Original | Odaily Planet Daily

Author | Loopy Lu

In this round of market recovery, we have seen a significant increase in activities on the Sui network.

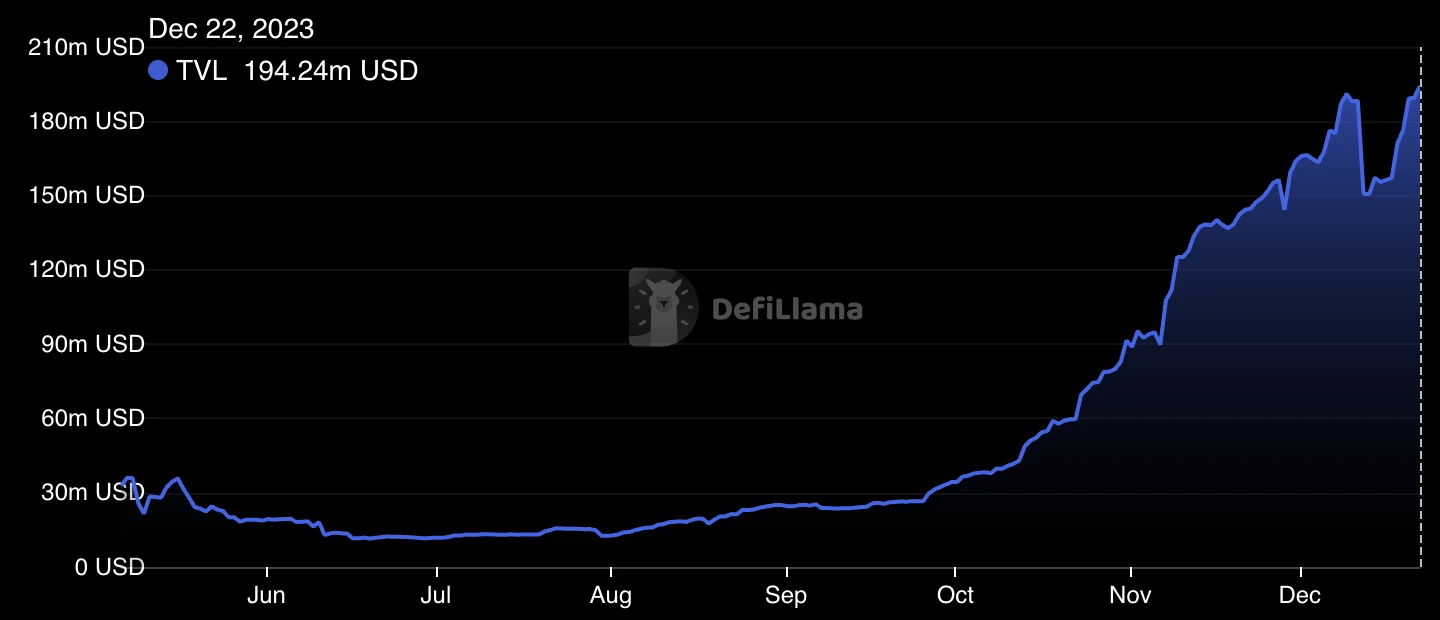

