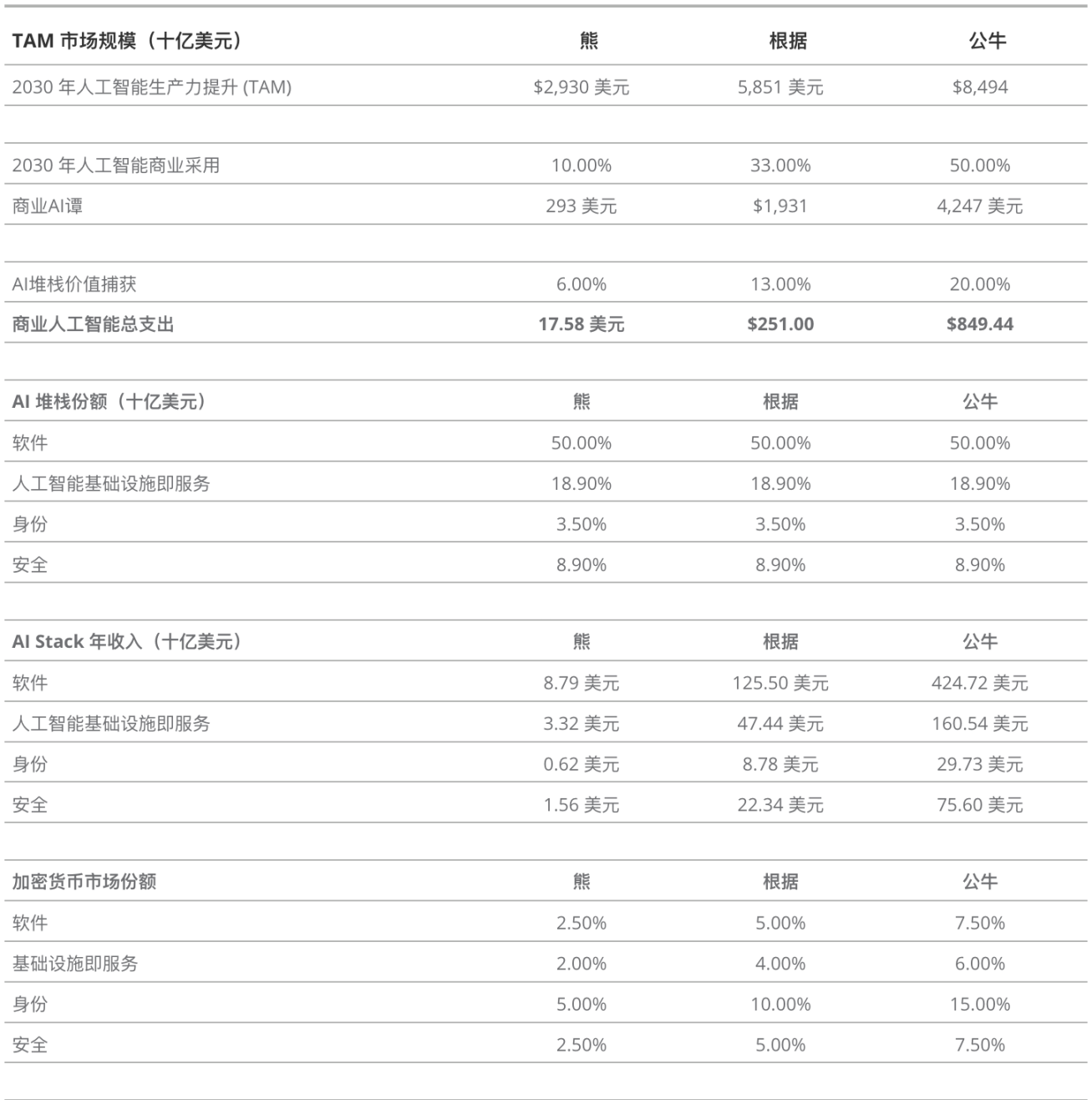

We outlined the scenario of artificial intelligence cryptocurrency revenue by 2030, emphasizing the $10.2 billion baseline and highlighting the key role of public blockchain in driving the adoption of artificial intelligence through fundamental functions.

Please note that VanEck may hold positions in the following digital assets.

Key points:

Based on our baseline, cryptocurrency AI revenue is expected to reach $10.2 billion by 2030.

Blockchain technology may become a key driver for the adoption of artificial intelligence and the progress of decentralized artificial intelligence solutions.

Integration with cryptographic incentives can enhance the security and efficiency of artificial intelligence models.

Blockchain may become a solution for artificial intelligence identity verification and data integrity challenges.

Public blockchain is likely to be a key enabler for widespread adoption of artificial intelligence (AI), and AI applications will be the reason for the existence of cryptocurrencies. This is because cryptocurrencies provide essential foundational elements required by AI, such as transparency, immutability, well-defined ownership attributes, and adversarial testing environments. We believe these characteristics will help AI to fully realize its potential. Based on our estimates of AI growth, we assert that cryptocurrency projects focused on AI will generate annual revenue of $10.2 billion by 2030. In this article, we speculate on the role of cryptocurrencies in promoting the adoption of artificial intelligence and the value that cryptocurrencies will bring to the AI business:

Please view the PDF version of this blog here.

We found the best applications of cryptocurrencies in artificial intelligence to be:

Providing decentralized computing resources

Model testing, fine-tuning, and validation

Copyright protection and data integrity

AI security

Identity

Cryptocurrencies are highly useful for artificial intelligence because they have already addressed many of the challenges faced by AI currently and in the future. Essentially, cryptocurrencies solve coordination problems. Cryptocurrencies bring together people, computing, and monetary resources to run open-source software. This is achieved by rewarding individuals who create, support, and use each blockchain network in the form of tokens that have value tied to each network. This reward system can be used to incentivize different components of the AI value stack. One significant implication of combining cryptographic technology with AI is the use of cryptocurrency incentives to develop the necessary physical infrastructure, such as GPU clusters specifically used for training, fine-tuning, and supporting the use of generative models. As cryptocurrencies create an adversarial environment using cryptocurrency to reward desired user behavior, it provides the best foundation for testing and fine-tuning AI models to optimize outputs that meet certain quality standards.

