This article comprehensively discusses the development process of the inscription market, including BTC protocol inscriptions, multi-chain inscriptions, the rise of runes, as well as the main participants and technological innovations in the related market. The aim is to provide an in-depth analysis of the inscription market, including the technical background, market trends, main challenges, and future prospects.

Author: BiB Exchange

Abstract: Recently, several job postings have made the author envious. OKX's Web3 Wallet is recruiting a Senior Product Manager with a starting salary of 33k-39k new coins, which is the same for Web3 practitioners. Looking at the author's own pay stub, why can colleagues in the wallet department earn such high income in a month? Not only that, even the co-founder of Binance, HE YI, is actively seeking talent for Binance Wallet. Why is this? In fact, behind Binance and OKX, both are competing for a market called "inscriptions," gaining more users and traffic through wallets to facilitate the liquidity of inscriptions. Therefore, this article comprehensively discusses the development process of the inscription market, including BTC protocol inscriptions, multi-chain inscriptions, the rise of runes, as well as the main participants and technological innovations in the related market. The aim is to provide an in-depth analysis of the inscription market, including the technical background, market trends, main challenges, and future prospects.

I. Introduction

Background of the Rise of the Inscription Market

The description of Ordinals can be traced back to 2012. Although Bitcoin was designed as a "homogeneous" token, a unique serial number can be assigned to each atomic unit (also known as satoshi). With this serial number, a satoshi may represent not only its face value (e.g., "colored" bitcoins, smart properties, securities). The serial number consists of two parts: the integer part is the block number that generates the satoshi, and the decimal part represents each unique satoshi. In 2022, Casey introduced the Ordinals protocol, which was like opening a mysterious box in the Bitcoin ecosystem.

The Ordinals protocol injects a unique serial number into each satoshi, providing users with the opportunity to inscribe various information on the satoshis, including text, images, videos, and 3D models. These unique inscriptions can be permanently stored in a Bitcoin wallet and tracked during Bitcoin transactions, demonstrating similar immutable and decentralized characteristics as Bitcoin. Casey described the positioning of the Ordinals protocol as preserving some eternal and unchangeable things on Bitcoin, with the initial application being used to create and store NFT art collections.

This innovation has brought new possibilities to the Bitcoin ecosystem, making it more diverse and expressive. Users are no longer limited to simple Bitcoin transactions but can create, store, and trade unique digital content on the Bitcoin chain. This initiative has also provided new impetus for the rise of the NFT market, making Bitcoin a platform for preserving and disseminating digital art and cultural creativity. The rise of the inscription market signifies the evolution of the Bitcoin ecosystem, providing users with more opportunities for participation and interaction, while injecting new vitality into the digital art and creative industry.

Relevance of Web3 to the Inscription Market

The inscription market is built on a distributed network, based on the interoperability of the Web3 platform, and achieves free trading and circulation in decentralized markets. Therefore, in the era of Web3, the inscription market, as an emerging field, is rapidly becoming an important part of cryptocurrency and blockchain technology.

First is the ownership of digital identity. Web3 advocates for users to control their own data, and in the inscription market, each inscription can be associated with a user's digital identity, ensuring the creator's ownership and control of their work. This aligns with the principles of Web3, making users more actively involved and in control of their digital assets. Second is the application of smart contracts. In the future inscription market, smart contracts can be used to manage the creation, sale, and trading of inscriptions, making the entire process more efficient, transparent, and programmable.

II. Main Sections of the Inscription Market

The inscription market is mainly divided into three major sections: NFT, Bitcoin inscriptions, and multi-chain inscriptions.

NFT (Non-Fungible Tokens)

The NFT section occupies an important position in the inscription market, including non-fungible tokens on Bitcoin and other blockchains:

Ordinals: This category refers to NFTs inscribed on the Bitcoin blockchain through the Ordinals protocol. They typically include digital art, game props, collectibles, etc. Specific projects include: Bitcoin Frogs, Node Monkes, ORLDUM (Rudolph Puppet), Goosinals, and more.

BRC-20: This category covers NFTs based on the BRC-20 protocol, which is a standard in BTC protocol inscriptions, allowing the creation of assets similar to ERC-20 tokens on the Bitcoin network. Project examples include: This Song about NFTs, Mineoral, Blue Wands, Ord Games Arcade, and more.

Others: In addition to Ordinals and BRC-20, there are other NFT categories, such as Atomics Dimit (NFTs traded through the AtomicSwap mechanism), Toothly, FalcãoFam, Atom Dragons.

Bitcoin Inscriptions

The most common inscription protocol we encounter is the BTC protocol inscriptions, mainly consisting of BRC-20 inscriptions in Bitcoin, followed by Ordi, SRC20, ARC20, Runes, etc. BTC protocol inscriptions specifically refer to inscriptions created using different protocols on the Bitcoin network, including the following categories:

- Ordinals: Basic inscription types on the Bitcoin network, achieved by assigning a serial number to each satoshi.

