From the perspective of game theory, why do I choose to believe that the Bitcoin spot ETF is about to be approved? 🧙♂️

Different financial markets have different game environments, and we should adopt different survival strategies in different game environments.

The pricing power of the cryptocurrency market is currently on Wall Street, and the game environment of the US financial market, where Wall Street is located, is more suitable for adopting a survival strategy of trust and cooperation.

Next, let's use the classic game theory game "The Evolution of Trust" to simulate the game environment of the financial markets in the United States and China, and verify why believing and cooperating in the game environment of the US financial market is a better survival strategy.

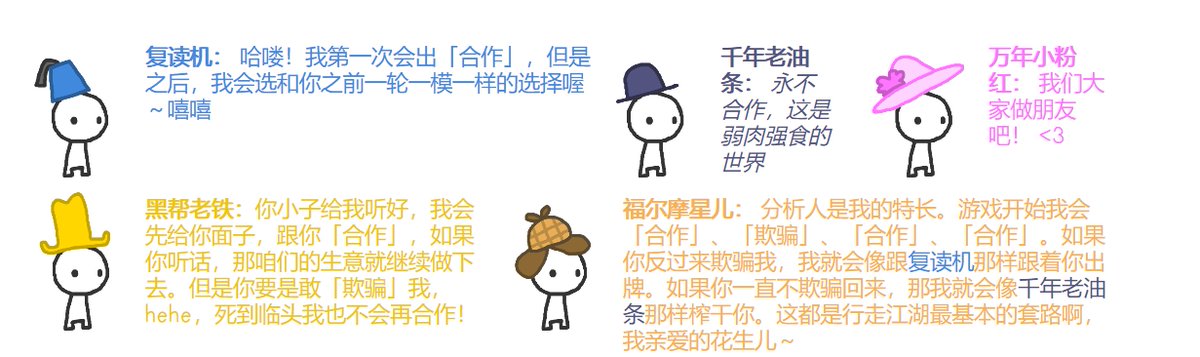

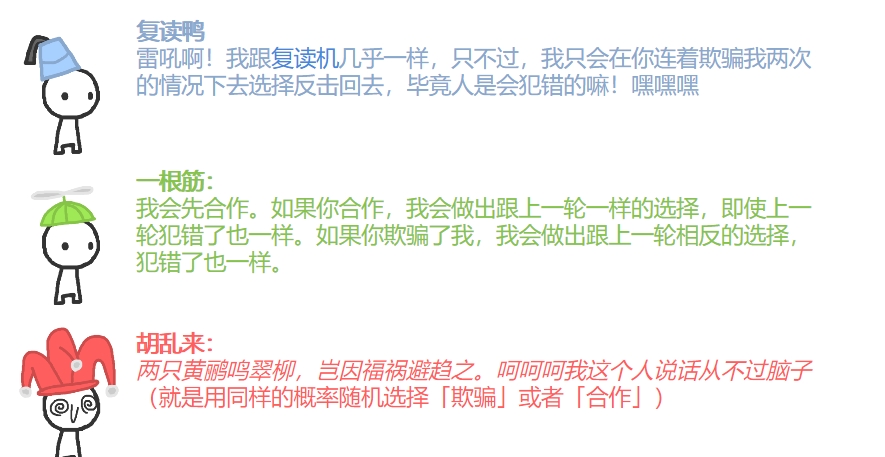

1⃣ First, let's introduce the various types of players participating in this simulation game:

- Copycat: Cooperates for the first time, then replicates the opponent's last choice;

- Deceiver: Never cooperates, always deceives;

- Eternal Optimist: Always cooperates, always believes;

- Gangster: Cooperates for the first time, but never cooperates again if deceived;

- FOMO: Tests the opponent by cooperating, deceiving, cooperating, and cooperating. If the opponent deceives, it becomes a copycat; if the opponent always cooperates, it becomes a deceiver.

- Echo: Similar to the copycat mechanism, but only starts to replicate the opponent's strategy after being deceived twice in a row.

- Stubborn: Chooses to cooperate for the first time. If the opponent cooperates, it cooperates in the next round; if the opponent deceives, it deceives in the next round. Stubborn does not allow the opponent to make mistakes unintentionally, with zero tolerance.

- Random: Randomly deceives or cooperates.

2⃣ Second, set the game environment. "The Evolution of Trust" allows the setting of game environment parameters:

- Player composition: Customize the composition ratio of different types of players;

- Rewards: Set the gains and losses of cooperation-cooperation, deception-cooperation, and deception-deception;

- Rules: Set the number of multiple game rounds per game, elimination mechanism, and fault tolerance rate.