Blockchain also brings transparency of digital ownership, which may help address some of the open-source software issues that AI will face in court, as seen in notable cases such as The New York Times v. OpenAI and Microsoft. In other words, cryptocurrencies can transparently prove ownership and copyright protection of data owners, model builders, and model users. This transparency will also extend to publishing mathematical proofs of model validity on public blockchains. Finally, due to unfalsifiable digital signatures and data integrity, we believe public blockchains will help mitigate identification and security issues that would otherwise undermine the effectiveness of AI.

Defining the role of cryptocurrencies in AI enterprises

Cryptocurrency AI revenue forecast for 2030: bear market, baseline, bull market scenarios

Source: Morgan Stanley, Bloomberg, VanEck Research as of January 29, 2024. Past performance is not indicative of future results. The information, valuation scenarios, and price targets provided in this blog are not intended as financial advice or a solicitation of any action, recommendation to buy or sell, or as predictions of future performance of AI businesses. Future actual performance is uncertain and may differ significantly from the assumptions described here. There may be risks or other factors not considered in the scenarios presented here that could hinder performance. These are purely simulated results based on our research and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

To forecast the market for cryptocurrency AI, we first estimate the total addressable market (TAM) of business productivity gains brought by AI, with our baseline number coming from McKinsey's assumptions for 2022. We then apply economic and productivity growth assumptions to McKinsey's forecast to calculate a baseline TAM of $5.85 trillion for 2030. Under this baseline, we assume AI productivity growth is 50% higher than GDP growth, with GDP growing at 3%. We then forecast the market penetration of AI in global enterprises (33% under the baseline) and apply it to our initial TAM, expecting AI to bring $1.93 trillion in productivity gains to enterprises. To calculate the revenue of all AI businesses, we assume that 13% of these productivity gains are captured by AI businesses (or spent by enterprise consumers) as revenue. We estimate the share of AI revenue by applying the average revenue share of the S&P 500 companies' labor costs and assume AI spending should be similar. The next part of our analysis applies Bloomberg Intelligence's forecast of the distribution of AI value stacks to estimate the annual revenue for each AI business group. Finally, we make specific estimates of the cryptocurrency market share for each AI business to arrive at the final data for each case and market.

We envision a future where decentralized AI models built using open-source public repositories are applied to every imaginable use case. In many cases, these open-source models outperform centralized AI creation. The basis for this assumption stems from the idea that open-source communities have a unique motivation to improve things, bringing enthusiasts and hobbyists together. We have seen open-source internet projects disrupt traditional businesses. The best examples of this phenomenon are Wikipedia effectively ending the commercial encyclopedia business and Twitter disrupting the news media. These open-source communities have succeeded where traditional enterprises have failed because they coordinate and motivate people to provide value through a combination of social influence, ideology, and group solidarity. In short, these open-source communities succeed because their members care.

Combining open-source AI models with cryptocurrency incentives can expand the influence of these emerging communities, giving them financial capability to create the necessary infrastructure to attract new participants. Applying this premise to AI will be an attractive combination of passion and financial resources. AI models will be tested in a cryptocurrency incentive competition, establishing an environment for model evaluation benchmarks. In this environment, the most effective models and evaluation standards will prevail, as the value of each model is clearly quantified. Therefore, in our baseline scenario, we expect blockchain-generated AI models to account for 5% of all AI software revenue. This estimate includes hardware, software, services, advertising, games, etc., reflecting the shift in enterprise operations. In the total revenue of AI software, we expect this to account for about half, or approximately $125.50 billion, of all AI revenue. Thus, we anticipate the 5% market share of open-source models to equate to a revenue of approximately $6.27 billion supported by cryptocurrency-backed AI models.

