Original Authors: Xiyu, ChainCatcher

With the continuous rise of BRC20 tokens such as ORDI, SATS, RATS, the heat of the Bitcoin ecosystem has also increased, and a variety of applications and infrastructure around Ordinals inscriptions and BRC20 in the Bitcoin ecosystem have emerged like mushrooms after rain.

According to data from the crypto platform Rootdata, multiple applications within the Bitcoin ecosystem have announced financing since December.

On December 20th, ALEX Lab, a one-stop DeFi service platform based on Bitcoin Stack, received strategic investment from LK Venture under Blueport Interactive.

On December 18th, Biis, a BRC ecosystem aggregation toolset, announced strategic investment from crypto investment institution CGV; GoDID, a DID market aggregator, completed a new round of financing with a valuation of 30 million led by NGC, and a few days earlier, GODID's sub-platform bdid.io focused on issuing the token BDID for the BTC ecosystem.

On December 16th, Tap Protocol, a Bitcoin infrastructure project for building OrdFi applications, completed a $4.2 million financing round led by Sora Ventures; on December 14th, the Bitcoin stablecoin lending protocol bitSmiley completed a financing round led by ABCDE and OKX Venture; on December 11th, Liquidium, a Bitcoin Ordinals lending solution, completed a $1.25 million Pre-Seed round of financing, with participation from Bitcoin Frontier Fund, Sora Ventures, and others.

On December 7th, cross-chain protocol MAP Protocol announced strategic investment from DWF Labs and Waterdrip Capital, and achieved BRC20 cross-chain functionality; Bitcoin staking project Babylon announced the completion of an $18 million Series A financing, led by Polychain Capital and Hack VC, and so on.

In less than two weeks, a total of 8 Bitcoin ecosystem-related projects have successively received funding support from crypto capital, covering cross-chain, lending, staking, and other products, all of which are financial application products built around new assets such as Ordinals and BRC20.

With the influx of funds, the wealth effect of the Bitcoin ecosystem continues to ferment, gradually evolving from the speculation of BRC20 inscriptions to the infrastructure and application products built around these assets, such as the IDO platform Bounce Finance token AUCTION, the cross-chain bridge Multibit token MUBI, and the stablecoin BitStable governance token BSSB, all of which have seen a growth of over 100% in the past 7 days. Under the strong support of capital and the surge of Bitcoin ecosystem application assets, a new track called BRCFi has emerged.

BRCFi refers to the DeFi ecosystem driven by BRC20 tokens, consisting of DeFi application products built around BRC20 and Ordinals assets. Currently, the BRCFi track has launched multiple cross-chain bridges, stablecoins, IDO platforms, lending, and other suite products. So, what are the representative products of BRCFi applications? How is the operation?

Bounce Finance "manages" the BRCFi suite: cross-chain bridges, stablecoins, IDO platforms, etc.

Bounce Finance (AUCTION) Centralized Auction Platform Takes Off with the Bitcoin Trend

Bounce Finance (AUCTION) was originally a multi-chain decentralized auction platform, providing services such as token issuance and NFT auctions, simplifying the process of new project IDOs, etc. The platform was created in September 2020 by Jack Lu and Ryan Fang, with Jack Lu being a partner at NGC Ventures. Born in the era of the comprehensive explosion of DeFi applications, Bounce Finance's application was not outstanding, and as the crypto market entered a bearish trend, the platform gradually faded from the view of crypto users.

However, in November, the Bounce Finance platform quickly gained popularity due to the issuance of the Bitcoin ecosystem's cross-chain bridge Multibit token MUBI and the stablecoin BitStable token BSSB. MUBI and BSSB, after the IDO on the Bounce Finance platform, saw gains of several tens of times, and the wealth effect brought by these IDO assets also made this hidden Bounce Finance asset issuance platform the biggest winner, seen by users as the "origin of the next tenfold coin".

