Original Author: Sohrab Khawas

Original Translation: Zen, PANews

In the third quarter of 2023, the primary market in the cryptocurrency and blockchain field experienced a sharp decline, receiving only $19.75 billion in investments. This figure not only hit the lowest point since the fourth quarter of 2020 but also marked the industry entering a new low. After reaching a peak of $12 billion in the first quarter of 2022, cryptocurrency financing has been continuously declining for a year and a half.

With changes in fund flows and scale, we need to conduct a more in-depth study of the current funding situation in the Web3, blockchain, and cryptocurrency fields. This analysis aims to reveal the complexity and nuances of the Web3 financing sector and provide a clear understanding of the current fund distribution.

Review of Web3 Primary Market Financing

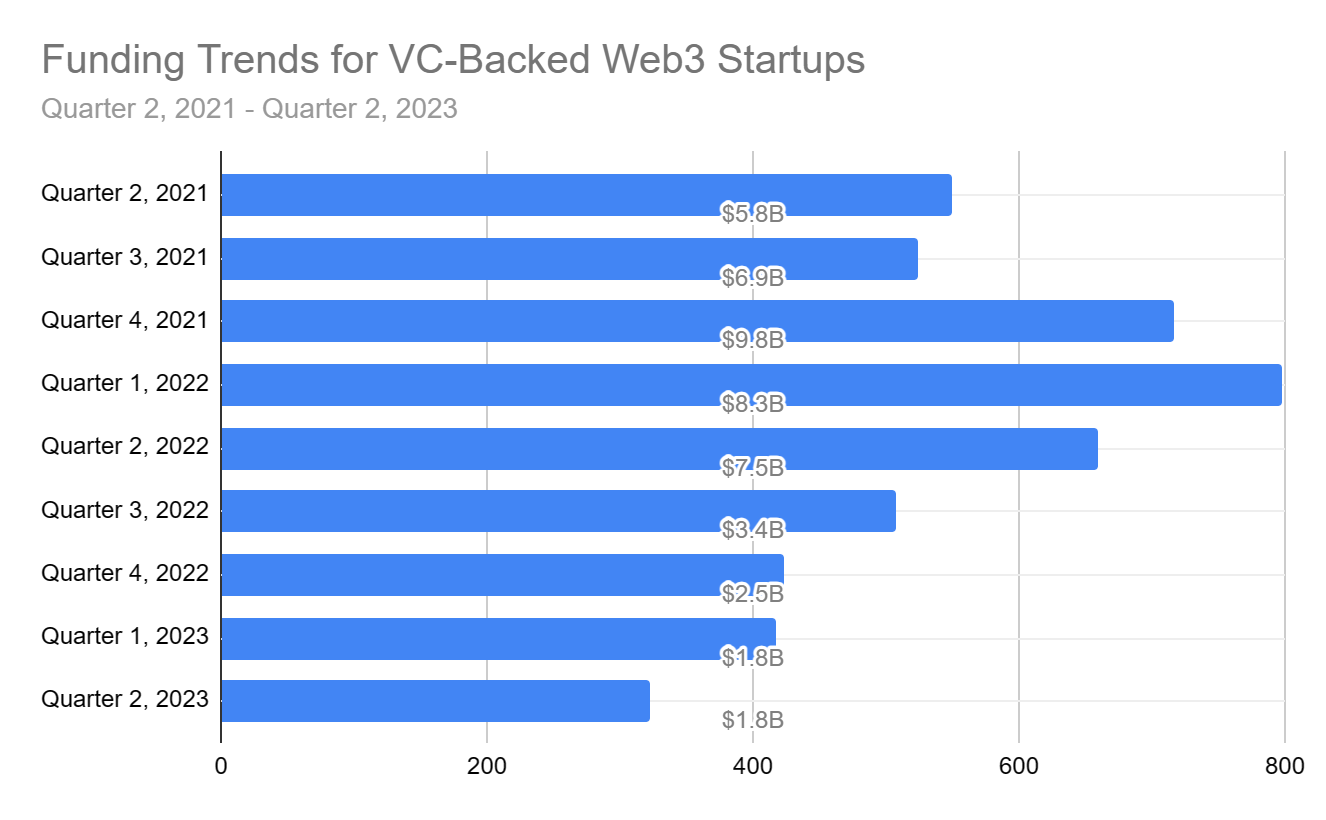

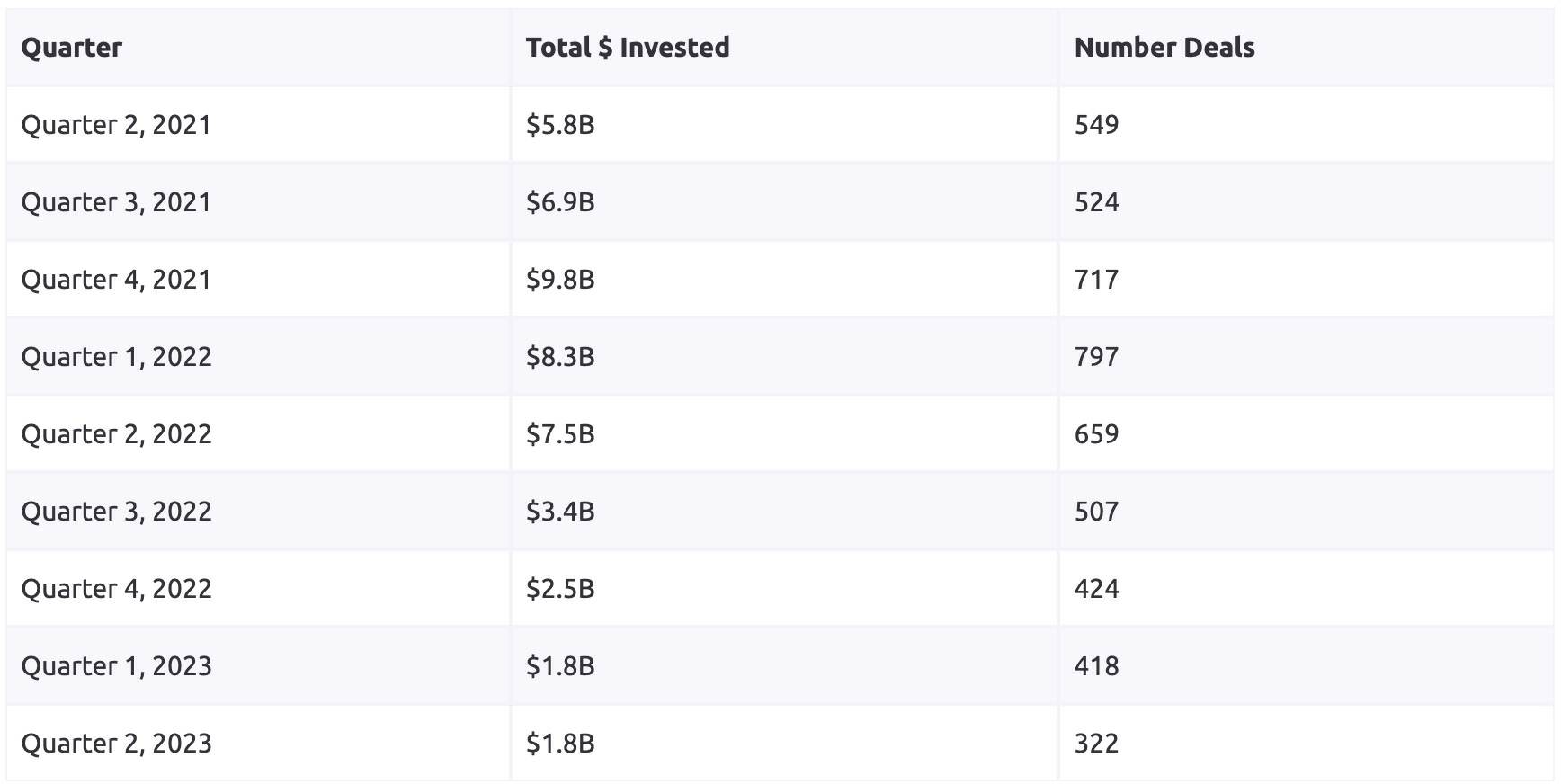

In early 2021, the market showed strong performance, but by the second half of 2022 and the beginning of 2023, it indicated that the market was undergoing a process of consolidation and integration, possibly forming a more stable trend. During this period, although the scale of funds fluctuated, the number of completed financing projects remained stable.

The Web3 industry showed strong growth in 2021, and this positive trend continued until the end of the year: Q2 saw a total investment of $54.8 billion involving 549 financings; Q3 reached $69 billion involving 524 financings; and Q4 saw a more significant growth, reaching $98 billion, completing 717 financings.

By early 2022, the scale of Q1 financing showed a slight decline to $83 billion, but the increase in the number of financings indicated that the market was still expanding. In Q2 of 2022, the financing amount decreased again to $75 billion, but it maintained a relatively stable number of financing transactions, possibly indicating market consolidation.

However, the decline in the second half of 2022 was indeed worrisome, with investments in Q3 and Q4 dropping to $34 billion and $25 billion, respectively. This downward trend continued into 2023, indicating a challenging phase for the industry.

Looking at half-year periods, the latter half of 2021 showed a strong growth trend, with financing amounting to $16.7 billion and 1,241 transactions. This optimistic sentiment continued into the first half of 2022, with financing reaching $15.8 billion. However, the second half of 2022 saw a sharp decline to $5.9 billion, indicating a market adjustment. This trend intensified in the first half of 2023, further indicating a significant contraction in the market.

Cryptocurrency Hedge Funds

According to the "Fifth Annual Global Cryptocurrency Hedge Fund Report," the percentage of hedge funds investing in cryptocurrency assets has decreased from 37% in 2022 to 29% in 2023. This shift indicates the need for a reassessment of the risks and potential of cryptocurrency assets in investment portfolios.

