1. Risks: The Logical Difficulty and Profit Difficulty of Security Sharing

Essentially, the Eigenlayer project is a nested project within the Ethereum ecosystem. Assuming this security sharing logic, theoretically, it can be nested infinitely, bearing a highly similar structure to the root cause of the 2008 subprime mortgage crisis. This is also a significant reason for V God's concern about the risk of re-staking. In other words, in the event of a major loss, the re-staking protocol relies on Ethereum's underlying consensus, and this impact can propagate to the 1st layer network, leading to normative conflicts within the 1st layer network, also known as the problem of "consensus overload." In financial terms, excessive leverage on consensus itself may lead to the collapse of consensus.

The nesting nature of Eigenlayer cannot be denied. However, based on a limited nesting, it is not only a way to improve the efficiency of asset operation on Ethereum, but also moderately extends the security consensus on the Ethereum main chain. This is indeed very beneficial to the prosperity of the Ethereum ecosystem itself. In essence, it provides SaaS services, although some refer to it as RaaS. Looking into the future of the crypto world, a significant trend is that the competition among public chains has entered the era of the Warring States, with multiple chains shining, and DApps emerging endlessly. High-level security consensus in the crypto world has become a rare commodity, and this is precisely the stage for projects like Eigenlayer. From this perspective, its positive significance outweighs the potential risks.

From a risk perspective, the biggest potential risk of the Eigenlayer project comes from the logical difficulty of security sharing itself. Those capable of ensuring security do not need to share, and those in need of sharing are inherently very insecure and are likely to collapse. Therefore, from a business model perspective, Eigenlayer still has a long way to go, especially for re-stakers. Without high returns or airdrops, it is basically impossible for them to engage in re-staking. Whether it can achieve stable profitability in the future is really a question mark. However, at least in the short term, with the support of numerous top investment institutions and the endorsement of the concept, there should be no problem with the market value expectation. In the long run, Eigenlayer's model is likely to work, especially in today's increasingly popular modularization trend, this fast, convenient, and low-cost deployment method is a very imaginative narrative.

2. Gameplay: Overview of Potential Projects

(1) Re-staking Projects

● Eigenlayer Staking:

Official website: https://app.eigenlayer.xyz/

Specific method: Currently provides 9 types of LRT, among which LIDO's stETH and Swell's swETH have a large TVL. Exiting requires a 7-day waiting period. It also provides native staking, which, as mentioned earlier, is aimed at large holders with Ethereum validation nodes and is not suitable for ordinary players.

Earnings: In addition to re-staking earnings, points can also be obtained, and the quantity of points may be the basis for future airdrops. The calculation of points depends on the staked amount and time. An example given on the official website is: If a user stakes 1 stETH for 10 days, they can earn 240 points. The calculation formula is: 1 ETH × 10 days × 24 hours/day.

● Swell Network Staking:

Official website: https://app.swellnetwork.io

Project gameplay: One is swETH Liquid Staking, where ETH is staked on the official website to earn swETH, which can then be re-staked on Eigenlayer. The other is rswETH Liquid Restaking, where staking ETH on Swell can earn rswETH, which can be directly re-staked.

Earnings: Staking earnings, Eigenlayer points, SWELL points/tokens

● Kelp DAO

Official website: https://kelpdao.xyz/restake/

Gameplay: A Restaking project by Stader Lab, mainly focusing on Liquid-LSD Restaking, allowing users to deposit lido's stETH to earn rsETH, which currently cannot be redeemed.

Earnings: Staking earnings + Eigenlayer points + Kelp points

● Puffer Finance

Official website: https://puffer.fi

Project progress: Backed by Binance Labs (announced on January 30th), Brevan Howard Digital, Jump Crypto, Lightspeed Faction, and the founder of Eigenlayer, Jason Vranek, a former Chainlink engineer, is leading the project. Additionally, seed round investors include BlockVC and Hashkey Capital. It is worth paying close attention to.

Project model: From current information, it seems that native staking is the main focus, with a dual token model expected to be introduced, but specifics have not been disclosed.

● Renzo

Official website: https://app.renzoprotocol.com/restake

Gameplay: Currently with a TVL of 160M, staking ETH earns ezETH, which cannot be redeemed at the moment. TVL has been rapidly increasing in 2024.

Earnings: Staking earnings + Eigenlayer points + Renzo points (based on holding hours)

● EtherFi

Official website: https://app.ether.fi/

Gameplay: Currently with a TVL of 532.7M, staking ETH earns eETH, which can be redeemed after 14 days.

Earnings: Staking earnings + Eigenlayer points + Ether points (ETH staked * 1000 * staking days)

● EigenPie

https://www.eigenlayer.magpiexyz.io/restake

This project will be detailed in another article.

(2) Ecosystem Projects: Altlayer and Other Potential Ecosystem Projects

Currently, the most recent ALTlayer (AVS and roll-up services) in the Eigenlayer ecosystem has been gaining significant attention, and the rise in token price has quickly ignited other projects within the Eigenlayer ecosystem.

