Original | Odaily Planet Daily

Author | Nan Zhi

On February 8th, Binance's new coin mining announced the launch of the 46th project, Pixels (PIXEL), which is a social network game based on the Ronin network. Users can deposit BNB and FDUSD into the PIXEL mining pool on the Launchpad website after 08:00 on February 9th (UTC+8) to receive PIXEL rewards. PIXEL can be mined for a total of 10 days.

Odaily Planet Daily will review the recent Binance Launchpool earnings in this article and estimate the price of the PIXEL token based on lending and exchange data.

Original Pixels game token exchange

According to the Binance Pixels research report, the Pixels project raised $4.8 million through three rounds of private token sales, with 14% of the PIXEL token supply sold at prices of $0.005, $0.009, and $0.012 respectively. As of February 8th, the maximum supply of PIXEL is 5 billion, with an initial circulation of 771,041,667 tokens (approximately 15.42% of the maximum supply) upon launch.

Pixels will gradually phase out the in-game token BERRY, and BERRY will be open for exchange with PIXEL at an initial exchange rate of 1000 BERRY: 7.6175 PIXEL. Subsequently, Pixels announced that the exchange rate would be reduced by 10% on February 13th.

Coingecko data shows that BERRY's current price is 0.00265 USDT, based on the above exchange rate, the price of PIXEL is 0.385 USDT.

Launchpool data review

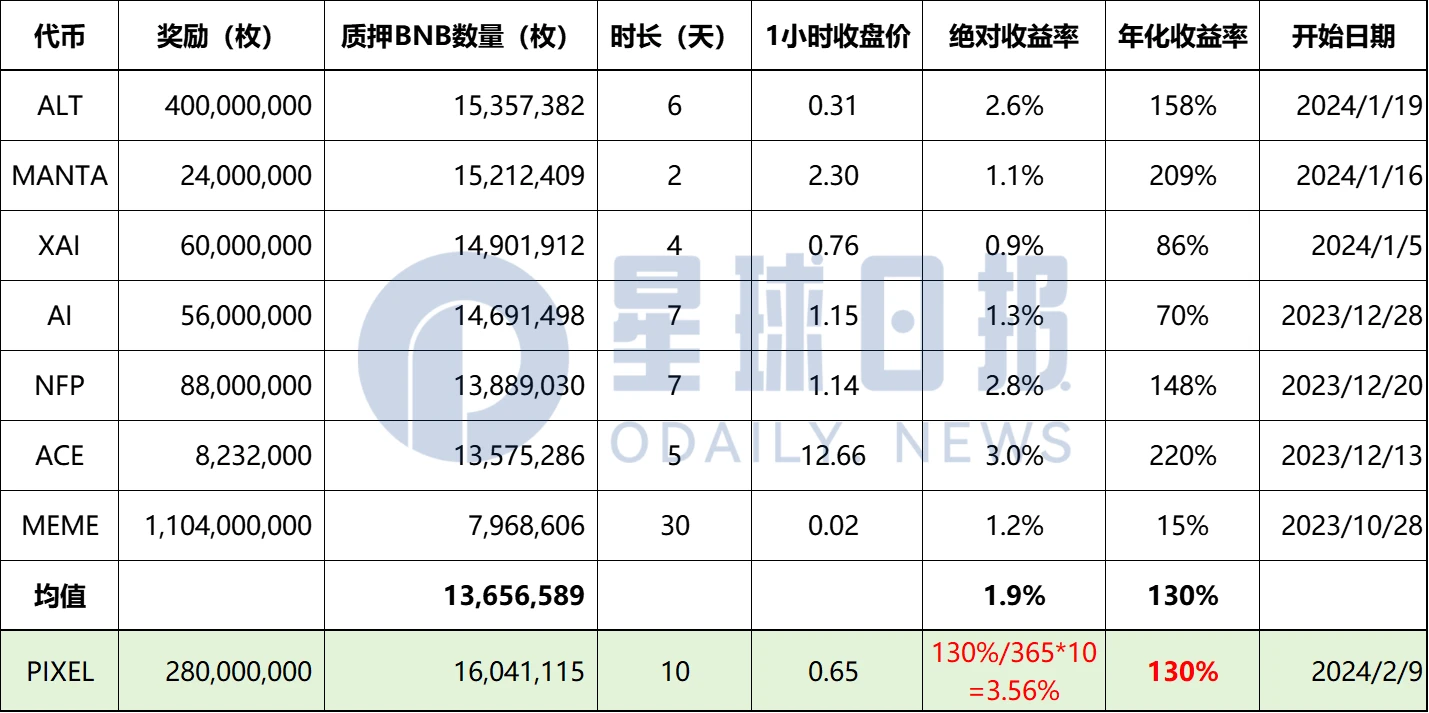

The following chart reviews the Launchpool data from Memecoin (MEME) to the most recent Altlayer (ALT), considering only the earnings from the BNB pool. The earnings rate calculates the BNB price based on the closing price of BNB before mining began (assuming that the BNB price had been sufficiently played before the Launchpool announcement and mining started).

In summary, the average Launchpool annualized return rate for the past 7 periods is 130%, and excluding MEME, the annualized return rate is 148%, which is higher than the USDT financial management of various protocols and exchanges to a certain extent.

Assuming that the annualized return rate of PIXEL is also 130%, and PIXEL mining continues for ten days, the absolute return rate of this Launchpool can be calculated as 130%/365×10=3.56% per day.

To achieve a 3.56% return rate, the price of PIXEL needs to reach 16,041,115×319.2×3.56%/280,000,000=0.65 USDT.

Prediction based on lending data

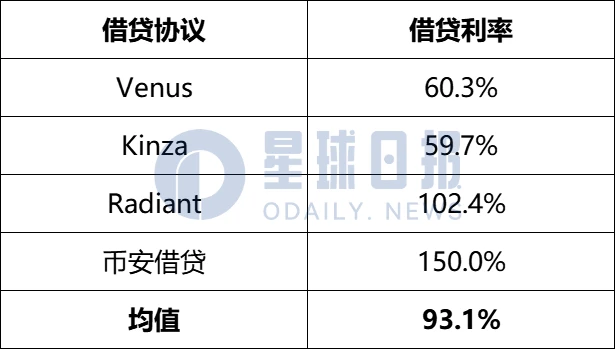

Assuming that the annualized return rate of PIXEL should be "BNB lending rate + risk-free return rate", where the BNB lending rate comes from various lending protocols and exchanges, and the risk-free return rate is the USDT lending rate of the exchange.

This section selects the BNB lending rates from Venus, Kinza, Radiant, and Binance lending, with an average of 93%, as shown in the following figure.

The Binance USDT financial management rate is approximately 12%, and OKX is approximately 38%, with an average of 25%. Therefore, the annualized return rate of PIXEL is 118%. According to the algorithm in the previous section, the corresponding price is 0.591 USDT when not considering the risk-free return rate. The minimum price is 0.466 USDT.

Conclusion

In summary, to maintain the average Launchpool return rate or make it profitable for lenders, the price of PIXEL needs to reach approximately 0.6 USDT. Based on the current market expectations and the minimum price calculation, the bottom line price is approximately between 0.4 USDT and 0.45 USDT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。