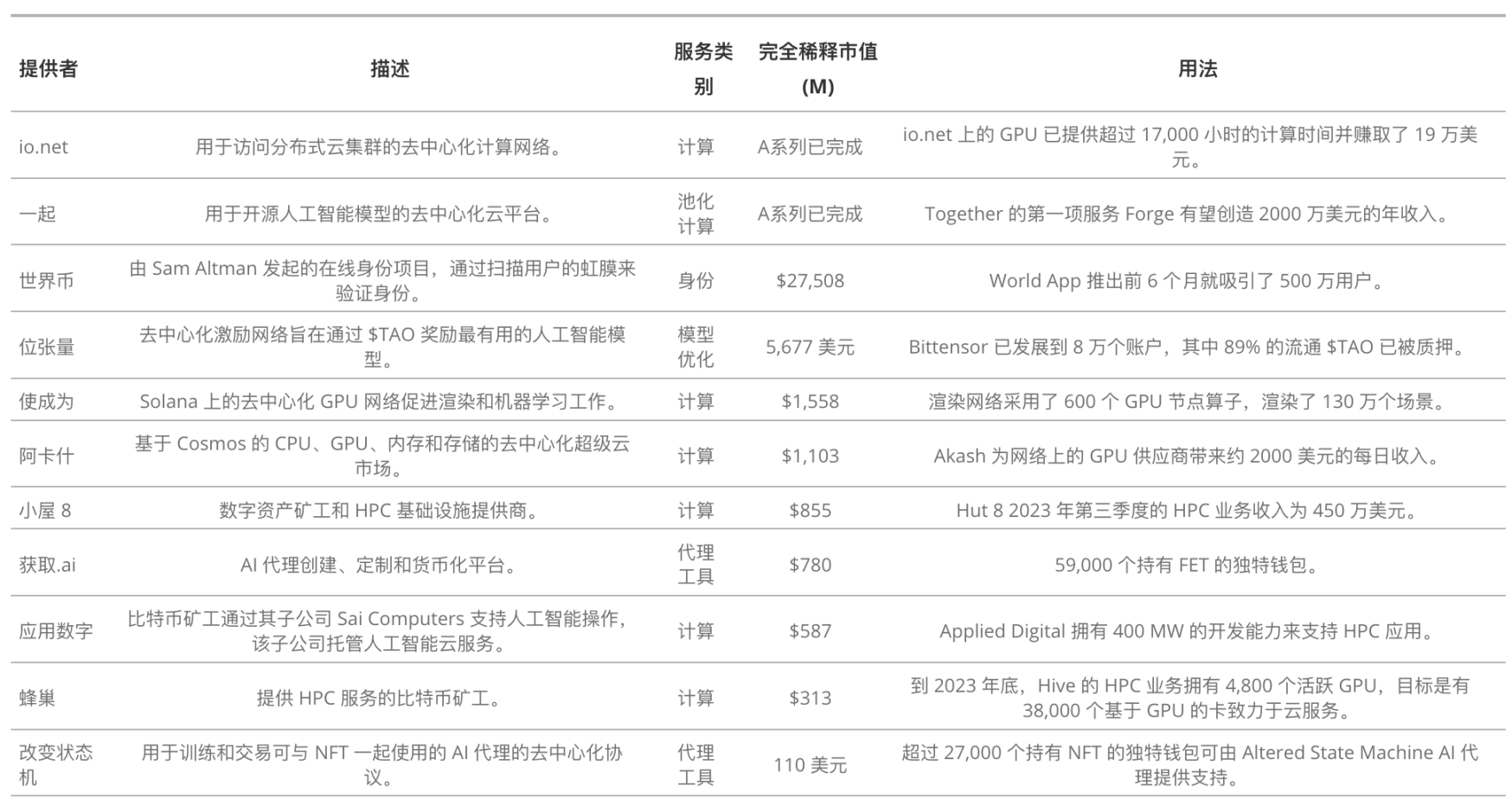

We expect that by 2030, the Total Addressable Market (TAM) for computing used for fine-tuning, training, and inference (or AI infrastructure as a service) could reach $47.44 billion. With the widespread adoption of artificial intelligence, AI will become an indispensable part of many functions in the world economy, and the supply of computing and storage can be envisioned as similar to public utilities for electricity generation and distribution. In this dynamic, the majority of the "base load" will come from GPU cloud hyperscale enterprises such as Amazon and Google, with their market share approaching 80% in a Pareto distribution. We see the backend server infrastructure allocated by blockchain as being able to meet specific needs and act as "peak" providers during periods of high network demand. For producers of custom AI models, providers of encrypted storage and computing offer advantages such as on-demand service delivery, shorter SLA lock-in periods, more customized computing environments, and higher latency sensitivity. Additionally, decentralized GPUs can seamlessly integrate with decentralized AI models in smart contracts, enabling AI agents to extend their computing needs in permissionless use cases. Viewing the GPUs provided by blockchain as the equivalent of Uber/Lyft for artificial intelligence computing infrastructure, we believe that blockchain-provided computing and storage will occupy 20% of the non-hyperscale market for AI infrastructure and could generate approximately $1.90 billion in revenue by 2030.

Defining "identity" through verifiable on-chain personhood in the context of AI agents and models can be seen as a witch defense mechanism for the world's computer network. We can estimate the cost of this service by examining the fees associated with protecting different blockchain networks. In 2023, these costs for Bitcoin, Ethereum, and Solana were approximately 1.71%, 4.3%, and 5.57% of the network's inflationary issuance value, respectively. Conservatively, we can infer that identity verification should account for around 3.5% of the AI market. Considering the TAM of AI software is $125.5 billion, this corresponds to annual revenue of approximately $8.78 billion. As we believe that cryptocurrencies provide the best solution for identity issues, we expect it to capture around 10% of this terminal market, with projected annual revenue of approximately $878 million.

AI security is expected to become another important component of AI devices, with the fundamental requirement being the use of undamaged, relevant, and up-to-date data to verify that models are running correctly. As AI expands into applications where human lives are at risk, such as autonomous vehicles, factory robots, and healthcare systems, the tolerance for failure becomes very low. The need for accountability in the event of accidents will drive the demand for specific security proofs in the insurance market. Public blockchains are an ideal choice for achieving this function, as they can publish "security proofs" on an immutable ledger visible to anyone. This business can be considered similar to compliance in financial institutions. Considering that U.S. commercial and investment banks generate $660 billion in revenue while spending $58.75 billion on compliance costs (8.9% of revenue), we estimate that AI security should account for approximately $22.34 billion of the $251 billion AI TAM. While cryptocurrencies have the potential to enhance AI security, given the U.S. government's focus on AI, we believe that most of AI's compliance will be centralized. Therefore, we estimate that cryptocurrencies will capture around 5% of this market, or approximately $1.12 billion.

Decentralized Computing Resources

Cryptocurrencies can apply their significant social and financial coordination advantages to democratize access to computing, addressing the pain points currently plaguing AI developers. In addition to the high costs and limited opportunities to obtain quality GPUs, AI model builders currently face other challenging issues. These include vendor lock-in, lack of security, limited computing availability, latency differentials, and geographic fences mandated by national laws.