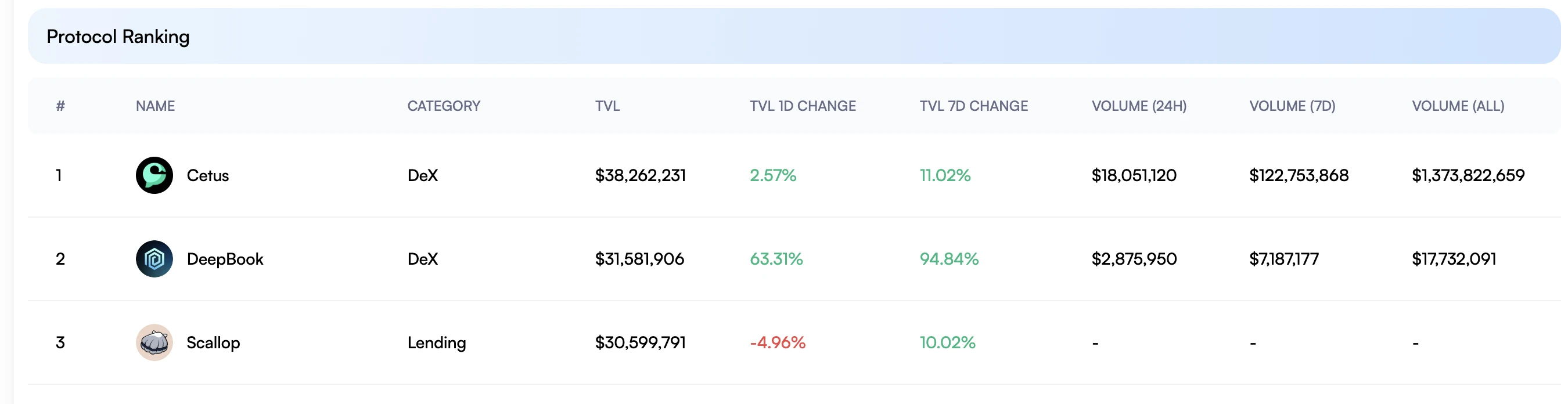

According to DeFiLlama data, Sui's TVL has risen rapidly, currently approaching $200 million, several times the average level of the previous months.

