Preview for this week (2.19-2.25): BTC long-term holdings decreased by 300,000 coins, mainly due to Grayscale selling; Ethereum's strength comes from continuous large whale accumulation, and analysis of main holdings' cost

○/Author: Lao Li Mortar

Report Directory for this week:

I. Preview of key events in macroeconomic data and the cryptocurrency market this week;

II. Review of key news in the cryptocurrency industry;

III. Community interaction and sharing;

IV. Important events, data, and research institute interpretations;

V. Institutional perspectives and overseas views;

VI. Cryptocurrency market performance rankings and community hot coin selection from last week;

VII. Attention to project token unlocking and negative data;

VIII. Cryptocurrency market concept sector performance rankings;

IX. Overview of global market macroeconomic analysis;

X. Research institute's future market judgment.

I. Preview of key events in macroeconomic data and the cryptocurrency market this week:

February 19th (Monday): The EU's escort operation in the Red Sea officially begins; the US stock market is closed for Presidents' Day, and CME and US stock index futures contracts trading ends early; the Toronto Stock Exchange in Canada is closed for Heritage Day.

February 20th (Tuesday): Eurozone December seasonally adjusted current account; US January Conference Board Leading Economic Index month-on-month; Starknet airdrop opens for application.

February 21st (Wednesday): Federal Reserve's Bostic delivers welcoming remarks at an event; NYMEX New York crude oil March futures affected by rollover; VanEck lowers its spot Bitcoin ETF fee to 0.2%.

February 22nd (Thursday): US API crude oil inventories; February manufacturing and services PMI for France, Germany, the UK, and the Eurozone; Eurozone January final CPI; US initial jobless claims for the week; US February Markit manufacturing and services PMI; US January existing home sales annualized total; US EIA natural gas inventories; Federal Reserve releases minutes of monetary policy meeting; European Central Bank releases minutes of January monetary policy meeting; Federal Reserve Governor Jefferson delivers a speech. FTX seeks permission to quickly sell Anthropic shares at a hearing.

February 23rd (Friday): US EIA crude oil inventories; Germany's Q4 non-seasonally adjusted GDP annualized final value; Germany's February IFO Business Climate Index; Federal Reserve Governors Bowman, Quarles, and Waller deliver speeches; Tokyo Stock Exchange in Japan is closed for the day.

February 24th (Saturday): CZ sentencing hearing will be held; NFT project TinFun: scheduled to launch on February 24th.

II. Review of key news in the cryptocurrency industry (Exclusive compilation):

Data aspect:

Storage sector tokens generally rose, with FIL rising nearly 20% in 24 hours. The trend of Bitcoin and the stock market shows that they seem to be leading the Fed's interest rate cut decision. In addition, data shows that over 10% of Bitcoin ordinal trades occurred in the Ordinals wallet, and whale users have increased their holdings by nearly 250,000 BTC this year, worth over $12.9 billion. These data reflect the activity of the cryptocurrency market and investors' interest in certain assets.

Project and platform aspect:

This week, tokens such as AVAX, ID, and DYDX will face one-time large unlocks, with a total value of over $400 million. This may have a certain impact on market prices. Meanwhile, Tiger Securities' CFO revealed that the company is evaluating the listing of more altcoins and plans to implement international expansion strategies in markets such as the UK and the US. In addition, 9 spot Bitcoin ETFs purchased 273,500 BTC worth $14 billion in 26 trading days, showing institutional investors' interest in Bitcoin.

Macro policy and regulatory aspect:

The UK government plans to introduce laws on stablecoins and crypto staking in the next six months, showing the government's increasing attention to the cryptocurrency market. At the same time, the European Parliament Committee voted in support of the launch of a digital euro, indicating Europe's positive attitude towards the development of digital currencies. The White House OSTP also emphasized the importance of DLT, digital assets, and digital identity for national security, showing policymakers' attention to these areas.

