I. Fundamental Situation

1. Game Overview

Fusionist is a space mech game. Set in the 28th century, with Earth being largely uninhabitable, it has sparked large-scale wars. With interstellar travel now possible, Fusionists set out to explore the universe, seeking habitable homes for human DNA sequences, and spreading humanity throughout the galaxy.

Source: Fusionist

There are three main types of games:

Colonization-Construction: Collect resources, build planets, upgrade technology, etc.

Conquest-Turn-based combat: PVE PVP

Unity-Exploration, expansion, utilization, elimination

The game was launched on Steam at the end of 2023.

Endurance is the mainnet of Fusionist, a social and gaming infrastructure layer, a sidechain, and an application chain, and expands to other partners and games using this chain. ACE is the main token of Endurance.

2. Key Milestones

(1) August 2022: Release of game introduction and game 1-Colonization

(2) October-November 2022: NFT whitelist minting, start earning points for future rights, tokens, airdrops, etc.

(3) January 2023: Endurance mainnet launch and ACE token release

(4) March-November 2023: Game 2-Expedition and Galaxy Duel versions and activities continue to be updated

(5) December 2023: Fusionist announced a partnership with the Korean blockchain game platform MARBLEX

Announced progress of cooperation with Korean game developer RedBrick Engine, 0xspin will launch Op-Endurance: Sparkle (Endurance Layer 2 supported by OP Stack), where players can earn ACE and RedBrick tokens as rewards.

Revealed the web-based game ACE Arenas, an MOBA game independently developed by the Fusionist team, made with Unity engine, which will exclusively use $ACE as the core token. Similarly, all games and applications developed by Fusionist in the future will follow this model.

3. Team and Financing

The Fusionist team comes from well-known Web2 game companies such as Tencent, with key members including:

(1) Ike T. Founder and CEO: 14 years of industry experience, joined Tencent in 2009, served as AAD (Associate Art Director)

(2) Daniel Fang Marketing Director: 14 years of industry experience, joined Tencent in 2009, successively served as ADP (Associate Development Producer), publishing producer, operations manager, responsible for game development and promotion in three positions

(3) Charles D. Technical Director: 11 years of industry experience, full-stack engineer, Chief Engineer of MOONTON GAME

On June 1, 2023, Binance Labs disclosed a financing of $6 million as the main investor.

Source: RootData

II. Token Situation

The total supply of ACE tokens is 140 million, which is the main token and native asset of the Endurance network. The main use cases of the token are:

Gas Fee

NFT market trading and service fees

Application tokens for independently developed apps by the team

Staking at Endurance network validator nodes

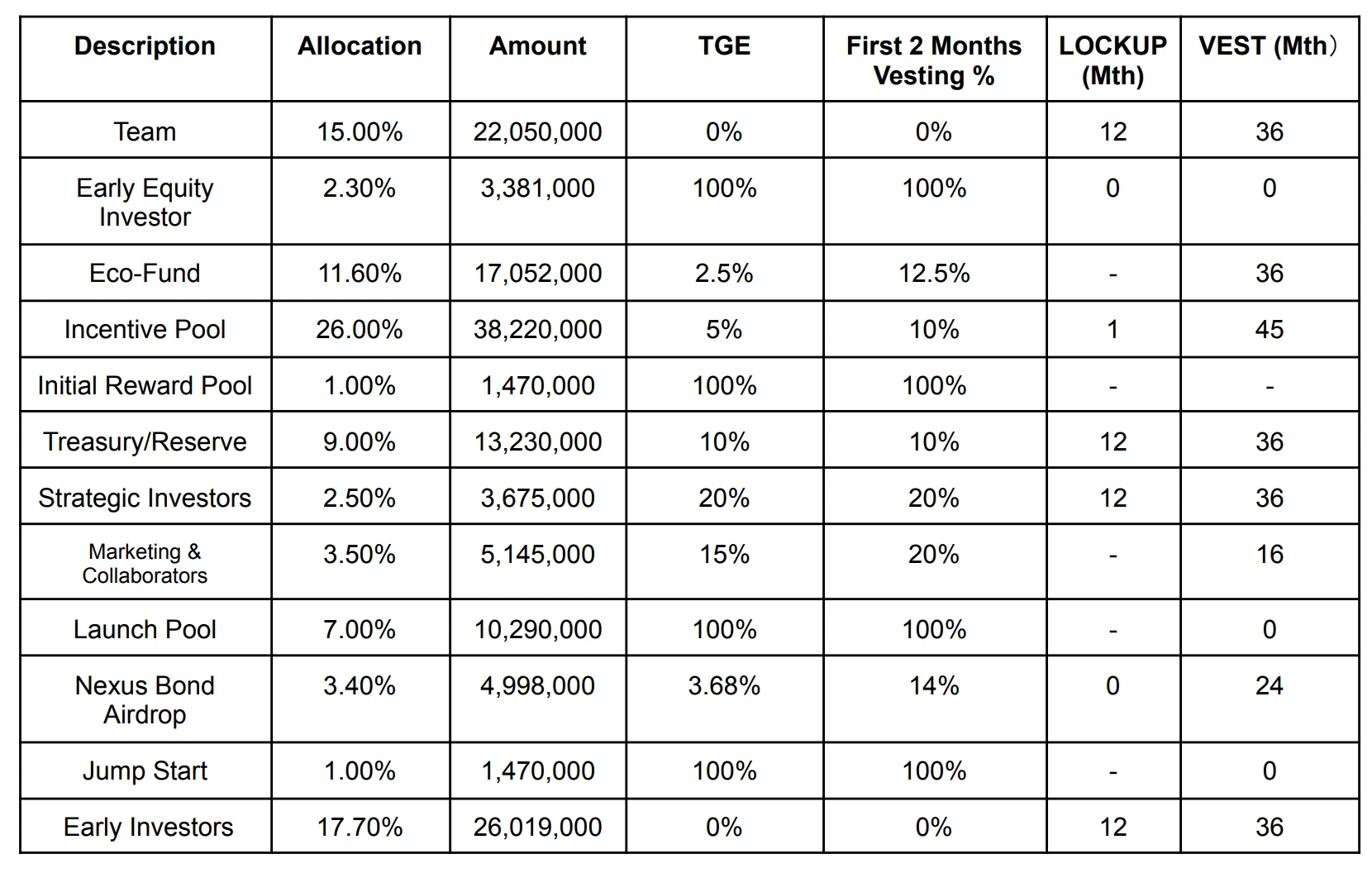

The token allocation in the white paper is as follows: the team and investors will allocate approximately 40% of the total token supply; by calculating TGE, the current circulating supply is 21,969,520 tokens, with 10,290,00 tokens distributed by Binance Launch Pool, and early equity investors holding 3,381,000 tokens, accounting for 15.38% of the current circulating supply.