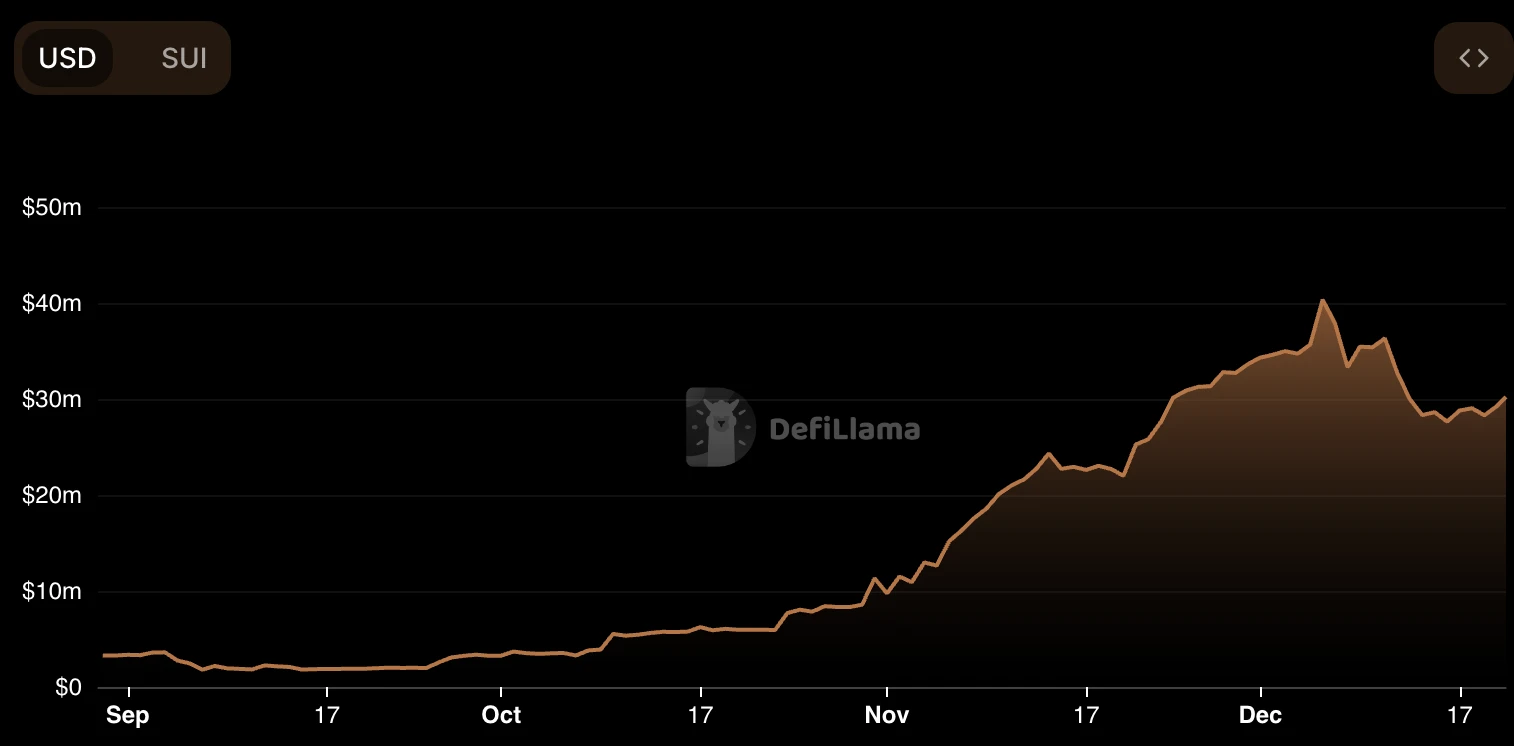

In the growth of the SuiDeFi ecosystem, the lending market named Scallop is particularly noteworthy. SuiVision data shows that Scallop's rapid growth has made it a key participant in the Sui ecosystem, with Scallop TVL currently exceeding $32 million, and at its peak, it once exceeded $40 million.

In terms of the ecosystem, the lending platform may seem "old-fashioned," but Scallop has made a differentiated innovative breakthrough in the DeFi lending track by relying on its technical strength and deep cultivation in this field.

Scallop not only represents an innovative breakthrough in the DeFi field but also demonstrates how the industry can better utilize the technical characteristics of non-EVM emerging public chains to continuously produce innovation for the old track.

The lending market is vast, and how to obtain official recognition in the non-EVM new ecosystem

Currently, there are over 300 DeFi lending protocols recorded by the data platform DeFiLlama. According to Stelareum's data, the total TVL of the entire DeFi lending market is extremely large, with the data showing that the total TVL of lending protocols has exceeded $10 billion.

Although the current market focus is still occupied by emerging hotspots, as an important liquidity infrastructure in the on-chain market, lending platforms are still a very important track and have a far-reaching impact on the market.

Despite the long development, current DeFi lending platforms still face various limitations, such as high gas fees, low transaction efficiency, security risks, and lack of scalability. The emergence of Scallop is expected to bring better solutions to the market.

Deployed on the Sui network, Scallop is an innovative on-chain lending market in the lending field and the first DeFi protocol to receive official funding from the Sui Foundation.

According to DeFiLlama's data, Scallop's TVL has peaked at over $40 million.