Institutional research reports and perspectives:

Some analysts believe that the rise in US stocks may indirectly prevent Bitcoin from reaching a new all-time high before the halving. Bitwise CIO is optimistic about Bitcoin's prospects, believing that the launch of ETFs is the IPO of Bitcoin in the US market and predicting that BTC may break through $80,000 this year. However, Bloomberg analysts believe that an Ethereum spot ETF will not be approved by the end of March. In addition, MicroStrategy's Bitcoin holdings are currently worth $10 billion, and the court has approved Genesis to sell $1.3 billion worth of GBTC shares. These views and events provide different perspectives and considerations for the market.

Summary analysis:

In terms of data, it shows the market's activity and investors' interest in certain assets, such as the general rise of storage sector tokens and whale users' increased holdings. Secondly, the dynamics of projects and platforms reveal the strategies and expansion intentions of market participants, such as Tiger Securities' international expansion and the purchase of spot Bitcoin ETFs. Updates on macro policies and regulations reflect the government's attention to and changing attitudes towards the cryptocurrency market, which may have far-reaching effects on market trends. The divergence of institutional research reports and perspectives indicates the existence of various views and expectations in the market, providing different references and decision-making bases for investors. Overall, the cryptocurrency market is still full of variables and opportunities, and investors need to closely monitor market dynamics and make wise decisions.

III. Community interaction and sharing:

Some commonly used terms explained in our research reports: Concept sector: In the investment field, a concept sector refers to a collection of stocks or cryptocurrencies with common characteristics or attributes, which are usually related to new technologies, industry trends, or market hotspots.

Percentage change: Percentage change is used to measure the change in asset prices over a certain period of time, usually expressed as a percentage. It is an important indicator for evaluating market trends and asset performance.

Rotation speculation market: The rotation speculation market refers to the flow of funds and investment opportunities between different sectors or assets in the market. Investors need to pay attention to this market to adjust their investment strategies in a timely manner and capture market opportunities.

IV. Important events, data, and Deepcoin Research Institute interpretations:

Regarding on-chain monitoring data, since February 8th, a whale has purchased a total of 52,759 ETH ($1.454 billion) from CEX and DEX.

Our research institute believes that Ethereum has shown relatively strong performance recently, which may be related to the Cancun upgrade of Ethereum and the potential ETF approval expectations. In addition, it is also due to the large-scale hoarding of main funds. The behavior of this whale may imply several important market signals: First, the whale's purchase behavior may indicate their optimistic outlook on Ethereum's long-term prospects. As a leader in smart contract platforms and decentralized finance (DeFi), Ethereum has attracted a lot of attention from developers and investors in recent years. The whale's purchase may indicate their positive view of Ethereum's technological development and application prospects, believing that its market value is expected to continue to grow. Secondly, the whale's purchase behavior may also have a positive impact on Ethereum's market price. Large purchases usually increase the liquidity of assets and attract more investors to enter the market. In addition, this behavior may trigger a market trend-following effect, driving more investors to buy Ethereum, thereby pushing up its price. However, we also need to be cautious about potential risks. The whale's purchase behavior does not always indicate a market rise; they may conduct large transactions for various reasons, such as hedging, arbitrage, or asset allocation. Therefore, we need to consider multiple factors such as market trends, technological developments, and regulatory policies to more comprehensively understand the impact of this event on the market. In summary, the whale's large-scale purchase of Ethereum may have a certain positive impact on the market, but we need to maintain a cautious attitude, closely monitor market dynamics, and make comprehensive analysis and judgments based on multiple pieces of information.

In addition, we have verified the latest data from the Ember Research: This whale has accumulated a total of 57,154 ETH ($164.6 million) through withdrawals from Binance and on-chain purchases in the past 10 days, with an average price of $2,730, currently floating profit of $8.63 million (+5%). The whale still has $40 million remaining from the $100 million USDT withdrawn from Binance and may continue to buy ETH in the future. We can continue to pay attention to its dynamics and cost of holdings.

