Original Author: Xinwei, MT Capital

TL;DR

The necessity of parallel EVM lies in its solution to the efficiency problem of traditional EVM processing transactions in sequence. By allowing multiple operations to execute simultaneously, it significantly improves the network's throughput and performance.

The implementation methods of parallel EVM include schedule-based concurrent processing, multi-threaded EVM instances, system-level sharding, and face technical challenges such as unreliable timestamps, blockchain determinism, and validator incentive orientation.

Monad Labs aims to significantly improve the scalability and transaction speed of the blockchain through its Layer 1 project Monad, featuring characteristics such as processing up to 10,000 transactions per second, 1-second block time, parallel execution capability, and MonadBFT consensus mechanism.

Sei V2 is an important upgrade of the Sei network, aiming to become the first fully parallelized EVM, providing backward-compatible EVM smart contracts, optimistic parallelization, new SeiDB data structure, and interoperability with existing chains, with the goal of greatly improving transaction processing speed and network scalability.

Neon EVM is a platform on Solana designed to provide an efficient, secure, decentralized environment for Ethereum dApps, allowing developers to easily deploy and run dApps while leveraging Solana's high throughput and low cost advantages.

Lumio is a Layer 2 solution developed by Pontem Network, which innovatively addresses Ethereum's scalability challenges through unique support for EVM and Move VM used by Aptos, elevating the Web3 experience to near Web2 levels.

Eclipse is an Ethereum Layer 2 solution that accelerates transaction processing using SVM, adopts a modular rollup architecture, integrates Ethereum settlement, SVM smart contracts, Celestia data availability, and RISC Zero fraud proofs.

Solana utilizes its Sealevel technology to achieve parallel smart contract processing, Sui improves throughput through Narwhal and Bullshark components, Fuel achieves parallel transaction execution through the UTXO model, and Aptos uses the Block-STM engine to enhance transaction processing capabilities, demonstrating different implementations and advantages of parallel technology in the blockchain field.

The main challenges of adopting parallel processing include resolving data race and read-write conflict issues, ensuring compatibility with existing standards, adapting to new ecosystem interaction patterns, and managing increased system complexity, especially in terms of security and resource allocation.

Parallel EVM demonstrates tremendous potential in enhancing blockchain scalability and efficiency, marking a major shift in blockchain technology by improving transaction processing capabilities through simultaneous execution by multiple processors, breaking through the limitations of traditional sequential transaction processing. While parallel EVM offers tremendous potential, its successful implementation requires overcoming complex technical challenges and ensuring widespread ecosystem adoption.

Basic Concepts of Parallel EVM

Introduction to EVM

The Ethereum Virtual Machine (EVM) is the core component of the Ethereum blockchain, serving as its computational engine. It is a Turing-complete machine that provides a runtime environment for executing smart contracts on the Ethereum network, which is crucial for maintaining trust and consistency throughout the entire Ethereum ecosystem.

EVM executes smart contracts by processing bytecode, which is a more basic form of smart contract code compiled from high-level programming languages (such as Solidity). These bytecodes consist of a series of opcodes used to perform various functions, including arithmetic operations and data storage/retrieval. EVM operates as a stack machine, processing operations in a last-in, first-out manner, with each operation in EVM incurring associated gas costs. The gas system measures the computational work required to execute operations, ensuring fair resource allocation and preventing network abuse.

In Ethereum, transactions play a crucial role in EVM functionality. There are two types of transactions: those that result in message calls and those that result in contract creation. Contract creation leads to the creation of a new contract account containing the compiled bytecode of the smart contract, which is executed when another account makes a message call to it.

The architecture of EVM includes components such as bytecode, stack, memory, and storage. It has a dedicated memory space for temporarily storing data during execution and persistent storage space on the blockchain for indefinitely storing data. EVM's design ensures the secure execution environment of smart contracts, isolating them to prevent reentrancy attacks and implementing various security measures such as gas and stack depth limits.

Furthermore, the influence of EVM extends beyond Ethereum, extending to a wider range through EVM-compatible chains. While these chains may differ, they maintain compatibility with Ethereum-based applications, enabling seamless interaction with Ethereum-based applications. These chains play a critical role in various fields such as enterprise solutions, GameFi, and DeFi.

