Preview for this week (12.18-12.24), on-chain data indicates the distribution range of BTC main capital volume and price, corresponding to the price level of the daily upward trend line

○/Text: DC Research Institute

Old Li Mortar

Table of Contents for this Week's Research Report:

I. Key events preview of macroeconomic data and the crypto market for this week;

II. Review of key news in the crypto industry;

III. Community interaction and sharing;

IV. Interpretation of important events, data, and Deepcoin Research Institute;

V. Institutional perspectives + overseas perspectives;

VI. Top gainers in the crypto market last week and selection of hot community coins;

VII. Attention to unlocking of project tokens;

VIII. Top gainers in the crypto market concept sectors;

IX. Summary of global market macro analysis;

X. Future market analysis by Deepcoin Research Institute.

I. Key events preview of macroeconomic data and the crypto market for this week:

December 18th (Monday): US December housing market index. Binance launches new coin mining project ACE; OKX launches SATS; Ubisoft's blockchain game will open Ethereum NFT minting.

December 19th (Tuesday): Bank of Japan interest rate decision, press conference by Kuroda; Eurozone November CPI annual rate; US November total housing starts, US November total building permits; Nostr Fair Casting Phase 2 lottery event will start; EigenLayer announces the introduction of six new LSTs, with the staking limit raised to 500,000 ETH.

December 20th (Wednesday): Eurozone October seasonally adjusted current account; US Q3 current account, US December consumer confidence index; Speeches by Atlanta Fed President and Chicago Fed President; Kyber publishes snapshot of stolen assets, compensation details to be announced.

December 21st (Thursday): US Q3 annualized real GDP final value; US Q3 real personal consumption expenditure rate, core PCE price index; US December Philadelphia Fed manufacturing index.

December 22nd (Friday): Japan November core CPI annual rate; US November core PCE price index, US November personal spending rate, US December consumer confidence index, US one-year inflation rate; Bank of Japan monetary policy meeting minutes; London Stock Exchange closes early due to Christmas holiday.

December 23rd (Saturday): Doge single entity token is planned to be sent to the moon.

Between December 18th and December 24th, tokens such as 1INCH, NYM, EUL, ID will undergo a new unlocking.

II. Review of key news in the crypto industry (Exclusive):

Market Overview: The cryptocurrency market has experienced various changes and developments in the past week, involving data, projects, policies, and perspectives. In terms of data, there have been significant changes in the supply and demand of the market for Bitcoin, with open interest contracts reaching a historic high, the weakening of the US dollar, a decrease in Binance's market share, Tether's issuance of USDT, and whales increasing their holdings of BTC. In terms of projects, Ordinals is about to launch the Runes protocol, with inscription forging revenue exceeding 4100 BTC, Arbitrum network transaction volume reaching a new high, leading ETH burn volume, Ripple looking to the future of CBDC, a booming NFT market, and PayPal launching PYUSD. In terms of policies, the Federal Reserve maintains interest rates, with market expectations of a rate cut next year, the US introducing cryptocurrency accounting rules, the Financial Stability Oversight Council calling for legislation, SEC approving Hashdex Bitcoin futures ETF, refusing to disclose the approval status of spot Bitcoin ETF, presidential candidates supporting the cryptocurrency industry, CFTC chairman considering many tokens as commodities, and the IRS strengthening enforcement, with the approval window for spot Bitcoin ETFs approaching. In terms of perspectives, Onchain Capital co-founder is optimistic about the future of BTC, VanEck CEO expects approval of Bitcoin ETFs and new highs for Bitcoin in the next 12 months, Grayscale believes that cash-form Bitcoin ETFs have no tax disadvantages, revised Bitcoin ETF model from BlackRock may meet SEC requirements, S&P evaluates stablecoin risks, and JPMorgan is bullish on Ethereum's performance next year. These contents reflect the activity and diversity of the cryptocurrency market, as well as the influence and potential of cryptocurrencies in the financial and social fields. The future of cryptocurrencies is still full of opportunities and challenges, requiring cooperation and innovation from all parties. Specific details are as follows:

Data Aspect:

In the past week, the digital asset market has seen multiple key dynamics. In terms of data, whales have increased their holdings by over 22,000 BTC this week, while exchanges' wallets have seen an outflow of 5,159.96 BTC in the past 24 hours, and open interest contracts have exceeded $18 billion. In addition, the US Dollar Index (DXY) has fallen below 102, reaching its lowest level since August 10, and Binance and Bitfinex have collectively absorbed nearly $871 million in BTC recently, while Tether on the Tron network has issued 1 billion USDT, reducing Binance's spot trading market share to 30%.