The ability of cryptocurrencies to meet the demand for GPUs in AI stems from the ability of cryptocurrencies to pool resources through token incentives. The token value of the Bitcoin network is $850 billion, with an equity value of $20 billion, demonstrating this ability. Therefore, both current Bitcoin miners and promising decentralized GPU markets have the potential to add significant value to AI by providing decentralized computing.

A useful analogy for understanding GPUs provided by blockchain is the electricity business. In simple terms, there are entities operating large, expensive factories that can generate electricity stably to meet most grid demands. These "base load" factories have stable demand but require significant capital investment, resulting in relatively low but guaranteed returns on capital. Complementing the base load are another type of generators called "peak power" providers. These enterprises provide power when demand exceeds the capacity of base load generation. This involves high-cost, small-scale energy production strategically positioned close to the demand for that energy. We expect to see similar dynamics in the "on-demand computing" space.

Bitcoin Miners Diversifying into AI

Bitcoin and other proof-of-work cryptocurrencies have high energy demands, much like artificial intelligence. This energy must be created, acquired, transported, and converted into usable power to power mining equipment and computing clusters. This supply chain requires significant investments by miners in power plants, power purchase agreements, grid infrastructure, and data center facilities. The currency incentives brought by mining PoW cryptocurrencies have led to the emergence of many Bitcoin miners distributed globally, who have rights to energy and power and an integrated grid architecture. Most of this energy comes from low-cost, socially avoided carbon-intensive sources. Therefore, the most compelling value proposition that Bitcoin miners can offer is low-cost energy infrastructure to power AI backend infrastructure.

Hyperscale computing providers such as AWS and Microsoft have pursued a strategy of vertically integrated operations and building their own energy ecosystems. Large tech companies have moved upstream, designing their own chips and procuring their own energy, much of which is renewable. Currently, data centers consume two-thirds of the available renewable energy for U.S. enterprises. Microsoft and Amazon have both committed to achieving 100% renewable energy supply by 2025. However, if the expected computing demand exceeds current infrastructure plans, as some have suggested, the number of data centers centered around AI could double by 2027, and capital expenditures could be three times the current estimate. Large tech companies have paid electricity costs of $0.06-0.10 per kilowatt-hour, much higher than the prices typically paid by competitive Bitcoin miners (0.03-0.05 kWh). If AI's demand for energy exceeds the current infrastructure plans of large tech companies, as some have suggested, the cost advantage of electricity for Bitcoin miners relative to hyperscale miners could increase significantly. Miners are increasingly attracted to high-profit AI businesses related to GPU supply. It is worth noting that Hive reported in October that its revenue from HPC and AI business was 15 times that of Bitcoin mining per megawatt. Other Bitcoin miners seizing the AI opportunity include Hut 8 and Applied Digital.

Bitcoin miners have experienced growth in this new market, helping to diversify their income and enhance revenue reporting. In Hut 8's third-quarter 2023 analyst call, CEO Jaime Leverton stated, "In our HPC business, we created some momentum in the third quarter through new customer additions and growth from existing customers. Last week, we launched on-demand cloud services, providing Kubernetes-based applications for those seeking HPC services from our GPUs, supporting AI, machine learning, visual effects, and rendering workloads. This service puts control in the hands of our customers while reducing configuration time from days to minutes, particularly attractive for those seeking short-term HPC projects. Hut 8 achieved $4.5 million in revenue from its HPC business in the third quarter of 2023, accounting for over 25% of the company's revenue during the same period. The demand for HPC services and new products continues to grow, which should contribute to the future growth of this business line, and with the Bitcoin halving approaching, HPC revenue may soon surpass mining revenue, depending on market conditions."

While their business sounds promising, Bitcoin miners transitioning to artificial intelligence may struggle due to a lack of data center construction skills or an inability to expand power supply. These miners may also face challenges related to operating and management expenses due to the cost of hiring new data center-focused sales personnel. Additionally, current mining operations lack sufficient network latency or bandwidth, as their optimization for cheap energy places them in remote areas that often lack high-speed fiber connections.

Implementing Decentralized Cloud for Artificial Intelligence

We also see a long tail of compute-centric crypto projects that will occupy a small but significant portion of the AI server resource market. These entities will coordinate computing clusters outside of hyperscale to provide value propositions that meet the needs of emerging AI builders. The benefits of decentralized computing include customizability, open access, and better contract terms. These blockchain-based computing companies enable small AI participants to avoid the exorbitant costs and widespread unavailability of high-end GPUs such as H100 and A100. Crypto AI enterprises will meet demand by creating a physical infrastructure network built around encrypted token incentives, while providing proprietary IP to create software infrastructure to optimize computing usage for AI applications. Blockchain computing projects will use market approaches and crypto rewards to find cheaper computing from independent data centers, entities with surplus computing capacity, and former PoW miners. Some projects providing decentralized computing for AI models include Akash, Render, and io.net.

Akash, a Cosmos-based project, can be considered a general decentralized "super cloud" offering CPU, GPU, memory, and storage. In essence, it is a bidirectional marketplace connecting cloud service users and providers. Akash's software aims to coordinate computing supply and demand while creating tools to facilitate AI model training, fine-tuning, and execution. Akash also ensures that market buyers and sellers fulfill their obligations honestly. Akash coordinates through its $AKT token, which can be used to pay for cloud services at a discounted price. $AKT also serves as an incentive mechanism for GPU computing providers and other network participants. On the supply side, Akash has made significant progress in adding computing providers, with 65 different suppliers in the Akash marketplace. While computing demand has been subdued until the launch of Akash's AI super cloud on August 31, 2023, buyers have spent $138,000 since the release date.

