Introduction

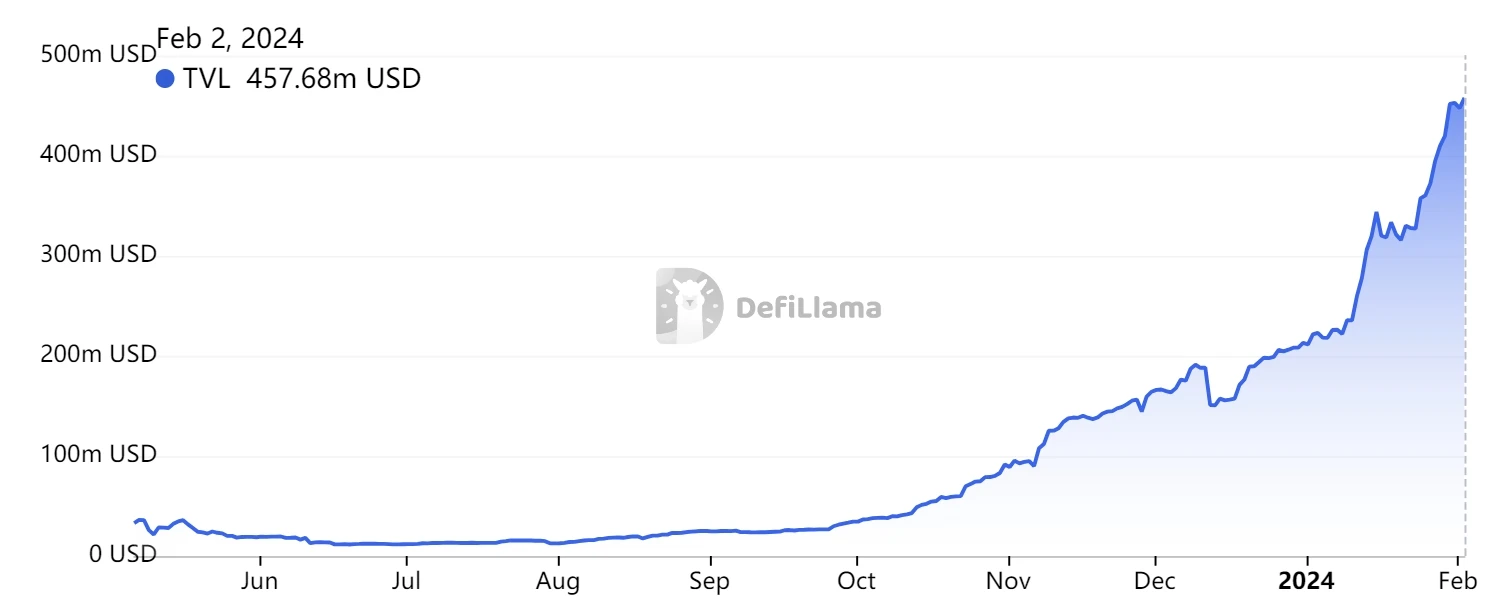

Trading and lending protocols are the cornerstone of the development of all chain ecosystems. The former is a basic need of users, while the latter meets the diverse needs of users for liquidity, leverage, hedging, and more. Recently, the Sui ecosystem has experienced explosive growth. One month ago, Sui's TVL exceeded $200 million, an increase of nearly 500% compared to September. Just last week, the TVL once again experienced explosive growth, surpassing $400 million.

With the explosive growth of Sui, the first native all-in-one liquidity protocol on Sui, NAVI Protocol, has seen significant growth in users, TVL, and strategic development. On January 31, NAVI Protocol's TVL exceeded $150 million, with a weekly growth rate of over 80%, making it the highest TVL DeFi project in the Sui ecosystem. According to SuiVision data, NAVI has completed over 5.4 million transactions, with 1.11 million active addresses. In addition, NAVI Protocol recently acquired the liquidity staking protocol Volo, gaining nearly 35% of the market share in the Sui ecosystem's liquidity staking track. NAVI aims to strategically develop lending + liquidity staking in sync, leveraging a dual-drive approach to help Sui's explosive growth and gain a leading position.