Hedge Fund Investment in Cryptocurrency Assets

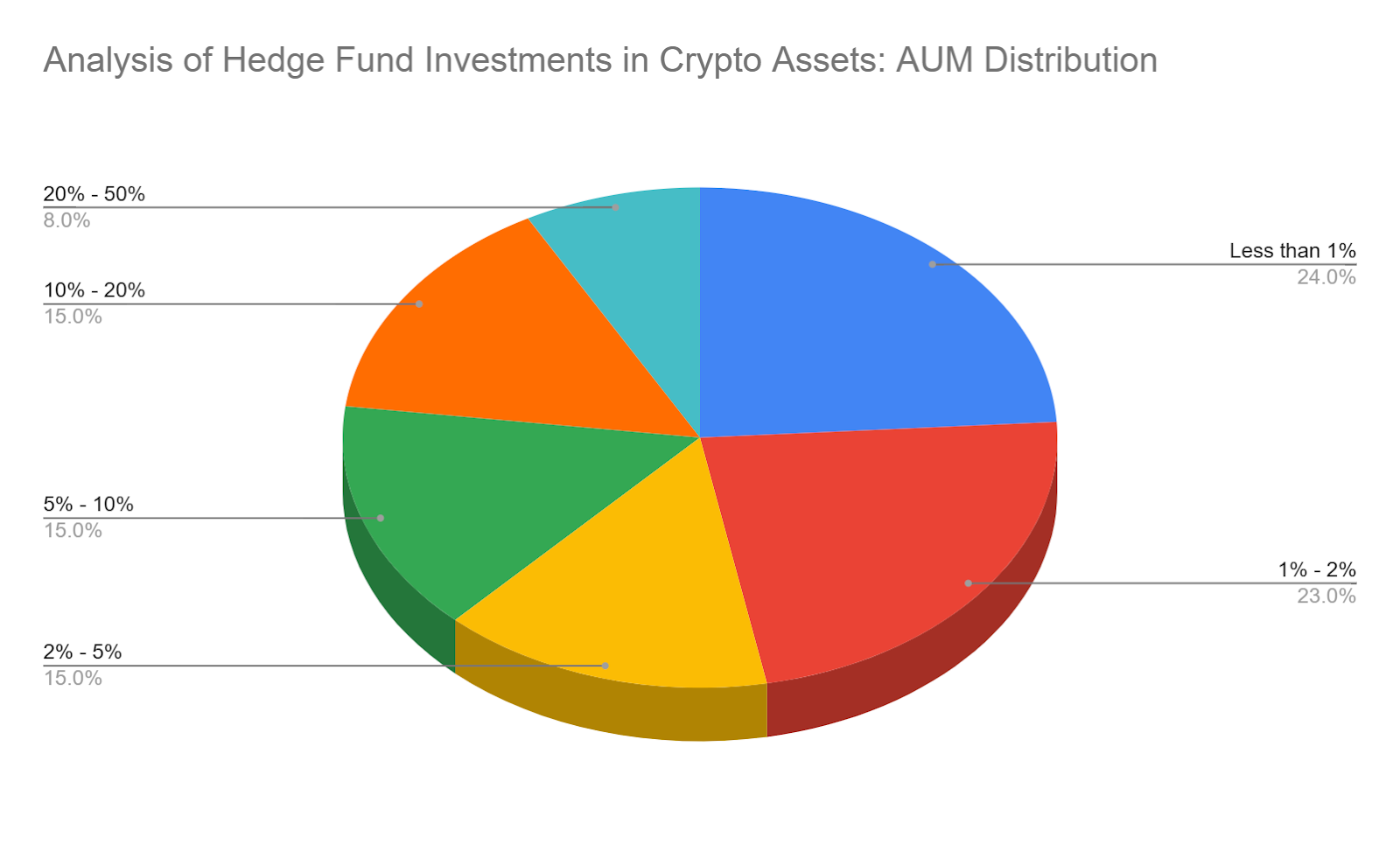

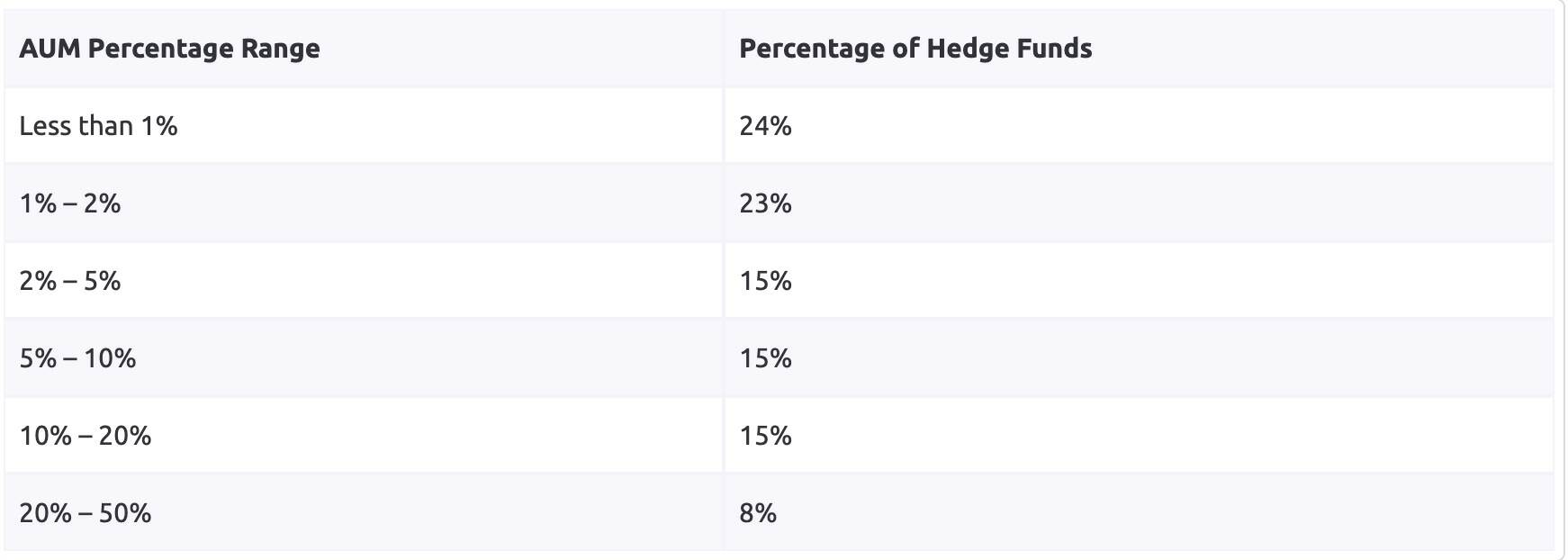

The above charts show the allocation of cryptocurrency assets in the total assets under management (AUM) of hedge funds. A considerable portion of hedge funds (24%) takes a conservative approach, with cryptocurrency investments accounting for less than 1% of their AUM, aligning with the overall volatility and risk of the cryptocurrency market. Interestingly, about half of the hedge funds investing in cryptocurrency assets adopt a "testing the waters" strategy, with funds allocated to cryptocurrency investments being less than 2% of their total assets under management. Of these, 63% of funds have over $1 billion in AUM, indicating that well-known funds are also cautiously exploring the cryptocurrency field.

In contrast, 38% of hedge funds actively investing in cryptocurrency assets show a high risk preference, with their cryptocurrency asset management accounting for over 5%. This represents a significant increase compared to last year's 20%, indicating growing confidence or willingness to hold more positions in the cryptocurrency market.