Necessity of Parallel EVM

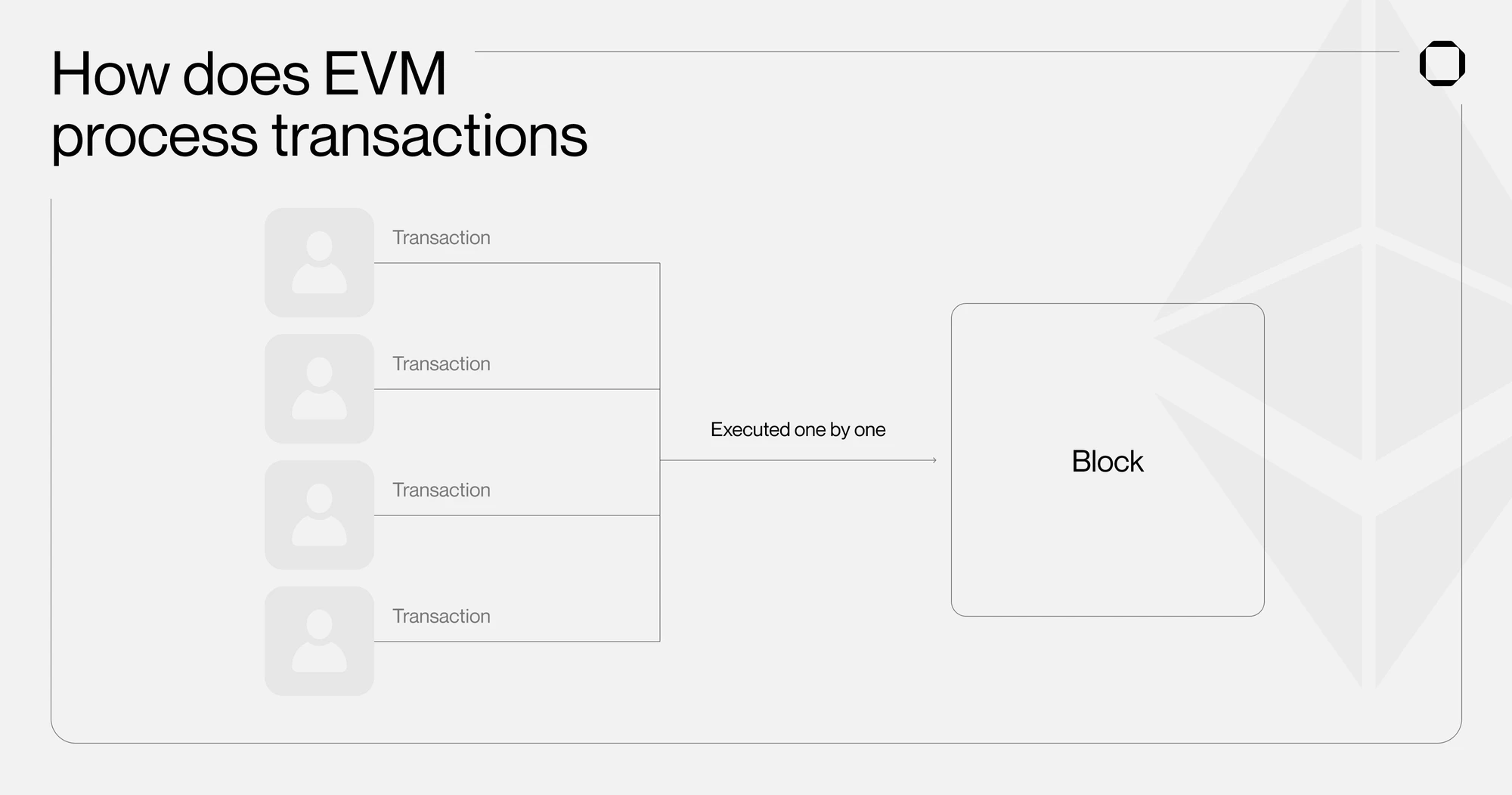

The necessity of parallel Ethereum Virtual Machine (EVM) lies in its ability to significantly enhance the performance and efficiency of blockchain networks. Traditional EVM processes transactions in sequence, which not only consumes a large amount of energy but also imposes a heavy burden on network validators. This processing method often leads to high transaction costs and low efficiency, considered a major obstacle to the widespread adoption of blockchain.

Parallel EVM fundamentally changes the consensus process by allowing multiple operations to execute simultaneously. The capability of parallel execution greatly enhances the network's throughput, thereby strengthening the overall performance and scalability of the entire blockchain. With parallel EVM, blockchain networks can process more transactions in a shorter time, effectively addressing common congestion issues and slow processing times in traditional blockchain systems.

Parallel EVM has a significant impact on various aspects of blockchain technology:

It provides a more energy-efficient transaction processing method. By reducing the workload of validators and the entire network, parallel EVM contributes to building a more sustainable blockchain ecosystem.

Improved scalability and increased throughput directly result in lower transaction fees. Users will enjoy a more economical experience, making blockchain platforms more attractive to a wider audience.

Processing multiple transactions simultaneously, rather than sequentially, means that dApps can run more smoothly even during periods of high network demand.

Implementation Methods of Parallel EVM

In the current EVM architecture, the most delicate read and write operations are sload and sstore, used for reading and writing data from the state trie, respectively. Therefore, ensuring that different threads do not conflict on these two operations is a simple entry point for implementing parallel/concurrent EVM. In fact, Ethereum has a special type of transaction that includes a special structure called an "access list," which allows transactions to carry the storage addresses to be read and modified. Thus, this provides a good starting point for implementing schedule-based concurrent methods.

In terms of system implementation, there are three common forms of parallel/concurrent EVM:

Multi-threading of a single EVM instance.

Multi-threading of multiple EVM instances on a single node.

Multi-threading of multiple EVM instances on multiple nodes (essentially system-level sharding).

The differences between parallel/concurrent processing in blockchain and database systems are:

Unreliable timestamps make it difficult to deploy time-based concurrent methods in the blockchain world.

Absolute determinism on blockchain systems to ensure that transactions re-executed by different validators are the same.

Validators' ultimate goal is higher returns, not faster transaction execution.

So, what do we need?

We need system-level consensus, where faster execution will bring higher returns.

Considering the multivariable scheduling algorithm of block limits, it can capture more income while being able to complete execution faster.

Finer-grained data operations, including opcode-level data locking, memory caching layers, etc.

Main Projects and Their Technologies

Monad Labs

Monad is an EVM Layer 1 project aimed at significantly improving the scalability and transaction speed of the blockchain through its unique technological features. One of Monad's key advantages is its ability to process up to 10,000 transactions per second and has a 1-second block time. This is made possible by its MonadBFT consensus mechanism and EVM compatibility, enabling efficient and fast transaction processing.

One of the most notable features of Monad is its parallel execution capability, allowing it to process multiple transactions simultaneously. This greatly improves network efficiency and throughput compared to the sequential processing method used in traditional blockchain systems.

Monad's development is led by Monad Labs, co-founded by Keone Hon, Eunice Giarta, and James Hunsaker. The project has successfully raised a seed funding of $19 million and plans to launch a testnet in the mid-first quarter of 2024, followed by the mainnet launch.