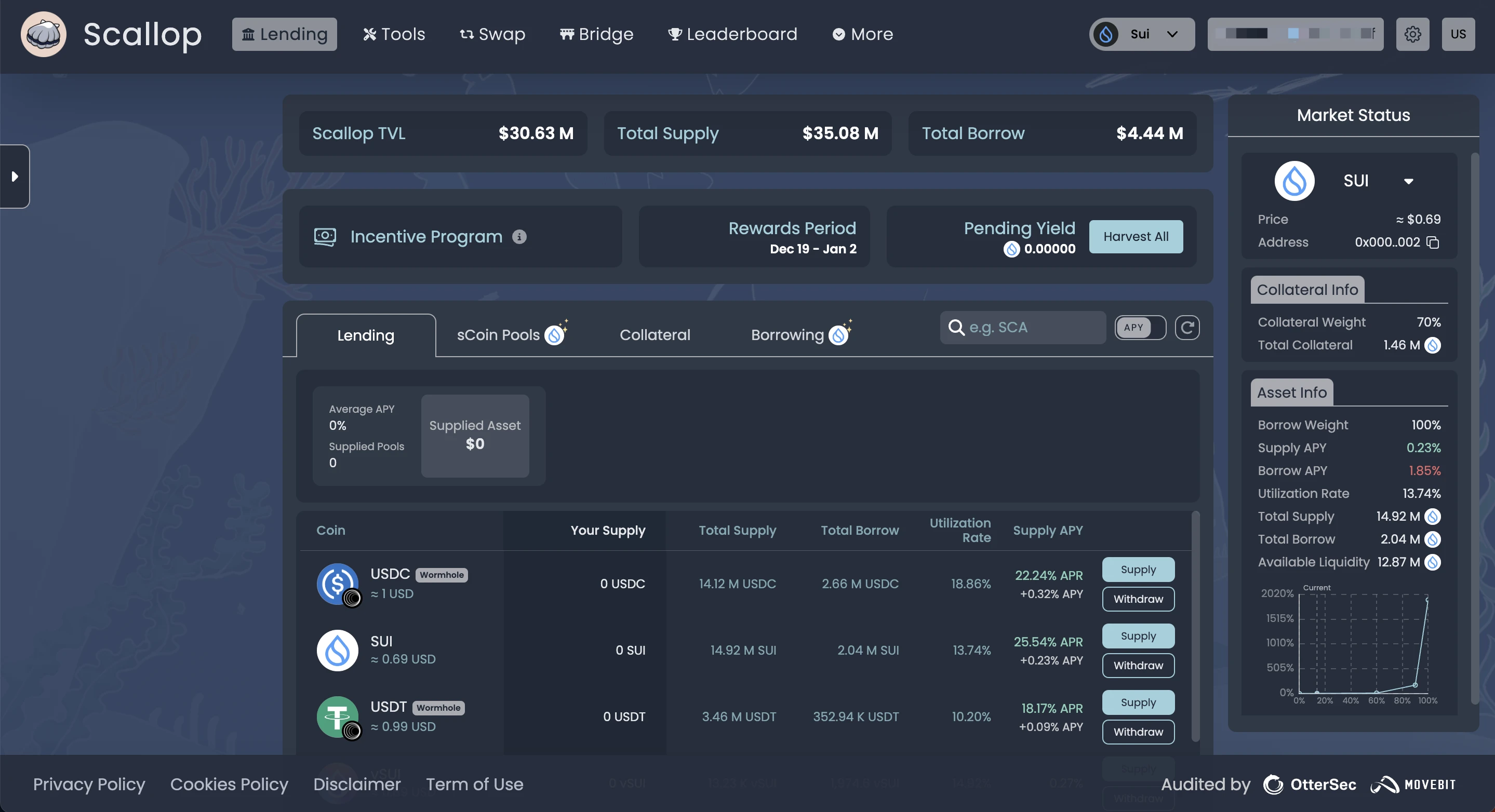

By emphasizing institutional-grade quality, enhanced composability, and strong security, it strives to build a dynamic money market, providing diversified services, including common on-chain lending, flash loans, and more. In addition, Scallop has specially developed a 2nd layer SDK for professional traders and provides an arbitrage trading UI without the need for programming knowledge.

For the lending market, the choice of lending model is an unavoidable issue. Since the launch of the CompoundV3 model at the end of 2022, it has long been considered the preferred choice for many EVM lending markets due to its stable security.

However, due to language and environmental differences and a late launch, the CompoundV3 model has always been limited to the EVM ecosystem. Scallop has pioneered the improvement of the CompoundV3 model in the non-EVM chain, based on CompoundV3, SolendV2, and Euler, making Scallop the only unique lending protocol.

With this, Scallop provides a secure, efficient, and transparent lending environment, effectively improving transaction efficiency and security, while leveraging the characteristics of the Sui network to successfully address scalability issues and make technological innovations.

Scallop values the concept of user experience, making the platform more attractive to a wide range of users, including traditional financial users, by providing a 2nd layer SDK for professional traders and an easy-to-use arbitrage trading UI.