In the past month, Bounce Finance has successfully issued tokens for 3 Bitcoin ecosystem projects. On November 12th, it issued the Bitcoin cross-chain bridge MultiBit asset MUBI, with an IDO unit price of $0.00047, now priced at $0.39, with a cumulative increase of over 1000 times; on November 29th, it launched the public sale of the cross-chain stablecoin protocol Bitstable project token BSSB based on Bitcoin, with each BSSB IDO costing about $0.27, now priced at $9.5, with a cumulative increase of about 40 times; on December 15th, it launched the token BDID for the DID service platform GoDID within the Bitcoin ecosystem, with a public sale price of $0.0029, now priced at $0.06, yielding over 20 times.

Due to the successive explosive wealth stories of IDO projects, Bounce Finance has become a platform for the benefit of IDOs within the Bitcoin ecosystem. After successfully issuing the Bitcoin ecosystem asset MUBI, Bounce Finance officially announced a series of actions to enter the Bitcoin ecosystem.

On November 25th, Bounce Finance posted on social media that it was preparing to extensively cultivate the BTC ecosystem, announcing a focus on incubating BTC projects and providing auction support.

On December 1st, it announced the launch of the Bounce Bit Bitcoin DeFi application chain built on Binance's BTCB. BTCB is a wrapped asset issued by Binance that is anchored 1:1 to real BTC assets. Users can obtain and use BTCB by locking BTC, allowing BTC holders to participate in on-chain DeFi activities without giving up their BTC position, thereby gaining more profits. The Bounce Bit network will build a series of DeFi applications around BTCB and the native token AUCTION.

On December 6th, Bounce Finance announced a rebrand to Bounce Brand, which includes the Bitcoin-based application chain Bounce Bit, the one-stop entry for exploring Bitcoin DeFi applications Bounce Box, and the Bitcoin ecosystem asset auction platform Bounce Auction.

On December 19th, Bounce Brand stated that the IDO will adopt a "kill two birds with one stone" strategy to launch token issuance, with two independent teams jointly issuing a token, keeping the project's identity confidential, and using AUCTION and BitStable's stablecoin DAII for participation, with two auction pools.

With the wind of the Bitcoin ecosystem, Bounce Finance has successfully transformed from a forgotten auction platform to a leading IDO application deeply rooted in the Bitcoin ecosystem. The native token AUCTION has seen a growth of about 108% in the past 7 days, with a daily increase of over 40%, and is currently priced at $40.78, with a market value of $260 million.