Monad has been optimized in the following four main areas, making it a high-performance blockchain:

MonadBFT:

MonadBFT is a high-performance consensus mechanism for the Monad blockchain, used to achieve transaction ordering consistency under partially synchronous conditions in the presence of Byzantine actors. It is an improved version based on HotStuff, using a two-phase BFT algorithm, with optimistic responsiveness, and linear communication overhead in common cases and quadratic communication overhead in timeout cases. In MonadBFT, the leader sends a new block and the previous round's QC (Quorum Certificate) or TC (Timeout Certificate) to the validators each round. Validators audit the block, and if they agree, they send a signed "yes" vote to the next round's leader. This process aggregates "yes" votes from **2f+1** validators using threshold signatures to form a QC. In common communication cases, the leader sends the block to the validators, who directly send votes to the next round's leader. MonadBFT also uses pairing-based BLS signatures to address scalability issues, aggregating incremental signatures into one signature, and verifying a single valid aggregate signature can prove that all shares associated with the public key have signed the message. For performance considerations, MonadBFT uses a hybrid signature scheme, where BLS signatures are only used for aggregatable message types (votes and timeouts). The integrity and authenticity of messages are still provided by ECDSA signatures. Due to these features, MonadBFT can achieve efficient and robust blockchain consensus.

Delayed Execution:

This is a key innovation that decouples the execution process from the consensus process. In this architecture, the consensus process involves nodes agreeing on the official ordering of transactions, while execution is the actual process of executing these transactions and updating the state. In this design, the leader proposes transaction ordering but does not know the final state root when proposing the ordering; validators do not know if all transactions in the block will execute successfully when voting on block validity. This design allows Monad to achieve significant speed improvements, enabling a single-shard blockchain to scale to millions of users. In Monad, each node independently executes transactions in block N while reaching consensus on block N, and begins to reach consensus on block N+1. This approach allows for a larger gas budget, as execution only needs to keep up with the speed of consensus. Additionally, because execution only needs to keep up with consensus on average, this approach is more tolerant to specific changes in computational time. To further ensure state machine replication, Monad includes a delayed Merkle root in block proposals, delayed by D blocks. This delayed Merkle root ensures consistency across the entire network even in the presence of nodes executing incorrectly or maliciously. In MonadBFT, the final determinism is single-slot (1 second), and the execution results typically lag behind by less than 1 second across all nodes. This single-slot final determinism means that users will see the official ordering of transactions after a single block following their submission. There is no possibility of reordering unless a supermajority of the network behaves maliciously. For users who need to quickly know the results of transactions (e.g., high-frequency traders), running a full node minimizes latency.

Parallel Execution:

It enables Monad to execute multiple transactions simultaneously. This approach initially seems different from Ethereum's execution semantics, but in reality, it is not. Blocks in Monad are the same as blocks in Ethereum, both being linearly ordered sets of transactions. The results of executing these transactions are the same between Monad and Ethereum. In parallel execution, Monad uses an optimistic execution approach, starting to execute subsequent transactions before earlier transactions in the block are completed. This sometimes leads to incorrect execution results. To address this issue, Monad tracks the inputs used in the execution process and compares them with the outputs of previous transactions. If differences exist, it indicates the need to re-execute the transaction with the correct data. Additionally, Monad uses a static code analyzer to predict dependencies between transactions during execution to avoid invalid parallel execution. In the best case, Monad can predict many dependencies in advance; in the worst case, it falls back to a simple execution mode. Monad's parallel execution technology not only improves network efficiency and throughput but also reduces cases of transaction failures caused by parallel execution through optimized execution strategies.

MonadDb:

MonadDb is optimized for data storage and processing. It is part of Monad's optimization strategy aimed at improving overall network performance, particularly in handling state and transaction data. This component design is intended to enhance the efficiency and scalability of data storage, improving the blockchain network's ability to process large amounts of data. It includes improved data indexing mechanisms, more efficient storage structures, and optimized data access paths. These optimizations help reduce data access times, improve transaction processing speed, and enhance the overall performance of the entire blockchain network.

Ecosystem Projects

Tayaswap:

TayaSwap is an AMM DEX based on Monad, supported by SubLabs, allowing the trading of assets without traditional order books or intermediaries. AMM relies on mathematical formulas and smart contracts to facilitate token exchanges, determine prices, and enable peer-to-peer transactions.

Ambient Finance:

Ambient (formerly CrocSwap) is a decentralized exchange protocol that allows the creation of bilateral AMM pools combining concentrated and constant product liquidity for any pair of blockchain assets. Ambient operates the entire DEX in a single smart contract, where a single AMM pool is a lightweight data structure rather than a separate smart contract.

Shrimp Protocol:

Shrimp is a (3,3) DEX with a flywheel token economy, supporting real-world assets, and is set to land on Monad.

Catalyst:

Catalyst is a permissionless liquidity solution for modular blockchains, designed to connect all chains and provide access to any asset anywhere. Catalyst enables developers to automatically connect to all chains, gain access to users in a unified ecosystem, and its simple, decentralized, and self-hosted design ensures secure and seamless access to liquidity.

Swaap:

Swaap is a market-neutral automated market maker (AMM). It combines oracles and dynamic spreads to provide sustainable returns for liquidity providers and cheaper prices for traders. The protocol significantly reduces impermanent loss and provides multi-asset pools.

Elixir:

Elixir is a decentralized market-making protocol that interacts with centralized exchanges using market-making algorithms through API calls, bringing liquidity to long-tail crypto assets.

Timeswap:

Timeswap

Timeswap is a decentralized currency market protocol based on AMM, which does not use oracles or liquidators. Unlike Uniswap, where borrowing involves trading tokens in real-time, borrowing on Timeswap involves trading tokens until the repayment is completed. The lender provides asset A for borrowing while "protecting" the borrower with a certain amount of asset B as collateral. Users can adjust their risk profile to obtain higher interest rates with a lower collateral ratio, and vice versa.

