The original author: Luccy, BlockBeats

At 4 am on January 11th, Beijing time, the U.S. Securities and Exchange Commission (SEC) simultaneously approved 11 spot Bitcoin ETFs. This is a historic moment worthy of attention in the history of Bitcoin and the entire cryptocurrency market. The spot Bitcoin ETF has finally been approved, and Bitcoin has turned a new page.

So what is the principle of ETF? How to track the prices of various institutional Bitcoin ETFs? BlockBeats has compiled existing information.

ETF (Exchange Traded Fund) represents partial ownership of the underlying asset, so ETF products support redemption, and ETF products cannot be issued out of thin air. The issuer needs to hold an equivalent amount of the underlying asset in order to issue the ETF.

A Bitcoin ETF is a certificate whose price is tied to the price of Bitcoin. ETFs are further divided into spot ETFs and futures ETFs.

Among them, a Bitcoin futures ETF is an agreement that is not tied to the spot price of Bitcoin, similar to a futures contract. You can agree to buy or sell Bitcoin at a future time by signing the contract. In other words, if you open a Bitcoin futures ETF, you don't need to spend any money to buy Bitcoin.

A Bitcoin spot ETF is different, as it is tied to the spot price of Bitcoin. Every unit of spot ETF you buy corresponds to a unit of spot Bitcoin.

Tracking ETF price changes

In the fierce competition of Bitcoin spot ETFs, the fees set by various companies are of decisive importance, which not only affects investors' choices but also significantly impacts the companies' market competitiveness. ETF fees, as the management costs borne by investors, directly affect the investment return rate. Therefore, when choosing ETF products, investors often prioritize options with lower fees.

As of January 11th, the updated fees are as shown in the following figure. Hashdex charges 0.90%, ARK 21Shares Bitcoin ETF (ARKB) charges 0.0% (0.21%), Bitwise charges 0.0% (0.2%), Franklin charges 0.29%, BlockRock charges 0.2% (0.3%), VanEck charges 0.25%, WisdomTree charges 0.0% (0.3%), Invesco and Galaxy Digital charges 0.0% (0.39%), Valkyrie Investment charges 0.0% (0.49%), Grayscale charges 1.5%, Fidelity charges 0.0% (0.25%).

Tools

- SEC: You can register on the SEC's official website, fill in your email, to receive official news and decisions related to Bitcoin ETFs in a timely manner. As a regulatory agency, the information it releases is the most authoritative and accurate.

In terms of market information, you can also follow some well-known industry analysts, such as Bloomberg ETF analysts Eric Balchunas and James Seyffart, who have in-depth research and insights into Bitcoin ETFs. Following their social media accounts can provide more professional analysis and forecasts, and turning on notifications will allow you to receive news in a timely manner.

- ETF management company official websites: You can view basic information such as issued shares, expense ratios, total amount of Bitcoin trust, amount of Bitcoin per share, as well as market price, market price changes, and daily trading volume (shares).

- Grayscale Bitcoin Trust

- Bitwise Bitcoin ETF

- iShares Bitcoin Trust

- Valkyrie Bitcoin Fund

- ARK 21Shares Bitcoin ETF

- Invesco Galaxy Bitcoin ETF

- VanEck Bitcoin Trust

- WisdomTree Bitcoin Fund

- Fidelity Wise Origin Bitcoin Fund

- Franklin Bitcoin ETF

- Hashdex Bitcoin ETF: Currently, Hashdex Bitcoin ETF has not added spot exposure, and this plan is awaiting final approval from the U.S. Securities and Exchange Commission (SEC).

- Trading platforms: Among the 11 spot Bitcoin ETFs approved by the SEC, six ETFs will be listed on the Chicago Board Options Exchange (CBOE), three will be listed on the New York Stock Exchange (NYSE), and two will be listed on the Nasdaq Exchange. You can enter the Bitcoin ETF code that will be listed on the platform's search interface to view relevant information.

- Data Websites: Tradingview, Yahoo Finance, CNBC, FinGuider, etc. Investors can enter the ETF code they want to query in the search box on these websites to view the corresponding ETF prices and related information.