Recently migrated to Solana, Render initially focused on connecting artists with decentralized groups that would provide GPU capabilities for rendering images and videos. However, Render has begun to shift the focus of its decentralized GPU cluster towards meeting machine learning workloads to support deep learning models. Through network improvement proposal RNP-004, Render now has an API to connect external networks (such as io.net), which will utilize Render's GPU network for machine learning. A proposal from the Render community was subsequently approved, allowing access to its GPU through Beam and FEDML to complete machine learning tasks. Thus, Render has become a decentralized enabler of GPU workloads, coordinating by paying providers in RNDR dollars and providing RNDR incentives to entities running network backend infrastructure.

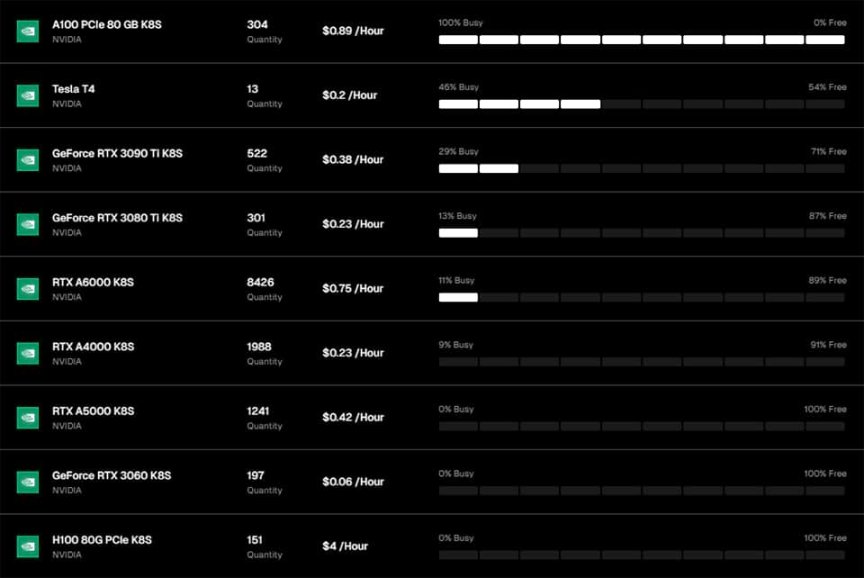

Comparison of GPU prices on io.net. Source: io.net as of January 4, 2024.

Another interesting project on Solana is io.net, considered a DePIN or decentralized physical infrastructure network. Io.net aims to provide GPUs, but its focus is solely on using GPUs to power AI models. In addition to simply coordinating computing, Io.net has added more services to its core stack. Its system claims to handle all components of artificial intelligence, including creation, usage, fine-tuning, and troubleshooting to properly facilitate and troubleshoot AI workloads across the entire network. The project also leverages other decentralized GPU networks, such as Render and Filecoin, as well as its own GPUs. While io.net currently lacks a token, it plans to launch in the first quarter of 2024.

Overcoming Bottlenecks in Decentralized Computing

However, utilizing this distributed computing remains a challenge due to the network demands brought by the typical 633TB+ data required for training deep learning models. Additionally, computer system latency and differentials located around the world present new obstacles to parallel model training. Together is a company actively entering the open-source base model market, building a decentralized cloud to host open-source AI models. Together will enable researchers, developers, and companies to leverage and improve AI through an intuitive platform that combines data, models, and computing, expanding AI accessibility and supporting the next generation of tech companies. Together has partnered with leading academic research institutions to build the Together Research Computer, allowing labs to centralize computing for AI research. The company has also collaborated with the Center for Research on Foundation Models (CRFM) at Stanford to create Holistic Evaluation of Language Models (HELM). HELM is a "living benchmark" aimed at improving AI transparency by providing a standardized framework for evaluating such foundational models.

Since its inception, Together founder Vipul Ved Prakash has spearheaded multiple projects, including 1) GPT-JT, an open LLM with a 6B parameter model trained over a 1Gbps link, 2) OpenChatKit, a powerful open-source foundation for creating dedicated and general chatbots, and 3) RedPajama, a project to create leading open-source models, aiming to be the foundation for research and commercial applications. The Together platform is a base model consisting of open models on commodity hardware, decentralized cloud, and comprehensive developer cloud, bringing together various computing sources, including consumer miners, crypto farms, T2-T4 cloud providers, and academic computing.

We believe decentralized and democratized cloud computing solutions like Together can significantly reduce the cost of building new models, potentially disrupting established giants like Amazon Web Services, Google Cloud, and Azure and competing with them. In context, comparing AWS capacity blocks and AWS p5.48xlarge instances with a Together GPU cluster configured with the same number of H100 SXM5 GPUs, Together's pricing is approximately 4 times lower than AWS.

As open-source master's degrees become more accurate and widely adopted, Together may become an industry standard for open-source models, much like Red Hat is to Linux. Competitors in this field include model providers Stability A and HuggingFace, as well as AI cloud providers Gensyn and Coreweave.

Enhancing AI Models through Cryptocurrency Incentives

Blockchain and cryptocurrency incentive measures have shown that network effects and rewards related to the size of network effects compel people to engage in useful work. In the context of Bitcoin mining, this task is to secure the Bitcoin network using expensive electricity, technical manpower, and ASIC machines. The coordination of these economic resources provides a witch attack defense mechanism, preventing economic attacks on Bitcoin. In exchange, miners coordinating these resources will receive BTC dollars. However, the green space for useful work in AI is much larger, and some projects are already driving improvements in AI and machine learning models.

The most original of these projects is Numerai. Currently, Numerai can be seen as a decentralized data science tournament aimed at identifying the best machine learning models to optimize financial returns by building stock portfolios. In each era, anonymous Numerai participants are granted access to hidden raw data and are required to use this data to build the best-performing stock portfolios. To participate, users are not only required to submit predictions but are also compelled to stake NMR tokens behind their model's predictions to prove the value of these models. Other users can also stake tokens on models they believe perform the best. Then, the output of each staked and submitted model is fed into a machine learning algorithm to create a metamodel, providing information for investment decisions for the Numerai One hedge fund. Users who submit the best-performing "inferences" with the highest information coefficient or effectiveness are rewarded with NMR tokens. Meanwhile, tokens from those staking the worst models are slashed (confiscated and redistributed as rewards to the winners).

