○/文: DC Research Institute

Lao Li Mortar

Table of Contents of this Week's Research Report:

I. Key Events Forecast of Macro Economic Data and Cryptocurrency Market this Week;

II. Review of Key News in the Cryptocurrency Industry;

III. Community Interaction and Sharing;

IV. Interpretation of Important Events, Data, and Deepcoin Research Institute;

V. Institutional Perspectives + Overseas Perspectives;

VI. Cryptocurrency Market Performance Ranking and Community Hot Coin Selection;

VII. Attention to Project Token Unlocking Negative Data;

VIII. Performance Ranking of Cryptocurrency Market Concept Sectors;

IX. Summary of Global Market Macro Analysis;

X. Future Market Judgment of Deepcoin Research Institute.

I. Key Events Forecast of Macro Economic Data and Cryptocurrency Market this Week:

January 8th (Monday): The Japanese stock market will be closed for Coming of Age Day; The voting on the proposal for the V 0.13.0 upgrade by Starknet will end.

January 9th (Tuesday): Eurozone unemployment rate for November; US trade for November; Atlanta Fed President Bostic will give a speech; Binance's new coin mining project XAI will start trading.

January 10th (Wednesday): SEC will make a decision on the application for a Bitcoin spot ETF at the latest; Silly Dragon will launch the first NFT series Chibi, containing 50 works.

January 11th (Thursday): US December CPI, core CPI year-on-year; New York Fed President Williams will give a speech; Bank of Korea will announce interest rate decision; Cboe Digital will launch Bitcoin and Ethereum margin futures and clearing services.

January 12th (Friday): US government budget for December; Japan's trade for November; US December PPI, core PPI year-on-year; Minneapolis Fed President Kashkari will give a speech; US banks including Bank of America, Wells Fargo, JPMorgan Chase, and BlackRock will release financial reports. DWF Joint Creation will announce the first batch of incubation projects and individual investments.

From January 8th to January 14th, GLMR, APT, and CYBER tokens will undergo a one-time unlock.

II. Review of Key News in the Cryptocurrency Industry (Exclusive Compilation):

Cryptocurrency Industry Overview: The cryptocurrency market has shown multiple dynamics recently. The number of physical businesses accepting Bitcoin has nearly tripled in the past year, and mining difficulty has reached a historical high of 73.2T, while confidence in the approval of a Bitcoin spot ETF by the SEC is only 39%, reflecting regulatory uncertainty. In terms of projects and platforms, the unlocking of 8% of the circulating supply of APT is worth about $225 million, DCG has successfully repaid $1 billion in debt, and NFT sales on the Ethereum and Solana networks have reached new highs. In terms of macro policies, the Fed does not rule out the possibility of raising interest rates again, and the SEC's warning to investors to be cautious about purchasing sends a cautious signal, while US employment data exceeded expectations. Finally, institutional research reports and celebrity opinions also influence the market, such as Bloomberg analysts' concerns about potential issues with gold ETFs and Bitcoin ETFs, and a warning from a Georgetown University lecturer about the SEC's delay in approving a Bitcoin ETF. These dynamics provide different perspectives for the market, and investors need to be cautious in response.

In terms of data overview, the number of physical businesses accepting Bitcoin has nearly tripled in the past year, Bitcoin mining difficulty has reached a historical high of 73.2T, and the 15th anniversary of the Bitcoin genesis block has been celebrated. A survey shows that only 39% of financial advisors believe that a Bitcoin spot ETF will be approved by the SEC, and the number of addresses holding at least 0.1 BTC has also reached a historical high. In addition, the amount of ETH held in the top 150 self-hosted Ethereum wallets has also reached a new high.

In terms of project and platform dynamics, this week will see a one-time unlock of 8% of the circulating supply of APT, worth about $225 million. DCG has repaid over $1 billion in debt, including $700 million from Genesis. Tether has issued an additional 2 billion USDT on the Ethereum and Tron networks. The total trading volume on DEX platforms in 2023 is close to $1 trillion, and in December of last year, NFT sales on the Polygon chain reached a new high of $47 million, while monthly NFT sales on Solana exceeded Ethereum for the first time, reaching $370 million.

In terms of macro policies and regulations, Fed's Logan stated that he does not rule out the possibility of raising interest rates again, while the SEC reminds investors that purchasing investments does not mean they are suitable for everyone. US employment data exceeded expectations, reaching the highest growth rate since August 2023, and the value of Bitcoin held by the US government currently exceeds $8 billion.