Regarding the reduction of approximately 300,000 BTC by long-term holders since November 2023, with more than half being outflows from GBTC.

Our research institute believes that in the past three months, long-term holders have sold approximately 300,000 BTC, accounting for a significant market share. In particular, the outflow from GBTC exceeds half, indicating that institutional investors or large holders may be adjusting their investment strategies or realizing profits. Over the past year, Bitcoin has seen a rise of +130%, and since the low point in November 2022, the increase has been as high as +207%. This strong performance has attracted a large number of new investors to enter the market, while also prompting some old investors to consider taking profits. The current trading price is only -28.6% lower than the historical high, indicating that the market is at a relatively high level, and investors are becoming cautious. As the market approaches the high point of 2021, the supply of Bitcoin with a cost higher than this level is gradually decreasing. This indicates that investors who bought in at high levels are gradually exiting the market, while new investors may be providing new liquidity to the market. This shift may have a significant impact on market trends. The outflow of funds from GBTC, approximately 151,500 BTC, indicates that the decrease in supply from long-term holders is largely due to investors selling. This further proves the change in investor behavior, as they may be seeking to convert Bitcoin into cash or other assets to realize profits or adjust their portfolios. In summary, these data indicate that the Bitcoin market is undergoing a change in investor behavior, as the market gradually approaches historical highs, some investors are choosing to take profits. This will have an important impact on market trends and investor strategies, and is worth close attention.

Regarding the Crypto Quant data, BTC spot ETF trading volume has reached 40% of the level of centralized exchanges.

Our research institute believes that this is also the reason why recent BTC fluctuations are closely related to spot ETF trading data, especially during weekends and US market closures, BTC volatility is very low, while during US ETF trading hours, the volatility of Bitcoin significantly increases. In addition, this data demonstrates the popularity of BTC spot ETF in the market. As a relatively novel investment tool, BTC spot ETF allows investors to access the Bitcoin market in a more traditional and convenient way without directly purchasing and storing Bitcoin. This convenience has made BTC spot ETF the preferred choice for many investors, driving its trading volume to grow rapidly. Secondly, this data also reflects the increasing recognition and acceptance of Bitcoin in the market. As the Bitcoin market becomes more mature and stable, more and more investors are beginning to realize the potential and value of Bitcoin as a digital asset. The high trading volume of BTC spot ETF is a manifestation of this recognition and acceptance, as well as a demonstration of the market's confidence in the future development of Bitcoin.

V. Institutional perspectives and overseas views:

Summary: The Bitcoin options market is hot, with a $20 million butterfly spread trade attracting attention. The trade bets on a slight decline in Bitcoin before the end of March, with a maximum profit point at $47,000. Large whale users continue to increase their short positions, with a mindset of protecting their spot positions or taking profits, contrary to the expectations of most people for hitting new highs. Although the price correction of Bitcoin seems reasonable, a broader upward trend may continue, and its price may exceed the historical high of $69,000 before the upcoming halving event.

There are few cryptocurrency-related events this week, with several countries releasing minutes of monetary policy meetings, focusing on the change in expectations for a Fed rate cut. Current data shows that Bitcoin and the US stock market seem to be leading the Fed's rate cut decision. Due to the highest correlation in two months, investors clearly favor an early rate cut. In the cryptocurrency aspect: the main focus is currently on the flow of funds in the BTC spot ETF, which has replaced other fund flow indicators. The strong spot bull market has driven market sentiment, and the main term IV is currently rebounding significantly, indicating high volatility expectations. In the cryptocurrency interest rate market: as the market calms down, leverage levels continue to rise, and the interest rate market has rebounded from a low level, with some high-interest orders appearing recently.

Bitcoin News reports that since the ETF started trading on January 11th, Grayscale has averaged daily outflows of $269 million worth of BTC.