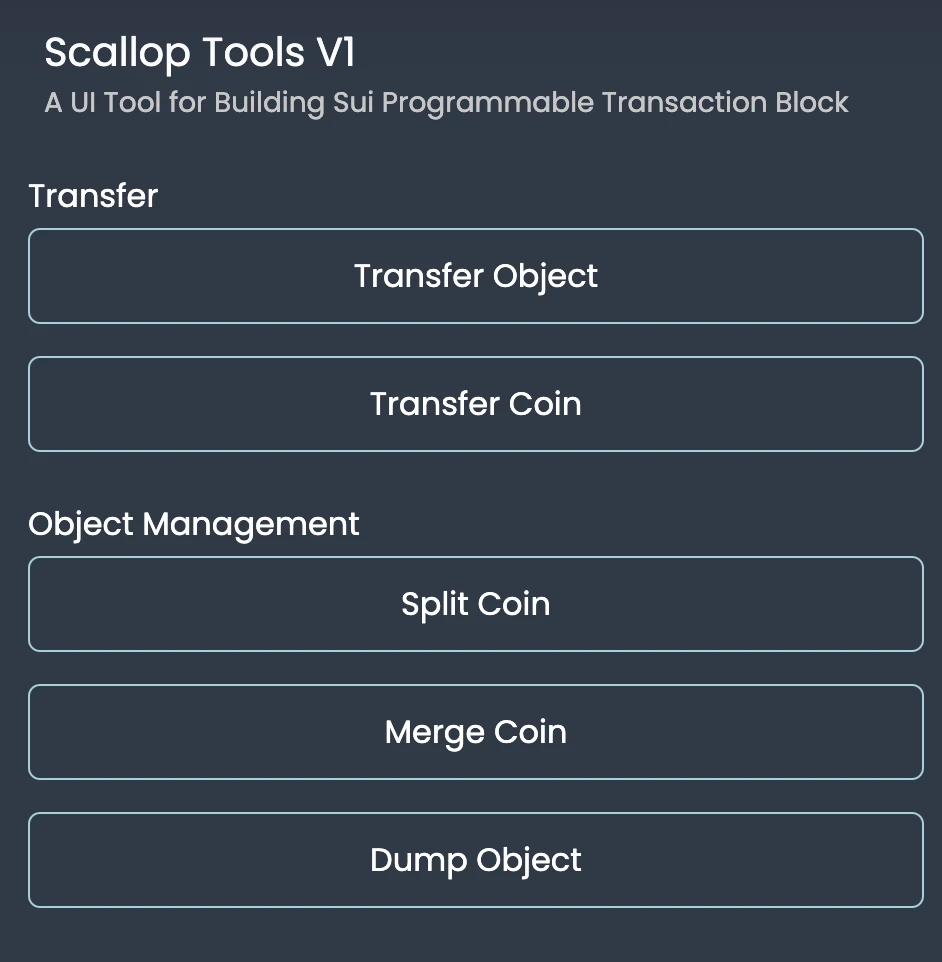

Another interesting design to optimize usability is that Scallop also integrates transfer tools and Sui object management tools, providing users with a better user experience.

Leveraging Sui's technical expertise to improve the CompoundV3 model

To better understand Scallop, we have to start with CompoundV3. Why is CompoundV3 so important?

For the DeFi market, the ability of a protocol to operate for a long time is one of the reference indicators for higher security.

Launched at the end of 2022, CompoundV3's most typical major improvement is that the borrower has complete ownership of their funds, as the collateral is no longer lent to others, thus eliminating the risk of insufficient liquidity and improving the overall risk management security of the protocol. While inheriting CompoundV3, Scallop also inherits the excellent risk management of the V3 model and makes some improvements on top of it.

