After the approval and listing of the Bitcoin spot ETF, Bitcoin's performance has been lackluster. The grayscale GBTC, which has transformed into a Bitcoin spot ETF, has seen continuous large outflows of funds, which are considered the main reason for the decline in coin prices. Some analysts believe that Bitcoin may continue to fall before the GBTC liquidation is complete, but Galaxy Digital founder Mike Novogratz holds a different view.

Since the approval of the Bitcoin spot ETF by the U.S. Securities and Exchange Commission (SEC), the price of Bitcoin has significantly declined from a high of $48,969 on the 11th, falling to around $41,500. The market believes that this is related to the grayscale GBTC's transformation into a Bitcoin spot ETF, with investors selling off in large amounts to realize profits as the negative premium approaches zero.

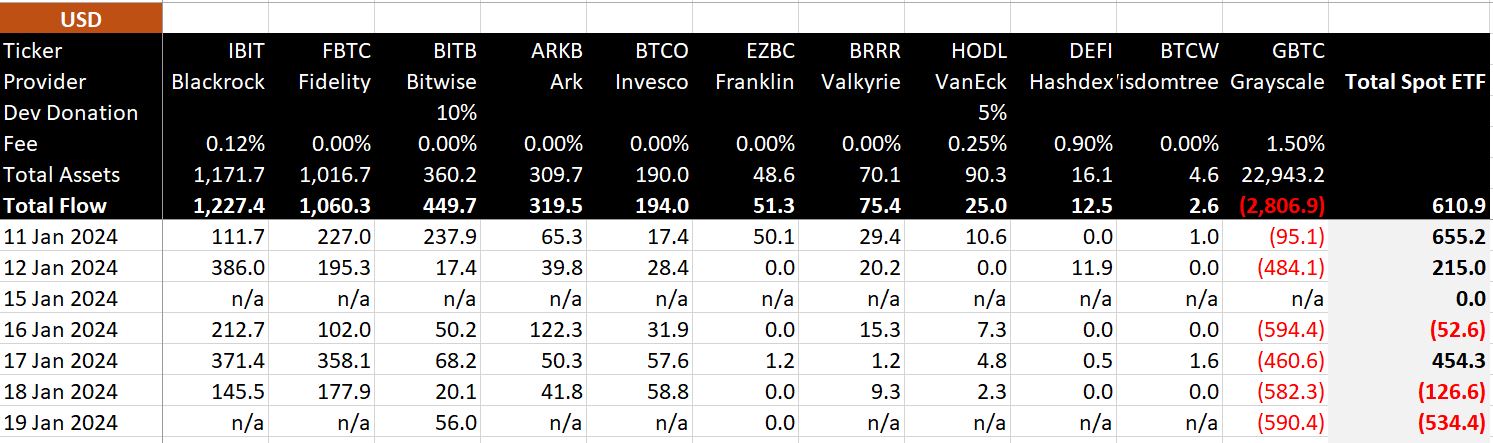

According to data from BitMEX Research shown, in the six trading days leading up to last Friday after the transformation of GBTC into a Bitcoin spot ETF, the total outflow of GBTC reached as high as $2.8 billion, with outflows of $95.1 million on the first day, $484.1 million on the second day, $594.4 million on the third day, $460.6 million on the fourth day, $582.3 million on the fifth day, and $590.4 million on the sixth day.

Changes in daily fund inflows and outflows of various Bitcoin spot ETFs. Source: BitMEX Research

Changes in daily fund inflows and outflows of various Bitcoin spot ETFs. Source: BitMEX Research

Will Bitcoin continue to fall?

Although some in the market believe that one of the reasons for the sale of GBTC may also be related to its high management fee of 1.5%, the funds selling off GBTC are likely to flow into other ETFs with lower management fees. However, Bloomberg analyst Eric Balchunas stated that he believes only about 10% of the GBTC funds will ultimately flow into other 9-tier ETFs, which is much less than people imagine.

Given that GBTC is currently the world's largest Bitcoin ETF, holding over $25 billion worth of Bitcoin, Ran Neuner, co-founder and CEO of Onchain Capital, previously warned that Bitcoin may face a period of selling pressure. $25 billion is a significant position, and even if only 20% is redeemed, it would mean $5 billion of selling pressure in the market.

Therefore, Chris J Terry, Chief Architect of BTCdata, stated in a tweet on the 21st that before the GBTC liquidation is complete, the price of Bitcoin will continue to remain flat or fall. In the coming weeks, there will be up to $25 billion in sales, and Grayscale's decision to maintain the ETF management fee at 1.5% will be the biggest strategic mistake in the history of cryptocurrencies.

Mike Novogratz is bullish on Bitcoin in the next 6 months

However, Galaxy Digital founder Mike Novogratz does not agree with Chris J Terry's argument. He stated in a tweet on the 21st that although people will sell off GBTC, most will turn to invest in other ETFs, and his own Invesco Galaxy Bitcoin ETF is his favorite:

We don't want to miss the forest for the trees. Now, it's easier for the baby boomer generation to buy targets, and you can get 4 to 5 times leverage through Bitcoin exposure. Indigestion will end, and Bitcoin will rise in the next 6 months.

Mike Novogratz had previously predicted in November last year that with the approval of the Bitcoin spot ETF, up to $10 billion in new funds would flow into Bitcoin ETFs in the first year, and this year the price of Bitcoin would surge to a historical high of $69,000, surpassing the bull market in 2021.

For those who want to seek warmth in a group or have doubts, feel free to join us - Public Brown Hao: Can Can Says Coin VX: 3379276514

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。