Poply

Poply is a community-based NFT marketplace specifically tailored for the Monad chain, showcasing and empowering NFT collections created specifically for this chain, attracting individuals interested in unique NFTs to trade ERC-721 tokens using AI-generated art and user-friendly interfaces.

Switchboard

Switchboard is a permissionless, customizable, multi-chain oracle protocol for general data feeds and verifiable randomness. By allowing anyone to push any form of data, regardless of data type, it provides users with a one-stop service and contributes to driving the development of next-generation decentralized applications.

Pyth Network

Pyth Network, developed by Douro Labs, is a next-generation price oracle solution aimed at providing valuable on-chain financial market data, including cryptocurrencies, stocks, forex, and commodities, to projects, protocols, and the public through blockchain technology. The network aggregates first-party price data from over 70 trusted data providers and publishes it for use by smart contracts and other on-chain or off-chain applications.

AIT Protocol

AIT Protocol is an artificial intelligence data infrastructure that offers Web3 AI solutions. The decentralized market of AIT provides a unique and extensive opportunity for millions of cryptocurrency users to participate in "earn while training" tasks, allowing them to contribute to the development and advancement of AI models while earning rewards.

Notifi

Notifi provides a universal communication layer for all Web3 projects, planning to embed notification and messaging functionalities into decentralized applications for user interaction on digital and on-chain channels. The Notifi API allows developers to unlock complex communication infrastructure through simple API, providing a native user experience for applications worldwide. Notifi Center offers users a customized notification experience, allowing them to view and manage all information in the Web3 world from mobile and web platforms. Notifi Push enables marketers to create cohesive multi-channel engagement to drive business growth and retain their user base.

ACryptoS

ACryptoS is an advanced crypto strategy platform, serving as a multi-chain yield aggregator optimizer and DEX, offering various unique products including auto-compounding single-asset vaults, dual-asset LP vaults, unique liquidity vaults, Balancer-V2 branch DEX, and stablecoin exchange. Initially launched on the BNB chain in November 2020, ACryptoS has expanded to 11 chains, deploying over 100 vaults to support DeFi users and protocols.

MagmaDAO

MagmaDAO is a DAO-controlled liquidity staking protocol aimed at achieving fair token distribution through ecosystem competition airdrops. It is the first distributed validator outside of Ethereum, built on the fastest, cheapest, and most censorship-resistant EVM L1 Monad.

Wombat Exchange

Wombat Exchange is a multi-chain stablecoin exchange with open liquidity pools, low slippage, and single-sided staking.

Wormhole

Wormhole is a decentralized universal messaging protocol that enables developers and users of cross-chain applications to leverage the advantages of multiple ecosystems.

DeMask Finance

DeMask Finance is an on-chain AMM protocol for trading between NFTs and ERC20 tokens. DeMask Finance supports the creation of NFT collections and NFT launchpads paired with ETH and other tokens. The NFT decentralized exchange supports ERC-1155 NFTs or other tokens paired with ETH and ERC-20 tokens. The DeMask protocol aims to increase liquidity in the NFT market, providing an interface for seamless exchange between ERC20 tokens or native tokens and NFT collections. DeMask is an interconnected smart contract system, allowing all users to create and own liquidity pools and conduct trades in a fully automated manner. Each pool holds a pair of assets, including a token and an NFT, providing a fixed price for instant trades. This also allows other contracts to estimate the average price of the two assets over time. Users with liquidity pools will be rewarded when exchanging asset pairs.

Sei V2

Sei V2 is a significant upgrade to the Sei network, aiming to be the first fully parallelized EVM. This upgrade will equip Sei with the following features:

Backward compatibility with EVM smart contracts:

This means that developers can deploy audited, EVM-compatible smart contracts on Sei without the need to modify their code. This is crucial for developers as it simplifies the process of migrating existing smart contracts from other blockchains such as Ethereum to Sei. From a technical perspective, Sei nodes will automatically import Geth, the Go implementation of the Ethereum Virtual Machine. Geth will be used to process Ethereum transactions, and any resulting updates (including state updates or calls to non-EVM-related contracts) will be routed through a special interface created by Sei for the EVM.

Optimistic parallelization:

It allows the blockchain to support parallelization without requiring developers to define any dependencies. This means that all transactions can run in parallel, and when conflicts arise (e.g., transactions touch the same state), the chain will track the storage portions each transaction touches and rerun these transactions in sequence. This process will continue recursively until all unresolved conflicts are resolved. Because transactions are sequentially ordered in blocks, this process is deterministic, simplifying the developer workflow while maintaining chain-level parallelism.

SeiDB:

It will introduce a new data structure called SeiDB to optimize the platform's storage layer. The primary goal of SeiDB is to prevent state bloat, where the network becomes excessively data-heavy, while simplifying the state synchronization process for new nodes. This design aims to enhance the overall performance and scalability of the Sei blockchain. Sei V2 achieves this goal by transforming the traditional IAVL tree into a dual-component system—state storage and state commitment. This change significantly reduces latency and disk usage, and Sei V2 also plans to transition to using PebbleDB to improve the read/write performance of multi-threaded access.

Interoperability with existing chains:

Sei V2 allows seamless integration between EVM and any other execution environment supported by Sei, providing developers with a smoother experience to access native tokens and other chain functionalities such as staking. It will also create a new component to support EVM smart contracts. These EVM smart contracts will benefit from all the changes made for consensus and parallelization and will also be able to interact with existing Cosmwasm smart contracts.

In terms of performance, Sei V2 will provide a throughput of 28,300 batch transactions per second, with a block time and finality of 390 milliseconds each, enabling Sei to support more users, provide a better interactive experience, and offer lower transaction costs than existing blockchains.

The main upgrade progress of Sei V2 is currently nearing code completion. After the audit is completed, this upgrade will be released on the public testnet in the first quarter of 2024 and deployed to the mainnet in the first half of 2024.