Bitcoin Cross-Chain Bridge Protocol Multibit

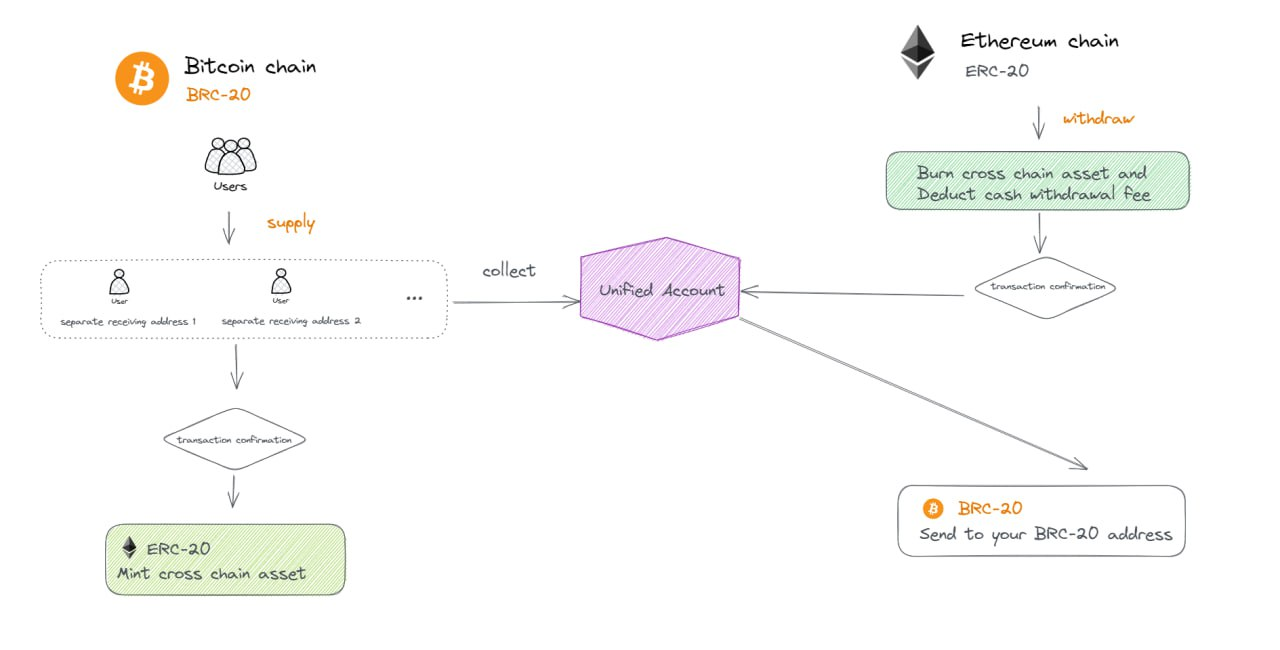

Multibit Bridge (MUBI) is a cross-chain protocol within the Bitcoin ecosystem that supports the seamless cross-chain transfer of BRC20 and ERC20 assets, allowing assets between Ethereum, BNB Chain, and other EVM networks and the Bitcoin network to be transferred across chains.

MultiBit simplifies the process of token cross-chain transfers between Bitcoin BRC20 and EVM networks. The specific cross-chain implementation process involves users depositing cross-chain BRC20 tokens into the BRC20 address provided by Multibit. Once the Multibit protocol confirms, the tokens will be minted and released to the user on the corresponding EVM target chain. When users want to cross back the BRC20 tokens, Multibit will destroy the corresponding amount of tokens on the EVM chain and release the corresponding BRC20 tokens on the Bitcoin chain.

However, Multibit's goal is not just a cross-chain bridge; it will also integrate OAMM trading, yield aggregators, stablecoin issuance, and other multi-faceted BRCFi application ecosystems in the future.

OAMM trading refers to the automatic market maker (OAMM) decentralized trading protocol launched by Multibit based on Ordinals assets, designed specifically for trading Ordinals (ORDI) tokens, with all liquidity pools priced in ORDI token pairs for price discovery. The yield aggregator optimizes the yield situation of the ORDI token in BRCFi applications, and the stablecoin is also minted with ORDI as collateral.

The Multibit platform was initially launched in May, but it was not noticed before November. What made it successful was the launch of the MUBI token, which completed an IDO auction on Bounce Finance on November 12th, with an opening increase of 1140%.

The wealth effect brought by the IDO quickly made Multibit a star project in the Bitcoin ecosystem. The MUBI token has seen a 131% increase in the past 7 days, with a current price of approximately $0.3, a total supply of 1 billion, a circulation supply of 950 million, and a circulating market value of $290 million.

Bitcoin Ecosystem Stablecoin BitStable

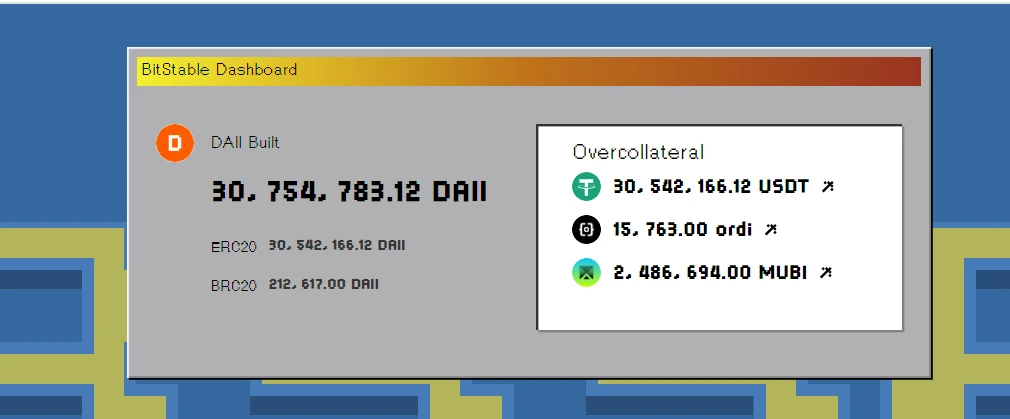

BitStable (BSSB&DAII) is a stablecoin protocol within the Bitcoin ecosystem that uses a dual-token system of BSSB as the governance token and DAII as the stablecoin.