In terms of institutional research reports and celebrity opinions, Bloomberg analysts pointed out more potential issues with gold ETFs, and a Georgetown University lecturer believes that the SEC may delay the approval of a Bitcoin spot ETF. Vitalik suggested not to use leverage of more than 2x, while a Fox Business reporter predicted that BlackRock's BTC spot ETF will be approved by the SEC this Wednesday. Bloomberg analysts believe that the approval of a Bitcoin spot ETF is basically complete, while traders at Bitfinex expect unprecedented volatility in the Bitcoin market.

III. Community Interaction and Sharing:

Regarding the Deribit volatility (DVOL) index, it is a volatility index for cryptocurrency options developed by Deribit, which measures the 30-day forward-looking expected volatility (implied volatility calculated from option prices), rather than the backward-looking actual volatility (realized volatility calculated from the price time series of the underlying asset). DVOL is an annualized volatility expectation. Roughly speaking, to obtain the daily expected change in the price of BTC, simply divide the DVOL value by 19 (the square root of 365). For example, if DVOL is 57 (actually meaning 57%), it is equivalent to a 3% daily volatility.

BTC's volatility index DVOL has reached a new high for the year, reaching 72, with the year-end low in mid-August at 31, which means it is currently at 232% of the low point. Due to the ETF issue this week, DVOL is expected to remain high.

As for which indicator is useful, there is actually no absolute answer. Oscillation indicators perform well in oscillating markets, while trend indicators perform better in trending markets.

IV. Interpretation of Important Events, Data, and Deepcoin Research Institute:

Regarding on-chain data, Bitcoin miners have sold approximately 4,000 BTC in the past 10 days, totaling over $176 million.

The Deepcoin Research Institute believes that a thorough analysis may need to focus on the following points:

The sale of BTC by miners may reflect certain market sentiment. In times of high market uncertainty or facing adjustments, miners may choose to sell some BTC to maintain liquidity and reduce operational risks. In addition, if the price of Bitcoin falls, miners' income may decrease, prompting them to balance income and expenses by selling BTC. Miners may have their own judgment on the future market trend. If they believe that the market will face a major adjustment or decline, selling BTC may be a risk-aversion strategy.

The main costs for Bitcoin miners include electricity, equipment, and maintenance. Over time, these costs may change, affecting miners' decisions. If operating costs rise and the price of BTC remains unchanged or falls, miners may sell BTC to offset the increased operating costs. In addition to daily operations, miners may also have other investment strategies. They may choose to reinvest some or all of their earnings to expand operations, improve equipment, or enter other cryptocurrency markets.

In summary, for the behavior of Bitcoin miners selling approximately 4,000 BTC in the past 10 days, a thorough analysis can be conducted from various factors such as market sentiment, operating costs, investment strategies, regulatory environment, future expectations, and other factors. This behavior not only reflects the current market conditions but may also indicate miners' expectations of a downward trend in the future.

Regarding the reference of top and bottom indicators.