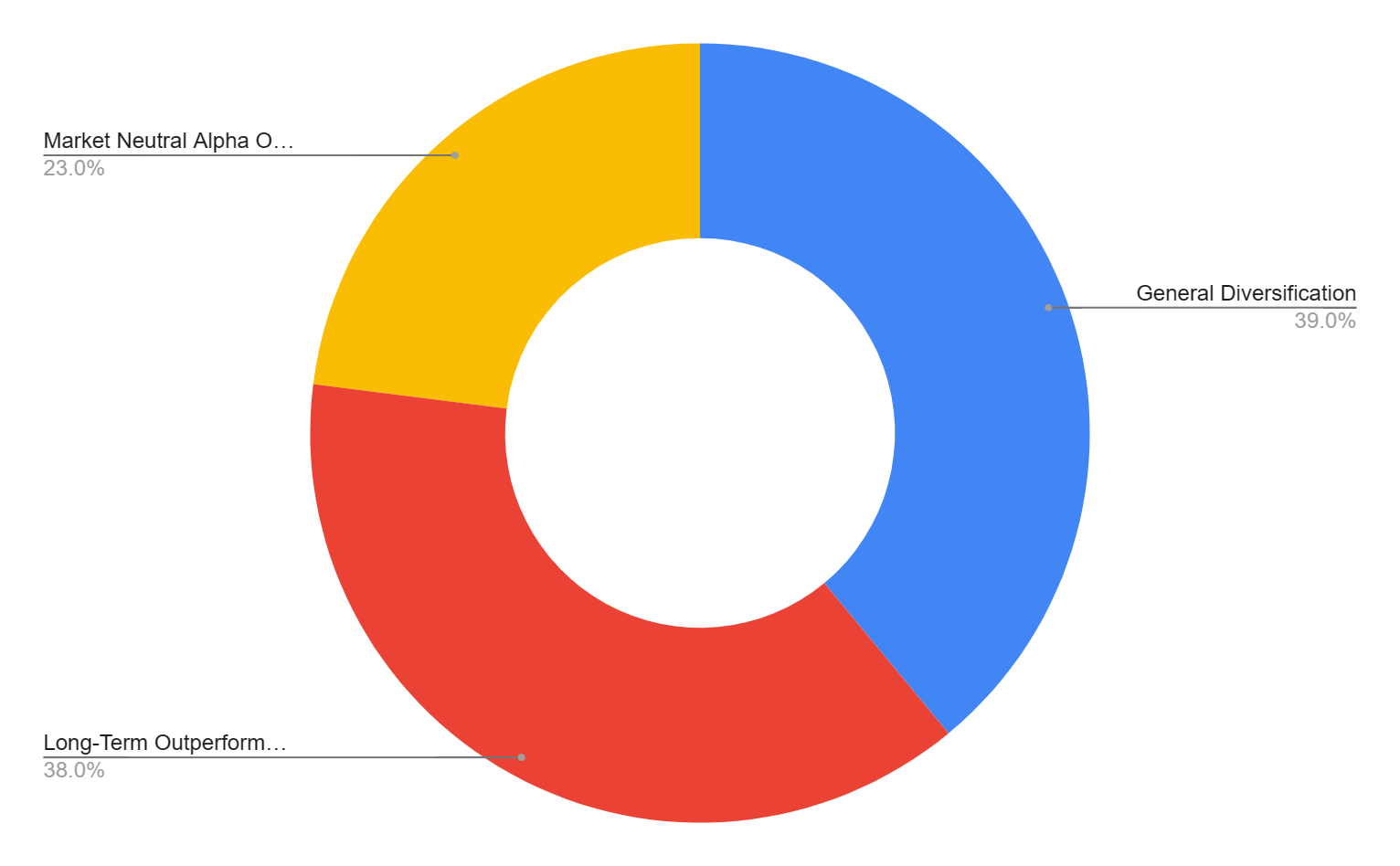

Main Reasons for Hedge Fund Investment in Cryptocurrency

Most hedge funds (39%) prioritize overall diversification, using cryptocurrency to diversify investment portfolio risks. Another important factor is the pursuit of long-term excess returns, with 38% of hedge funds hoping for sustained growth from cryptocurrency investments. Additionally, 23% are attracted to market-neutral alpha investment opportunities, indicating an interest in utilizing potential returns when the overall market trend is unclear. These motivations collectively highlight the multifaceted role of cryptocurrency assets in enhancing hedge fund investment portfolio strategies.