All-in-one liquidity protocol

Mainstream and long-tail lending

NAVI provides a range of lending services for mainstream tokens (including SUI, USDC, USDT, etc.), with deposits exceeding $63.26 million, $45.68 million, and $25.20 million respectively. Compared to the $400 million TVL across the entire ecosystem, and with cross-pool lending supported in all related token pools, users of various capital sizes in the ecosystem can fully utilize NAVI's capital pools for DeFi applications.

NAVI's lending interest rate model is a dual-linear interest rate model, where the interest for borrowing varies based on the utilization rate of the capital pool. Users can borrow at rates determined by the market, and will receive incentives for borrowing from NAVI. According to official data, the supply interest rates for SUI, USDC, and USDT are 18.3%, 19.6%, and 17.4% respectively. Especially when demand in the market is high and combined with the Boosted rewards provided by NAVI, borrowers can also achieve significant returns.

Among the top three lending protocols on Sui, NAVI's user borrowing amount reaches $60 million, Scallop's borrowing amount is $14.10 million, and OmniBTC's is $22.40 million, with a market share as high as 62%, highlighting the significant competitive advantage in protocol design and operation. This demonstrates strong user willingness to use NAVI as the primary lending avenue. Additionally, NAVI's capital utilization rate is 40%, once again demonstrating the borrowing side's application willingness, while also attracting significant interest from lenders.

In addition to the above assets, NAVI also supports tokens such as CETUS (the top DEX on Sui), vSUI (SUI LSD tokens issued by the LSD protocol Volo), and haSUI (SUI LSD tokens issued by the LSD protocol Haedal). Through the support of a wide range of lending tokens, NAVI ensures the composability of users' DeFi activities and brings about a second growth curve for the protocol.

Robust risk control design

While providing users with a rich variety of lending assets and depth, NAVI Protocol has also established a series of mechanisms to reduce the risk of bad debts and other extreme situations, providing effective risk control for user assets.

Long-tail asset deposit limits: NAVI limits the supply of collateral assets to avoid risks from specific long-tail assets. Specifically, excessive supply of tokens with small market capitalization, high FDV, and weak liquidity can bring structural risks. Regardless of whether it's due to massive unlocking or attacks, after such events, positions supported by these assets are likely to be unable to be liquidated, leading to bad debts. This mechanism aims to prevent such situations from occurring.

Long-tail asset borrowing limits: NAVI also sets limits on borrowing against specific pools within the entire capital pool. Similar to supply limits, debt limits can ensure that certain long-tail assets cannot be used for excessive collateralized borrowing, thereby achieving precise risk control.

Borrowing limits: NAVI sets mandatory borrowing limits for all accounts, calculated based on the percentage of collateral value, to ensure that users maintain a safe collateral ratio and protect the lending pool from default impacts.

Currently, NAVI's $150 million TVL is evenly distributed. According to Leaderboard data, the largest borrower has provided $7.90 million in liquidity, while the remaining nine of the top ten addresses have provided $27.70 million in liquidity. Additionally, according to official data, 50% of liquidity providers supply funds ranging from $5,000 to $500,000, ensuring a reasonable distribution of liquidity levels on the platform and mitigating the risk of sudden withdrawal of liquidity by large holders. The significant participation of a large number of users further cements the stability of the capital pool.

In summary, through borrowing-side mechanisms, numerical limits, and control of lending-side distribution, NAVI's lending capital pool provides a secure and stable guarantee without affecting efficient operation.

All-in-one platform

As mentioned earlier, trading, lending protocols, and further leverage and hedging are basic activities for users and the cornerstone of chain development. The vast majority of activities fall within this range, and there is a strong demand for protocol usage. However, in the process of users participating in specific ecosystems, they often face complex protocol searches, high protocol management costs, and insufficient security. NAVI Protocol addresses these challenges and issues effectively by building an all-in-one platform that connects users' front-end usage needs, solving the above difficulties and problems.

At the forefront of activities, i.e., fund inflow, NAVI integrates HeroSwap, allowing users to directly cross-chain trade various assets such as ETH, BTC, and SOL from other chains to Sui. Additionally, it incorporates the cross-chain protocol Portal Bridge, enhancing Sui's accessibility and providing a fast channel for user introduction.

