Top 10 ways to make risk-free returns. 6 will shock you

Now since I've got your attention let me add a few more words about @Instadapp. You can still be early.

What is Instadapp?

It is a set of tools that improves the UX and it currently has $2.2B TVL.

Today it consists of 3 protocols:

• Instadapp Pro

• Instadapp Lite

• Avocado wallet

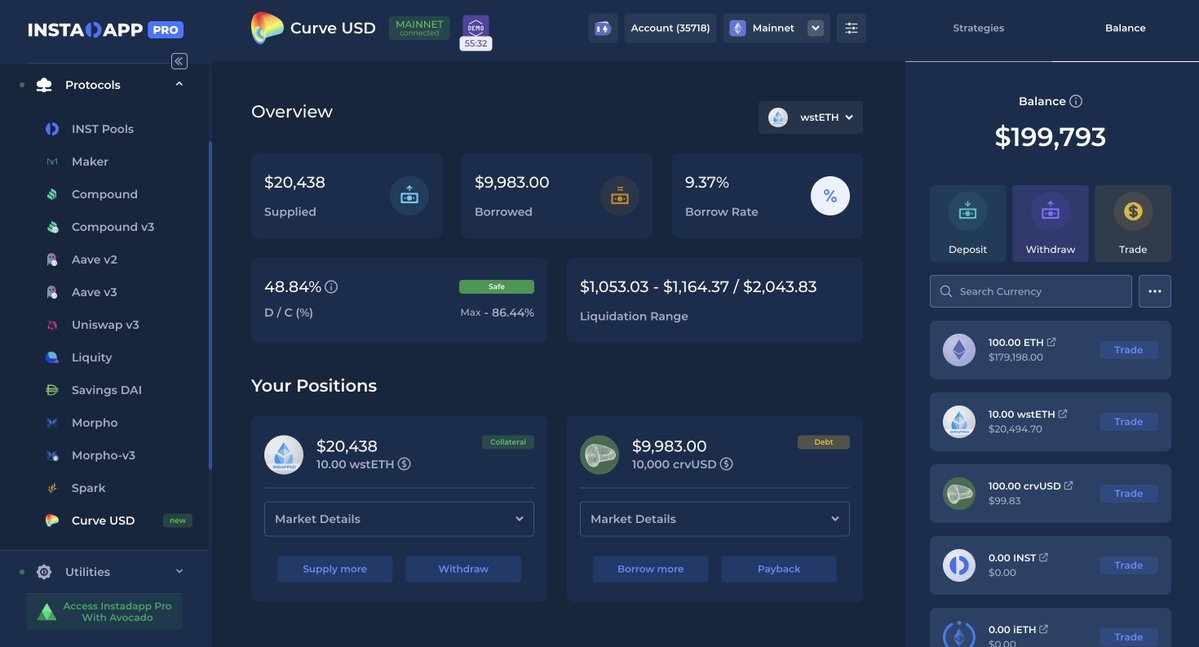

ID Pro is a middleware platform for whales. It allows automation of DeFi strategies, refinancing the loans, swapping collaterals and debts, etc.

Basically, ID Pro allows whales to transfer their lending market positions from one protocol to another based on their needs (lower rates, higher LTV, etc) in a few clicks.

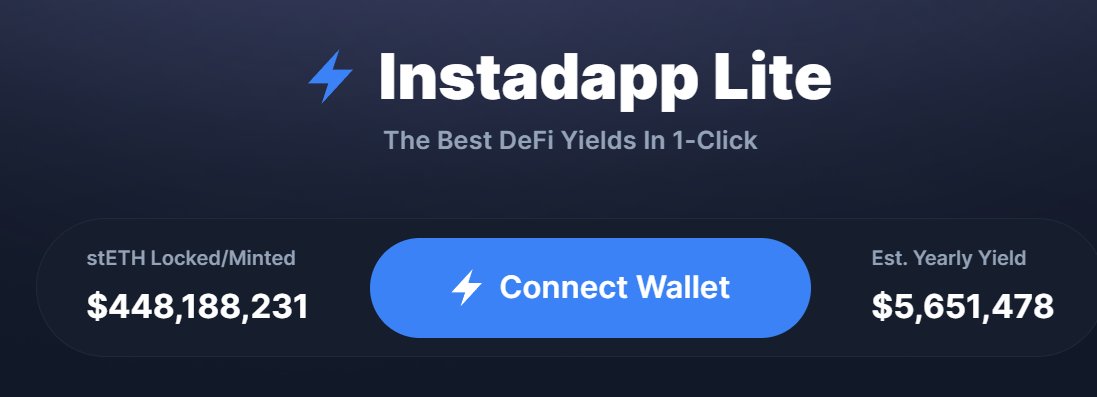

ID Lite is a yield platform. At the moment it has 1 strategy with leveraged stEth with $448M TVL. All of this TVL is routed to Aave - the biggest lending market in DeFi.