Currently, platform users can use assets approved by "BSSB Governance" as collateral to generate DAII, currently only supporting ORDI, MUBI, and BTCB assets as collateral. In addition, BitStable has cross-chained some DAII to Ethereum, supporting DAII holders to exchange with USDT.

As of December 19th, the BitStable platform has minted 30.75 million DAII, with 30.54 million in ERC20 format and only 210,000 in BRC20 format.

BitStable first appeared in the IDO platform Bounce Finance with the issuance of the BSSB token, which has seen a 176% increase in the past 7 days, with a current price of $7.5, a total supply of 21 million, and a market value of $180 million.

However, it is worth noting that the BitStable protocol has been controversial since its launch. During the BSSB token public sale, the official website was unable to open, leading some users to suspect a rug pull. The team stated that they encountered a coordinated attack planned by miners and high-tech developers, as well as a DDOS attack, resulting in uneven token distribution and unauthorized wallets receiving most of the available supply. The team destroyed 75% of the auctioned tokens. Additionally, the BitStable X social media account was only online for two days during the auction, with the first post made on November 27th.

Furthermore, some users have expressed that the Bounce Finance, Multibit, and BitStable projects are all from the same team, aiming to create a Bitcoin ecosystem that integrates IDO, cross-chain, and stablecoins. This speculation is not unfounded, as the IDOs of Multibit and BitStable were both executed on the Bounce Finance platform, and future IDO projects on the Bounce Finance platform can use BitStable's stablecoin DAII as participation tickets, while BitStable supports assets such as MUBI as collateral for minting DAII, creating a close relationship between the three.

DID Market Aggregator GoDID Launches Bitcoin Ecosystem DID Management Tool Bdid.io

Like Multibit and BitStable, the DID aggregation tool GoDID also issued the token BDID on the Bounce Finance platform and announced the completion of a new round of financing led by NGC Ventures with a valuation of 30 million on December 18th.

Interestingly, Bounce Finance founder Jack Lu is also a partner at NGC Ventures. Some users have expressed their surprise, speculating that all products launched on the Bounce Finance platform are related to NGC Ventures, and NGC Ventures may be the true operator behind a series of Bitcoin ecosystem projects such as Multibit.

