A new report from Fidelity suggests that institutions may eventually enter the DeFi space in 2024 as yields begin to rise.

The report covers the asset management company's outlook for the crypto industry in 2024, focusing on several key areas of development, including Bitcoin mining, stablecoins, and DeFi. The report states, "If DeFi yields become more attractive than TradFi yields again and more advanced infrastructure emerges, people may regain interest by 2024."

In the past, institutional investors were unable to make money in DeFi.

While decentralization and security are important for DeFi, both traditional finance and decentralized finance rely on a core point: the ability to make money, especially for wealthy individuals and institutions. Allowing these individuals to make money is the most realistic problem facing DeFi.

Since the collapse of LUNA, liquidity issues have spread throughout the entire crypto market. The subsequent collapse of Three Arrows Capital due to reduced market activity led to large clients withdrawing funds and ultimately collapsing. According to some former 3AC employees who spoke to BlockBeats, in the later stages of the company's operation, the team managed large-scale assets with almost no scenarios that could generate expected returns. The year-end collapse of FTX further exacerbated the market's woes.

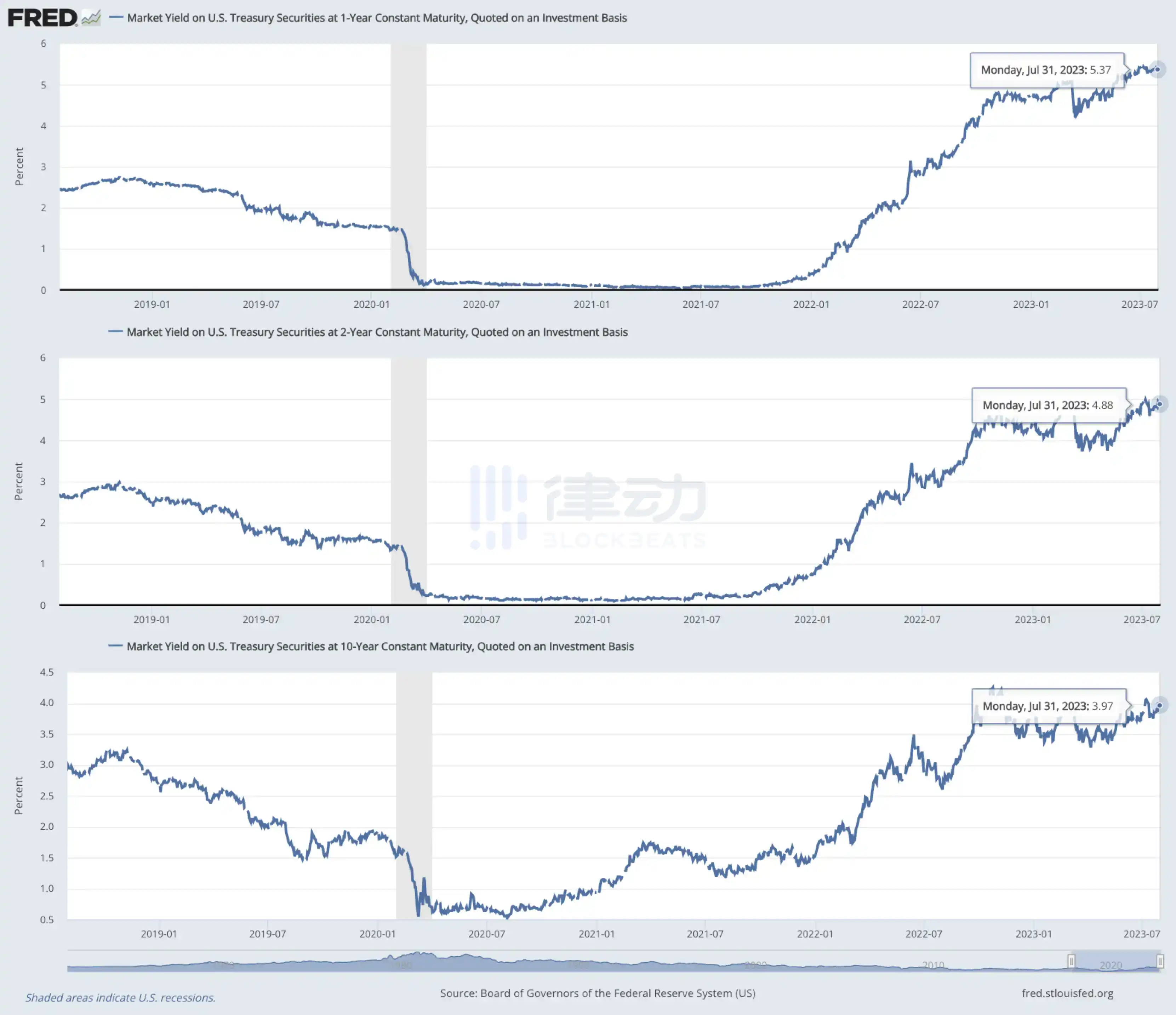

According to FRED data, as of August last year, the yields on US one-year, two-year, and ten-year Treasury bonds were 5.37%, 4.88%, and 3.97% respectively. Regardless of the yield curve, both short-term and long-term bonds have been steadily rising since the end of 2021. Compared to mainstream DeFi protocols such as Curve and Aave, even the yield on the ten-year Treasury bond is significantly higher than their average yield.