Projects and Platforms:

The founder of Ordinals revealed that the Runes protocol will go live at the time of Bitcoin halving, and the fee income from inscription forging has exceeded 3,800 BTC, surpassing 4,100 BTC. In addition, over 140 million USDT has been transferred to JustLendDAO, Arbitrum network transaction volume has reached a new high, and Ripple plans to promote CBDC.

Macro Policy and Regulatory Aspects:

William Williams of the Federal Reserve emphasized that a rate cut is not currently under discussion, but according to CME's "FedWatch" data, the probability of a rate cut in February next year is 10.3%. In addition, the US plans to introduce its first cryptocurrency accounting rules, while the Financial Stability Oversight Council once again urges legislation to address the risks of cryptocurrencies. The SEC chairman stated that they will reconsider spot Bitcoin ETF applications, and the role of cryptocurrencies in the capital markets is being downplayed. The Republican presidential candidate expressed support for the thriving development of the cryptocurrency industry, and the US IRS has listed cryptocurrency-related cases as a focus for 2023.

Institutional Research Reports and Perspectives:

Onchain Capital co-founder predicts that Bitcoin will reach $200,000 in the next bull market cycle, VanEck CEO predicts that the SEC will approve all spot Bitcoin ETF applications and expects Bitcoin to reach a new high in the next 12 months. In addition, Grayscale believes that cash-form Bitcoin ETFs have no tax disadvantages, and BlackRock's revised spot Bitcoin ETF model may meet SEC requirements. S&P Global's stablecoin report shows USDC ranking first, with DAI and USDT ranking in the middle. JPMorgan predicts that Ethereum's performance next year may surpass that of Bitcoin. The dynamics of the digital asset market this week demonstrate its vitality and evolving nature.

III. Community Interaction and Sharing:

Regarding trading mindset during oscillation. If it is a range operation mindset, it is convenient to set long and short positions as long as the upper and lower bounds of the oscillation range are not broken, making it easier to set the risk-reward ratio. If it is a range breakout, it is also relatively easy to come out and switch trading directions.

Regarding changes in global stock market assets, the French stock market has just broken a historic high, the German stock market broke a new high a few days ago, the Indian stock market broke 70,000 points last week (just over 40,000 points before the pandemic), and continues to reach new highs. The Dow Jones index broke a new high last week, and the S&P and Nasdaq are also close to new highs. Stock markets in Mexico, Indonesia, Brazil, and other countries are also close to historic highs, with the gradual confirmation of the shift by the Federal Reserve, global stock markets have recently started a competition to break new highs, with increasing risks.

Regarding Ethereum deflation. In just the past 30 days, nearly 120,000 ETH worth $260 million has been burned; subtracting the issuance part, the net deflation exceeds 48,000 ETH. It can be imagined that the burn volume will be considerable in a hot market. And with L2/L3 capable of handling network activities in the Ethereum ecosystem, there is no need to worry about the negative impact of deflation on the growth of the Ethereum ecosystem.

Regarding altcoin rotation. When one whale falls, everything else rises. As a result of the game of market funds in stock, when BTC falls, market funds flow to other currencies, causing rotation performance of altcoins.

Regarding changes in the data aspect. The long/short ratio has shown a significant change compared to the previous long period of being below 1, so it is worth paying more attention. In addition, on the big drop last Tuesday, the entire crypto market's trading volume also reached a new high of $104.1 billion, which is close to a data comparison from last month.

Regarding recent news. Generally, when there is a decline, most of what is seen are bearish news, and when there is an increase, most of what is seen are bullish news. Just like the fear and greed index every day, the weights of media, search volume, and market surveys in the index are all above 10-15%.

IV. Important Events and Data and Interpretation by Deepcoin Research Institute:

According to on-chain analysis data, it is currently revealed that the price of Bitcoin has fallen below a key supply area. Within the price range of $41,200-$42,400, there are 1.87 million addresses holding a total of 730,000 BTC. If the market continues to decline, this may prompt these holders to sell to reduce losses. If selling pressure increases, the next demand area may be in the range of $37,500-$38,700, where there are currently 1.28 million addresses holding approximately 553,000 BTC.

The Deepcoin Research Institute believes that based on the on-chain analysis data, the price of Bitcoin has now fallen below a key supply area, specifically in the range of $41,200 to $42,400. In this range, 1.87 million addresses collectively hold 730,000 BTC. This situation indicates that there are a large number of Bitcoin holders in this price range who may be influenced by the continued market downturn and considering selling to reduce potential losses.