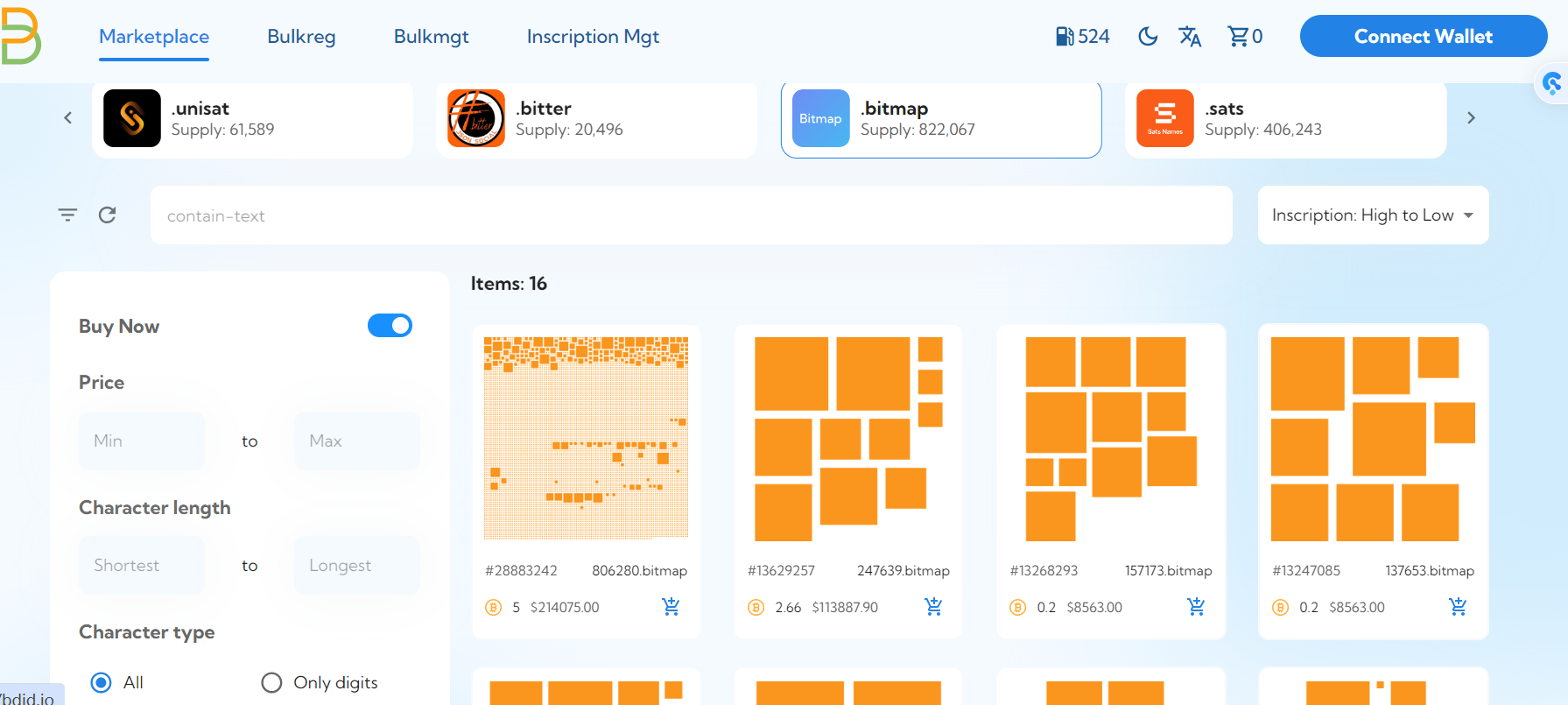

GoDID is a decentralized identity DID market aggregator, with its core functions including batch searching, querying, registering, trading, and managing of DIDs, currently providing services for ENS, Space ID, and Bitcoin Ordinals DID.

On December 15th, the sub-platform Bdid.io of GODID issued the token BDID on the Bounce Finance platform. Bdid.io, incubated by GODID, supports the registration, trading, and management of various suffix mainstream DIDs created by the Ordinals protocol, such as .sats, .bitmap, .btc, .unisat, .bitter, etc.

The total supply of BDID is 500 million, with an IDO price of approximately $0.00297 on the Bounce Finance platform, and a current price of $0.04, yielding a return on investment of approximately 20 times.

Representative lending products: BitSmiley, Liquidium, Liquidium

Stablecoin Lending Protocol BitSmiley

BitSmiley is a stablecoin lending protocol in the Bitcoin ecosystem, similar to "MakerDAO+Compound," consisting of decentralized over-collateralized stablecoin protocols, lending protocols, and derivative protocols. On December 14th, bitSmiley announced the completion of a financing round led by ABCDE and OKX Venture.

BitUSD and bitSmiley Protocol

bitUSD is a stablecoin generated with BTC as over-collateralized assets and pegged to the US dollar. The collateral mechanism is similar to MakerDAO, but the issuance of bitUSD is backed by BTC as collateral. Any BTC holder can generate bitUSD by depositing Bitcoin into the "bitSmiley Treasury" smart contract, and each circulating bitUSD is backed by over-collateralized assets.