Cryptocurrency exchange Coinbase predicts that the bankruptcy of crypto lending company Genesis approving the sale of its Grayscale Bitcoin Trust (GBTC) shares will not disrupt the cryptocurrency market. It believes that most of the funds will flow back into the cryptocurrency ecosystem, thus having a neutral impact on the market.

Greekslive published an article on Sunday, stating that the daily ATM option IV was only 35%, while on Saturday, the daily ATM option IV was only 30%, indicating that the cryptocurrency market is completely controlled by US time recently. Weekend option IV has maintained the above pattern for several weeks. Compared to the spot trend, it was found that the volatility during the weekend was not significantly lower than that during weekdays, or at least the difference was not very large. It can be concluded that traders participating in trading during the US trading hours prefer to go long on volatility.

The CEO of Sound Planning Group predicts a significant surge in Bitcoin prices and believes that the upcoming Bitcoin halving and the adoption of BTC spot ETF are key factors driving his bullish forecast for cryptocurrency prices. Bitcoin is a true asset class and will have significant value.

Author of "Rich Dad Poor Dad" Robert Kiyosaki predicts that the prices of Bitcoin and silver will "take off," while gold will fall below $1,200. He urges investors to prepare for the "biggest crash in history" that he predicted in his book years ago. Kiyosaki also emphasizes that the Fed is "destroying" the US economy and advises, "I'd rather trust gold, silver, and Bitcoin than the Fed."

Data shows that a mysterious address that previously purchased 100 BTC per day has resumed purchases, accumulating approximately 44,533 BTC, worth about $2.305 billion, since February 15th.

Cryptocurrency analyst Marcel Pechman's article analyzes that investors expect S&P 500 companies' earnings growth to reach 10.9%, higher than 3.8% in 2023. Assuming that the current inflation risk is equivalent to the risk when Bitcoin reached its historical high, investors are likely not motivated to seek alternative assets. Bitcoin needs to rise an additional 34.5% from its current level of $52,000 to reach a historical high of $70,000, which means the market value of Bitcoin will increase by $350 billion. However, as long as the US dollar continues to depreciate, Bitcoin still has the potential to rise above $70,000, but this is unlikely to happen before the block reward "halving" in April.

VI. Cryptocurrency market performance rankings and community hot coin selection:

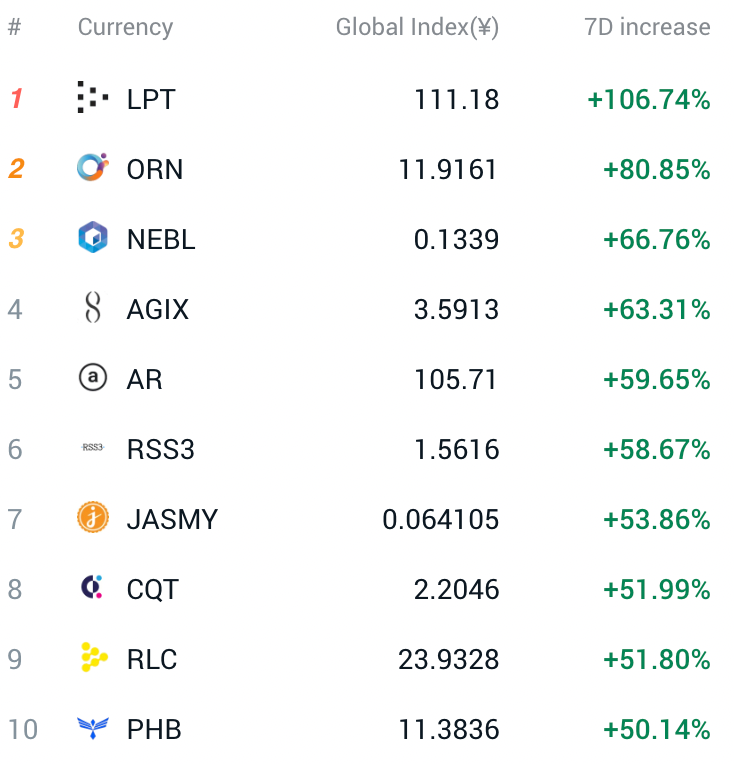

Last week, the altcoin market saw a strong uptrend. In particular, the LPT token performed exceptionally well, with a significant increase and has already doubled in value. The ORN token closely followed, with an increase of about 80%. Additionally, the NEBL, AGIX, AR, and RSS3 tokens saw increases ranging from 58% to 67%. These tokens ranked at the top in terms of price increases, demonstrating the market's high attention and interest in them.