On FinGuider, after registering an account with an email, you can create a collection of ETFs that you want to observe, and the website will automatically generate comparative market information for the selected ETFs.

ETF Management Company Asset Management Scale

Among the listed and applying companies, Grayscale (GBTC) stands out with its approximately $46 billion asset management scale, and iShares under Blackrock also holds a leading position with a massive $9.42 trillion asset management scale. Following closely is ARK 21Shares (ARKB), managing approximately $6.7 billion in assets. In comparison, Bitwise (BITB) has a smaller scale but still manages around $1 billion in assets.

Other important participants include VanEck, managing approximately $76.4 billion in assets; WisdomTree (BTCW) with a $97.5 billion asset management scale; Invesco Galaxy (BTCO) and Fidelity Wise Origin, managing $1.5 trillion and $4.5 trillion in assets, respectively.

Mechanism for Determining ETF Prices

ETFs can be traded in real-time, similar to stocks, so their prices are determined by market supply and demand. ETFs can be created based on a basket of assets or a single asset, and the total price of these assets is called the ETF's Net Asset Value (NAV).

When you buy an ETF, it's like buying the assets contained in that basket. In theory, the ETF price reflecting the NAV is the most basic premise of investing in an ETF. ETFs are also traded in the market, and the market trading price is determined by the behavior of countless participants. The market cannot dictate that everyone must trade according to the NAV. Therefore, the market price of an ETF may differ from its NAV.

Here, we use a very simplified model to explain the trading operation of an ETF.

Suppose the issuer wants to issue an ETF fund, and each ETF contains only two stocks, A and B, in a 1:1 ratio. After the issuer obtains approval from the SEC, they raise funds to buy a large amount of stocks A and B, then place these stocks in a trust and create the corresponding ETF based on the owned stocks to put it on the market.

So, the ETF sold in the market is a certificate, not the actual stocks contained inside, which are held by the issuer. The issuer of the ETF earns the management fee for the ETF, and their responsibility is to issue and manage it, not directly participate in its market trading.

For example, if the market price of the two stocks contained in each ETF at the opening is $2, which is the NAV, and there are only two people trading the ETF in the market. The first buyer is willing to pay $4 to buy one share of the ETF. If successful, this would cause the market price to rise to $4, far above the $2 NAV, which may lead potential investors to refuse to buy the ETF.

At this point, the second buyer speculates and buys one share of stock A and stock B in the market for a total of $2, intending to sell it to the first buyer for $3.

However, the first buyer only wants to buy the ETF certificate, so the second buyer goes to the issuer to exchange the held stocks for the ETF certificate, a process called ETF creation. Then, they sell it to the first buyer for $3, lowering the market price, and earning a $1 difference.

Similarly, if the ETF price is lower than the NAV, the first buyer intends to sell the ETF for $1, the second buyer can offer $1.50 to buy the ETF, then exchange it for stocks with the ETF issuer, and sell it in the market, a process called ETF redemption. This would raise the market price, earning a $0.50 difference.

If other buyers engage in the same operations, it would ultimately lead to the market price of the ETF closely tracking the $2 NAV cost, achieving the price of the ETF closely following the NAV.

In this process, the buyer who engages in ETF creation and redemption is called an Authorized Participant (AP). In the market, they must exchange ETFs and stocks with the ETF issuer, so to facilitate arbitrage, APs will have a certain amount of ETF inventory.