- BRC-20: A standard based on Ordinals, used to create a token system similar to ERC-20 on Bitcoin.

- BRC-10: Possibly another inscription standard based on Bitcoin.

- Tap Protocol: A protocol related to the Taproot upgrade, used for inscription creation on the Bitcoin network.

The URLs for each category are as follows:

- https://unisat.io/brc20 (Ordi)

- https://openstamp.io/home (SRC20)

- https://atomicalmarket.com/market/token?ticker=atom (ARC20)

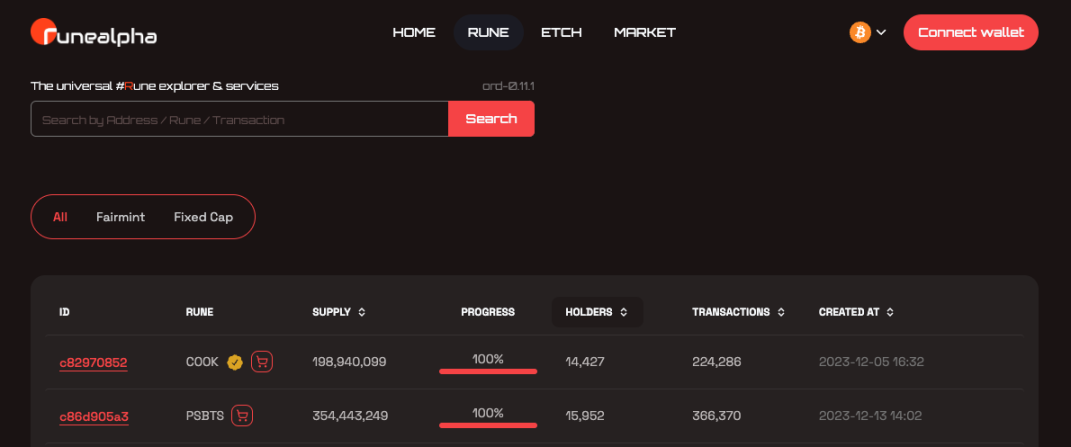

- https://runealpha.xyz/runes (Runes)

These categories may further differentiate into specific applications or projects, such as Launchpads, Apps/Institutions, etc.

Multi-Chain Inscriptions

Multi-chain inscriptions refer to inscriptions implemented across different blockchains, represented by inscriptions on ETHS, SOLS, AVAV, and other public chains. Inscriptions on Ethereum include ETHS, IERC-20, SetS, FacetS, etc.; inscriptions on Solana include SOLS, SLAPP, etc.; inscriptions on Avalanche include: AAWS, AVAV, etc. Other EVM-compatible chains also have their own inscription projects, and there are also many inscription projects on public chains that use Move language to write code, such as: SAPTS (Aptos), SHOVE (Sui), etc.

III. Development and Impact of Each Section

The different sectors in the inscription market, including the development of the NFT market, the innovation of Bitcoin inscriptions, and the expansion of multi-chain inscriptions, each have their own characteristics and influence, collectively driving the development of the entire market.

Role and Development of NFT

NFTs (Non-Fungible Tokens) in inscriptions play an important role and have gradually become an integral part of the digital culture and art market. NFTs give inscriptions unique identity and ownership. Each NFT is unique, and blockchain technology ensures the uniqueness and indivisibility of digital art. Creators and holders can use NFTs to prove ownership in the inscription market, ensuring the authenticity and uniqueness of digital art.

Impact of Bitcoin Inscriptions

The Ordinals protocol has driven the prosperous development of the inscription market. Ordinals has made the pricing and trading of inscriptions more reasonable, providing a fair and open platform for more creative inscription artists. This has contributed to the rapid growth of the inscription market, bringing more innovation. Ordinals has introduced financial innovations such as auctions, lending, and fractionalization to inscriptions, enriching the application scenarios of inscriptions and bringing more possibilities to the market. It has enhanced the status of inscriptions as assets.

In particular, the rise of BRC-20 inscription protocols such as Ordi/Sats/Rats has played a significant role in the Bitcoin ecosystem, especially the innovation through the Ordinals protocol, bringing new possibilities to the Bitcoin ecosystem. This development has extended to the L2 ecosystem of Bitcoin, with various scaling, cross-chain protocols, and products gaining popularity.

Trends and Challenges of Multi-Chain Inscriptions

The technological innovation in the multi-chain inscription field is mainly reflected in the development of smart contracts. Cross-chain interoperability, automatic contract execution, and programmability may provide more possibilities for the functionality and interaction of inscriptions in the future. Creators are increasingly inclined to create meta-inscriptions (NFTs containing other NFTs or digital assets) and composite inscriptions, further driving the diversity and complexity of inscriptions.