Subnets and use cases on Bittensor. Source: https://taostats.io/api/ as of January 2, 2024.

Bittensor is a project that expands on the core concept of Numerai on a large scale. Bittensor can be considered the "Bitcoin of machine intelligence" as it is a network that provides economic incentives for AI/ML models. This is achieved by entities called "miners" who build artificial intelligence models and "validators" who assess the quality of these model outputs. Bittensor's architecture consists of a base network and several smaller subnets. Each subnet focuses on different areas of machine intelligence. Validators pose various questions or requests to miners on these subnets to evaluate the quality of their AI models.

The best-performing models receive the highest TAO token rewards, while validators are compensated for accurately assessing the quality of the miners' outputs. At a higher level, both validators and miners must stake tokens to participate in each subnet, and the proportion of each subnet's total stake determines how many TAO tokens it receives from the overall Bittensor inflation. Therefore, each miner is not only incentivized to optimize their models to win the most rewards but also to concentrate their models on the best subnets for machine intelligence. Additionally, since miners and validators must maintain funds to participate, everyone must overcome the capital cost barrier, or they will exit the system.

As of January 2024, there are a total of 32 different subnets, each dedicated to specific areas of machine learning or artificial intelligence. For example, Subnet 1 is for text similar to ChatGPT prompts LLM. On this subnet, miners run various fine-tuned LLM versions to best respond to prompts from validators assessing response quality. On Subnet 8, named "Taoshi," miners submit short-term predictions for Bitcoin and various financial assets. Bittensor also has subnets dedicated to human language translation, storage, audio, web scraping, machine translation, and image generation. Subnet creation is permissionless, and anyone with 200 TAO can create a subnet. Subnet operators are responsible for creating assessment and reward mechanisms for each subnet's activities. For example, the underlying Opentensor behind Bittensor operates Subnet 1 and recently collaborated with Cerebras to release a model to evaluate LLM outputs from miners on that subnet.

While these subnets were initially fully subsidized by inflation rewards, each subnet must eventually sustain itself economically. Therefore, subnet operators and validators must coordinate to create tools to allow external users to pay for access to each subnet's services. As TAO rewards from inflation decrease, each subnet will increasingly rely on external income to sustain itself. In this competitive environment, there is direct economic pressure to create the best models and incentivize others to create profitable real-world applications for these models. Bittensor is harnessing the competitive spirit of small enterprises to identify and profit from AI models, unlocking the potential of artificial intelligence. As the renowned Bittensor advocate MogMachine puts it, this dynamic can be seen as the "Darwinian competition of artificial intelligence."

Another interesting project is using cryptographic technology to incentivize the creation of AI agents, which are programmed to autonomously perform tasks on behalf of humans or other computer programs. These entities are essentially adaptive computer programs designed to solve specific problems. Agents are a broad term covering chatbots, automated trading strategies, game characters, and even virtual universe assistants. A notable project in this field is Altered State Machine, a platform for creating AI agents with ownership, power, and training using NFTs. In Altered State Machine, users create their "agents" and then "train" them using a decentralized GPU cluster. These agents are optimized for specific use cases. Another project, Fetch.ai, is a platform for creating customized agents based on the needs of each user. Fetch.ai is also a SaaS business, allowing registration and leasing or selling of agents.