This data reveals a market psychological phenomenon, where when the price falls below a key support area, some investors may tend to sell their Bitcoin to avoid further losses. This psychological phenomenon could lead to increased selling pressure in the market, further affecting the price of Bitcoin.

If the market continues to decline, on-chain data suggests that the next potential demand area will appear in the price range of $37,500 to $38,700. In this area, there are currently 1.28 million addresses holding approximately 553,000 BTC. This means that if the price of Bitcoin continues to fall, these holders may become buyers in the market, attempting to buy Bitcoin in this price range.

Overall, this on-chain data provides key insights into the price trends of Bitcoin. Holders at the current price levels may face decision pressure, whether to sell or increase demand at lower price levels. This observation helps investors better understand the dynamics of the market to make wiser investment decisions. It also highlights the potential impact of market fluctuations on holder behavior, emphasizing the importance for investors to remain vigilant and make decisions based on data in a constantly changing market.

From a technical analysis perspective, it also aligns with our previous view, corresponding to the future daily upward trend line position. For more details, please refer to the technical analysis of the future market at the end.

The kimchi premium for major cryptocurrencies such as BTC is about 6%. The trading price of Bitcoin in the Korean won market on Upbit is 59.05 million Korean won, which is 6.06% higher than the price on the Binance market. The kimchi premiums for ETH, BCH, LINK, and XRP are also around 5.8%.

The Deepcoin Research Institute believes that this round of price increases often occurs during the Asian session, indicating the driving role of Asian funds in the market. The kimchi premium refers to the higher prices of cryptocurrencies in the Korean market compared to other countries or regions, reflecting strong demand for cryptocurrencies in Korea and limited supply.

The reasons for the kimchi premium are mainly threefold: first, capital controls and anti-money laundering regulations in Korea limit Korean investors from buying or selling cryptocurrencies from foreign exchanges, leading to insufficient liquidity in the Korean market; second, social factors in Korea, such as concerns about inflation, desire for stable income, and enthusiasm for cryptocurrencies; third, market psychology in Korea, such as expectations for the listing of cryptocurrency exchanges, optimism about the future of cryptocurrencies, and fear of missing out on opportunities.

The impact of the kimchi premium has both advantages and disadvantages: on the one hand, the kimchi premium can stimulate Korean investors' interest in cryptocurrencies, driving the development and innovation of the Korean cryptocurrency market. On the other hand, the kimchi premium may also lead to higher risks for Korean investors, such as price fluctuations, arbitrage opportunities, and regulatory uncertainty.

In addition, in recent weeks, the perpetual contract price of BTC has been several tens of dollars higher than the spot price, a phenomenon that has continued for over a week. As Old Li has mentioned before, the contract mark price of most exchanges is derived from the weighted average prices of several spot exchanges. For example, Binance's spot index price, which is the mark price, is derived from the weighted average prices of six exchanges: Coinbase Pro, Bitstamp, Kraken, Gemini, Bittrex, and Bitfinex. Currently, Kraken, Gemini, and Bittrex have a premium in their spot prices, which is also the reason for the recent premium in the contract prices on most platforms.

Regarding the analysis by a JPMorgan analyst in a recent research report, the performance of Ethereum in 2024 may surpass that of Bitcoin and other cryptocurrencies. Next year, Ethereum is expected to regain its role and market share in the cryptocurrency ecosystem. The main catalyst is the EIP-4844 upgrade or Protodanksharding, which is expected to take place in the second half of 2024. This upgrade may take a bigger step towards improving Ethereum network activity, helping Ethereum outperform the broader market.

The Deepcoin Research Institute believes that, overall, Ethereum's performance this year has been weaker than that of Bitcoin, whether in terms of annual gains, position in the previous bull market, or the exchange rate between the two, which has reached a temporary low. However, if we consider the viewpoint of the JPMorgan research report, with the upgrade of Ethereum next year, it is possible for funds to flow from Ethereum to Bitcoin, leading to a potential shift in strength.

