Recently, the market has seen a surge in Restaking activities, with many protocols initiating staking activities. The Total Value Locked (TVL) of LRT (Liquid Restaked Token) has also shown significant growth, reaching a level of 15 billion US dollars. The relationship between LRT and Restaking, its advantages and risks, as well as the LRT protocols available in the market, are all topics worthy of in-depth exploration.

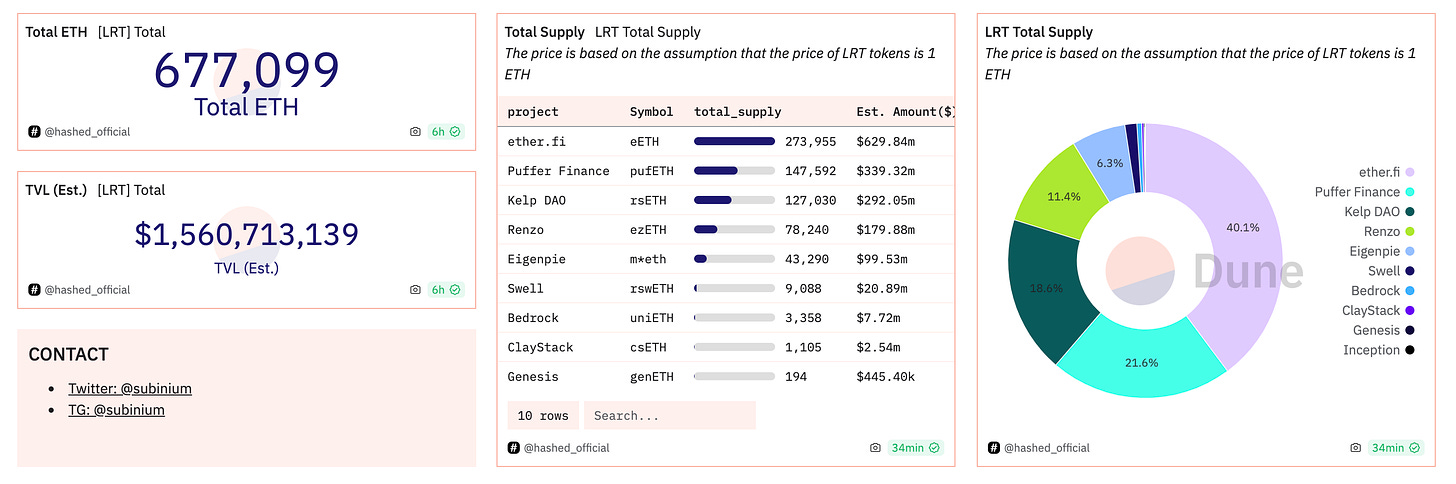

Data Source: DUNE

Background

Restaking refers to re-staking assets after the initial staking. This strategy is mainly based on the security framework of Ethereum and aims to improve the efficiency of fund utilization in the entire cryptocurrency ecosystem. Through Restaking, stakers can not only support the security of a network but also provide validation services for multiple networks, thereby earning additional rewards, which is very beneficial for increasing the yield of assets. In short, Restaking opens up a new way for stakers to earn additional income while also strengthening the security and stability of multiple networks.

At the same time, one of the main issues faced by Restaking is liquidity. Similar to PoS staking, after Restaking, assets are "locked" in nodes, thus losing liquidity. To address this issue, Liquid Restaked Token (LRT) was introduced. LRT is a synthetic token issued for Restaked ETH, ETHx, or other LST. It not only solves the aforementioned problem but also allows easy access to Restaking and DeFi.

Compared to LST, LRT is more complex in both technical and economic aspects. For LST, all underlying tokens are staked for a single task, which is to ensure the security of the PoS chain. However, for LRT, there will be multiple AVS (Active Validation Services) that require selection for Restaking to ensure the security of applications and networks, leading to the allocation of various additional rewards.

Therefore, the relationship between LRT and Restaking can be summarized as follows: LRT is a synthetic token designed to address the liquidity issue in Restaking, allowing staked assets to provide security support for multiple services while bringing additional rewards and returns to stakers.