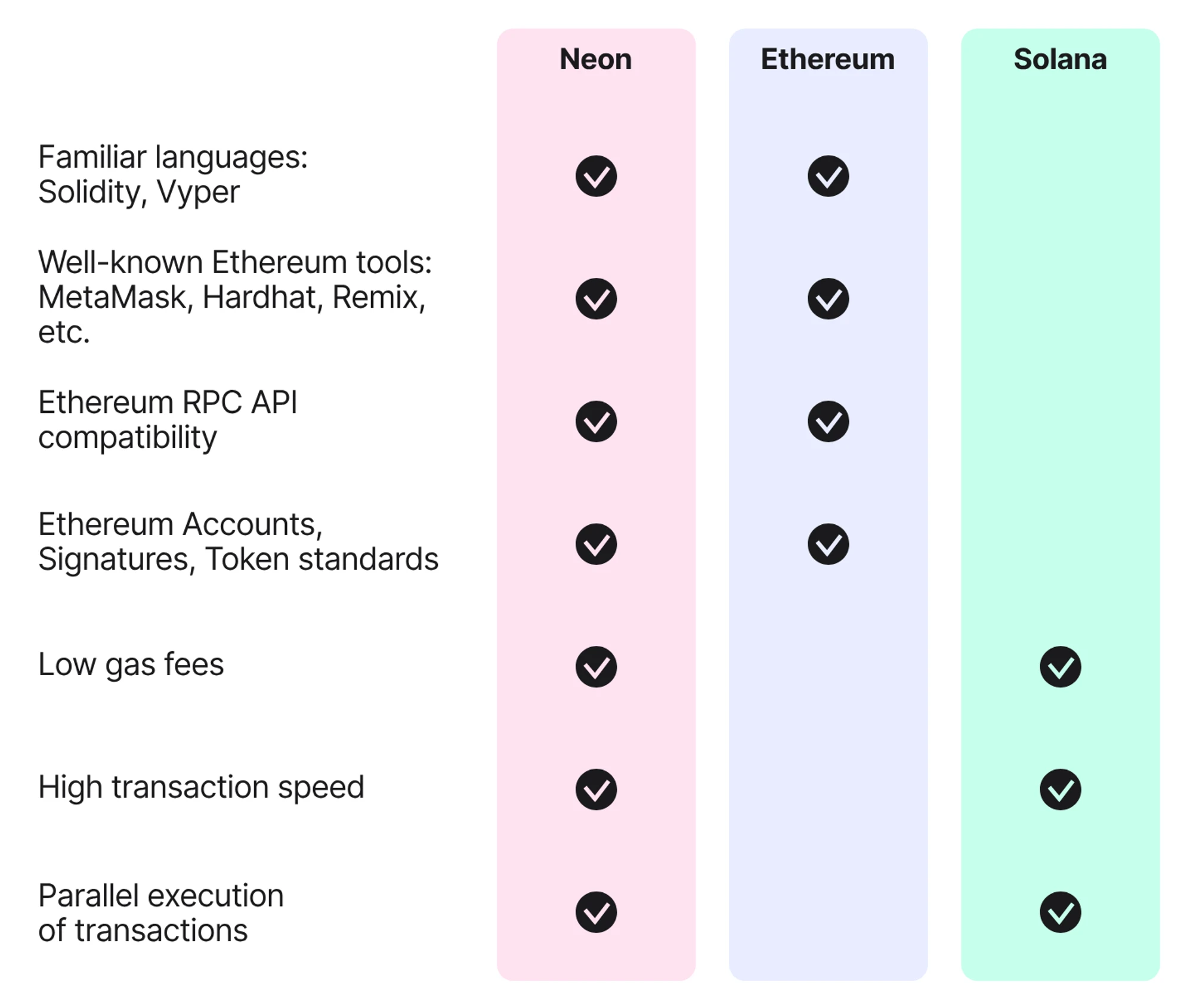

Neon

Neon EVM leverages the capabilities of the Solana blockchain to provide an efficient environment for Ethereum dApps. It runs as a smart contract within Solana, allowing developers to deploy Ethereum dApps with minimal or no code changes and benefit from the advanced features of Solana. The architecture and operation of Neon EVM focus on security, decentralization, and sustainability, providing Ethereum developers with a seamless transition to the Solana environment. It utilizes Solana's advantages such as parallel transaction execution, high throughput, and reduced costs, including low fees and high transaction speeds. The key components of the Neon EVM ecosystem include:

Neon EVM Program:

It is an EVM compiled into Berkeley Packet Filter bytecode, running on Solana. It processes Ethereum-like transactions (Neon transactions) on Solana, following Ethereum rules. Neon EVM is configured through decentralized multi-sign EVM accounts, allowing participants to modify Neon EVM code and set parameters.

The process of handling transactions by Neon EVM involves several key steps. Users initiate Ethereum-like transactions (N-tx) through Ethereum-compatible wallets. These transactions are encapsulated into Solana transactions (S-tx) by Neon Proxy and then passed to the Neon EVM program hosted on Solana. The Neon EVM program unpacks the transactions, verifies user signatures, loads EVM state (including account data and smart contract code), executes transactions in the Solana BPF (Berkeley Packet Filter) environment, and updates Solana's state to reflect the new Neon EVM state.

Neon Proxy:

It enables Ethereum dApps to be ported to Neon with minimal reconfiguration. Neon Proxy packages EVM transactions into Solana transactions in the form of a containerized solution for ease of use. Operators running Neon Proxy servers facilitate the execution of Ethereum-like transactions on Solana, accepting NEON tokens as gas fees and other payments within the Solana ecosystem.

Neon DAO:

The DAO provides governance services for the Neon Foundation and guides future research and development. It operates a series of contracts on Solana, providing a governance layer to control Neon EVM functionality. NEON token holders can participate in DAO activities, including proposing and voting on decisions.

NEON Token:

This utility token serves two main functions—paying gas fees and participating in governance through the DAO.

