Bitcoin (BTC) has recently experienced significant selling pressure, with the price plummeting to $40,000 earlier today. This is due to a large amount of funds flowing from the Grayscale Bitcoin Trust (GBTC) into the newly launched Bitcoin ETF.

Some people wonder why Grayscale has been selling coins. Don't they know that the halving, interest rate cuts, and bull market are coming? It's important to understand that the selling of coins is not an action taken by Grayscale as an institution, but rather a result of redemptions from Grayscale's clients, which Grayscale must fulfill. Grayscale is just a custodian, and some GBTC users who have been locked in for years and have seen their investments multiply may need funds. Additionally, Grayscale's management fees are higher than those of other institutions, so some clients may prefer to buy from other sources to save money.

Furthermore, we can see that BlackRock's $IBIT has poured in over $1 billion into the Bitcoin spot ETF so far, with $3.71 billion flowing in yesterday, and Fidelity's $FBTC ranking second with a total inflow of $881 million. It's clear that the sentiment for purchasing Bitcoin ETFs remains strong. Bitcoin is not far from a stable upward trend until the selling pressure at the grayscale level is digested.

Bitcoin price may correct to $34,000

Renowned cryptocurrency analyst Ali Martinez pointed out that Bitcoin's price movement follows a parallel channel. Martinez stated that this indicates resistance at the upper limit of the channel at $48,000.

The analyst predicts that Bitcoin will fall to the lower limit of $34,000. Subsequently, Martinez expects Bitcoin to rebound, with a target of retesting the upper limit at $57,000. This observation provides valuable insights into the potential price trajectory of Bitcoin and offers a perspective on the key support and resistance levels within the established parallel channel.

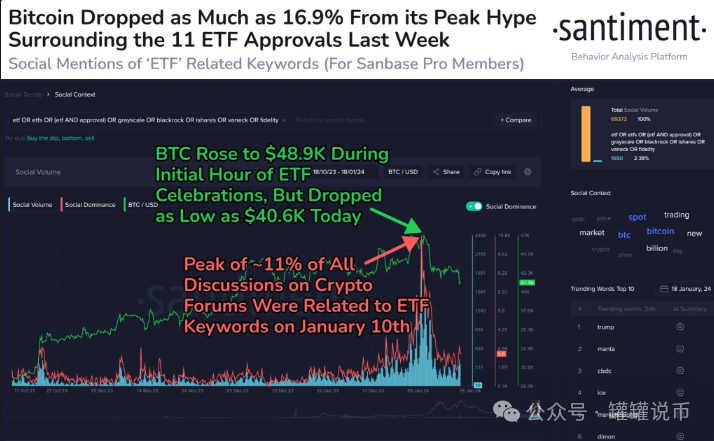

Leading on-chain data provider Santiment reported that on January 10, the U.S. Securities and Exchange Commission (SEC) approved 11 initial Bitcoin spot ETFs, and traders remain optimistic about their long-term impact. However, Santiment emphasized a significant shift in market sentiment, indicating that fear of missing out on approval (FOMO) may be a reason for the local cryptocurrency market reaching its peak.

Experts believe that the widely anticipated approval was already reflected in the market prices at the time of the announcement, leading to a subsequent decline in Bitcoin's value. After Bitcoin plummeted to $40,600 (a 16.9% drop from last week's market peak), Santiment observed that the narratives surrounding these ETFs may change.

There has been a keen interest in monitoring whether public sentiment has turned negative, associating words like "scam" or "disaster" with the approved ETFs. Santiment expects that if bearish sentiment surrounding this theme (which initially drove prices higher from October to December) emerges, fear, uncertainty, and doubt (FUD) may trigger selling by novice traders.

Expect months of stagnation

In a recent analysis, On-chain College suggested that Bitcoin's price may experience several months of adjustment or stagnation. According to the analysis, this trend does not necessarily indicate an impending bear market. As tokens become stronger in the market, this trend may further pave the way for a strong bull market in the future.

Under current market conditions, attention remains focused on Bitcoin's short-term costs, with the current price at $37,800. Historically, this level has acted as support during bull markets and resistance during bear markets, further shaping market dynamics. Insights provided by On-chain College offer a detailed perspective on the potential trajectory of Bitcoin's price, acknowledging the historical impact of key price levels on market trends.

For those seeking warmth or with doubts, feel free to join us—Public Zonghao: Guanguan Shuibi VX: 3379276514

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。