However, the multi-chain inscription sector faces some serious challenges:

High Transaction Fees: High transaction fees on some mainstream public chains remain a challenge, especially for small-scale inscription transactions. This may lead to user attrition and increased costs for creators. For example, with ETH inscriptions, a single interaction or on-chain transfer may result in the loss of tens of dollars.

Lack of Standardization: Different inscription standards on different public chains may lead to interoperability issues for inscriptions in different ecosystems, increasing the technical difficulty for developers.

Intense Competition and Price Volatility: With the rapid development of the inscription market, competition between various public chains and inscription platforms has become fierce. Price instability and rapid devaluation of inscriptions promoted by some KOLs have led to significant losses for some investors.

Four, The Role of Wallets in the Inscription Market

As key participants in the inscription market, wallets play a crucial role in the market's development through their economic models and technological innovations.

Business Model and Revenue Sources

Firstly, through storage and management, wallets allow users to securely store and manage their inscriptions, including metadata, proof of ownership, and other related information. Users can initiate sales, purchases, and transfers of inscriptions from the wallet. Interoperability between different inscription markets and platforms allows users to use the same wallet for transactions on different blockchains, which is particularly important for the multi-chain inscription market. Wallets also serve as the entry point for users to participate in the inscription market community, connecting to different NFT platforms, markets, and social networks for communication, auction participation, and various airdrop activities.

Of course, wallet services are not charitable. Firstly, there are transaction fees: wallets provide convenience for inscription transactions in the market and typically charge transaction fees. These fees can cover the costs on the blockchain network and are also a way for wallets to generate revenue. Secondly, collaboration with NFT markets: this can enhance the user experience of the wallet and create more trading opportunities. Wallets may also generate income through displaying advertisements or promoting specific inscription projects. Some wallets may collaborate with artists, creators, or brands to promote their works or products on the platform. Lastly, for exchanges, wallets may analyze user behavior and market trends, and provide data analysis services or insight reports to users, creators, or market participants, primarily for market makers and exchanges themselves to generate fees.

Innovation and Development of Wallet Technology

Rise of Cross-Chain Wallets: With the development of multi-chain inscriptions, inscription wallets may continuously improve their cross-chain technology to provide a smoother user experience and higher transaction efficiency. This may involve technical innovations such as cross-chain bridging and cross-chain transaction execution. Wallets that support multiple blockchains will have a competitive advantage.

Integration with NFT Markets: Deep integration of wallets with NFT markets will be a future trend, providing a more seamless user experience. With the increasing diversity of inscriptions, wallets may provide support for more NFT standards and may also allow users to create custom NFT standards. This will help better adapt to various inscription types and use cases.

Social Interaction with Project Parties: Some inscription wallets may enhance social features on their platforms to facilitate interaction and collaboration among users. This may include creating jointly owned inscriptions, collaborative creation, and community activities.

In conclusion, wallets need to continuously innovate and introduce more features to meet the growing needs of users, such as cross-chain technology, multi-standard integration, support for meta-inscriptions, social features, and decentralized identity and authentication technology to enable users to better control their identity information and build trust in the inscription market.

Five, Market Issues and Development Suggestions

Market Issues

The liquidity problem in the inscription market is currently the most important issue, as many projects are initially popular but then quickly fade away. This can cause significant harm to the liquidity of inscriptions, similar to many NFT markets in the past that eventually became desolate. Therefore, the following issues need to be addressed.

- Market Fragmentation: The inscription market may be distributed across multiple platforms and chains, leading to dispersed trading and difficulty in consolidating liquidity.

- Lack of Standardization: Different inscription markets may use different NFT standards, which may hinder interoperability between inscriptions on different platforms, reducing liquidity.

- High Transaction Costs: High transaction fees on some blockchains, especially during busy periods, may make small-scale inscription transactions uneconomical, reducing liquidity.

- Insufficient Market Participants: A lack of buyers and sellers in the inscription market may lead to delayed trade matching and reduced liquidity.

Development Suggestions

Enhance cross-wallet and cross-chain interoperability, firstly by improving the cross-chain interoperability of the inscription market, allowing users to freely trade on different blockchains, which will help improve overall liquidity. This will break free from the passive situation of being limited to a single chain, wallet, or platform for trading.

Standardization: The inscription market can advocate or support a universal NFT standard to ensure easier interoperability and circulation of inscriptions across different platforms. While this may be difficult to achieve in the short term, it is still necessary to establish a unified standard. Additionally, inscription market platforms can integrate or establish collaborative relationships to consolidate their liquidity pools and improve overall market liquidity.