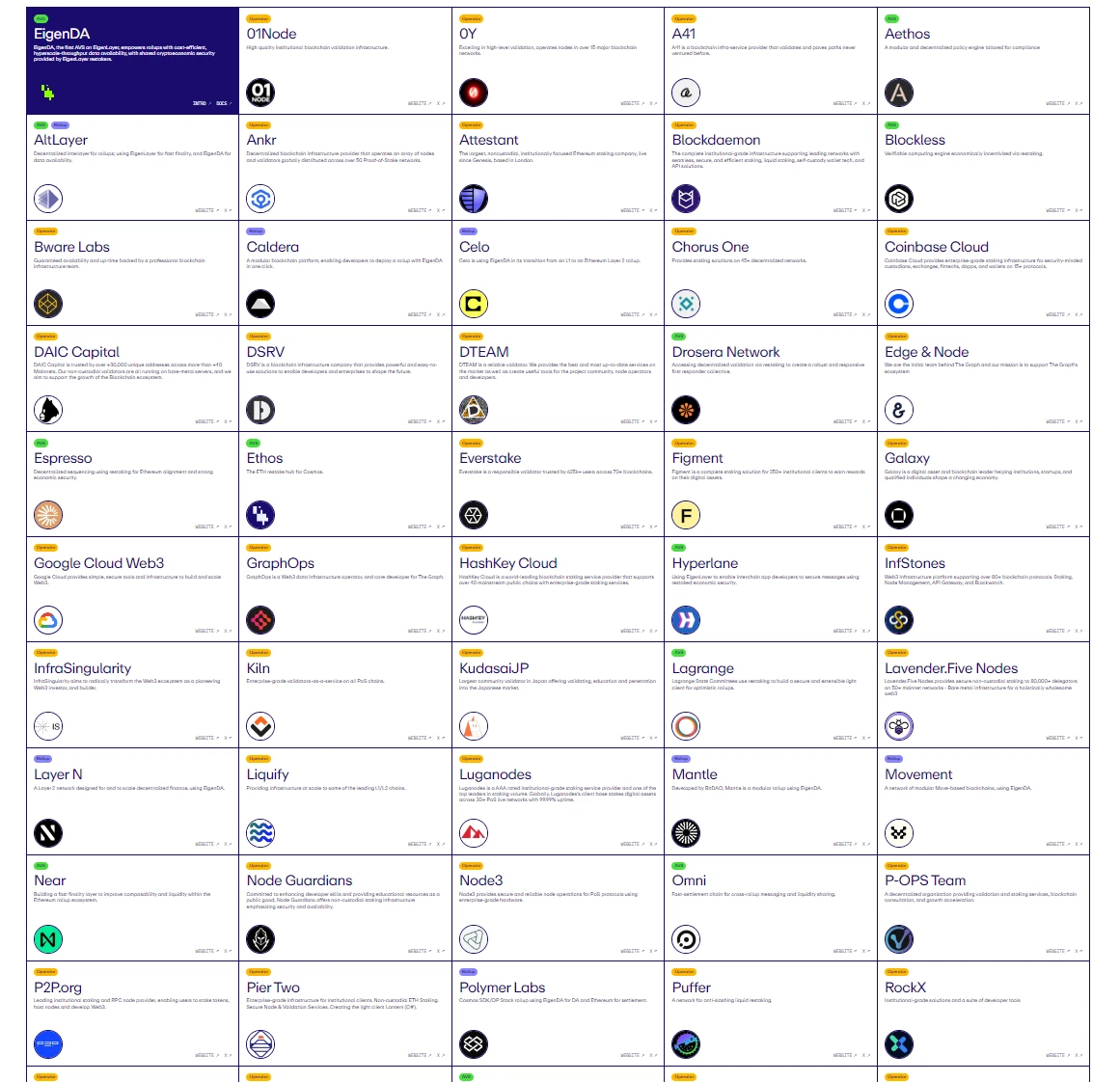

In the Eigenlayer ecosystem, the main categories are AVS, Roll-up, and Operator.

Key Project Introductions

● EigenDA: Data Availability Layer (DA)

Main introduction: The first official AVS service launched by Eigenlayer. Restakers can delegate their rights to node operators executing verification tasks for EigenDA in exchange for service payments, and Rollups can also publish data to EigenDA.

Similar ecosystem projects: AltLayer, Celo, Mantle, Movement, Caldera, Layer N, Polymer Labs

● Witness Chain: Witness Chain

Main introduction: Middleware. Witness Chain uses Eigenlayer to build a decentralized monitoring network, providing AVS services that can be proven for OP rollups.

● Lagrange: Cross-chain Bridge

Main introduction: Cross-chain infrastructure mainly used for cross-chain state verification, verifying and confirming the state transition of optimistic rollups, and generating zero-knowledge state proofs. It is currently compatible with EVM and will further be compatible with non-EVM chains in the future, such as Solana, Sui, etc.

- Espresso: Decentralized Sequencer

Main progress: Seed round of $32 million, initially planned as a privacy public chain; the project was early on involved in copyright infringement and ethical scandals. Later shifted to become a decentralized sequencer, mainly providing a modular Sequencer sharing component for Rollups, enabling one-click chain launching.

- Omni: L1 blockchain, https://omni.network/

Main progress: Currently raised $18 million in funding, with investments from Coinbase, Jump Capital, Polygon, Pantera Capital, etc. Currently, it is possible to earn points through its test network in the Omni Overdrive Launch Supporter on the Galxe platform.

- layerN: Modular L2, https://www.layern.com/

Main progress: In September 2023, it received a $5 million joint lead investment from Founders Fund and dao5, and has since completed 3 rounds of funding. The public test network was launched in February, available for experience.

- Polyhedra Network ZKP Track, Cross-chain Bridge

Main progress: Accumulated $25 million in funding, including investments from Binance Labs, Polychain Capital, ABCDE Labs, OKX, and other well-known institutions. Currently, it is possible to participate in early testing coins or activities through chainlist.org.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。