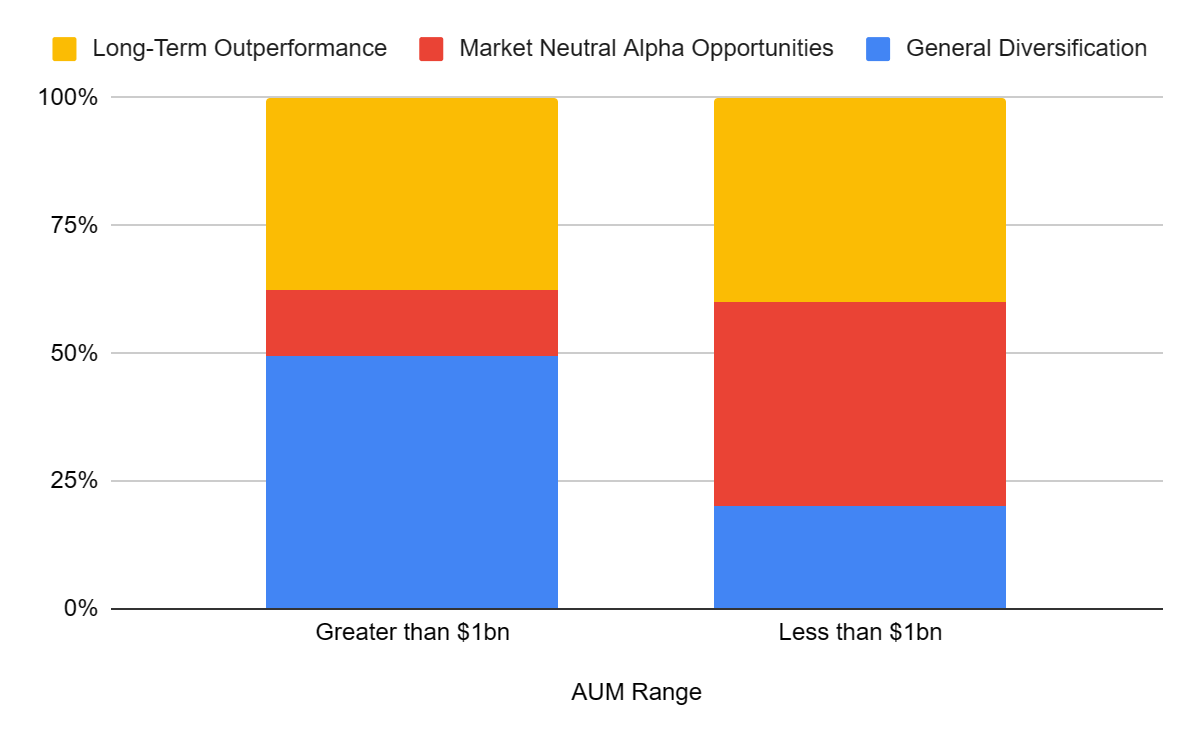

Motivation Insights Based on Asset Management Scale

Based on the assets under management (AUM) of hedge funds, different preferences for investing in cryptocurrency assets are evident. Hedge funds with AUM exceeding $1 billion prefer general diversification (50%) and long-term excess returns (38%). In contrast, funds with AUM below $1 billion emphasize market-neutral alpha opportunities (40%) and long-term excess returns (40%).

Hedge Fund Preferences for Cryptocurrency Assets

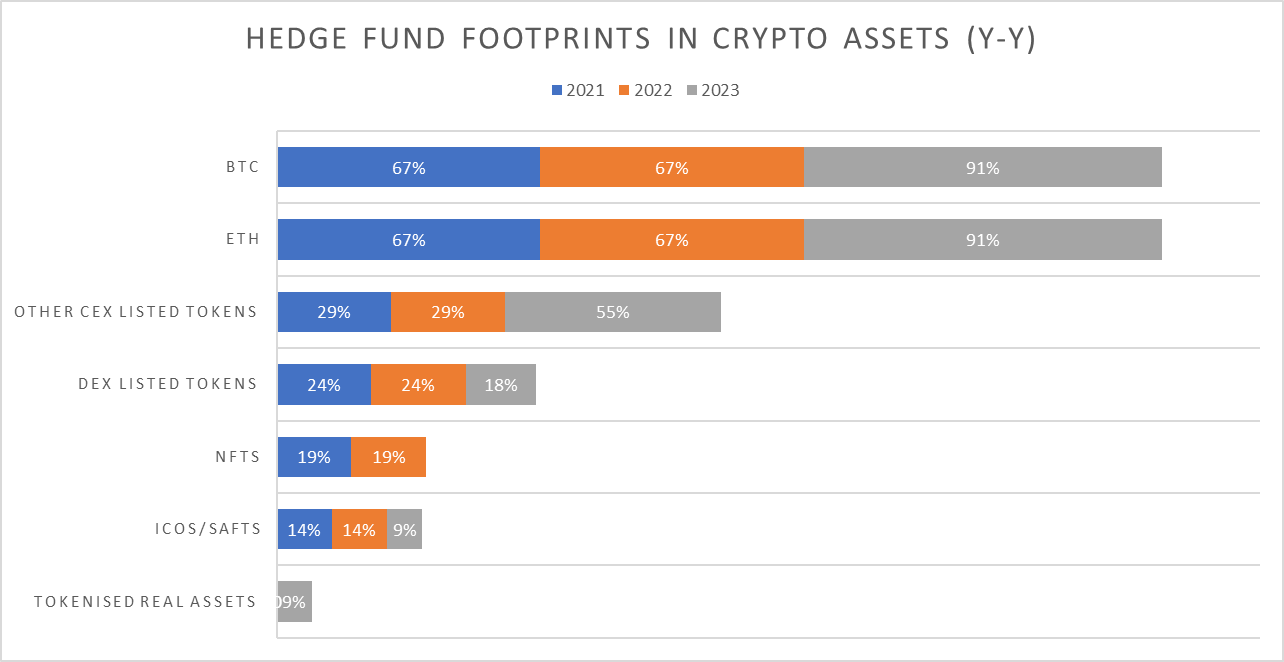

The data shows an interesting shift in hedge fund investments in various cryptocurrency assets from 2021 to 2023. Notably, the allocation of Ethereum (ETH) and Bitcoin (BTC) has significantly increased from 67% in 2021 to 91% in 2023, possibly driven by their market dominance and recognition as store of value assets. In contrast, the allocation for NFTs has decreased significantly, while investments in other tokens listed on CEX have surged from 29% in 2022 to 55% in 2023.