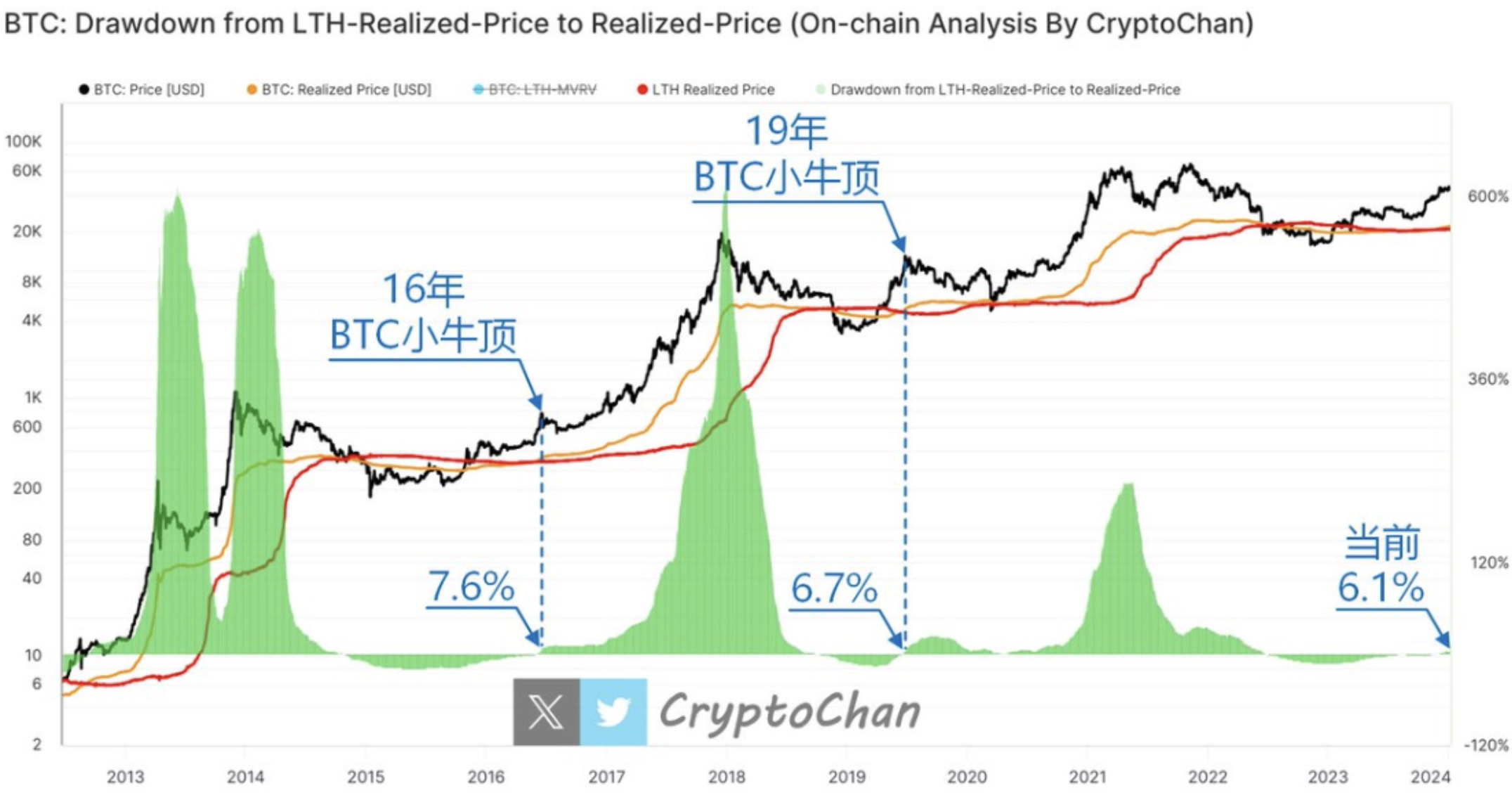

Deepcoin Research Institute verified from cryptochan that during the 2016 BTC bull market peak, the green bar rose to 7.6%; during the 2019 BTC bull market peak, the green bar rose to 6.7%; currently, the green bar has risen to 6.1%. The black line in the chart represents the BTC price; the orange line represents the realized price of BTC (Realized Price, the overall average purchase price of on-chain BTC); the red line represents the long-term holder realized price of BTC (Long-Term Holder Realized Price, the overall average purchase price of BTC that has not moved on-chain for more than 155 days); the green bar is calculated as (orange - red) / red x 100%, used to visualize the relative difference between the orange and red lines.

Another set of data shows that during the 2012 BTC bull market peak, this on-chain indicator reached a maximum of 94.3%; during the 2016 BTC bull market peak, this on-chain indicator reached a maximum of 95.3%; during the 2019 BTC bull market peak, this on-chain indicator reached a maximum of 96.5%; currently, this on-chain indicator continues to rise, reaching 92.1%; the indicator represents the percentage of on-chain BTC in a profitable state out of the total BTC circulation. It is worth mentioning that it can be visually observed that the percentage of this on-chain indicator at the BTC bull market peaks in 2012, 2016, and 2019 has been increasing (94% → 95% → 96%), because on-chain BTC continues to enter long-term dormancy or get lost over time, gradually becoming ancient profitable chips, leading to an increasingly "overvalued" indicator.

Regarding last week's Matrixport report, it is expected that the SEC will reject all ETF proposals in January because none of the applications have met its requirements. If the SEC refuses to approve, there will be a large-scale liquidation activity in the market, and the price of Bitcoin may quickly drop by 20%.

The Deepcoin Research Institute believes that this news led to a sharp drop in the market by nearly $5000. Let's analyze the logic of the impact on the market before and after the release of the news.