Integrations and Tools:

Neon EVM supports various integrations and tools for development and analysis. These include block explorers (such as NeonScan), ERC-20 SPL wrappers for token transfers, NeonPass for transferring ERC-20 tokens between Solana and Neon EVM, NeonFaucet for providing test tokens, and compatibility with EVM-compatible wallets like MetaMask.

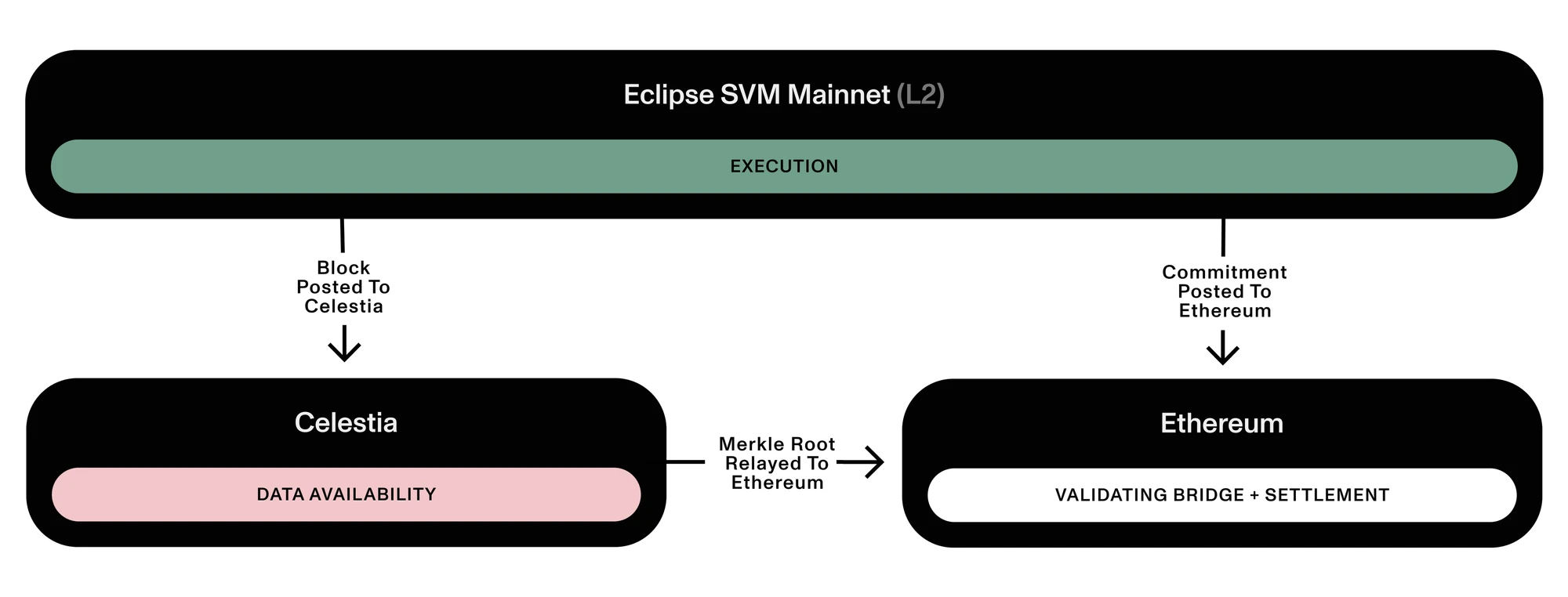

Eclipse

Eclipse is a Layer 2 solution for Ethereum designed to significantly accelerate transaction processing by leveraging the Solana Virtual Machine (SVM). Its design aims to achieve speed and scalability, adopting a modular rollup architecture and integrating key technologies such as Ethereum settlement, SVM smart contracts, Celestia data availability, and RISC Zero fraud proofs.

Specifically, Eclipse Mainnet combines the best modular stack components:

Settlement Layer - Ethereum:

Eclipse uses Ethereum as its settlement layer. Transactions are finalized and secured at this layer. Using Ethereum not only means leveraging its robust security and liquidity but also using ETH as the gas token for transaction fees. This setup allows Eclipse to inherit strong security features from Ethereum.

Execution Layer - SVM:

Eclipse adopts SVM for smart contract execution. In contrast to the sequential execution of transactions by EVM, SVM can process transactions in parallel. Its Sealevel runtime's feature allows parallel processing of transactions that do not involve overlapping states, enabling Eclipse to scale horizontally and increase throughput.

Data Availability - Celestia:

To ensure timely and verifiable data availability, Eclipse adopts Celestia. Celestia provides a scalable and secure platform for data publication, serving as a crucial support for Eclipse's high throughput.

Fraud Proofs - RISC Zero:

Eclipse integrates RISC Zero for zero-knowledge fraud proofs, eliminating the need for intermediate state serialization and thereby improving system efficiency and security.

The design goal of Eclipse is to provide a truly scalable general Layer 2 solution for Ethereum. It aims to address the limitations and resulting isolation and complexity issues brought about by specific application rollups, which could degrade the user and developer experience. Through its modular rollup system and integrated technical components, Eclipse provides an attractive choice for building scalable and high-performance dApps on Ethereum.

Lumio

Lumio is a Layer 2 solution developed by Pontem Network to address Ethereum's scalability challenges and bring a Web2-like experience to Web3. It stands out as a unique rollup in the blockchain space because it can simultaneously support EVM and the Move VM used by Aptos. This dual compatibility allows Lumio to process transactions on Aptos while settling on Ethereum, providing a versatile and efficient solution for dApp developers and users. It has several key features:

Dual Virtual Machine Compatibility: Lumio uniquely supports both EVM and Aptos' Move VM. This dual compatibility allows Lumio to seamlessly integrate the functionalities of Ethereum and Aptos, enhancing the flexibility and efficiency of dApp development and execution.