Concept

Liquid Restaked Token (LRT) is a new liquidity primitive in the cryptocurrency market aimed at improving the capital efficiency of assets. In traditional liquidity mining activities, users deposit their crypto assets into liquidity pools to earn rewards, but these assets are usually unable to be further utilized during the staking period. LRT allows users to restake already staked assets, thereby achieving higher capital efficiency and increasing asset liquidity and flexibility.

Advantages

Improved capital efficiency: Through the Restaking mechanism, users can participate in other staking projects or lending activities without withdrawing the original staked assets. This allows for the simultaneous support of the security of the Ethereum network and AVS without the need to directly establish security using native tokens, thereby improving capital efficiency.

Maximizing returns: LRT allows users to earn multiple rewards from the same asset. Stakers can earn rewards from supporting validation activities for multiple services without using additional funds, improving their capital efficiency and increasing rewards related to validation services. Basic rewards include ETH staking rewards, AVS restaking rewards, and additional LRT utilization rewards.

Enhanced liquidity: LRT protocols address liquidity challenges by restaking deposited ETH in various operators, standardizing reward and risk allocation, and providing tokenized representations of staked ETH and rewards for users to further utilize in other DeFi protocols. This mechanism contributes to increased market liquidity, making assets more active and beneficial for the overall cryptocurrency ecosystem's prosperity.

Risks

Increased complexity: Restaking introduces complexity that investors need to understand and manage. This includes not only the basic staking and reward mechanisms but also how to effectively restake assets across multiple networks to maximize returns, which can be a challenge for novice investors. Additionally, the introduction of LRT involves the selection and evaluation of multiple different AVS, as well as how to allocate staked assets among them to obtain an optimized reward structure.

Smart contract risks: The implementation of LRT relies on the interaction of multiple layers of smart contracts, and each additional layer of smart contract theoretically introduces new security vulnerabilities or flaws, which could lead to asset theft or loss. The complexity and interaction of smart contracts make comprehensive auditing and verification more difficult, increasing the technical risks faced by investors.

Liquidity risk: While LRT aims to improve liquidity by providing representative tokens for restaked assets, in extreme market conditions (such as severe fluctuations or panic selling), the liquidity of these assets may still be severely affected. Most LRT protocols are easy to enter but difficult to exit. In these situations, restaked assets may be difficult to convert into liquidity quickly, increasing the risk of liquidation.

Governance risk: Due to the technical and economic complexity of LRT protocols, their governance structure and decision-making processes are relatively complex. This complexity may lead to inefficient governance or allow a minority interest group to manipulate protocol decisions for their own gain, thereby harming the interests of the majority of holders. Furthermore, the need to select restaking for multiple AVS further increases the complexity and difficulty of governance decisions, potentially leading to opaque governance and increased participation thresholds.

In conclusion, as a financial innovation, LRT increases capital efficiency and potential returns while also bringing higher risks and management complexity. Investors need to carefully assess their risk tolerance and investment strategies before participating, ensuring a thorough understanding of the relevant mechanisms and potential risks.

Project Inventory

Eigenlayer: A leading project in the field, built on Ethereum, introducing a new primitive in crypto-economic security - restaking. This primitive allows for the reuse of ETH at the consensus layer. Users staking native ETH or using LST to stake ETH can choose to join the EigenLayer smart contract to restake their ETH or LST, extending crypto-economic security to other applications on the network for additional rewards.

Kelp DAO: A multi-chain liquidity staking platform, initiated by former members of the Stader Labs team, currently focused on building an LRT solution, rsETH, on EigenLayer, aiming to provide liquidity for illiquid assets deposited in EigenLayer and other restaking platforms. Currently, Kelp DAO does not charge any fees for LST deposits, allowing users to freely deposit ETHx, sfrxETH, and stETH on the Kelp dApp without incurring any fees.