Before Matrixport released this report yesterday, the market's expectation for the approval of a Bitcoin spot ETF was very strong. Almost all media reports had a bias towards approval, as can be seen from some survey data. Yesterday at noon, we mentioned in the community that on the decentralized prediction platform Polymarket, the price of the approval contract for a Bitcoin ETF before January 15th was 89 cents, indicating an 89% probability of the event occurring this month, a significant increase from about 50% a month ago. In other words, the market's expectation of approval probability was close to 90%. It was under this sentiment that suddenly an institutional research report mentioned the expectation that the SEC will reject all proposals in January, leading to an unexpected drop in the market.

Our institute carefully examined the content of the Matrixport report. They believe that there are three reasons why the spot ETF will not be approved: first, 5 voting commissioners are Democrats, and Democrats do not like cryptocurrencies. Second, the applicants did not meet the SEC's requirements; third, there is no political reason to approve a Bitcoin ETF. Obviously, these three reasons lack persuasiveness, so the market did not continue to decline but rebounded instead.

Later in the evening, there was also news that two influential analysts from Bloomberg stated that they did not see any other signs besides the imminent approval, so they also wanted to know if Matrixport had other sources of information, or if the conclusion that the ETF would not be approved was just speculation.

As for Wu Jihan, the founder of Matrixport, he also released a statement late at night, mentioning that the opinions of Matrixport analysts are not interfered with by management, and the report was originally prepared for clients, and its widespread dissemination in the media is beyond their control. He also stated that whether the spot ETF is approved in January is not important, as it will definitely be approved in the future.

Regarding the ETF review, our institute's view is that the main final approval date for ARK is on January 10th, and judging from Cathie Wood's recent selling of Coinbase stocks and GBTC shares for over a month, ARK itself may not hold out hope for the ETF approval. Therefore, the market's future focus may turn to the applications of the other 7 companies from January 14th to 17th and the majority of the final review window in mid-March.

V. Institutional Perspectives + Overseas Perspectives:

GLIVE analysis: The results of the Bitcoin spot ETF review are about to be finalized, and the market generally believes that it will be approved smoothly. Stimulated by the continuous appearance of positive news, the current BTC has returned to a short-term high of $45,000. The IV of at-the-money options expiring on the 12th has already reached 110%, and the IV of at-the-money options expiring on the 11th is as high as 120%. After today's settlement, the IV has risen by nearly 20% again. The FOMO sentiment in the European and American markets is very strong, as if the Bitcoin spot ETF is about to be approved in the next minute. Shorting Dvol is very cost-effective at the moment.

Two influential analysts from Bloomberg stated that the probability of the spot Bitcoin exchange-traded fund (ETF) being approved in the United States has risen to over 90%, while participants in the cryptocurrency market on Polymarket (a prediction market that allows betting on world events) have become more pessimistic, lowering the approval probability to 85%.

In a client-exclusive research report on January 3rd, Matrixport pointed out that there is an opportunity to hedge the portfolio by 1.6% through bearish options in the next ten days. We had previously expected a strong rebound in the fourth quarter. By mid-December, we issued a warning about price consolidation. Initially, we expected a strong start to the year and were still bullish on Bitcoin on January 2nd; but the next day, one of our trading models turned bearish on Bitcoin for the first time since August. As the stock market weakened, we changed direction, expecting the weakness in the stock market to also affect Bitcoin. As we have pointed out in the past few weeks, due to the high funding rates and the high number of open positions, the likelihood of profit-taking has increased, and Bitcoin positions have been excessively expanded. We believe that the main reason the US Securities and Exchange Commission (SEC) may refuse to approve the ETF is the lack of a large-scale monitoring and sharing agreement representing the global BTC trading market.

An analyst from Bitfinex stated that derivative traders expect unprecedented volatility in the Bitcoin market. As the industry awaits news of over a dozen spot Bitcoin ETF approvals, signals from the options market indicate that the volatility expectations of derivative traders are currently higher than the volatility observed in the entire market in 2023. Bitfinex data shows that implied volatility has reached a recent high, exceeding the historical average volatility of 41.1%. The Bitfinex analyst stated, "Based on signals from the options market, traders are preparing for unprecedented price volatility in Bitcoin."