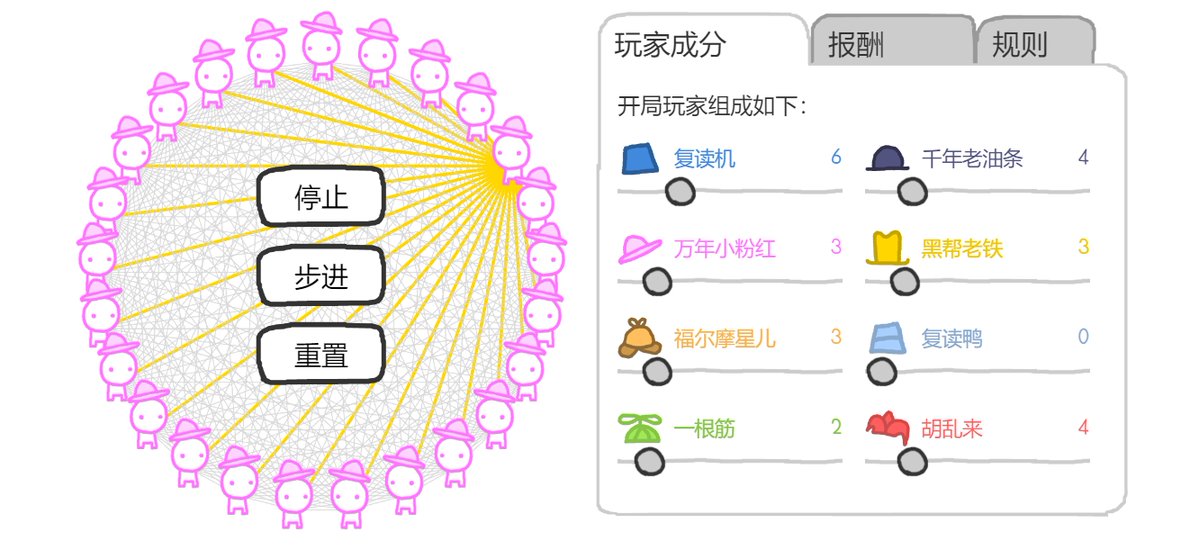

For the simulation parameters of the game environment in the US financial market, we set:

- Player composition: Copycat 4, Deceiver 4, Eternal Optimist 3, Gangster 3, FOMO 3, Stubborn 3, Echo 0 (Confucian integrity does not exist in the US, right?), Random 5;

- Rewards: Cooperation-cooperation set as (3,3), deception-cooperation (2,-1), deception-deception (0,0);

- Rules: 10 rounds per game, eliminate the bottom 5 players after each game, breed the top 5 players, and set a fault tolerance rate of 5%.

The simulation results are as shown in the figure. After 9 games, only the Eternal Optimist, who always believes and cooperates, remains on the field.

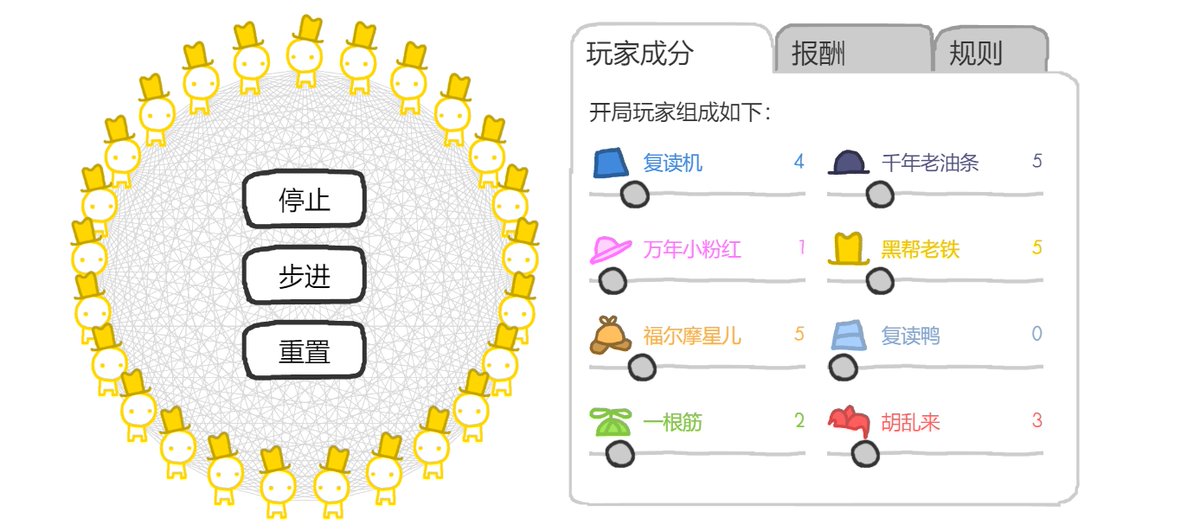

Now, let's simulate the game environment of the Chinese financial market with the following parameters:

- Player composition: Copycat 4, Deceiver 5, Eternal Optimist 1, Gangster 5, FOMO 5 (the most savvy among the Chinese), Stubborn 2, Echo 0 (Confucian integrity does not exist in modern China either), Random 3;

- Rewards: Limited rewards for cooperation in the Chinese financial market, with many benefits for deception. Cooperation-cooperation set as (2,2), deception-cooperation (3,-2), deception-deception (0,0);

- Rules: 10 rounds per game, eliminate the bottom 5 players after each game, breed the top 5 players, and set a fault tolerance rate of 5%.

The simulation results are as shown in the figure. After 10 games, only the Gangster, who deceives me once and I will deceive you forever, remains on the field.

In conclusion, in the cryptocurrency market, I choose to be an Eternal Optimist, believing in the news released by Bloomberg, BlackRock, and other institutions; in the A-share market, I choose to be a Gangster. You can deceive me once, but I will never trust you again and will deceive you back. This is what is called "serving the lord with all one's might" 😂

The above is only a personal opinion and not investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。