Source: Endurance White Paper

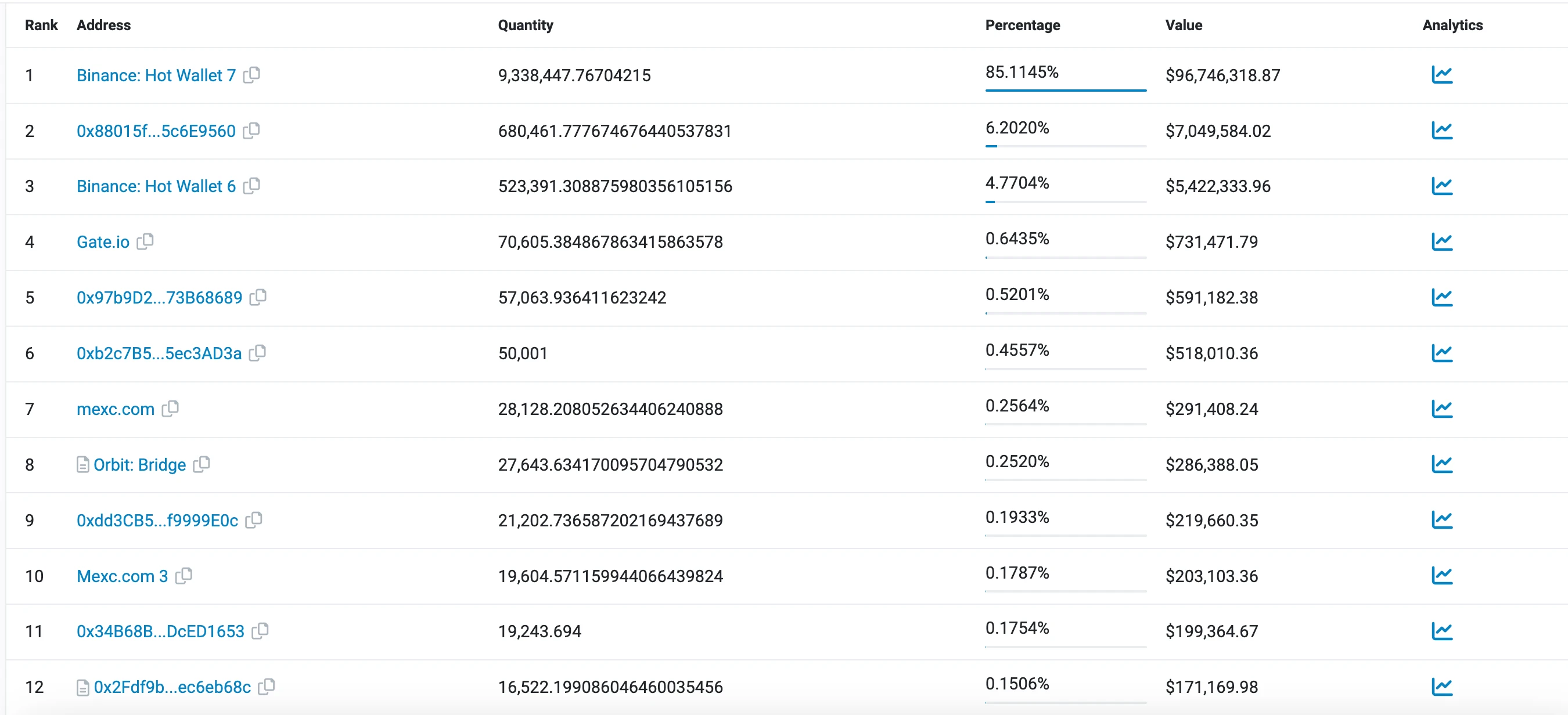

ACE tokens are mainly distributed on the BSC chain and the Endurance mainnet. BscScan can currently track 10,971,626 tokens, with Binance addresses accounting for approximately 90% of the total, and the second largest holder address 0x880 holding about 6.2% of the tokens.