In the core business of NAVI, i.e., lending, NAVI provides deep lending pools for mainstream and long-tail assets, ensuring that users' diverse DeFi needs are met. The categories of assets supported by NAVI are still expanding, with the acquisition of Volo demonstrating its ambitious vertical expansion.

In the backend, i.e., management and monitoring after ecosystem participation, NAVI has launched a centralized reward management page, providing the most direct farming channel for all basic participants. NAVI has also partnered with BlockVision to introduce a one-click query function for transaction history, providing advanced users with the most detailed data to further guide DeFi trading. Its Leaderboard aims to help users systematically identify the community and early supporters, assisting large traders in decision-making.

Multi-dimensional strategic expansion

Financing situation

On January 31, NAVI Protocol announced the completion of a $2 million financing round, with OKX Ventures, dao5, and Hashed leading the investment, and participation from other top cryptocurrency funds such as Mysten Labs, Comma3 Ventures, Mechanism Capital, GeekCartel Capital, Nomad Capital, Coin98 Ventures, Cetus Protocol, Maverick, Viabtc, Assembly Partners, Gate.io, Hailstone Labs, Benqi, LBank Labs, and more.

NAVI Protocol has stated that it will use the funds from this round of financing to expand its all-in-one lending and LSD platform.

Acquisition of Volo, Expanding the LSD Landscape

On January 17, NAVI Protocol announced the acquisition of Volo, a decentralized liquidity staking protocol. The liquidity staking protocol allows users to deposit locked assets into the protocol, which then issues asset certificates to the users. This allows users to release liquidity while retaining the right to asset earnings. The represented assets include stETH, CRX, stATOM, and more. Volo allows users to stake SUI and receive liquidity staking tokens vSUI, which currently have no locking restrictions and can be used in a series of ecosystem protocols including NAVI Protocol, as well as traded on DEXs such as Cetus, FlowX, Turbos, and Kriya Dex.

According to DefiLlama data, the Total Value Locked (TVL) in the Liquid Staking category of the Sui ecosystem is $24.8 million, with Volo accounting for 26.6%. Through this acquisition, NAVI Protocol has quickly entered the LSD track and secured an important strategic position.

Analysis of NAVI's LSD Strategy Intent

Whether it's tokens, protocols, or ecosystems, one of the most important factors for Web3 users is liquidity, including the liquidity of funds entering and exiting, as well as the liquidity of assets. In current DeFi designs, to avoid panic selling, there are often waiting period restrictions for the unlocking of tokens, with well-known examples in the ecosystem including ETH PoS staking, ATOM node staking, and protocols like CRV (Curve). In response to the widespread demand for liquidity, there have been derivatives of liquidity staking products (LSD) such as stETH, stATOM, CRX, and more, allowing users to obtain liquidity without losing the value of their collateral.

However, not all LSD protocols can ensure that the collateral assets and liquidity staking tokens (LST) maintain a 1:1 ratio. Even stETH has experienced a deviation of over 10% in 2022. For example, the ARB staking protocol PlutusDAO on Arbitrum has a deviation of 47% for its LST plsARB, and has maintained this level of deviation for several months. Therefore, for an ecosystem, an LSD protocol that can provide sufficient liquidity and operate effectively to ensure the anchoring ratio is crucial.