In the bitSmiley protocol, bitUSD can be used to settle debts, such as paying stability fees or loan interest. Users deposit a specific amount of BTC into the bitSmiley Treasury to generate bitUSD. To retrieve the deposited BTC, users need to repay the generated bitUSD and pay a stable minting fee.

Based on the stablecoin bitUSD, BitSmiley has launched the BRC20-based peer-to-peer lending protocol bitLending.

Currently, bitSmiley's products have not yet been officially launched, and the official Twitter account was only established on December 4th.

NFT and BRC20 Lending Protocol Liquidium

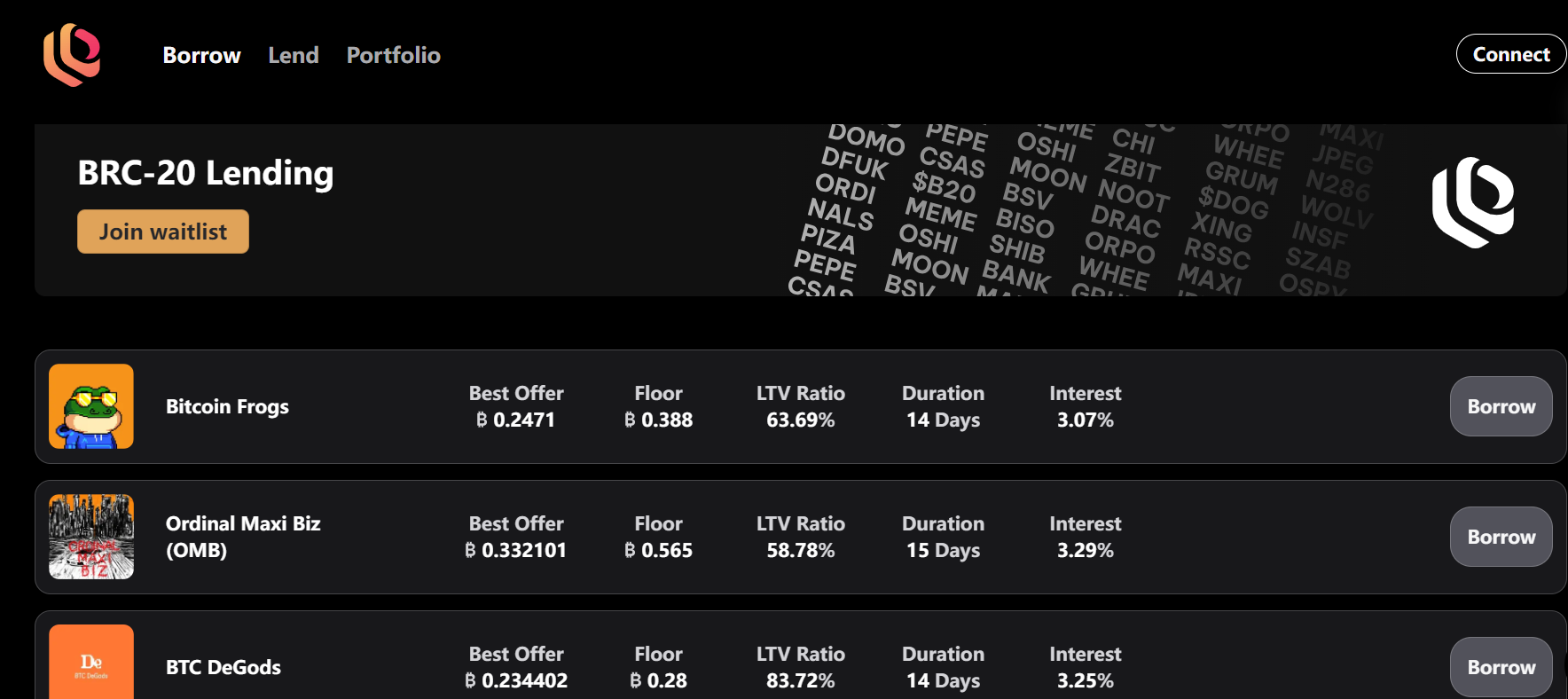

Liquidium is a P2P lending protocol built on the Ordinals protocol, supporting users to borrow and lend Bitcoin using Ordinals inscriptions and BRC20 as collateral. On December 11th, it announced the completion of a $1.25 million Pre-Seed round of financing, with participation from Sora Ventures, among others.