In the current market environment, it is advisable to continue monitoring these potential trading opportunities and closely observe the switching of market hotspots. With the fluctuation of market sentiment and fund flows, the performance of different tokens may change. Therefore, timing is crucial to adjust investment portfolios and capture new trading opportunities when hotspots switch.

When participating in trading, it is important to maintain rationality, fully understand market information, and the projects behind the tokens to make wise investment decisions. At the same time, it is essential to control risks, adhere to risk management principles, and ensure investment safety.

The following are the hot coin discussions in the DC community, with the following selections for reference only and not constituting trading advice:

Some coins such as celo and rdnt have daily rhythms consistent with BTC, both rebounding from January 23rd, maintaining an upward trend, but overall weaker than BTC because they have not reached new highs. These types of altcoins are not as attractive as focusing on BTC itself, following the uptrend when it rises, but may experience larger declines than BTC when it falls.

This week, ETH has shown relatively strong performance, possibly due to the Constantinople upgrade and the positive expectations for ETFs. Bernstein stated in a research report on Monday that it may be time to focus on the second-largest cryptocurrency, Ethereum. The report mentioned that Ethereum "may be the only digital asset for a spot ETF that could be approved by the SEC." The likelihood of approval for an Ethereum spot ETF before May is about 50%, and it is almost certain to be approved within the next 12 months.

According to Compound Proposal 217, it has reached the required number of votes and has been approved. The proposal involves lowering 8 collateral factor parameters for the Compound V2 protocol, which is expected to be implemented within the next two days. Specifically:

- AAVE collateral factor will be reduced from 43% to 38%;

- BAT collateral factor will be reduced from 50% to 45%;

- COMP collateral factor will be reduced from 30% to 25%;

- LINK collateral factor will be reduced from 49% to 44%;

- MKR collateral factor will be reduced from 43% to 38%;

- SUSHI collateral factor will be reduced from 37% to 32%;

- YFI collateral factor will be reduced from 45% to 40%;

- ZRX collateral factor will be reduced from 35% to 30%.

It is advisable to pay attention to the potential market fluctuations of the above project tokens.

According to recent reports from Stocklytics, the total market value of AI-related cryptocurrencies has exceeded $12 billion. The report monitored nine AI cryptocurrencies: Bittensor (TAO), Render (RNDR), Akash Network (AKT), Fetch.ai (FET), CorgiAI (CORGIAI), SingularityNET (AGIX), Echelon Prime (PRIME), Ocean Protocol (OCEAN), and OriginTrail (TRAC). The highest market value among AI-related cryptocurrencies is TAO (Bittensor), reaching $3.8 billion.

VII. Attention to Negative Unlocking Data for Project Tokens:

Token Unlocks data shows that this week, AVAX, ID, and DYDX tokens will undergo one-time large-scale unlocks, releasing a total value of over $400 million. Specifically:

AVAX (Avalanche) will unlock 9.54 million tokens worth approximately $383 million, accounting for 2.6% of the circulating supply on February 22 at 8:00; ID (SPACE ID) will unlock 18.49 million tokens worth approximately $11.58 million, accounting for 4.29% of the circulating supply on February 22 at 8:00; DYDX (dYdX) will unlock 575,000 tokens worth approximately $1.78 million, accounting for 0.19% of the circulating supply on February 20 at 23:00.