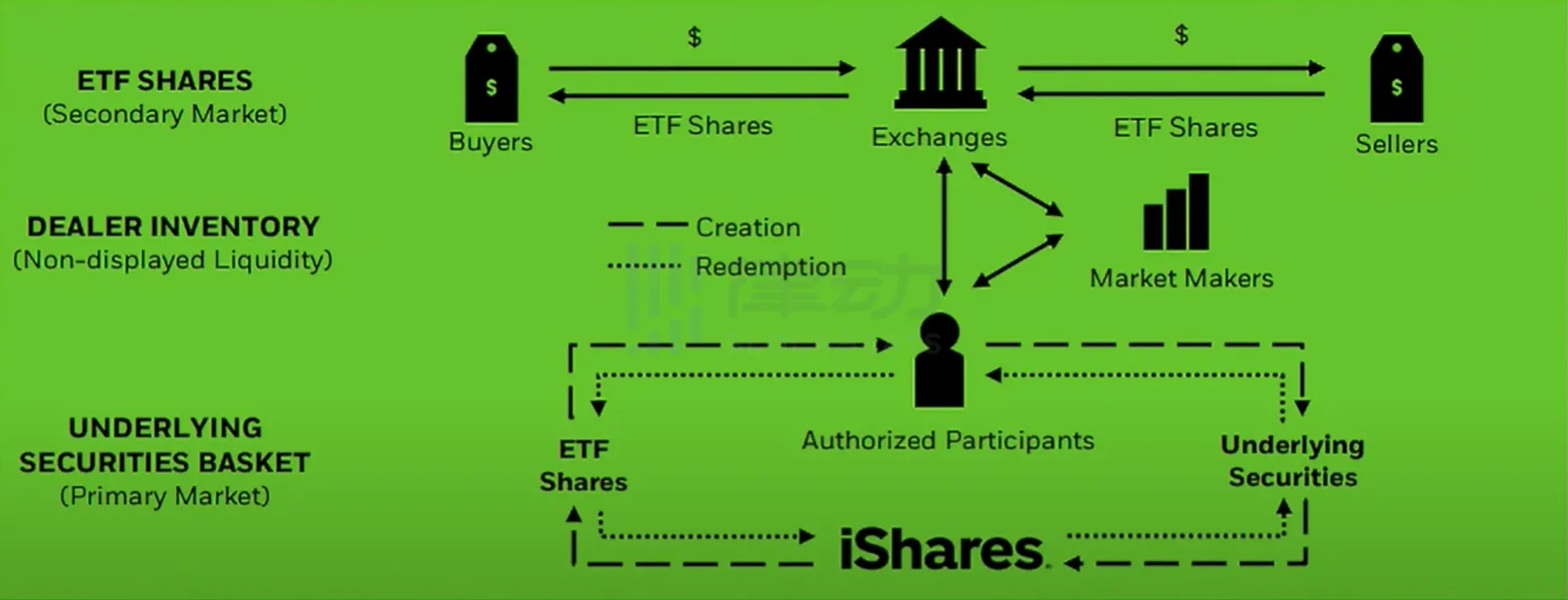

Of course, this is a simplified model, and the real market situations are more complex. In the ETF market, there are two levels of markets and different participants.

Image Source: BlackRock

Participants include the ETF management companies, also known as "sponsors," such as iShares in the image; market investors, including retail and institutional investors; Market Makers (MM) and APs. APs are often institutions, such as banks, shown as two different participants in the image, but in the real world, they can be the same institution.

As mentioned earlier, ETF management and issuing companies earn management fees. After creating the ETF, they wholesale these ETFs to large institutions, allowing these institutions, often APs, to put the ETFs into the market. This process occurs in the primary market, where retail investors cannot participate.

The ETFs wholesaled by APs are put into the secondary market where retail investors participate. If APs are wholesalers, then MM are retailers. MM and AP engage in wholesale buying and selling, then directly trade with retail investors in the secondary market, bringing the trading price of the ETF close to the NAV. AP and MM operate in a competitive environment and are economically incentivized to participate in the creation or trading of ETF shares.

Example 1: Creation of Bitcoin ETF shares (Investing in ETF):

A retail investor wants to invest $10,000 in a specific Bitcoin ETF, such as IBIT. If the BTC:USD spot price is $40,000, and the market trading price of the Bitcoin ETF IBIT is $40,010, the AP receives an order from the investor's broker to purchase $10,000 worth of IBIT at the fair value of $40,010. Because the Bitcoin trading price is $40,000, and $10,000 is equivalent to 0.25 Bitcoin, the trading price of IBIT is $10 higher than its NAV. Therefore, the AP's profit is not the entire $10 difference between the ETF spot and BTC spot, but rather ($0.25 x $10) = $2.50.

Example 2: Redemption of Bitcoin ETF shares (Closing ETF position):

When the trading price of the ETF is $39,990 and the Net Asset Value (NAV) of the ETF is $40,000 (with a spot price of BTC:USD at $40,000), a retail investor wishes to sell their $10,000 position.