High Throughput and Low Latency: By leveraging high-performance chains like Aptos for transaction ordering, Lumio significantly boosts transaction bandwidth. This integration ensures that Lumio can efficiently handle a large volume of transactions while maintaining the security and liquidity features of Ethereum.

Optimistic Rollup Technology: Lumio utilizes an open-source optimistic rollup technology with an OP stack. Optimistic rollups are known for their efficient transaction processing and lower costs, making them suitable for scaling Ethereum-based applications.

Flexible Gas Fee Economic Model: Lumio introduces an application-centric gas fee economic model. This model allows application developers to directly benefit from network usage, potentially incentivizing more innovative and user-friendly dApp development.

Interoperability and Integration: Lumio is capable of processing transactions on Aptos and settling on Ethereum, demonstrating a high degree of interoperability between different blockchain ecosystems. This feature enables developers to fully leverage the advantages of Ethereum and Aptos in their applications.

Balancing Security and Scalability: By combining Ethereum's robust security and Aptos' scalability, Lumio provides an attractive solution for building high-performance, secure dApps. The architecture of Lumio is designed to effectively balance these two key aspects.

Lumio is currently in the closed testing phase and is planned to be gradually rolled out to selected users. This approach allows for comprehensive testing and improvements to the platform based on user feedback, ensuring a robust and user-friendly platform for broader release.

Other Parallel Projects in the Industry

Solana

Solana's Sealevel technology is a key component of its blockchain architecture, aimed at enhancing the performance of smart contracts through parallel processing. This approach significantly differs from the single-threaded processing of other blockchain platforms, such as EVM and EOS' WASM-based runtimes, which process one contract at a time and sequentially modify the blockchain state.

Sealevel enables Solana's runtime to parallel process tens of thousands of contracts, utilizing all available cores of validators. This parallel processing capability is made possible because Solana transactions explicitly describe all the state they will read or write during execution, allowing non-overlapping transactions to be executed concurrently and transactions that read the same state to be processed.

The core functionality of Sealevel is based on Solana's unique architecture, including components such as the Cloudbreak account database and the Proof of History (PoH) consensus mechanism. Cloudbreak maps public keys to accounts, which maintain balances and data, while programs (stateless code) manage the state transitions of these accounts.

Transactions in Solana specify an instruction vector, with each instruction containing a program, program instructions, and a list of accounts the transaction wishes to read or write. This interface is inspired by low-level operating system interfaces to devices, allowing the Solana Virtual Machine (SVM) to sort through millions of pending transactions and schedule the parallel processing of all non-overlapping transactions. Additionally, Sealevel can sort all instructions by program ID and run the same program on all accounts simultaneously, a process similar to SIMD (Single Instruction, Multiple Data) optimization used in GPUs.

Sealevel offers several benefits, including enhanced scalability, reduced latency, cost efficiency, and improved security. It enables the Solana network to process a significantly higher number of transactions per second, provide nearly instant transaction finality, and lower transaction fees. Even during parallel processing, the security of smart contracts is maintained through Solana's robust security protocols.

By implementing high-speed parallel processing and increased transaction throughput, Sealevel makes Solana a powerful decentralized application platform.

Sui

Sui's parallel technology features make it an efficient, high-throughput blockchain platform suitable for various Web3 applications and use cases. These notable features work together to improve the efficiency and throughput of its network:

Narwhal and Bullshark Components: These two components are crucial to Sui's consensus mechanism. Narwhal serves as a memory pool, accelerating transaction processing, improving network efficiency, and ensuring data availability when submitted to Bullshark (the consensus engine). Bullshark is responsible for sorting the data provided by Narwhal, using Byzantine fault tolerance to validate the transactions' validity and distribute them across the network.

Asset Ownership Model: In the Sui network, assets can be owned by a single owner or shared by multiple owners. Assets owned by a single owner can be freely transferred within the network, while shared assets require validation through the consensus system. This asset ownership system not only improves transaction processing efficiency but also allows developers to create various types of assets for their applications.

Distributed Computing: Sui's design allows the network to scale resources based on demand, similar to cloud services. This means that as demand for the Sui network increases, network validators can add more processing power to maintain network stability and keep gas fees low.

Sui Move Programming Language: Sui Move is Sui's native programming language designed to create high-performance, secure, and feature-rich applications. It is based on the Move language and aims to address the shortcomings in smart contract programming languages, improving smart contract security and programmer efficiency.

Programmable Transaction Blocks (PTB): PTB in Sui is a complex, composable sequence of transactions that can access any public on-chain Move function in all smart contracts. This design provides strong guarantees for payment or finance-oriented applications.

Horizontal Scalability: Sui's scalability extends beyond transaction processing to storage. This allows developers to define complex assets with rich attributes and store them directly on the chain without resorting to indirect off-chain storage to save on gas fees.

Fuel

In the Fuel network, "parallel transaction execution" is a key technology that enables the network to efficiently process a large volume of transactions. The core of this parallel execution is achieved through the use of a strict state access list based on the Unspent Transaction Output (UTXO) model, which is a fundamental element in Bitcoin and many other cryptocurrencies.

Fuel introduces the capability of parallel transaction execution within the UTXO model. By using a strict state access list, Fuel can process transactions in parallel, utilizing more CPU threads and cores that are typically idle in single-threaded blockchains. This allows Fuel to provide more computational power, state access, and transaction throughput compared to single-threaded blockchains.

Fuel addresses concurrency issues in the UTXO model. In Fuel, users do not directly sign UTXOs but instead sign contract IDs, indicating their intent to interact with contracts. As a result, users do not directly change the state, leading to the consumption of UTXOs. Instead, block producers are responsible for determining how various transactions in a block affect the overall state, impacting contract UTXOs. The consumed contract UTXOs create new UTXOs with the same core features but updated storage and balances.