Trends in Blockchain Financing in 2023

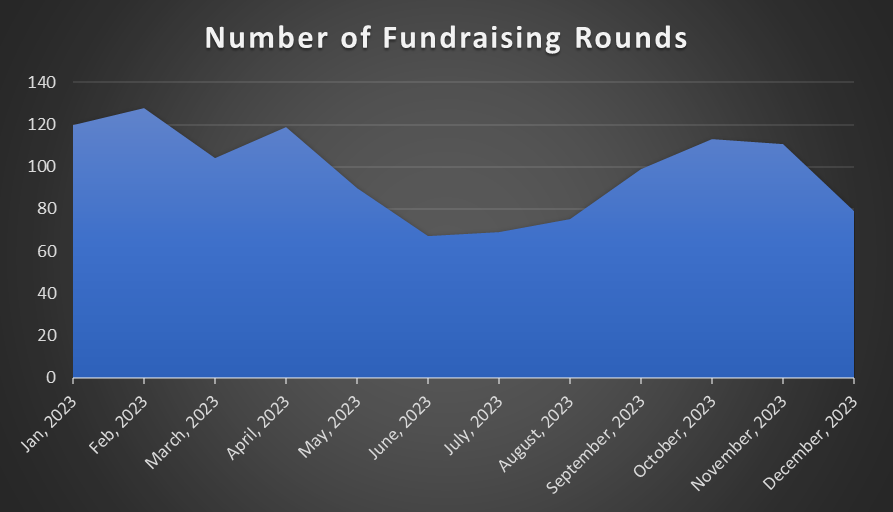

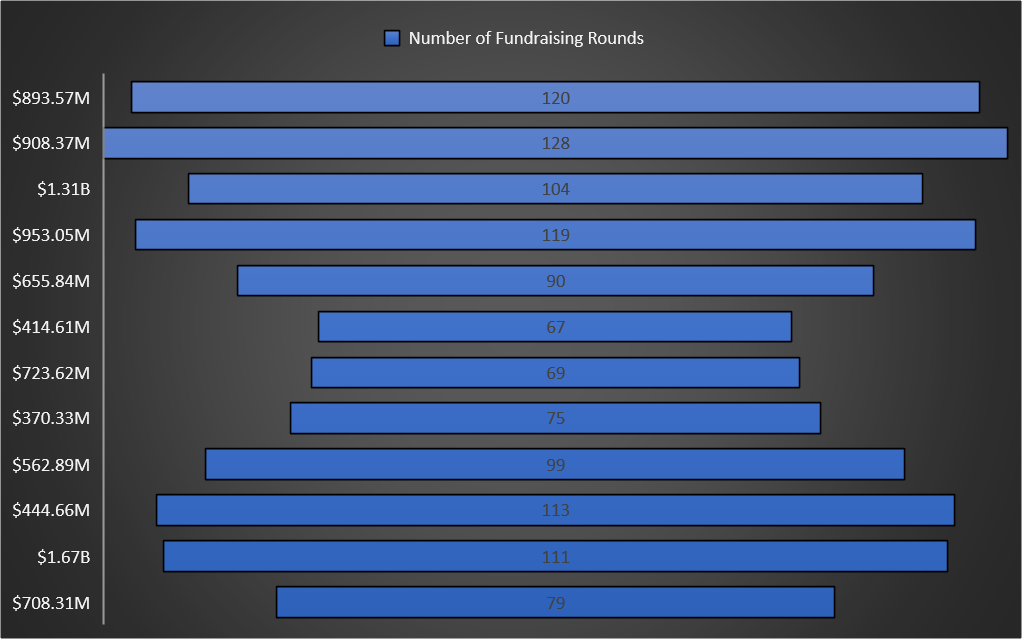

In 2023, the blockchain fundraising trend has shown a dynamic trajectory, with fluctuations in both "total financing amount" and "number of financings," as follows:

Strong Start: The year started off strong, reaching a minor peak in March, with 104 rounds of financing raising a total of $1.31 billion.

Mid-Year Decline: The lowest financing amount was in June, at $414.61 million, indicating a mid-year downturn in the industry.

Year-End Surge: A significant surge occurred in November, with 111 rounds of financing raising a total of $1.67 billion.

The total cryptocurrency financing amount in 2023 reached $9.615 billion, with 1,174 financings. In comparison, the total amount in 2022 was higher, reaching $41.86 billion, with 2,072 financings. Although the total financing amount in 2023 has decreased, the number of financings has remained relatively stable. This indicates that the market is diversifying, with more frequent financing activities shifting towards relatively smaller-scale projects.

Analysis of Different Tracks

Blockchain infrastructure and services have been consistently in the spotlight. In early January, there were 6 and 39 rounds of financing, respectively, and significant growth was seen in February with 8 and 48 rounds. This trend indicates a growing interest in basic technology and related services, emphasizing the industry's focus on enhancing blockchain capabilities.

Decentralized Finance (DeFi) has been a prominent area, with 22 financings in January and 40 in October, maintaining a competitive advantage. The DeFi sector has experienced substantial growth, reflecting the industry's commitment to decentralized financial solutions.

GameFi projects reached their peak with 22 financings in February but also experienced cyclical fluctuations, with only 8 and 10 financings in July and October, respectively.

NFTs received attention throughout the year, reaching peaks in January and March with 10 and 8 financings, respectively, indicating the continued unique appeal of digital assets in various applications.

Web3 social projects showed resilience, especially in April, August, and November, each receiving 14 financings. This indicates sustained interest in platforms integrating blockchain with social interaction.

It is noteworthy that stablecoins and traditional currencies did not see significant financing activities during the year. This may indicate a shift in focus from traditional fiat-backed digital assets to other areas, possibly due to regulatory considerations or an increased demand for more innovative cryptocurrency solutions.

2023 VS 2022

Comparing the trends in 2023 and 2022 provides valuable insights into the evolving landscape of the market.

In 2023, financing for blockchain infrastructure significantly increased from 62 rounds to 72 rounds, indicating a growing interest and investment in the fundamental elements of blockchain technology. This suggests that industry practitioners will continue to focus on building robust infrastructure to support various blockchain projects. On the other hand, blockchain services decreased from 621 to 381, indicating a possible shift in focus from services to infrastructure development.

Decentralized Finance (DeFi) still holds a significant position, decreasing from 326 rounds to 242 rounds, indicating consolidation or maturation in the decentralized finance sector. However, GameFi financing decreased from 351 rounds to 130 rounds, suggesting a reassessment of interest in cryptocurrency projects related to gaming.