Layer 2 Solutions: Utilize Layer 2 solutions such as zkRollups and Optimistic Rollups to reduce transaction fees and improve transaction speed, thereby enhancing the liquidity of small-scale inscription transactions, especially in the BTC inscription trading market, to avoid excessive fees for miners.

Provide scenarios similar to ETH's PoS staking, introduce liquidity mining and reward mechanisms to encourage users to provide liquidity, thereby attracting more market participants and improving market liquidity.

Community Building and Ecosystem Collaboration Support: Enhance user engagement in the inscription market through community building, encourage users to share inscriptions, participate in auctions and activities, thereby promoting market activity and liquidity. Provide real-time trading functionality and market subscription services to enable users to access the latest market dynamics, facilitating faster decision-making and trade execution. Collaborate with other ecosystem participants, such as NFT markets, creators, and wallets, to collectively drive liquidity and development in the entire inscription market.

Six, Future Development

Market Opportunities

As mentioned earlier, there are bottlenecks in the development of inscriptions, such as investing in multi-blockchain inscription platforms to leverage opportunities in different blockchain ecosystems while reducing risks on a single chain. Additionally, opportunities may include:

- Technological Innovation Platforms: Investing in multi-blockchain inscription platforms to leverage opportunities in different blockchain ecosystems while reducing risks on a single chain.

- Third-party Inscription Service Providers: Partnerships with other blockchain projects, technology providers, NFT markets, etc., may bring broader awareness and support to the project.

- Narrative inscriptions combining Gamefi/Socialfi: Investing in games and virtual world projects that integrate NFT technology, which is a promising area that can attract a large number of users and investments.

Investment Strategy

It is advisable to adopt a diversified investment approach. Diversifying the portfolio can reduce specific risks, considering investments in inscriptions on different blockchains, in different domains, and based on different standards.

Conduct thorough due diligence (DD) before investing. Gain in-depth understanding of the fundamentals of each project, including team background, technical capabilities, community support, and vision. Information about the project's whitepaper, roadmap, and community feedback is also important.

Stay updated on community dynamics and emerging projects. Strong community support and active project social activities are often key to project success. Stay informed about the community dynamics of projects through social media, forums, chat rooms, etc. Focus on projects that demonstrate outstanding performance in novel technologies, innovative features, or inscriptions on different public chains, social interaction, etc. For example, projects that integrate multiple inscription markets, enable cross-chain transactions, and introduce technological innovations. For instance, developments related to Bitcoin L2 inscriptions, where Bitcoin L2 has already surpassed 30, covering sidechains, Rollups, data availability, state channels, and other different characteristics.

Future Trends in the Inscription Market from a Historical Perspective

The current wave of the inscription market can be attributed to the rise of the Bitcoin ecosystem. From the eruption of Bitcoin NFTs, which expanded Bitcoin from a peer-to-peer electronic cash system to the most valuable NFT infrastructure. Through the Taproot upgrade and Segwit scaling of Bitcoin, more data can be stored on the chain, supporting the minting, transfer, and destruction of NFTs.

Subsequently, an anonymous developer, domo, introduced BRC-20 based on the Ordinals protocol, as a specific JSON text file, becoming a standard for the issuance of Bitcoin altcoins. BRC-20 quickly ignited Bitcoin Ordinals, resulting in tens of thousands of tokenized inscriptions.

Following that, Casey proposed the Runes protocol, based on the UTXO model, to replace BRC-20. Arthur introduced the Atomicals protocol, an improved version of Ordinals based on the Bitcoin UTXO model. Finally, from November to December 2023, inscription funds overflowed from Bitcoin to major EVM public chains, leading to large-scale transactions, causing some public chains to even crash.

The future trend of the inscription market may lean towards orthodoxy, possibly forming a paradigm similar to Binance IEO, becoming a hub for project issuance in wallets such as Pionex and Binance. Additionally, it is important to pay attention to the potential of runes, which may become the main force in the recent momentum, indicating that the coexistence of different types of inscriptions and runes, as well as the competition and cooperation of multiple types of runes and inscriptions, will be a future trend.

The future trends of the inscription market will gradually emerge under the comprehensive influence of technological innovation and other factors. Investors, creators, and platforms need to closely monitor industry trends and adapt flexibly to market changes. At the project level, in addition to continuing to support BTC protocol inscriptions, the launch of multi-chain inscriptions and runes of multiple varieties, as well as enhancing market liquidity, will be key development directions.

Seven, Conclusion

In conclusion, inscriptions combine art, collectibles, and financial assets. The inscription market is still in its infancy and has a long way to go before maturity. There is a lack of liquidity in trading, and successful inscription products in the future will be those that can provide sufficient liquidity. It is important to be cautious of the speculative nature of inscription value and focus on valuable inscriptions. The future of the inscription market is expected to be even more imaginative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。