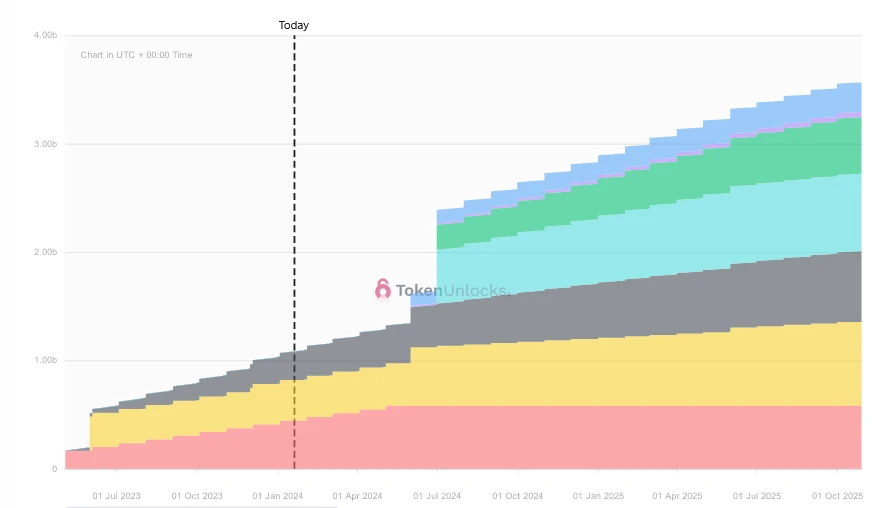

TokenUnlocks data shows that the current circulating supply of SUI is 1.1 billion tokens, and in addition to regular monthly unlocks, there will be two large-scale unlocks in July 2024, bringing the total circulating supply close to 2.9 billion tokens by the end of 2024.

With the expected strengthening of the bull market in 2024, the circulating supply and market value of SUI are expected to increase, requiring suitable protocols to accommodate the demand for SUI and ensure its liquidity and stability. NAVI's acquisition of Volo ensures its strategic position and lays the foundation for further development. As an ecosystem-level LSD, the substantial volume and returns of SUI will effectively drive the development of NAVI. Furthermore, the LSD business can be combined with NAVI's lending business to fully unleash its DeFi composability, comprehensively and continuously leveraging the advantages of a vertical dual-drive strategy.

Launching the Governance Token NAVXIDO

Alongside the financing announcement, NAVI also announced the IDO plan for the governance token NAVX on Cetus. The IDO event will start on February 4 at 20:00 (UTC+8) and will last for three days. The IDO token quantity accounts for 1.2% (12 million tokens) of the total NAVX supply, with 0.96% allocated to the NAVX-SUI pool and 0.24% allocated to the NAVX-CETUS pool. Specifically:

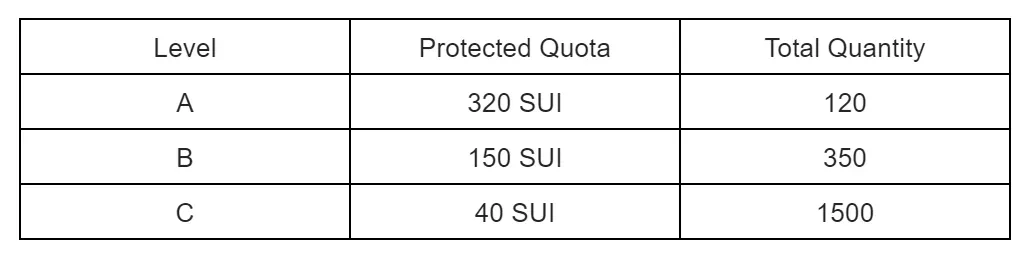

The NAVX-SUI pool adopts a whitelist + oversubscription public sale format, with a maximum whitelist quota of 75%. This means that in the event of fundraising exceeding the target amount, priority will be given to whitelist participants, and then oversubscribed funds will be distributed proportionally, with oversubscribed funds refunded.

The NAVX-CETUS pool allows 100% oversubscription participation and does not have a whitelist.

The whitelist will be distributed to community users, partners, and the top 500 CETUS holding addresses, with the number of whitelist spots and corresponding quotas as shown in the following image:

In terms of pricing, the NAVX-SUI pool is fundraising at a rate of 1 NAVX = 0.021 SUI, with the current price of SUI at approximately 1.5 USDT. This translates to a unit price and Fully Diluted Valuation (FDV) of 0.0315 USDT and $31.5 million, respectively.

The NAVX-CETUS pool is fundraising at a rate of 1 NAVX = 0.26 CETUS, with CETUS currently priced at approximately 0.11 USDT. This corresponds to a unit price and FDV of 0.0286 USDT and $28.6 million, respectively.

Conclusion

NAVI Protocol's lending users will not only enjoy the advantages of the protocol's deep capital pools and effectively build DeFi strategies, but will also benefit from additional incentives from the protocol. The growth momentum of the Sui ecosystem is still ongoing, and through the strategic layout of its core lending business and the LSD track, NAVI Protocol is expected to experience a new round of explosive growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。