Bernstein predicts that Bitcoin is expected to reach a new all-time high in 2024 and may soar to $150,000 in 2025. In a report, they wrote: We are entering a new era of cryptocurrency, marked by unprecedented mainstream institutional acceptance, which will drive capital from traditional markets to the cryptocurrency market. This is an unprecedented moment. They also pointed out: We are in a favorable macro environment, with interest rates peaking, inflation declining, and the possibility of monetary stimulus policies in a global election year. We are very optimistic about Bitcoin and Bitcoin mining stocks. Analysts expect that the world's top asset management companies will launch Bitcoin ETFs this week or next week. Although there is a risk of "buy the rumor, sell the fact," they believe that there are still multiple bullish factors throughout the year, such as the halving of mining rewards, the inflection point of transaction fees, and ETF marketing. The analysts added: Instead of selling when the news is confirmed, it is better to buy when the price falls. Selling the fact may mean leaving the market after a correction of 15-20%, but this may cause you to miss out on future gains. They predict that after the halving in 2024, Bitcoin will reach a new all-time high in the second half of the year and may reach about $80,000 by the end of the year (based on our marginal cost estimate). Their forecast for 2025 remains at $150,000, which will be the peak of the cycle.

VI. Cryptocurrency Market Performance Ranking and Community Hot Coin Selection:

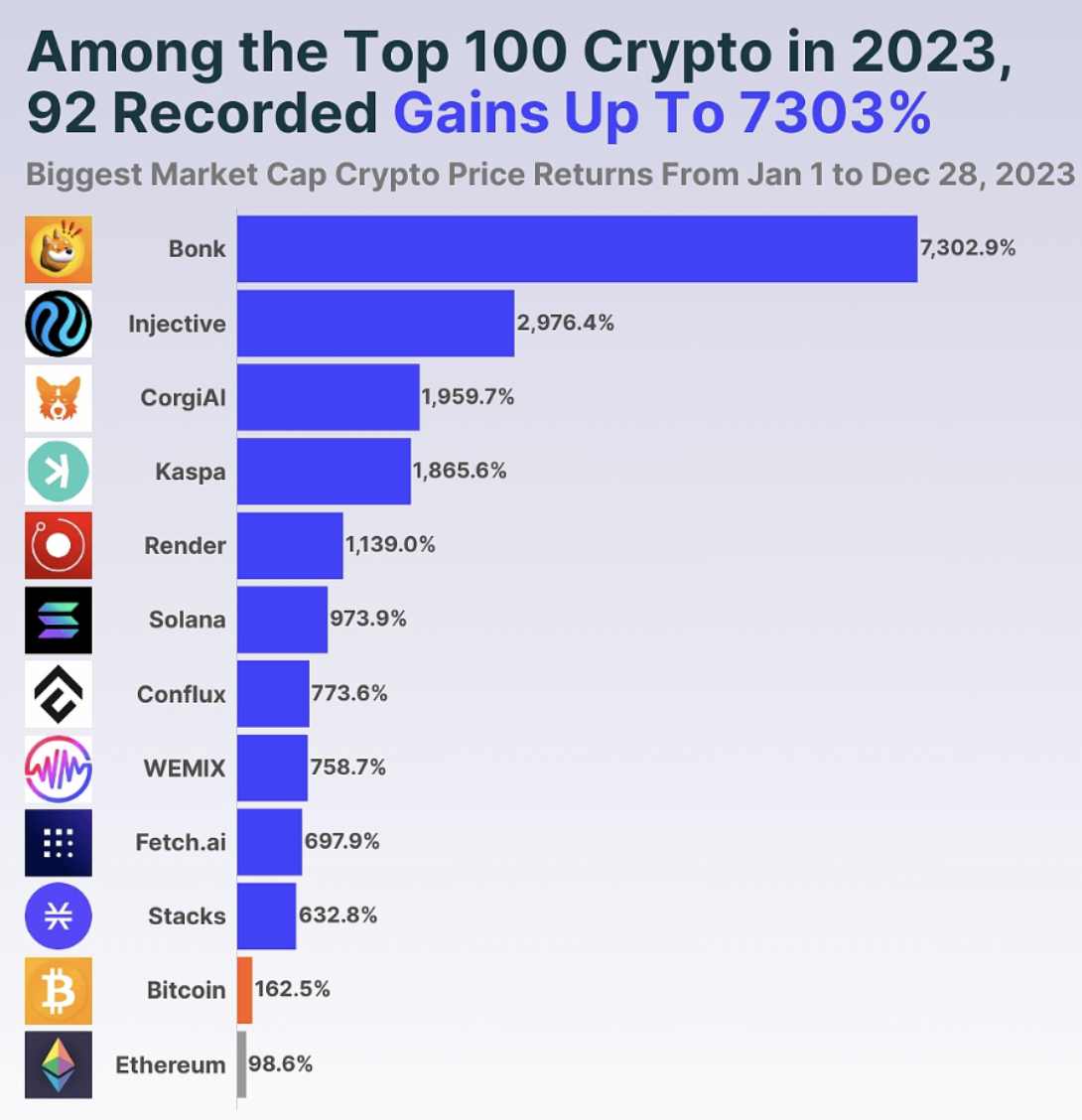

Research data from CoinGecko shows that among the top 100 tokens by market capitalization in 2023, BONK has seen a 7302.9% increase, ranking first. Injective has seen a 2976.4% increase, ranking second. Ethereum's increase is only 98.6%, far less than Bitcoin's 162.5%.

Seven-Day Performance Ranking of Altcoins:

PEOPLE surged by 225% in the past week; YFII saw an increase of around 70%; TENS, VLX, and OM had increases ranging from 25% to 35%. Other coins also ranked high on the list, providing potential trading opportunities for the week. It is important to note that there may be significant market volatility due to the approval of ETFs this week, and currently, altcoins are showing relatively weaker trends compared to BTC.

Discussion of Hot Coin Selection in the DC Community:

The weekly chart resistance for MKR is around $2300. TRB is a strong coin with concentrated chips and strong manipulation by the main force. If you want to buy, it's best to enter at a relatively low level and avoid chasing the rise. In the past week, the crazy demand for the Meme token issued on the Solana blockchain in the cryptocurrency community seems to have disappeared, as the new token failed to gather a meaningful community and the prices of the most popular tokens continue to decline. The dog-themed Meme token BONK has risen by over 1,000% in the past three months and has been listed on influential exchanges such as Binance and Coinbase. However, the current price has dropped by over 70% from its peak in December last year.

