URPD is actually one of my favorite data, because it can clearly show the movement of each #BTC on the chain. Tracking the URPD data for a certain period of time can reveal the dynamics of buying and selling forces. Although it cannot be used as a standard for price judgment, it does reflect emotions.

Of course, for many friends, price movement is the most concerning. In this regard, URPD has limited assistance, but if we refine it, we can still determine the current trend of bottoming or rising by judging user sentiment, which will be more helpful for medium- to long-term investors.

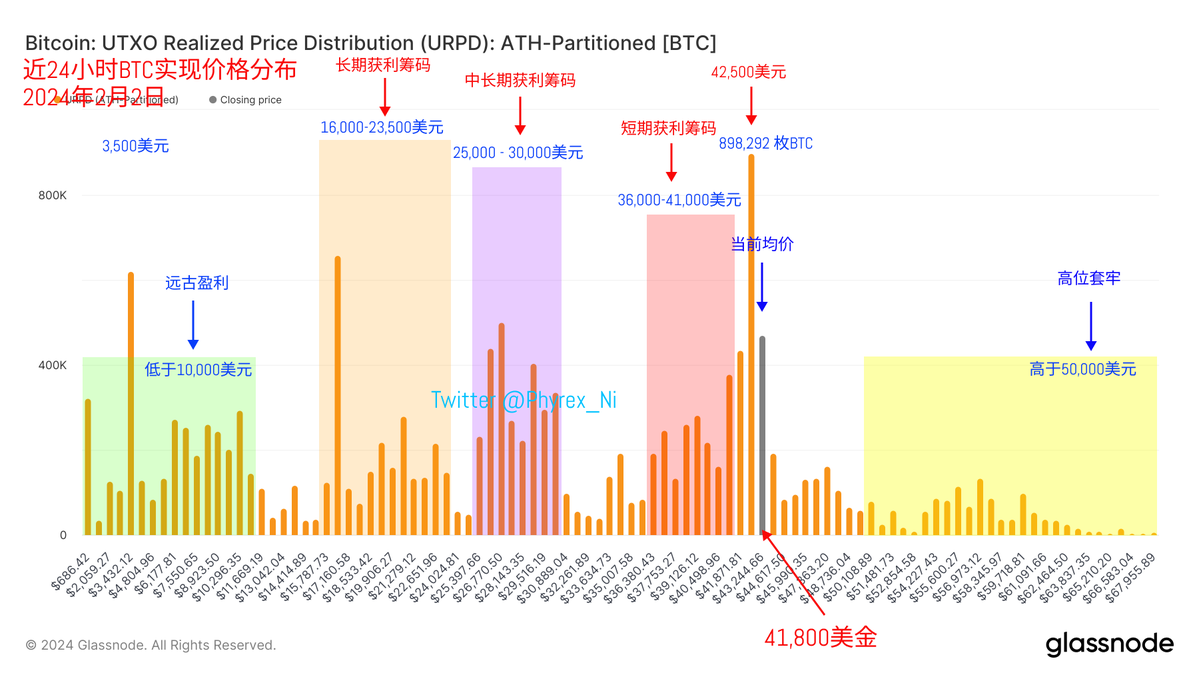

Personally, I like to divide the chips into three directions: long-term, medium-term, and short-term, and distinguish between profitable and losing chips. Through this division, I can clearly see whether the current selling pressure is mainly from profitable chips or if the majority are losing chips exiting.

In addition, excessive concentration of a single price level is also a risk. For example, the inventory at $42,500 already accounts for nearly 900,000 #BTC, indicating that more investors are concentrated in this price range. If sentiment is positive, this represents a solid bottom; if sentiment is pessimistic, it could lead to terrifying selling pressure.

Brother Murphy @Murphychen888 has done something very meaningful. I have thought about it before, but what Murphy has done is completely different, but both are providing additional basis for judgment for friends.

Keep it up!

This post is sponsored by @OfficialApeXdex | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。