V. Institutional Perspectives + Overseas Perspectives:

Comprehensive data and expert opinions indicate a high probability of the Federal Reserve maintaining interest rates in the future. CME data indicates an 89.7% probability of maintaining rates in the range of 5.25%-5.50% in February next year. In the cryptocurrency market, the price correction of Bitcoin has led to large-scale protective options trading, with the position of put options exceeding that of call options. On-chain analysis suggests that Bitcoin may need to retrace before testing the $39,000 area, with attention to the trading gap at $39,700 in the CME futures market. Multiple factors supporting the rise of Bitcoin include low interest rates, global liquidity returning, the potential peak of the US dollar, the upcoming Bitcoin ETF, and the demand for Bitcoin from listed companies. Additionally, with the next Bitcoin halving expected in April 2024, a "perfect storm" may be on the horizon, and historical experience also shows that Bitcoin's rebound may drive the rotation of altcoin sectors. These viewpoints collectively depict future market trends, and investors need to closely monitor these dynamic factors to formulate more accurate investment strategies.

According to CME's "FedWatch," the probability of the Federal Reserve maintaining rates in the range of 5.25%-5.50% in February next year is 89.7%, with a 10.3% probability of a 25 basis point rate cut. The probability of maintaining rates in March next year is 30.5%, with a cumulative 62.7% probability of a 25 basis point rate cut and a 6.8% probability of a cumulative 50 basis point rate cut.

In terms of options data, Greeks.live indicates that the cryptocurrency market experienced a retracement last week, especially when BTC briefly fell to $40,000, leading to a large volume of protective options trading, resulting in a higher position of put options than call options. Looking at the options data, the main trading is still concentrated on BTC options, with the implied volatility (IV) being very stable for nearly a month, and large options transfers are still ongoing.

On-chain analyst Willy Woo suggests that BTC may need to test the $39,000 area before continuing to rise. He points out an important trading gap at $39,700 in the CME futures market, indicating that Bitcoin may retrace to the $39,000 level. Woo also cites several factors supporting a bullish view of Bitcoin, including low interest rates, global liquidity returning, the potential peak of the US dollar index, the upcoming Bitcoin ETF, and the demand for Bitcoin from listed companies.

Thomas Perfumo, Kraken's strategy director, suggests that the next Bitcoin halving is expected to take place in April 2024, and the Federal Reserve may adjust its policies. With the approval of a US spot ETF, investors may be in for a "perfect storm." Perfumo states, "If history repeats itself, you often see smart contract platforms rise, followed closely by applications (assets with smaller market capitalization) such as dapps that are more affected by higher volatility. Bitcoin's rebound may drive the rotation of sectors such as Ethereum, Solana, and other altcoins."

VI. Top Gainers in the Crypto Market Last Week and Selection of Hot Community Coins:

IV. Important Events and Data and Interpretation by Deepcoin Research Institute:

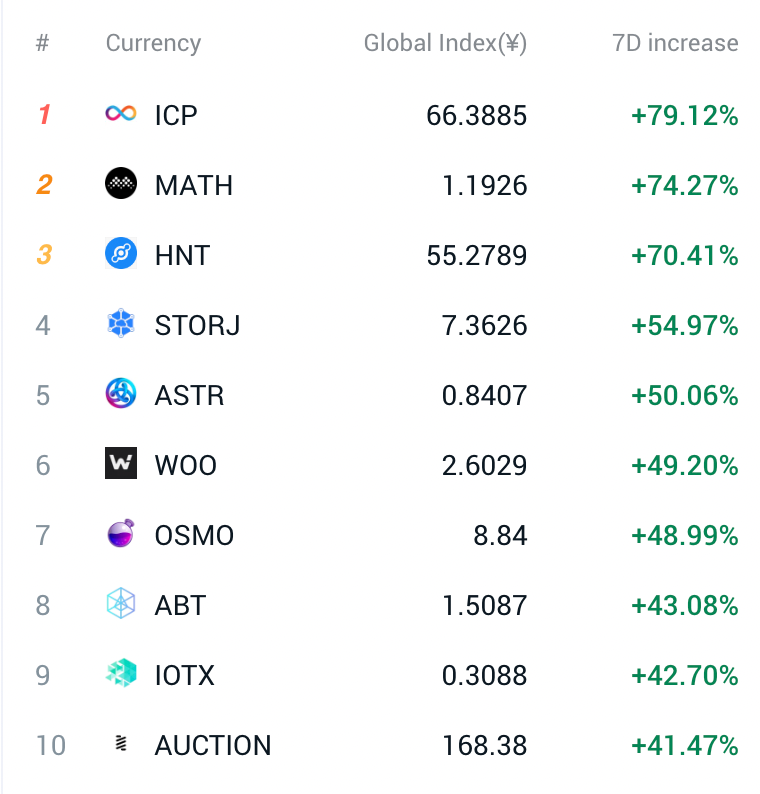

The top gainers in the altcoin market over the past week include ICP, MATH, and HNT, with gains ranging between 70% and 80% over the past 7 days. STORJ, ASTR, WOO, and OSMO have seen gains of approximately 50%. Other coins have also shown significant gains, providing potential trading opportunities for the week. It's important to be attentive to potential trading opportunities as the market dynamics shift.

