With the borrowing rates equal to $eth staking APR, $prisma is just a farm-and-dump token

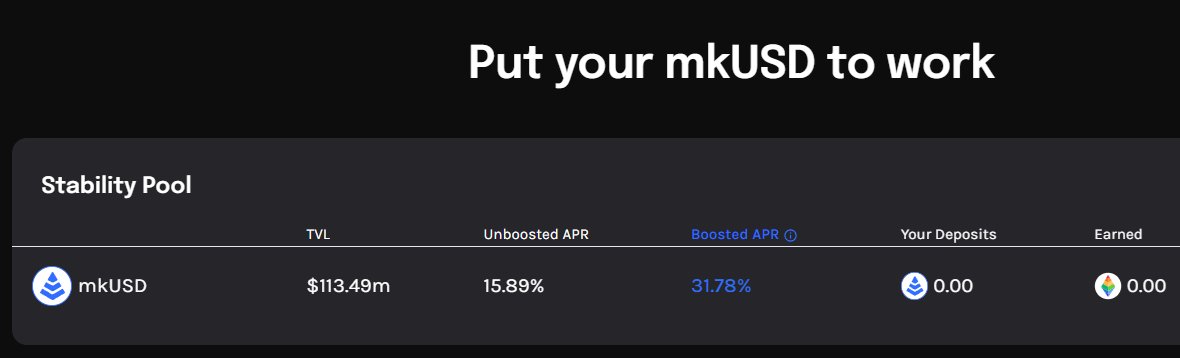

You can get at least 12% APR on your ETH with 200% CDR purely in $prisma if you stake $mkusd in the stability pool.

There is no reason to borrow on Prisma except farming native tokens and Justin (controls ~50% TVL) is doing exactly this ($1.3M $prisma farmed, and giving time shillers to get him a better exit price).

The stability pool also reminds $ape stake-not-to-dump model cause there is obviously no way to absorb so much supply.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。