In contrast, the yield levels of DeFi have gradually declined. According to DeFi Llama data, the median DeFi yield has dropped from 6% to 2% between early 2022 and July 2023, making it almost unprofitable for large investors.

In response, Fidelity's latest report states that last year, "In a generally risk-averse environment, institutions found that the mid-single-digit returns offered by DeFi yields were too low for the associated risks." The Federal Reserve's decision to raise interest rates in 2023 provided institutions with better, or at least perceived as safer, options, further exacerbating the liquidity squeeze in the cryptocurrency market.

When it becomes difficult to generate sufficient returns on-chain, bringing real-world returns into DeFi is a viable solution, namely Real World Assets (RWA). In June last year, as the market entered a deep bear market, tokens of old DeFi projects like Compound and MakerDAO began to rise with the RWA narrative, reaching new highs within the year.

Previously, the founder of MakerDAO's "Endgame" proposal article, published after the Tornado Cash incident, sparked a discussion about RWA. There were also rumors in the market that MakerDAO significantly increased its income over the past few months by using treasury funds to purchase US Treasury bonds. The founder of Compound also announced the establishment of a new company, Superstate, at the end of June, specifically dedicated to bringing bonds and other assets onto the chain to provide potential clients with real-world returns. Under the wave of compliance in Hong Kong, the popularity of RWA reached a new high.

Based on the premise that the yield on Treasury bonds exceeds the yield on DeFi, the demand for tokenized government bonds among cryptocurrency investors continues to grow. People not only hope to achieve better on-chain returns through this narrative, but also aim to attract more traditional funds, creating a new cycle of cryptocurrency boom.

One key part of MakerDAO's decentralized stablecoin construction is to use RWA as collateral. RWA, as one of the most important topics for MakerDAO, is constantly being discussed and verified by the community, seen as an important solution.

Related reading: "Inventory of Popular MakerDAO RWA Projects, Analyzing the Trading Architecture of Capturing Off-chain Assets in DeFi"

DeFi Yields Surpass Treasury Bonds

According to a report by DLNews, DeFi lending protocols like Aave, the largest in its category with over $8.3 billion in deposits, provide investors with a simple way to use their cryptocurrency assets. However, to do this, other investors must deposit stablecoins for them to borrow. In recent months, Aave users have earned yields by lending stablecoins that have exceeded the 10-year US Treasury bond rate.

According to FRED data, the current 10-year US Treasury rate is approximately 4.25%. For the largest stablecoin pegged to the US dollar, USDT, investors can earn up to 14% in returns. The circulation of USDT has exceeded $97 billion, an increase from around 5% in August.

Yields on other stablecoins are also higher. Dai, the third-largest stablecoin with a circulation of approximately $4.8 billion, offers Aave depositors a yield of about 8.5%, while the second-largest stablecoin, Circle's USDC, has a yield slightly below 5%. DeFi investors typically view the lending rates for stablecoins provided by protocols like Aave as the industry's risk-free rate. This is because it represents the benchmark return for evaluating all other DeFi positions.

The lending rate provided to borrowers on Aave is determined by the protocol's algorithm, and the yield increases as the assets become more popular with borrowers. If the US Treasury bond yield declines, such high yields may attract institutions to enter DeFi. As long as risk appetite continues to exist, the enticing returns that DeFi investors can obtain through stablecoin lending are unlikely to diminish in the near future.

Although throughout 2023, as DeFi investors turned to US Treasury bonds to earn higher yields, stablecoins pegged to the US dollar were affected. However, if the Federal Reserve lowers rates by 0.75% as predicted by the end of 2024, institutions may begin to seek more profitable ways to make more money, namely investing in DeFi.

Can the RWA Story Continue?

Bringing RWA onto the chain is to bring the value that real-world assets can create into the crypto world, catering to the preferences of users and investors in the crypto world. The reason these two worlds exist independently, apart from blockchain technology, is fundamentally due to strong regulatory differences. This fundamental difference has created the frenzy of wealth effects in the crypto world, which is the reason why most people are drawn into the crypto world. Traditional assets, due to their asset and compliance attributes, are actually contrary to the crypto world.

However, bringing RWA onto the chain is not easy and involves challenges in designing new product architectures, financial, legal compliance, and technical risks, as well as unknown unknowns.

The reason why RWA has sparked a wave of attention is also because, under the baptism of the bear market, some whales who have made money are beginning to crave stable fixed income in the real world. From the current development of RWA, it is mainly limited to exposure to government bonds, especially US Treasury bonds. On the one hand, this reduces the regulatory resistance of DeFi, and on the other hand, it means that once the Fed reverses, RWA protocols relying on US bonds will fail again, entering an irreversible trend of declining returns. And in the eyes of many, the Fed's reversal is not far away.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。