In this week's market unlocking projects, special attention is given to the potential negative effects of token unlocking. In this situation, it is important to carefully assess the risks and consider using derivative products such as futures contracts to seek short opportunities to mitigate potential risks in the spot market. Specifically, the large unlocking of ID and AVAX tokens may make them the focus of the market. Due to the large number of tokens being unlocked, the increased supply of these tokens may exert downward pressure on their prices. Therefore, it is crucial for investors seeking to capitalize on this market dynamic to closely monitor the trends of these two tokens. Shorting is a commonly used strategy in the futures market to profit from price declines. However, it is important to note that shorting also carries risks, especially in situations of high market volatility or lack of adequate hedging measures. Paying attention to the negative effects of token unlocking and flexibly using derivative products to seek short opportunities is a feasible strategy in the current market environment. Caution and rationality should be maintained to ensure effective risk management while pursuing returns.

VIII. Top Performers in the Concept Sector in the Cryptocurrency Market Last Week:

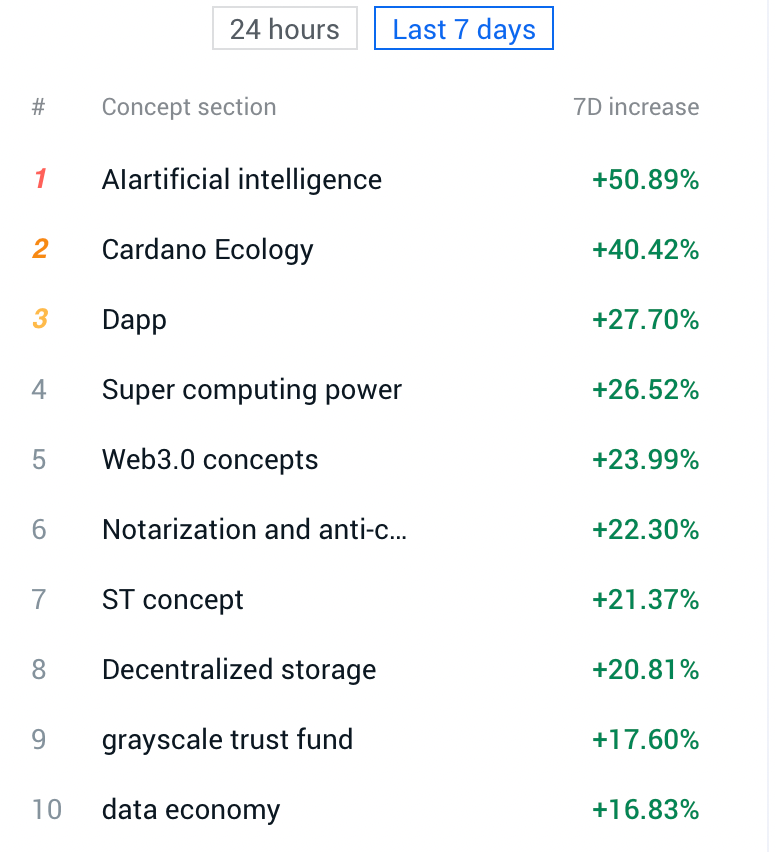

Last week, in terms of performance in the concept sector, the AI artificial intelligence, Cardano ecosystem, Dapp, supercomputing power, and Web3.0 concept sectors led the market with significant increases. According to the classification of price changes, these sectors all showed strong upward trends. In the current market environment, investors should closely monitor the rotational speculation trends of these significantly rising coins and their respective sectors to capture potential trading opportunities and risks.

IX. Global Market Macro Analysis Overview:

During the Spring Festival period (February 9th to February 16th), most major stock indices globally showed an upward trend. The Japan Nikkei 225 index performed the best, with a cumulative increase of 4.4%. Similarly, the three major European stock indices also performed well, with the Germany DAX 30 index rising by 1.13%, the UK FTSE 100 index and the French CAC 40 index, as well as the South Korea Composite Index, all rising by over 1%. In contrast, the three major US stock indices showed a slightly weaker trend, influenced by US inflation data, with the Dow Jones falling by 0.11%, the S&P 500 index falling by 0.42%, and the Nasdaq index performing the worst, with a cumulative decline of 1.34%.