Centralized Finance (CeFi) and public chain categories both saw a decrease in financing in 2023, with CeFi decreasing from 244 rounds to 97 rounds and public chains decreasing from 71 rounds to 65 rounds. This may indicate a declining interest in centralized financial services. It is noteworthy that the momentum for Meme projects is not significant. NFTs saw a sharp decline from 224 rounds to 62 rounds.

The social category decreased from 148 rounds to 119 rounds, indicating a reduction in social-oriented cryptocurrency projects or a more selective investment approach in this category.

Overall, investment institutions seem to be diversifying their interests, emphasizing blockchain infrastructure, and adjusting their focus in specific categories such as DeFi and GameFi.

Financing Stage Segmentation

Seed round funding has been a major driver, accounting for 30.62% of the share, indicating support for early-stage emerging enterprises. Strategic financing follows closely at 9.53%; pre-seed and Series A financing account for 8.68% and 6.43% respectively; Grant funding at 3.49%; M&A at 1.94%; and the highest share for other categories at 39.3%. This indicates that the cryptocurrency industry has a financing ecosystem that values early-stage innovation, strategic partnerships, and flexible financing methods, with a significant portion dedicated to diverse and evolving financing models.

Regional Trends in Blockchain Project Financing

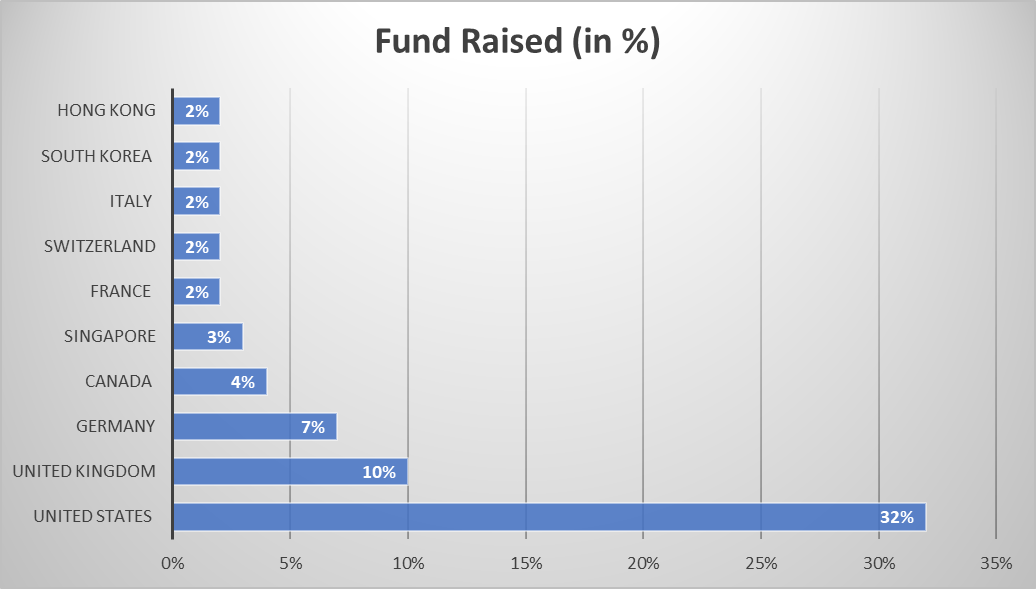

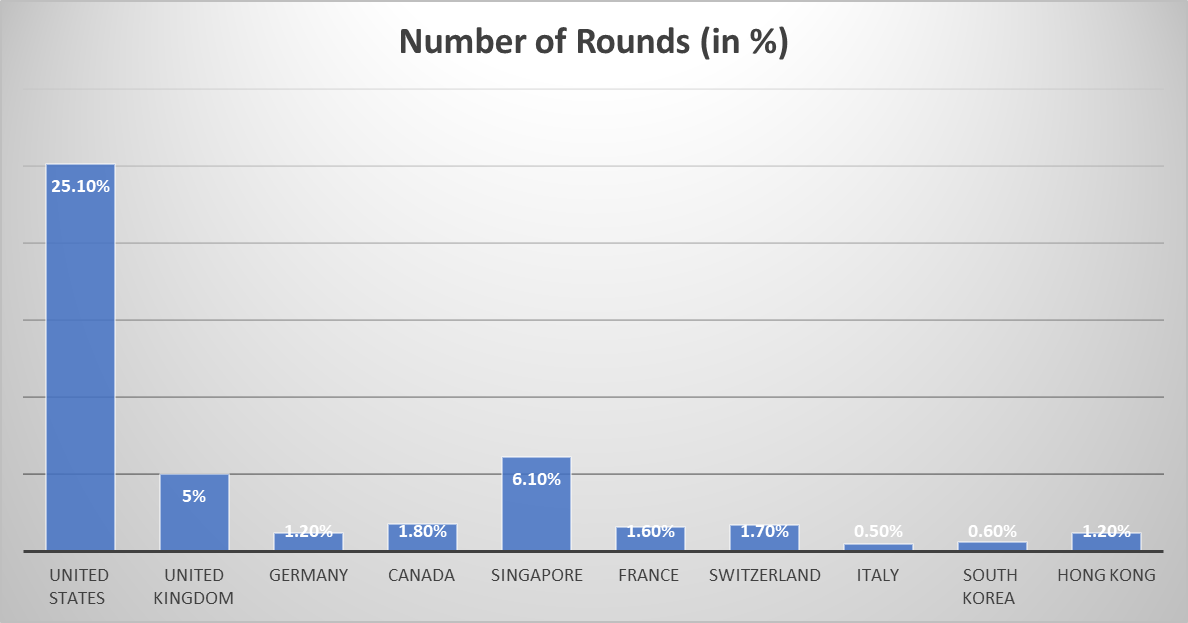

In 2023, the primary centers for cryptocurrency fundraising include the United States, the United Kingdom, Germany, Canada, Singapore, France, Switzerland, Italy, South Korea, and Hong Kong.

