What should we do at the beginning of a bull market? Every decline is for the best rise. How to judge the beginning and the end of a bull market?

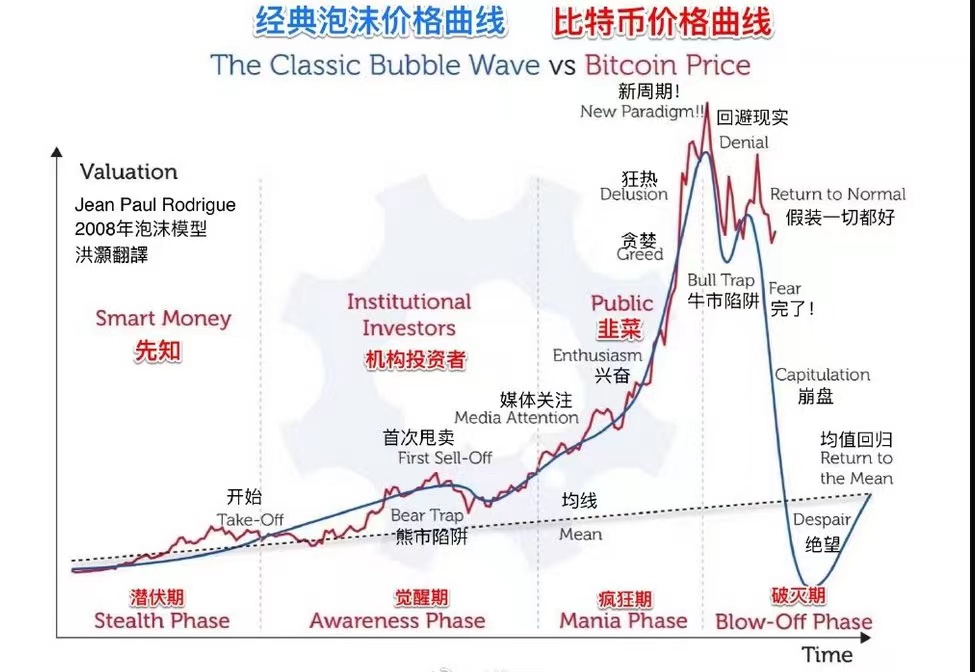

The significant feature of a bull market is that there will be at least two to three major mid-term corrections throughout the process, and after each correction, the market will continue to surge ahead.

Unless it is the last decline, the previous declines are all for better rises, and each rise will be higher than the previous one. When the last correction occurs, the bull market will come to an abrupt end with a sharp decline.

Therefore, it is very important to accurately judge which decline is for a better rise and which rise is in the final "crazy" period.

Various tracks rotate, market sentiment surges, and opportunities become more and more abundant, leading to a rapid increase in asset value. During this process, the time I spend on social media increases, and the frequency of gatherings also becomes more frequent, all in order to accurately judge the "enthusiasm" of the public for the current bull market. In terms of sentiment, this is an important basis for judgment.

This stage is called the so-called "bull beginning". I believe that the beginning of a bull market is when there are the most opportunities and the fastest accumulation of capital. During a bear market, everyone remains motionless, and the market is silent; at the peak of a bull market, everyone is close to madness, and there are more deceptive schemes. Only at the beginning of a bull market are there many opportunities and relatively high returns.

At this time, do not be afraid of the decline. Try to discover as many opportunities as possible, find ways to preserve your capital, select the best return on investment among many opportunities, and then heavily invest. During the emotionally charged "crazy bull" phase, gradually sell the assets you acquired at the beginning of the bull market in stages. Only then can your wealth achieve a qualitative leap over a cycle.

As for how to judge the final correction or the possible bear market stage, based on my previous experience, I have mentioned before that my judgment of the market at any time comes from: sentiment theory + specific market conditions.

I have already discussed sentiment theory. As for market conditions, in a normal bull market progression, it should be "increasing volume and rising prices," which means that the trading volume of the subsequent rise should be greater than the trading volume of the previous rise before the correction. If there is an obvious divergence in the volume of the new rise, meaning that the trading volume of the new rise does not reach a new high, or even falls below the trading volume of the previous rise, but the price continues to reach new highs, this is a highly dangerous signal, indicating that a reversal could occur at any time.

It is important to note that once a reversal occurs in this situation, the impact will be significant.

During this final sprint to the peak, do not be misled by the daily surge in the market value of your account. It is important to realize soberly that trend investing is not possible at the peak, and there will inevitably be a certain degree of profit retracement. If you continue to focus on the former highest market value of your account and fantasize about reaching the highest point, then you are no different from the majority of reckless gamblers. It is very likely that you will be influenced by a sense of luck, ultimately enduring the entire "crazy bear" phase and ending in tragedy.

Because when facing losses, people always like to take risks, which is a weakness of human nature. It is very easy to lose rationality due to losses, ignore greater risks, and choose to bet everything on one outcome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。