On-chain monitoring shows that as the ETH/BTC exchange rate has fallen back to the 0.05 level, a whale who shorted the ETH/BTC exchange rate (around 0.0525) by collateralizing 2,647.9 WBTC and borrowing 29,480 ETH to transfer to Coinbase has started to profit. The loan health has increased from the initial 1.28 to 1.39. Another whale who has been longing the ETH/BTC exchange rate since March 2023 has seen the loan health decrease to 1.02, once again approaching the liquidation line.

Unlocked Token Data to Watch for Negative Impact:

According to TokenUnlocks data, from January 8th to January 14th, the GLMR, APT, and CYBER tokens will undergo one-time unlocks, including 304 GLMR tokens (approximately $1.2 million, accounting for 0.38% of the circulating supply) on January 11th at 08:00, 24.84 million APT tokens (approximately $225 million, accounting for 8.05% of the circulating supply) on January 12th at 09:59, and 1.26 million CYBER tokens (approximately $9.03 million, accounting for 8.51% of the circulating supply) on January 14th at 22:24. It is important to pay attention to the negative effects of these token unlocks this week and avoid spot trading, seeking short opportunities in contracts. It is particularly important to monitor the large unlocks of APT and CYBER.

Top Performers in the Concept Sector in the Cryptocurrency Market Last Week:

The specific performance of the concept sectors in the past week is as shown in the image. The public services, DAO, dog-themed coins, algorithmic stablecoins, and Cardano ecosystem sectors led the gains. It is important to pay attention to the leading coins in these sectors for potential speculative trading.

Global Market Macro Analysis Overview:

Last week, the global market performance was generally poor, with over $3 trillion evaporating, marking the worst start for global stocks and bonds in twenty years. According to Bloomberg data, the total market value of global stock markets evaporated by over $2 trillion in the first week of 2024, and the total market value of the global bond market fell by approximately $1 trillion, resulting in a total evaporation of $3.18 trillion. The global market still faces significant uncertainty. Factors such as the Fed's interest rate hikes and the slowdown in global economic growth will continue to affect market trends. However, with the improvement in domestic economic data and policy support, the global market is expected to gradually stabilize.