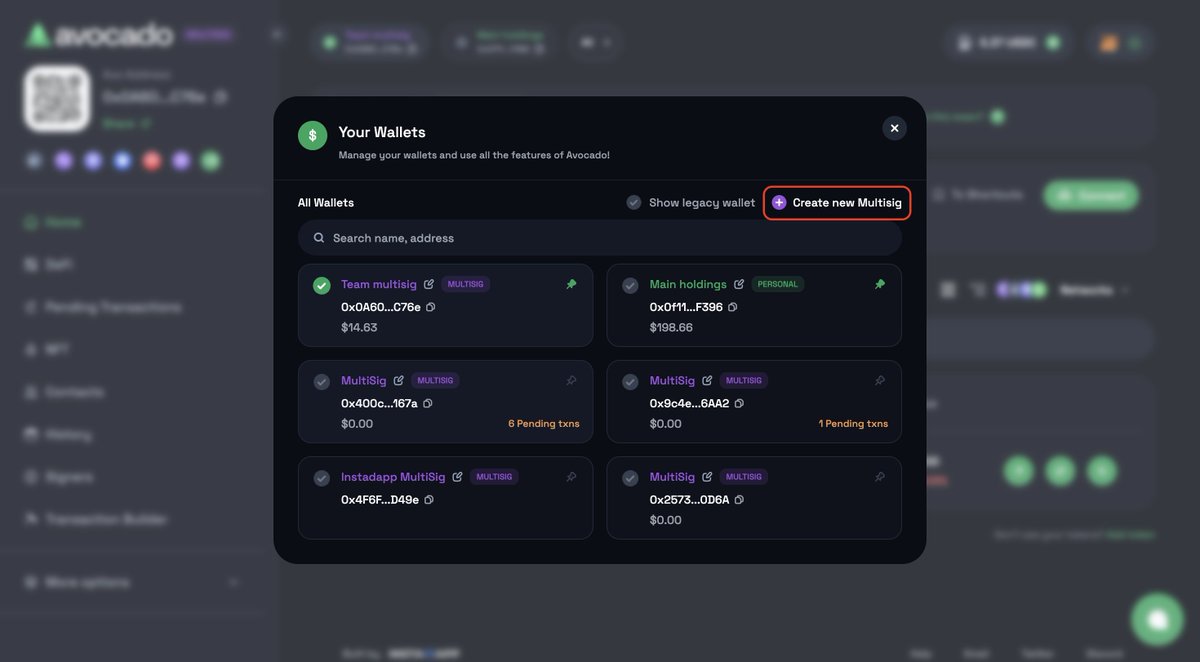

@avowallet is a smart contract (Account Abstraction) wallet that also supports multichain multisig, users can pay gas in any token, 2FA, etc. There is a lot of demand for this wallet from the funds, DAOs, etc who have to manage capital across multiple blockchains.

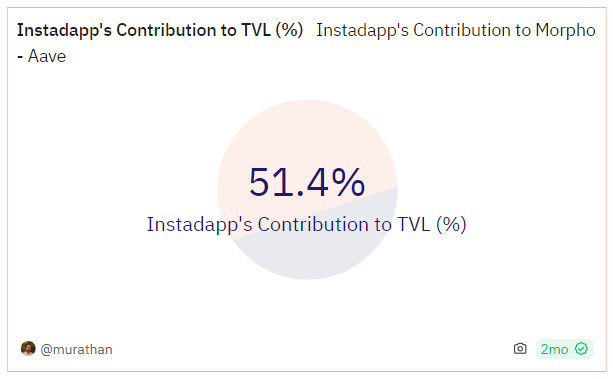

Overall, Instadapp is mostly used to simplify and make the usage of the lending protocols for the users more efficient. Instadapp routes liquidity to lending markets. For example, Instadapp's contribution to Morpho is more than 50%.

Here comes the @0xfluid. As explained in the quoted thread, It is designed to be the most efficient lending on the market right now. It will organically attract borrowers and lenders to the protocol.

On top of that, users who already use Instadapp will be encouraged to transfer their funds to Fluid from other lending markets for better terms.

Fluid itself will consist of the lending module, vaults, and dex engine. There are a few more modules that will be built on top of Fluid after the launch (pre-launch in early January, full launch end of January).

Additionally, there are other teams who might build products on top of the Fluid.

Considering all of the above I believe that Instadapp might become one of the biggest protocols in DeFi within 12 months (probably the biggest except liquid staking protocols).

$INST is the only token that governs all Instadapp products and its utility is governance. While plenty of people believe that governance is a meme (yes, it is), governance gives access to the protocols' treasuries.

It is irrelevant for small projects, but having an influence on projects with big treasuries is very lucrative.

I explained in this thread (https://t.co/EQCAG1vt2h) how different service providers get up to $4M a year for not that much workload.

Eg, if the protocol generates $40m revenue a year but the token Market Cap is only $20M then there is a clear incentive to acquire tokens and take over the treasury.

Also wanted to mention that Instadapp has raised $12.4M from VCs and Angels such as @cbventures, @PanteraCapital, @naval, @AndreCronjeTech, etc in 2021.

Let's see how it works out but I can not wait until it launches.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。