Currently, the Liquidium platform only supports Ordinals inscriptions NFT as collateral for lending, and BRC20 lending products have not been officially opened to the public and are in the whitelist application stage.

The Liquidium platform does not use a liquidation mechanism based on the loan-to-value (LTV) of the collateral. The loan status depends on the repayment within the set period, and if not repaid by the due date, the loan defaults, and the collateral belongs to the borrower.

BRC20 Ecosystem Stablecoin Lending Protocol Uplink Finance

Uplink Finance (UPFI) is a stablecoin lending protocol designed for ORDI, SATS, and other BRC-20 asset investors, claiming to be the MakerDAO of the BRC-20 ecosystem. BRC20 asset holders can release the liquidity value of their assets without selling by using BTC, ORDI, SATS, and other BRC-20 assets as collateral to borrow the platform's stablecoin UPSD.

On December 12th, Uplink Finance announced that SATS and ORDI would be the first collateral for the platform's stablecoin minting, and airdropped the platform governance token UPFI to its asset holders.

Currently, the Uplink Finance platform's collateral lending page has not been officially launched.

Ordinals Ecosystem Infrastructure Tools: Donation platform TurtSat and Tap Protocol for building OrdFi applications

TurtSat: Gitcoin of the Bitcoin Ecosystem

TurtSat (TURT) is a community-led Ordinals donation platform with the mission to become the Gitcoin of the Ordinals world. The platform features a donation protocol aimed at enabling more open-source developers and communities to participate in the development of the Ordinals ecosystem and enjoy returns. Anyone can build and donate to Ordinals ecosystem protocols through Turtsat.

In summary, project teams can obtain funding through TurtSat, and users can earn returns by supporting donation projects. Currently, TurtSat supports the token issuance of multiple Bitcoin ecosystem projects in the form of a Launchpad, similar to Bounce Finance.

As of December 20th, TurtSat has issued BRC20 asset protocol tokens CHAX for Chamcha, MUBI for Multibit, NHUB for NXHUB, DOVA for Dova Protocol, RAIT for Rabbit, and SVGR for Svarga, among others. These projects are all infrastructure construction platforms related to BRC20 and Ordinals within the Bitcoin ecosystem. Yesterday, the TurtSat platform also listed the Bitcoin collateral platform Zooopia token ZOOA.

On December 7th, TurtSat announced the launch of a staking pool for its native token TURT, supporting TURT holders to participate in token issuance projects on the platform to earn more returns. Additionally, TurtSat will issue a new asset, EGGS, which requires staking TURT tokens to obtain. EGGS can be exchanged for whitelist access to Launch projects, and in the future, EGGS will be used in more scenarios such as project launch voting and direct exchange for cooperative token packages.

The maximum supply of TurtSat's native token TURT is 1 billion, with a current price of $0.078 and a market value of $78.73 million. The supply of EGGS has not been disclosed.

Tap Protocol for Building OrdFi Platforms

Tap Protocol, launched by the Ordinals indexing protocol Trac, is a platform for building OrdFi applications. On December 16th, it announced the completion of a $4.2 million financing round led by Sora Ventures.

Trac is an infrastructure project in the Ordinals ecosystem, aiming to provide a decentralized system to track and access protocols related to Ordinals, such as BRC20, sats domains, and more, providing a standardized interface for creating, managing, and trading digital assets on the Ordinals platform.

Tap Protocol is designed to build OrdFi applications, providing a range of tools to help developers build DeFi products based on Ordinals, even without complex Bitcoin Layer2 networks, such as providing inscriptions for fragmentation and enabling DeFi applications on inscriptions.

In the future, Tap Protocol will launch fragmented products, exchange pools, lending, staking, and other products for Ordinals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。