To achieve parallel transaction execution, Fuel has developed a specific virtual machine—FuelVM. The design of FuelVM focuses on reducing wasteful processing in traditional blockchain virtual machine architectures while providing more potential design space for developers. It combines lessons learned and proposed improvements from the Ethereum ecosystem over the years, which could not be implemented on Ethereum due to the need to maintain compatibility with previous versions.

Aptos

Aptos Blockchain adopts a parallel execution engine called Block-STM (Software Transaction Memory) to enhance its transaction processing capabilities. This technology allows Aptos to execute transactions in each block in a predetermined order and allocate transactions to different processor threads during execution. The core idea of this approach is to record the memory locations modified by transactions while executing all transactions. After all transaction results are verified, if a transaction is found to access a memory location modified by a previous transaction, that transaction will be invalidated. The aborted transactions will then be re-executed, and this process repeats until all transactions are completed.

Unlike other parallel execution engines, Block-STM maintains the atomicity of transactions without needing to know the data to be read/written in advance. This allows developers to more easily build highly parallelized applications. Block-STM supports richer atomicity than other parallel execution environments, which often require breaking logical atomicity by splitting operations into multiple transactions. By reducing latency and improving cost efficiency, Block-STM enhances user experience.

Additionally, Aptos also employs a consensus mechanism called AptosBFTv4, which is a rigorously proven production blockchain BFT protocol. This protocol optimizes responsiveness, providing low latency and high throughput, fully leveraging the advantages of the underlying network. AptosBFTv4 adopts a pipeline design similar to a processor, ensuring maximal resource utilization at each step. Therefore, a single node may participate in many aspects of consensus, from selecting transactions to include in a block, executing another set of transactions, writing the output of another set of transactions to storage, and authenticating the output of another set of transactions. This ensures that throughput is limited only by the slowest stage, rather than the sequential combination of all stages.

Challenges

Technical Challenges

In general, the core challenge of adopting parallel or concurrent approaches is the issue of data races, read-write conflicts, or data hazards. All these terms describe the same problem: different threads or operations attempting to read and modify the same data simultaneously. Implementing efficient and reliable parallel systems requires addressing complex technical issues, especially in ensuring predictable and conflict-free execution of parallel operations across thousands of decentralized nodes. Additionally, the challenge of technical compatibility lies in ensuring that new parallel processing methods can be compatible with existing EVM standards and smart contract code.

Ecosystem Adaptation

For developers, they may need to learn new tools and methods to maximize the advantages of parallel EVM. Additionally, users also need to adapt to potential new interaction patterns and performance characteristics. This requires all participants in the ecosystem (including developers, users, and service providers) to have a certain level of understanding and adaptability to new technologies. Furthermore, a robust blockchain ecosystem relies not only on its technical features but also on widespread developer support and a rich array of applications. For new technologies like parallel EVM to succeed in the market, they need to establish sufficient network effects to attract developer and user participation.

Increased System Complexity

Parallel EVM requires efficient network communication to support data synchronization across multiple nodes. Network latency or synchronization failures may lead to inconsistent transaction processing, increasing the complexity of system design. To effectively leverage the advantages of parallel processing, the system needs to intelligently manage and allocate computing resources. This may involve dynamically distributing loads across different nodes and optimizing the use of memory and storage. Developing smart contracts and applications that support parallel processing is more complex than traditional sequential execution models. Developers need to consider the characteristics and limitations of parallel execution, which may make the coding and debugging process more challenging. In a parallel execution environment, security vulnerabilities may be amplified, as a security issue could affect multiple parallel-executed transactions. Therefore, stricter security audits and testing processes are required.

Future Outlook

Parallel EVM demonstrates significant potential in improving the scalability and efficiency of blockchain. The parallel EVMs mentioned above represent a significant shift in blockchain technology, aiming to enhance transaction processing capabilities by executing transactions simultaneously on multiple processors. This approach breaks away from traditional sequential transaction processing, allowing for higher throughput and lower latency, which are crucial for the scalability and efficiency of blockchain networks.

The successful implementation of parallel EVM largely depends on the foresight and skills of developers, especially in the design of smart contracts and data structures. These elements are crucial in determining whether transactions can be executed in parallel. Developers must consider parallel processing from the outset, ensuring that their designs enable independent execution of different transactions without interference.

Parallel EVM also maintains compatibility with the Ethereum ecosystem, which is crucial for developers and users already involved in Ethereum-based applications. This compatibility ensures a smooth transition and integration of existing dApps, which is a challenge for systems like DAGs that typically require significant modifications to existing applications.

The development of parallel EVM is seen as a key step in addressing the fundamental limitations of blockchain scalability. These innovations are expected to prepare blockchain networks for the future, enabling them to keep up with growing demands and become the cornerstone of the next generation of Web3 infrastructure. While parallel EVMs offer significant potential, their successful implementation requires overcoming complex technical challenges and ensuring widespread ecosystem adoption.

MT Capital

MT Capital, headquartered in Silicon Valley, is a crypto-native fund focused on Web3 and related technologies. With a global team, diverse cultural backgrounds, and perspectives, we have a deep understanding of global markets and can seize investment opportunities in different regions. MT Capital's vision is to become a leading global blockchain investment company, focusing on supporting early-stage technology enterprises that can generate immense value. Since 2016, our portfolio has covered various fields including Infra, L1/L2, DeFi, NFT, GameFi, and more. We are not just investors but also a driving force behind founding teams.

Website: https://mt.capital/

Twitter: https://twitter.com/MTCapital_US

Medium: https://medium.com/@MTCapital_US

References

https://github.com/hsyodyssey/awesome-parallel-blockchain

https://www.techflowpost.com/article/detail_15290.html

https://amberlabs.substack.com/p/parallel-power-unlocked

https://squads.so/blog/solana-svm-sealevel-virtual-machine

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。