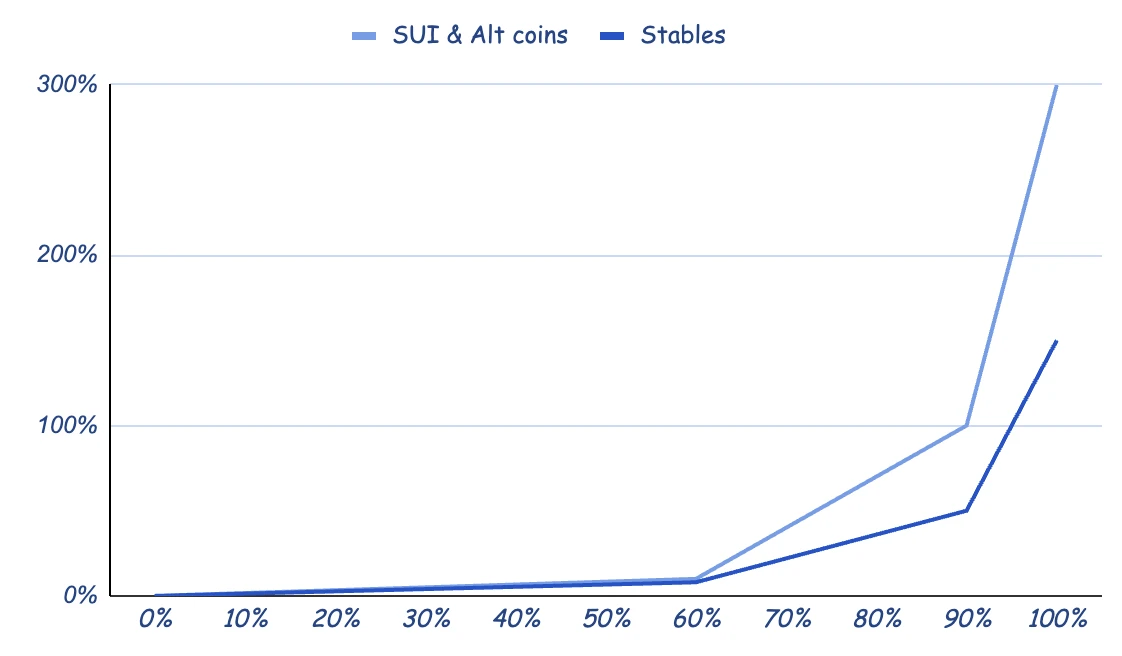

Unlike the dual-rate model used by most lending protocols, Scallop's tri-linear model is its most outstanding design. The tri-linear interest rate model is specifically designed to meet the dynamic needs of the decentralized finance field, optimizing the stability of interest rates and the ability to respond to market conditions.

Specifically, this model is divided into three different stages, each triggered by different levels of capital utilization. When the capital utilization rate approaches the upper limit, the system ensures that liquidity providers are adequately compensated for increased risks, and due to the increased cost of borrowing, borrowers receive signals to reduce their positions.

As is well known, price manipulation by oracles has always been a major attack method in the lending market. To prevent this risk, Scallop has added an additional security layer for oracles—using a multi-oracle consensus strategy to maximize the cost of price manipulation attacks and avoid oracle price manipulation attacks. Scallop's price module components include Pyth, Switchboard, and SupraOracles, and can be scaled to allow multiple oracles to obtain data together.

When Scallop lends, users can obtain market tokens representing the lending assets, such as sCoins (ScallopMarketCoins), such as sSUI, sUSDC, etc. sCoin is a type of lending derivative designed to tokenize debt, maximizing the protocol's composability. sCoins can be collateralized in other protocols to release idle liquidity, and currently, sCoins are the largest derivative on the Sui fast chain.

Scallop also implements dynamic constraints on the total amount of allowed borrowing and withdrawal for each asset and pool. This helps prevent abnormal token minting events and reduces abnormal withdrawal behavior.

For Scallop, the characteristics of the Sui network are fully utilized. Sui's programmable trading blocks, high scalability, and low transaction costs enable Scallop to effectively provide fast and efficient financial services. Additionally, the emergence of Scallop has also promoted the ecological diversity and overall development of the Sui network, bringing more users and activities to Sui.