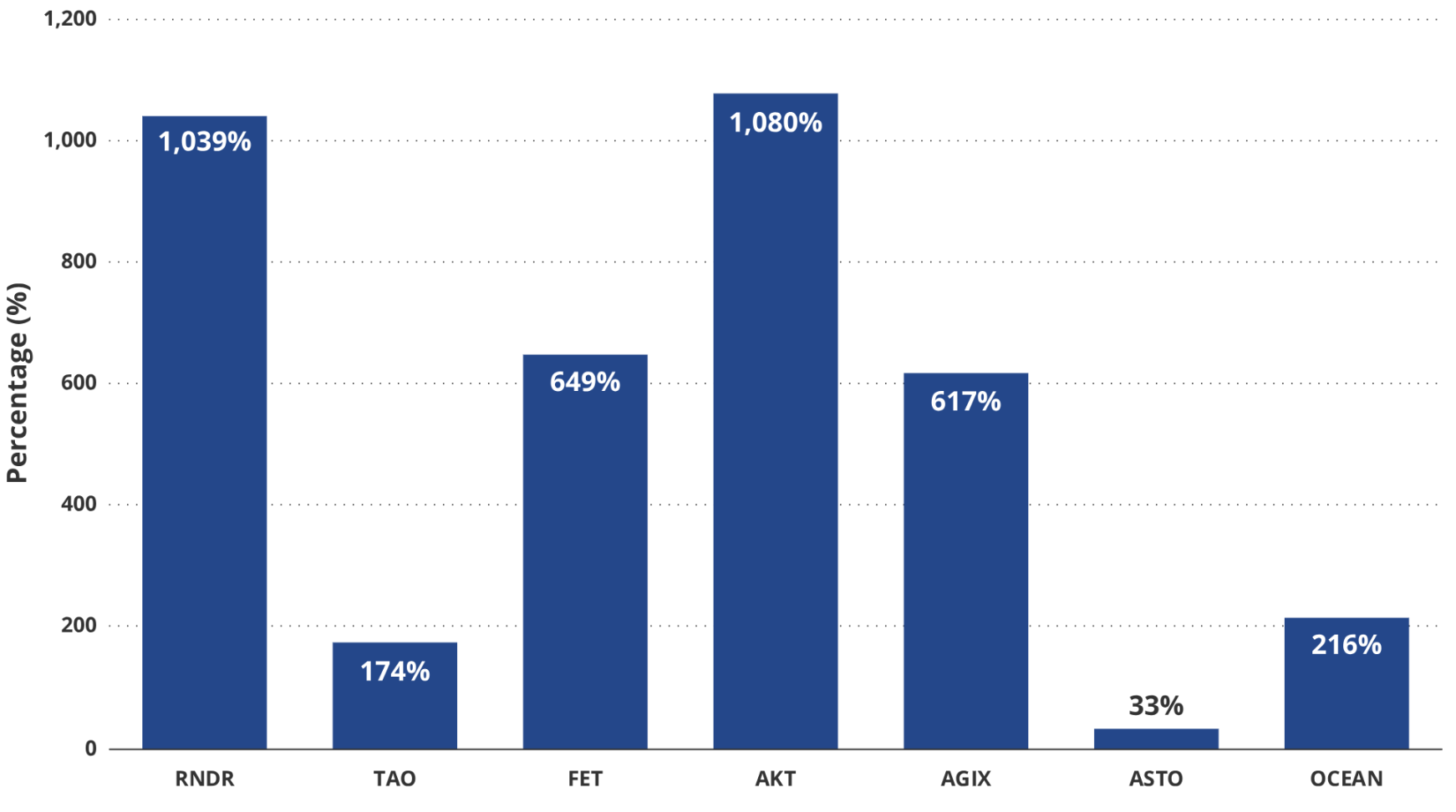

AI Token Returns since January 1, 2023

Source: Artemis XYZ as of January 10, 2024. Past performance is not indicative of future results.

Verification through Zero-Knowledge (zk) Proofs

2023 was a landmark year for new AI models, with OpenAI launching ChatGPT, Meta releasing LLAMA-2, and Google introducing BERT. Due to the outlook for deep learning, as of June 2023, there were over 18,563 AI-related startups in the United States. The surge of many new entities in a field where for every $4 invested in AI-related company investments, $1 is invested should raise serious concerns.

Who actually creates and owns each model?

Are the outputs actually generated by the specified model?

Is the model really as effective as advertised?

What are the data sources for each model and who owns that data?

Does training, fine-tuning, and/or inference infringe on any copyrights or data rights?

Investors and users of these models should be 100% certain they can address these questions. Currently, there are many benchmarks for different components of LLM outputs, such as HumanEval for code generation, Chatbot Arena for LLM-assisted tasks, and ARC Benchmark for LLM reasoning capabilities. However, despite attempts at model transparency like Hugging Face's Open LLM Leaderboard, there is no concrete proof of the effectiveness of models, their ultimate origins, or the sources of their training/inference data. Not only can benchmarks be gamed, but it cannot be ensured that a specific model is actually running (rather than using an API connected to another model), and the leaderboard itself cannot be guaranteed to be honest.

This is the unified frontier of public blockchain, artificial intelligence, and the advanced mathematical field known as zero-knowledge (zk) proofs. ZK proofs are an application of cryptography that allows someone to prove with a desired level of mathematical certainty that their statements about data are correct without revealing the underlying data to anyone. Statements can range from simple assertions (such as rankings) to complex mathematical computations. For example, someone can not only prove that they know the relative wealth of a sample without revealing that wealth to another party, but they can also prove the correct calculation of the mean and standard deviation of that group. Essentially, you can prove that you understand the data and/or that you have made truthful assertions using that data without revealing the details of the data or how you performed the calculations. Beyond artificial intelligence, zk proofs have been applied to extend Ethereum, allowing transactions to occur off-chain on layer 2 blockchains. Recently, zk proofs have been applied to deep learning models to prove:

Using specific data to generate a model or provide inference outputs (in addition to which data/sources were not used)

Using a specific model to generate inferences

Inference outputs have not been tampered with

ZK proofs can be published on a public, immutable blockchain and verified through smart contracts. The result is that the blockchain can publicly and irrefutably prove important properties of artificial intelligence models. Two cutting-edge projects applying ZKML proofs to artificial intelligence are known as "Zero-Knowledge Machine Learning" (ZKML), namely EZKL and Modulus. EZKL uses the Halo2 proof system to generate zk-snarks, a form of zero-knowledge proof, which can then be publicly verified on Ethereum's EVM. While EZKL can currently prove relatively small model sizes, approximately 100M parameters, compared to ChatGPT 4's 175B parameters, EZKL's CEO Jason Morton believes they are dealing with "engineering problems" rather than "technical limitations." EZKL believes they can overcome proof issues by splitting and parallelizing proofs to reduce memory constraints and computation time. In fact, Jason Morton believes that one day, "verifying models will be as simple as signing blockchain transactions."

The application of ZKML proofs to artificial intelligence can address important pain points in AI implementation, including copyright issues and AI security. As demonstrated by recent lawsuits against Open AI and Microsoft by The New York Times, copyright law will apply to data ownership, forcing AI projects to provide proof of their data sources. ZKML technology can be used to quickly resolve disputes in court regarding model and data ownership. In fact, one of the best applications of ZKML is to allow data/model markets like Ocean Protocol and SingularityNet to prove the authenticity and effectiveness of their listings.