Hong Kong stocks continued to rise for three consecutive trading days since the market opened on February 14th, with the Hang Seng Tech Index surging by 6.89%, reaching a new high in nearly a month, and the Hang Seng Index and the H-share Index also rising by 3.77% and 4.75% respectively. The Nasdaq China Golden Dragon Index also surged by over 5%. In addition, the FTSE China A50 Index futures also showed strength, rising by 1.35% on February 16th, reaching a new high in over two months.

Economic Data: Economic entities in Europe and the United States have updated their Purchasing Managers' Index (PMI) data for February, an important indicator of economic recovery momentum. In addition, the interest rate decisions of central banks in emerging economies such as Indonesia, South Korea, and Turkey are also worth paying attention to.

Important Meetings: The Federal Reserve and the European Central Bank will respectively release the minutes of their interest rate meetings, with the Fed also releasing the minutes of its January monetary policy meeting on Thursday. The detailed internal policy discussions of the committees may have a significant impact on the market.

Company Performance: The US stock earnings season is in full swing, and the performance of companies such as Nvidia, Walmart, Rivian, and Lucid will be closely watched by the market.

Due to Washington's Birthday, the US stock market will be closed on Monday. In addition, trading of precious metals and US crude oil futures contracts under the Chicago Mercantile Exchange (CME) will end early. Normal trading will resume on Tuesday. European stocks closed with mixed results, with the Germany DAX 30 index falling by 0.15%, the UK FTSE 100 index rising by 0.24%, the French CAC 40 index closing flat, and the Euro Stoxx 50 index falling by 0.03%. Globally, the US dollar index rebounded slightly. Offshore renminbi rose above 7.21 during intraday trading, reaching a new high in over a week, before falling back by over a hundred points. Brent crude fell by over 1% before turning higher, marking three consecutive days of gains and reaching a three-month high for two consecutive days. Gold continued to rise. Tin fell by 2%, marking four consecutive declines, while copper fell from a two-week high, and aluminum fell for the third consecutive time to a four-week low.

Market Analysis and Outlook: Last week, major economic data in the United States showed mixed results, especially with the CPI exceeding expectations, disappointing investors hoping for an early rate cut by the Federal Reserve. The market generally believes that the likelihood of a rate cut by the Federal Reserve in the March and May meetings is low, and June may be the starting point for the Fed's rate cut cycle. In addition, several members of the Federal Reserve will speak this week, and their remarks may have a direct impact on the market.

X. Future Judgment:

BTC daily chart, the TD indicator has shown a 9-turn signal, but the overall pullback is relatively small. Due to the closure of the US stock market on Monday and the weekend in the past two days, ETFs have not been traded, resulting in small fluctuations for three consecutive days. From a larger perspective, the reference support below is $48,000, $46,600, and $44,000, while the resistance above is $53,000 and $57,500. The weekly MACD was close to a death cross two weeks ago, but it was later disrupted by a rally, and the formation of the death cross may be delayed, leading to a significant pullback before and after this period.

The positive logic behind BTC's recent rally lies in the slowdown of outflows from GBTC, while other ETFs maintain positive growth. The overall rebound is stronger than our previous expectations, coupled with large whales hoarding coins and the approaching halving, which makes the comparison with other currencies more obvious in terms of strength and weakness. Some coins have daily rhythms consistent with BTC, all rebounding from January 23rd, oscillating upwards to maintain the recent upward trend. However, their overall performance is weaker than BTC because they have not reached new highs. These types of altcoins are not as attractive as focusing on BTC itself, following the uptrend when it rises, but may experience larger declines than BTC when it falls.

Follow us: Lao Li Mortar

February 20, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。