In the A-share market, the first week of 2024 saw a volatile adjustment, mainly due to several reasons: the Fed meeting minutes showed that Fed officials believe the risk of an economic recession still exists, but they are still committed to raising interest rates this year. This has increased market concerns about global economic growth, and risk assets are generally under pressure. Economic data has been poor, with the year-on-year growth rate of industrial added value in December falling to 4.5%, below market expectations. This has also raised concerns about the slowdown in economic growth. Northbound funds saw a net outflow of approximately 5.5 billion yuan in a single week, indicating that overseas investors still have a certain degree of wait-and-see sentiment towards the A-share market.

Looking ahead, the A-share market still faces significant uncertainty. Factors such as the Fed's interest rate hikes and the slowdown in global economic growth will continue to affect market trends. However, with the improvement in economic data and policy support, the A-share market is expected to gradually stabilize.

In the Hong Kong stock market, the technology-dominated Hang Seng Index saw the largest decline, mainly due to several reasons: the heating up of expectations for Fed interest rate hikes led to general pressure on global risk assets. The tightening of domestic regulatory policies has had a certain impact on the internet industry. The constituent stocks of the Hang Seng Tech Index are highly valued and are more susceptible to selling pressure in a subdued market sentiment.

The Hong Kong stock market still faces significant challenges. Factors such as the Fed's interest rate hikes and the slowdown in global economic growth will continue to affect market trends. However, with the gradual clarification of domestic regulatory policies and the decline in valuations of the internet industry, the Hong Kong stock market is expected to gradually stabilize.

In the U.S. stock market, all three major indices saw declines last week. The main reasons are as follows: the Fed meeting minutes showed that Fed officials believe the risk of an economic recession still exists, but they are still committed to raising interest rates this year. This has increased market concerns about global economic growth, and risk assets are generally under pressure. December inflation data in the U.S. is expected to be released this week. The market expects inflation to remain high, which will further exacerbate concerns about Fed interest rate hikes.

The U.S. stock market still faces significant challenges. Factors such as the Fed's interest rate hikes and the slowdown in global economic growth will continue to affect market trends. However, with the improvement in U.S. economic data and the slowing pace of Fed interest rate hikes, the U.S. stock market is expected to gradually stabilize.

This week, major global events will continue to have a significant impact on market trends. Internationally, several Fed and ECB officials will deliver speeches, releasing important policy signals. The heavy-hitting December inflation data in the U.S. will affect market expectations for Fed interest rate hikes. The annual consumer electronics event CES will be held in Las Vegas, and AI is expected to take center stage. U.S. bank stocks will kick off the Q4 earnings season, providing important performance guidance for the market. OpenAI will launch a custom GPT store, sparking attention in the field of artificial intelligence.

Overall, the global market still faces significant uncertainty in 2024. Investors should closely monitor factors such as domestic and international economic conditions, policy trends, and implement effective risk control measures.

Market Outlook:

The daily chart for BTC shows that last week, the highest point of BTC oscillated back from around $45,880 to the lower end of the previous oscillation range near $40,750, with an overall decline of over 10%. The entire cryptocurrency market experienced a short-term liquidation of over $530 million as a result. This was mainly influenced by the Matrixport report, which mentioned the expectation that the SEC will reject all ETF proposals in January, leading to a drop in the market of over $5,000. However, after the rapid decline, there was a significant rebound, and the price is currently fluctuating around $45,000. As we previously expected, there may be relatively strong performance before the announcement of the ETF approval, and when the news is announced, if it is approved, there may be a small to medium-sized increase followed by a decline. The medium to long-term resistance above is around $48,190 to $48,555. If it is not approved, there may be a direct decline, with medium-term support around $38,000 and $33,400.

Therefore, in terms of operations, it is relatively prudent to buy on a significant decline or at the lower end of the oscillation range before the approval results are announced. However, as the announcement time approaches, it is important to take profits and reduce positions at relatively high levels to prevent profit retracement in the event of a market pullback or decline. At the time of or after the announcement, short positions can be taken at low leverage if there are relatively high levels, to speculate on a decline after the non-approval or the realization of positive news.

Regarding the timetable, as we have previously shared: from the established timeline, the closest time point for the result of the spot Bitcoin ETF application is January 10th: the ARK 21Shares Bitcoin ETF, which has experienced two delays, will have its final decision. In addition, from January 14th to 17th, there are also 7 spot Bitcoin ETF applications that will face the decision of the U.S. SEC. However, according to past practice, it is highly likely that the decision will be further postponed to the final time window in mid-March.

Follow us: Lao Li Mortar

Deepcoin Research Institute

January 8, 2023

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。