Source: BscScan

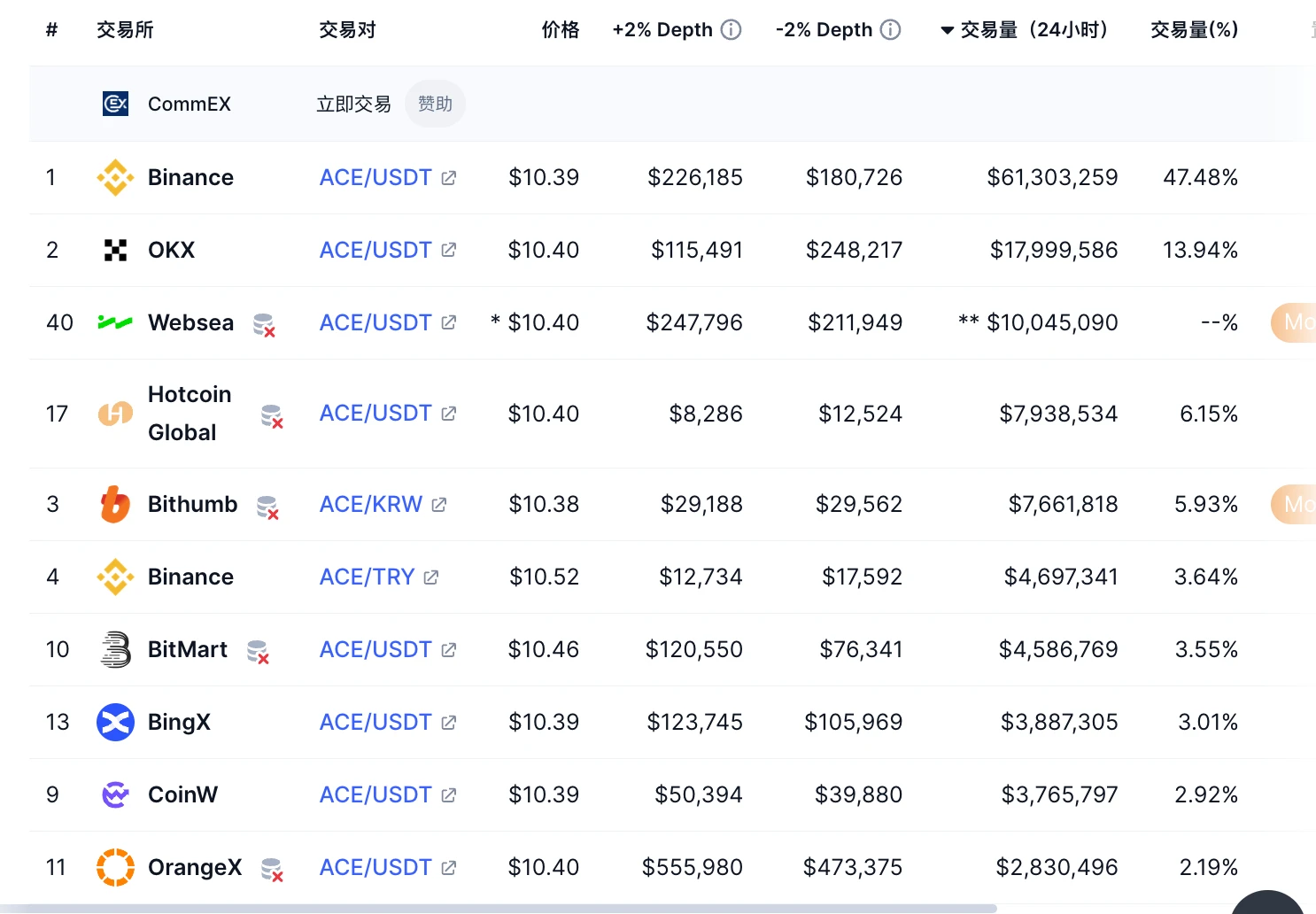

The main trading venues for ACE are Binance (47.48%), followed by OKX (13.94%) and Bithumb (5.93%).

Source: CoinMarketcap

III. Recent Spot and Futures Changes

1. Spot Changes

In the past 7 days, Binance's two wallets have seen a net outflow of 172,000 tokens, while the second largest holder address 0x880 has seen a net inflow of 144,000 tokens in the past 7 days. This address frequently trades on Bithumb and Binance, possibly being a market maker or an exchange-related address accumulating chips.

Source: Nansen

Source: Arkham

In the past 24 hours, Binance's spot trading volume has increased compared to the previous day, reaching 5.36 million tokens. Since the price dropped by 13% to $13 on December 22, the daily trading volume has gradually decreased, with a 7-day trading volume of approximately 2-5 million ACE/day.

Source: Binance

2. Futures Changes

In the past 24 hours, the funding rate for ACE on Binance has been between 0.04% and 0.08%, which is relatively high. However, the phenomenon of high funding rates across the entire market has been quite evident recently, with the funding rates for tokens with good momentum mostly above 0.04%. This indicates a relatively bullish sentiment in the market recently.

Source: Coinglass

The long/short ratio for ACE contracts has consistently remained above 2.9 since December 27, 2023, and has been above 3 in the past 24 hours. The long/short ratio for large accounts has remained above 1.13 in the past 7 days.

Source: Coinglass

In the past 7 days, ACE has experienced several significant declines, accompanied by an increase in long positions in the contracts. However, the position size is quickly replenished shortly after the increase in long positions. The Binance contract position size has remained above 2.5 million, reaching a new high in the past 24 hours.

Overall contract data indicates a relatively bullish sentiment in the market for ACE.

Source: Coinglass

IV. Summary

Fusionist has a strong fundamental foundation, with Binance Labs as the main investor and a core team from traditional game companies such as Tencent. It is positioned as a blockchain AAA game, following the model of application chain and platform token. It has close cooperation with Korean game developers and platforms. The overall game ecosystem is still in the early stages, with expectations of stable development.

The chip structure of ACE is relatively concentrated, with a large number of tokens held by the project and investors in the total supply. Early equity investors hold 15.38% of the circulating supply. In the BSC traceable addresses, Binance addresses account for approximately 90%, constituting a major potential source of selling pressure.

The token price has shown extreme volatility on the candlestick chart since its listing. Currently, the spot trading volume is relatively low, with outflows from Binance wallet addresses and inflows accumulating chips in the second largest holder address. Contract data shows a decrease in trading volume in recent days. On the contract level, the filling of long positions and a relatively high long/short ratio, funding rates, and other data indicate a relatively bullish sentiment in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。