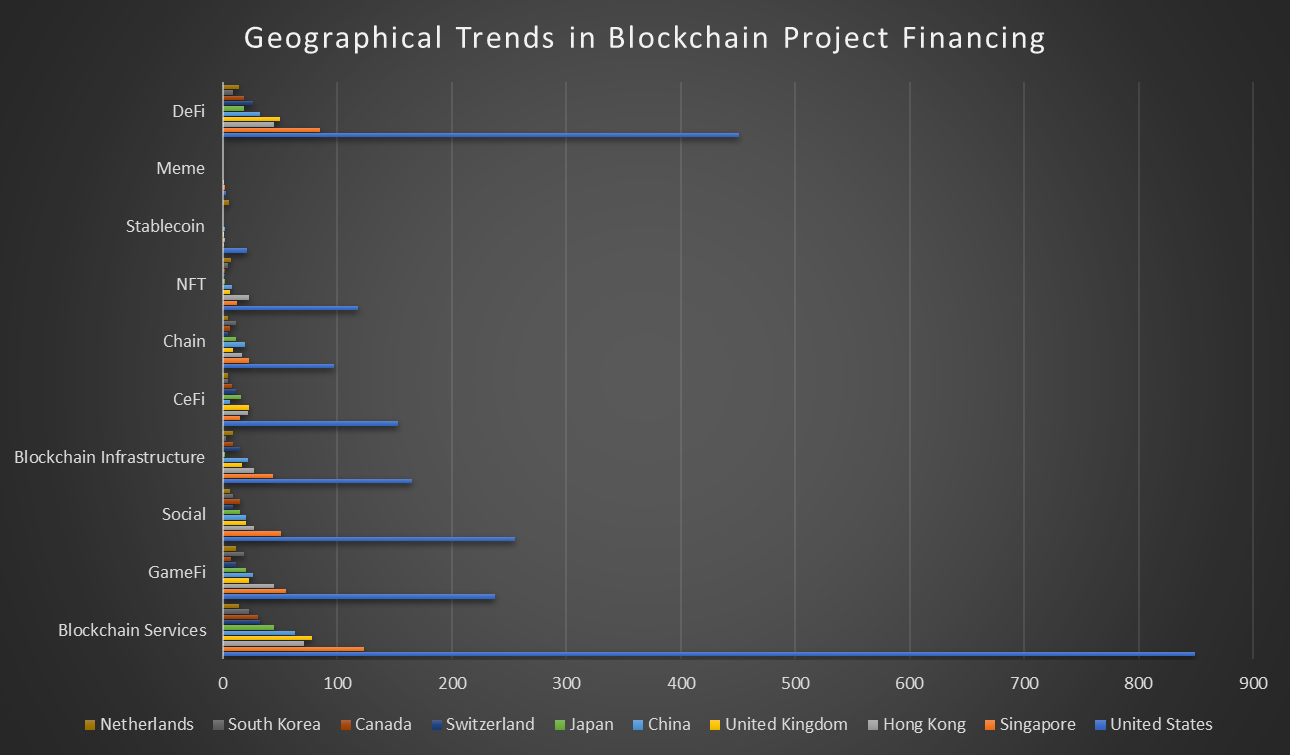

By analyzing comprehensive blockchain project financing data, geographical trends among different jurisdictions can be revealed. The following charts analyze and emphasize the global nature of blockchain innovation, as well as the unique strengths and preferences exhibited by different regions in project financing.

The United States emerges as a strong leader in the blockchain field, with a diverse range of projects covering blockchain services, GameFi, social, blockchain infrastructure, CeFi, public chains, NFTs, stablecoins, Meme, and DeFi. It is noteworthy that blockchain services and DeFi projects are most concentrated, indicating a primary emphasis on fundamental blockchain products and decentralized financial solutions in the region.

Singapore closely follows, demonstrating a balanced mix of various project categories. Blockchain services and DeFi also dominate in Singapore, aligning with global trends. The data shows a significant interest in blockchain technology for financial and decentralized applications.

While Hong Kong follows global trends with a growing interest in blockchain services and DeFi, it stands out in the GameFi, blockchain infrastructure, public chain, and NFT categories. This indicates a preference for gaming, blockchain infrastructure, and NFTs in the region, and the diversity of project focuses demonstrates Hong Kong's goal of embracing blockchain technology in different verticals.

The UK excels in blockchain services, CeFi, and DeFi, showing a strong interest in traditional blockchain services and the decentralized finance industry. Meanwhile, China, as a significant player in the global tech sector, maintains a strong position in multiple categories, particularly dominating in blockchain services, DeFi, GameFi, and blockchain infrastructure.

Japan takes a balanced approach, with prominence in blockchain services, GameFi, DeFi, CeFi, and public chain projects; Switzerland and Canada are known for their robust financial industry, focusing on blockchain services, blockchain infrastructure, and DeFi, aligning with their strategic financial innovation.

South Korea focuses on blockchain services, GameFi, and public chains, indicating a preference for practical application projects. Finally, the project mix in the Netherlands is relatively balanced, with even distribution in blockchain services, GameFi, blockchain infrastructure, NFT, and DeFi projects.

Summary

For the Web3 and cryptocurrency sectors, 2023 has been a rollercoaster ride. Despite a sharp decline in total financing amount for the year, the data shows potential resilience and an evolving landscape. Blockchain infrastructure and services remain a top priority, while DeFi and GameFi continue to attract significant attention. The rise of early-stage financing and strategic partnerships highlights the emphasis on nurturing innovation and ensuring long-term success.

Looking ahead, how these trends will shape the future of Web3 and cryptocurrency, whether established enterprises can reclaim dominance, and whether new pioneers can rise to redefine the landscape, are all worth anticipating and observing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。