Restake Finance: The first protocol to launch modular liquidity staking on EigenLayer, proposing a decentralized yield restaking method that allows users to earn Ethereum staking rewards and EigenLayer native rewards without locking assets or maintaining staking infrastructure. Restake Finance will be supported by Restake Finance DAO, ensuring the project remains true to its decentralized nature and aligns with the interests of stakeholders. The DAO will be governed using the RSTK token, with the core goal of creating value for token holders through governance and revenue generation.

Renzo Protocol: The first native restaking protocol launched on the EigenLayer mainnet. It provides an interface for restaking on EigenLayer, eliminating technical barriers, resource allocation, and risk management. It also creates new primitives and design considerations for AVS applications, promoting open innovation and flexible construction of open distributed systems.

Puffer Finance: The first native liquidity staking protocol on EigenLayer, making native restaking on EigenLayer more accessible, allowing anyone to run an Ethereum PoS validator while increasing their rewards. Stakers and node operators have created a flywheel effect, leading to Puffer's growth rate surpassing that of traditional liquidity staking protocols. However, to ensure that Puffer never poses a threat to Ethereum's trust neutrality, the Burst Threshold sets the upper limit of Puffer to 22% of the validator set.

etherFi: A decentralized, non-custodial delegation staking protocol with liquidity staking derivative tokens. A notable feature of ether.fi is that stakers control their private keys. The ether.fi mechanism also allows for the creation of a node service market, where stakers and node operators can register nodes to provide infrastructure services, with the income from these services shared with stakers and node operators.

Swell Network: An non-custodial staking protocol that has launched rswETH. Through Swell, users can earn passive income by staking or restaking ETH to earn blockchain rewards and re-earned AVS rewards. In return, users can receive yield-bearing liquidity tokens (LST or LRT) to hold or participate in the broader DeFi ecosystem for additional returns.

Stakestone: A full-chain LST protocol aimed at bringing native staking rewards and liquidity to L2 in a decentralized manner. With its highly scalable architecture, StakeStone not only supports leading staking pools but is also compatible with upcoming restaking. It has also established a multi-chain liquidity market based on STONE. StakeStone pioneers the first decentralized liquidity staking solution through an innovative mechanism called OPAP. Unlike traditional methods relying on MPC wallets, StakeStone provides fully transparent underlying assets and yields. OPAP allows for the optimization of the underlying assets of STONE, ensuring that STONE holders can automatically and easily obtain optimized staking rewards.

Babylon: The "Eigenlayer for the BTC ecosystem," Babylon is fundamentally changing the way we extend Bitcoin, without relying on adding new layers or building new ecosystems on top of Bitcoin. Instead, it extracts security from the Bitcoin chain and shares it with various PoS chains. Babylon is developing a Bitcoin staking protocol that allows Bitcoin holders to stake their BTC on PoS chains and earn staking (and restaking) rewards to ensure the security of PoS chains, applications, and app chains. Unlike existing methods, this innovative protocol eliminates the need to bridge, wrap, peg, or custody staked Bitcoin.

Picasso: A project aiming to introduce the concept of Restaking to the Solana blockchain, allowing stakers to reuse their assets for staking on Solana and other networks through a liquidity restaking method similar to EigenLayer, to earn additional rewards. The protocol focuses on leveraging crypto-economic security to provide additional security for various decentralized applications and services. In doing so, Picasso not only increases asset liquidity but also promotes overall network security and stability through shared security mechanisms.

These projects showcase the diversity and innovation in the LRT field, while also indicating the potential and direction of the restaking market. When choosing to participate in these projects, it is advisable to thoroughly research their characteristics, risks, and potential returns to make informed investment decisions.

In summary, the introduction of LRT marks an innovative leap in the crypto asset staking field. By unlocking the liquidity of staked assets, LRT allows these assets to be restaked across multiple networks and services for additional returns, enhancing capital efficiency and potential returns.

However, like all innovations, LRT also comes with risks, including increased technical complexity, potential security vulnerabilities in smart contracts, and the impact of market fluctuations. Investors should thoroughly understand these risks before participating and develop appropriate risk management strategies to ensure effective control of potential losses while pursuing returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。