For the Sui ecosystem, Scallop undoubtedly brings higher liquidity support to the entire network. SuiVision data shows that Scallop is currently the top lending platform in terms of TVL in the Sui ecosystem, which means a large amount of mainstream assets can release liquidity, bringing higher capital efficiency to the ecosystem.

Based on Scallop, multiple yield aggregators have already integrated Scallop's liquidity, including Typus, KaiFinance, and SUIPearl.

Among them, KaiFinance is a particularly interesting project that emphasizes the use of stablecoins and only provides a way for users to deposit USDC. This product emphasizes the expansion to Web2 users, providing ample liquidity for Scallop.

Through this strong composability, Scallop can capture assets from various sources, including native crypto users and those who are just getting into Web3.

Another highly innovative feature of Scallop makes full use of the characteristics of the Sui network. Sui's account system is different from common EVM addresses, providing users with main accounts and sub-accounts. Scallop fully utilizes this feature, allowing users to efficiently self-manage multiple accounts. Asset and liability transfers between sub-accounts do not require approval, allowing users to easily isolate collateral and debt according to their preferences.

Even more interestingly, Scallop provides a transferable sub-account feature. Users can encapsulate assets and debt in a sub-account, which can then be transferred. In addition to risk isolation considerations, this allows users to conveniently package their asset portfolios for circulation.

Team background and rich experience, promising future roadmap

The Scallop team consists of senior experts in the blockchain and fintech fields, with team members having rich technical backgrounds and a deep understanding of the financial market. The outstanding performance of Scallop in the industry reflects the team's professional capabilities, and Scallop has already won multiple awards.

Scallop is the first DeFi project officially funded by the Sui Foundation and has also achieved success in multiple hackathon competitions, including:

- First place in the Circle award at MoveHackathon;

- Third place in the SuixKucoinLabs Summer Hackathon;

- Third place in the SuixJump_BuilderHouse Ho Chi Minh City CTF Challenge;

- Fifth place in the SuiBuilderHouse Denver CTF Challenge;

At the SuiBuilderHouse Seoul Hackathon, the Scallop team won two awards—ScallopTools won first place in the Seoul Hackathon, and Sui network interaction package SuiKit won fifth place.

In addition to official funding from the Sui Foundation, Scallop has other investors, including MystenLabs, Comma3, AssemblyPartners, SkynetTrading, SupraOracles, VitalityVentures, CreditScend, PHDCapital, LOLCapital, OtterSec, Movebit, and others.

Scallop is set to issue its native token SCA, with a maximum total supply of 250 million.

SCA serves multiple functions in Scallop, including governance token for voting and various practical uses. Holding a certain amount of SCA can enjoy discounts on lending interest fees, and users can also participate in liquidity mining with SCP.

The specific token allocation is as follows:

- 45% for liquidity mining;

- 18.5% allocated to Scallop contributors;

- 4.00% for development and operations;

- 2.00% allocated to advisors;

- 10.00% allocated to strategic partners;

- 8.50% for the ecosystem, community, and marketing;

- 5.00% for liquidity;

- 7.00% for the project treasury.

In the future, Scallop plans to continue expanding its influence in the DeFi field. It will explore new partnership opportunities and launch more innovative products.

The official roadmap shows that ScallopToolsV2 is set to be released in the first quarter of 2024. Additionally, Telegram and Discord bots will be introduced. In terms of assets, Scallop will also support synthetic asset pools, bringing more asset types to the Sui chain ecosystem. The introduction of isolation pools in this quarter will also bring more security to Scallop.

In the second quarter of 2024, the introduction of RWA, cross-chain deployment, and support for cross-chain lending and leveraged lending will open up more possibilities for Scallop.

According to the team, Scallop plans to launch the first phase of airdrops by the end of this month to reward early users. Subsequently, the second phase of airdrops will be opened in the form of "points + blind boxes". Users who are eager to experience the new ecosystem and seize early opportunities can stay tuned for progress through official channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。