In this example, the ETF is trading at a discount. The AP will initiate the trade, purchasing $10,000 worth of IBIT and simultaneously selling $10,000 worth of BTC (0.25 BTC) at a BTC:USD trading price of $40,000, thereby netting $2.50 ($0.25 x $10 = $2.50).

Historically, if an AP exits the ETF market, other APs will intervene to facilitate the creation and redemption of ETF shares, especially if there is a significant premium or discount to the NAV, or if there is a difference between the ETF and its underlying stock prices. This is because APs typically seek to exploit the economic arbitrage opportunities arising from these differences, which also applies to Market Makers (MM).

In this way, ETF prices are determined through the participation of different entities in the primary and secondary markets, using an "arbitrage mechanism" to ensure that the trading price of the ETF closely tracks its NAV. Of course, ETF prices may experience premiums or discounts due to factors other than trading, such as the trading of assets within the ETF in different time zones.

Authorized APs for ETF Management Companies

Given the complexity associated with the creation and redemption of ETFs, APs are typically institutions with a high level of expertise and market operational capabilities. In situations of high market volatility or low liquidity, the activities of APs are particularly important for ensuring the healthy operation of the ETF market. Through the mechanism of APs, ETFs can more effectively track the performance of their underlying assets, providing investors with a more stable and reliable trading environment.

According to the latest information, most asset management companies applying for Bitcoin spot ETFs, including BlackRock, have selected and disclosed their respective Authorized Participants.

For example, BlackRock plans to select JPMorgan Securities and Jane Street as its Authorized Participants. The CEO of Grayscale stated on social media that Grayscale had already confirmed in the filing submitted in May of this year that Jane Street Capital and Virtu Americas would be the Authorized Participants for its ETF after GBTC is converted to a spot ETF.

Goldman Sachs is in talks with BlackRock and Grayscale to negotiate becoming an Authorized Participant (AP) for their spot Bitcoin ETF. According to Nate Geraci, President of The ETF Store, after Goldman Sachs, JPMorgan is also in negotiations with Grayscale to act as an Authorized Participant for its spot Bitcoin ETF.

WisdomTree has submitted the latest revised S-1 document for its spot Bitcoin ETF, designating Jane Street Capital as the Authorized Participant for its spot Bitcoin ETF. Invesco Galaxy has designated JP Morgan and Virtu Americas as the Authorized Participants for its spot Bitcoin ETF, with no fees for the first 6 months. Fidelity has named Jane Street Capital as one of its Authorized Participants. Invesco/Galaxy has chosen JPMorgan and Virtu as Authorized Participants. Valkyrie has chosen Jane Street and Cantor Fitzgerald as its Authorized Participants.

These details may change as the approval process progresses and companies adjust their strategies. However, it is evident that Jane Street is the choice for almost all of these asset management companies.

Three Types of BTC ETFs

ETF Based on BTC Spot

In a BTC spot ETF, the price of BTC is the NAV, as in the example above. Simply put, issuing a BTC spot ETF requires holding an equivalent amount of BTC spot. Therefore, the BTC spot ETF market is equivalent to the BTC spot market.

This means that global financial institutions like BlackRock are likely to attract new BTC investors, who may not have participated in the existing crypto market and are more accustomed to, or restricted by regulations to purchase ETF products issued by institutions. The greater the demand for BTC spot ETFs in the market, the more BTC spot institutions need to hold.

Therefore, the issuance of BTC spot ETF products by large financial institutions can bring incremental funds to the BTC spot market and a broader international market.

ETF Based on BTC Futures

Currently, several financial institutions have issued BTC futures ETF products, but these BTC futures ETF products are based on CME's BTC futures, which are settled in cash. Therefore, the BTC futures ETF market cannot bring incremental funds to the BTC spot market.

Cash-Based BTC ETF

ETFs based on cash hold cash to issue BTC ETFs and redeem cash upon redemption. Naturally, this does not bring funds to the BTC spot market.

References:

- "ETF Trading Principles You Must Know: How is the Price of ETF Determined?"

- "Five Key Information to Pay Attention to Regarding Bitcoin Spot ETFs"

- "Analysis of the Differences Between BTC Spot and ETF"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。