Accuracy and security are crucial for artificial intelligence models that will ultimately extend to critical areas. It is estimated that by 2027, there will be 5.8B AI edge devices, which may include heavy machinery, robots, autonomous drones, and vehicles. As machine intelligence is applied to things that can cause harm and death, it is crucial to prove that reputable models running on these devices use high-quality data from reliable sources. While building continuous real-time proofs from these edge devices and publishing them to the blockchain may be economically and technically challenging, verifying models at activation or periodically publishing to the blockchain may be more feasible. However, Zupass from the 0xPARC Foundation has already established original proofs derived from "carrying data proofs" that can cheaply establish factual proofs from events on edge devices. Currently, this is related to attendance at events, but it can be foreseen that this will soon migrate to other areas such as identity and even healthcare.

How good is your AI model, your robotic surgeon?

From the perspective of enterprises that may be liable for equipment failures, having verifiable evidence to prove that their models are not the root cause of costly accidents seems like an ideal choice. Similarly, from an insurance perspective, the use of reliable models trained on actual data may become economically necessary. Likewise, in a world of deepfake AI, it may become the norm to use cameras, phones, and computers verified and proven through blockchain to perform various operations. Of course, the proof of the authenticity and accuracy of these devices should be published on a public, open-source ledger to prevent tampering and fraud.

While these proofs have tremendous potential, they are currently limited by gas fees and computational expenses. At current ETH prices, submitting proofs on-chain costs approximately 300-500k Gas (around $35-58 at current ETH prices). From a computational perspective, Sreeram Kennan of Eigenlayer estimates that "running proof computation on AWS would cost $50, and using current ZK proof technology would cost about 1,000,000 times that." As a result, the development of zk proofs has progressed much faster than anyone's expectations a few years ago, but there is still a long way to go before opening up actual use cases. Suppose someone is curious about the application of ZKML. In that case, they can participate in a decentralized singing competition judged by verified on-chain smart contracts and permanently upload the results to the blockchain.

Establishing Humanity through Blockchain-based Identity

One possible consequence of widespread, advanced machine intelligence is that autonomous agents will become the most prolific users of the internet. The release of AI agents is likely to lead to purposeful robot-generated spam and even harmless task-based agents clogging the network ("getting rid of spam"). When robots vie for arbitrage opportunities worth about $100,000, Solana's data flow reaches 100 GB per second. Imagine the deluge of network traffic when AI agents can ransom millions of enterprise websites and extort billions of dollars. This suggests that the future internet will impose restrictions on non-human traffic. One of the best ways to limit such attacks is to levy economic taxes on excessive use of cheap resources. But how do we determine the best framework for charging for spam, and how do we establish humanity?

Fortunately, blockchain has adopted built-in defenses to prevent AI robot-style witch attacks. Combining metering non-human users with charging non-human users would be an ideal implementation, while slightly burdensome computations (such as Hashcash) would deter robots. In terms of proving humanity, blockchain has long been working to overcome anonymity to unlock activities such as under-collateralized loans and other reputation-based activities.

One way to gain the incentive to prove identity is through the use of JSON Web Tokens (JWT). JWTs are "0Auth" credentials, similar to "cookies," generated when you log into websites like Google. They allow you to present your Google identity when accessing various websites on the internet after logging into Google. zkLogin, created by L1 blockchain Sui, allows users to link their wallet private keys and operations to generate JWTs with Google or Facebook accounts. zkP2P further extends this concept, allowing users to exchange fiat currency for cryptocurrencies on the Base blockchain without permission using JWTs. This is done by confirming peer-to-peer cash transfers through the Venmo payment app, unlocking smart contract-hosted USDC tokens when confirmed via email JWT. Both projects result in a strong connection to off-chain identity. For example, zkLogin links wallet addresses to Google identities, while zkP2P is only applicable to Venmo's KYC users. While both lack sufficiently reliable guarantees to achieve on-chain identity, they create important building blocks that others can use.

While many projects are attempting to confirm the human identity of blockchain users, the boldest is WorldCoin, founded by OpenAI CEO Sam Altman. Despite controversy due to users having to use the dystopian "Orb" machine to scan their irises, WorldCoin is moving towards an immutable identity system that cannot be easily forged or overwhelmed by machine intelligence. This is because WorldCoin creates an encrypted identifier based on each person's unique eye "fingerprint," which can be sampled to ensure uniqueness and authenticity. Once verified, users receive a digital passport on the Optimism blockchain called World ID, allowing the user to prove their humanity on the blockchain. Most importantly, a person's unique signature will never be leaked or traceable as it is encrypted. World ID simply asserts that a blockchain address belongs to a human. Projects like Checkmate have already linked World ID to social media profiles to ensure the uniqueness and authenticity of users. In the AI-dominated future internet, explicitly proving humanity in every online interaction may become commonplace. When AI overcomes the limitations of CAPTCHA, blockchain applications can cheaply, quickly, and concretely prove identity.

Contributing to Artificial Intelligence through Blockchain Technology

There is no doubt that we are in the early stages of the artificial intelligence revolution. However, if the growth trajectory of machine intelligence aligns with the boldest predictions, artificial intelligence must rise to the challenge, achieving excellence while surpassing its potential harm. We believe that cryptocurrency is the ideal grid to "train" the rich but potentially treacherous artificial intelligence plant. The suite of blockchain AI solutions can enhance the output of machine intelligence creators by providing decentralized computing that is faster, more flexible, and potentially cheaper. It also incentivizes builders who can create better models while providing economic incentives for others to leverage these AI models to build useful businesses. Equally important, model owners can prove the validity of their models while demonstrating the non-use of protected data sources. For AI users, cryptographic applications can confirm whether the models they are running meet security standards and may be useful. For others, blockchain and cryptocurrency may be an entanglement of punishment and reward, binding the Gelflings that artificial intelligence is destined to become.

Source: VanEck Research, project website, as of January 15, 2024.

Disclosure: VanEck has a stake in Together through our strategic partnership with early-stage venture manager Cadenza, who kindly contributed to the section "Overcoming the Bottleneck of Decentralized Computing."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。