From January 12th, for five consecutive trading days, 54,343 BTC (2.313 billion US dollars) were transferred to Coinbase. On the other hand, institutions such as BlackRock and Fidelity have injected a total of 2 billion US dollars into the market. Although the actual difference in scale is not too large, the inflow has limitations, while the outflow does not.

Because Bitcoin ETFs are purchased and redeemed in US dollars, when clients initiate redemptions, Grayscale needs to liquidate BTC into US dollars to return to clients instead of directly providing BTC. Market selling pressure comes from here, as Grayscale needs to sell BTC in the market to exchange for US dollars to return to users.

The recent inflow of funds into Bitcoin spot ETFs from institutions such as BlackRock and Fidelity is also significant. However, the funds for purchases cannot immediately enter the market to buy BTC, and it will take at least 1-2 working days. Also, not all assets in the ETF are BTC; there may be some financial instruments in between, which actually track the performance of Bitcoin prices. This is similar to the significant deviation between the price of gold ETFs and the actual price of gold.

In simple terms, the incoming funds are still on the way and have not fully entered the market. The actual buying pressure will be less than the funds entering the market, but the selling pressure from Grayscale redemptions is real. With insufficient incoming funds and strong selling pressure, it has caused a significant market downturn.

When will the selling pressure slow down or stop?

I personally expect the selling pressure to be released in about two weeks and will not last too long.

The current incoming funds are delayed and have not yet reached a balanced state. The outflow of funds from the market is greater than the inflow, and the incoming funds cannot immediately enter the BTC market.

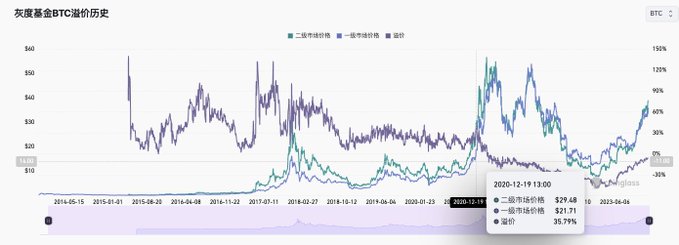

Although Grayscale's 580,000 BTC may seem frightening, the actual outflow is limited and cannot all be withdrawn. Additionally, the key point we have overlooked is that most of the holdings in GBTC are originally institutional. Furthermore, due to the high premium of GBTC (over 30% in 2020), the actual cost of holding is higher than $20,000. Although there is profit, it is not a huge profit that urgently needs to exit the market. Grayscale itself also holds a significant proportion.

Among the major holdings in GBTC, ARK has also passed the Bitcoin spot ETF. These original institutional holdings will be divided among ETFs such as BlackRock, Fidelity, and ARK. However, since spot ETFs cannot directly complete share conversions, redemptions and repositioning are required, resulting in a time gap and funding gap, leading to the current situation where the market needs to decline first.

The institutional repositioning behavior will not last too long, and the selling pressure from short-term profit-taking will mainly be concentrated in the first month. At that time, the market's selling pressure will significantly decrease, and it will reach a balanced state compared to the incoming funds.

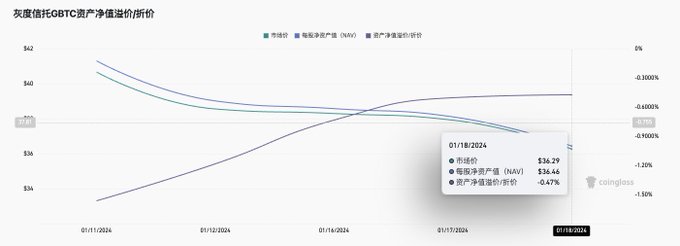

There is still a portion of arbitrage funds from the original GBTC negative premium intervention. The net asset value discount rate of the current GBTC has rapidly contracted, and this portion of the funds has almost exited the arbitrage, with little remaining impact from the potential arbitrage funds' selling pressure.

For those who want to seek warmth or have doubts, feel free to join us - Public Zonghao: Guanguan Shuibi VX: 3379276514

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。