The following are hot community coins selected for discussion in the DC community. These viewpoints are for reference only and do not constitute trading advice:

ICP has shown recent strength and is expected to test the short-term resistance near $6.82, with medium-term resistance around $7.236. However, as a previously well-known project, ICP has disappointed many, and its long-term prospects are not favorable.

Bitcoin network NFT sales have ranked first in the past 24 hours, 7 days, and 30 days. The concept of NFTs has spread to other public chain ecosystems, indicating that the NFT concept may be nearing the end of its current cycle, similar to the rise of low-quality altcoins after a general market surge.

I have previously analyzed Dogecoin, and on December 5th, it broke a year-long downtrend line. It has since retested the extended trend line position and rebounded effectively. The key resistance above is around $0.11192. If it continues to break through, the medium-term resistance is around $0.159. If it faces pressure near $0.11192, it may return to a range-bound adjustment.

RNDr has been a strong performer this year, recently reaching a nearly two-year high of $4.337. The focus now is on whether it can effectively surpass the $4.26 level. If it does, it may test the resistance near $5.5.

VII. Attention to Negative Unlocking Data for Project Tokens:

Data shows that between December 18th and December 24th, 1INCH, NYM, EUL, and ID tokens will undergo new unlocking events, including:

- 1INCH token will unlock 15,000 tokens (approximately $55,000) on December 20th at 04:00.

- NYM token will unlock 3.34 million tokens (approximately $614,000) on December 20th at 08:00, accounting for 0.53% of the circulating supply.

- EUL token will unlock 123,000 tokens (approximately $400,000) on December 21st at 13:54, accounting for 0.66% of the circulating supply.

- ID token will unlock 18.49 million tokens (approximately $5.32 million) on December 22nd at 08:00, accounting for 4.29% of the circulating supply.

This week, it's important to pay attention to the negative effects of these token unlockings and avoid spot trading, while seeking short opportunities in the futures market. The unlocking of ID tokens is particularly significant and requires close attention.

VIII. Top Concept Sector Gainers in the Crypto Market Last Week:

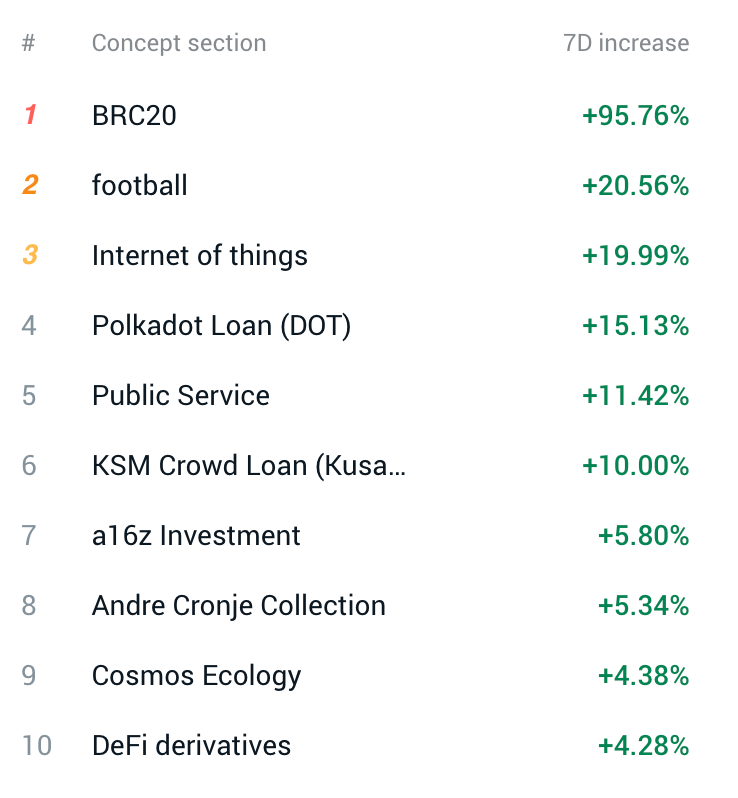

Last week, the performance of concept sectors in the crypto market was as shown above. Based on the percentage of gains and losses over the past seven days, the BRC20 sector as a whole nearly doubled. Other leading concept sectors such as football, Internet of Things, Polkadot's DOT ecosystem, and public services saw gains of around 10%-20%. It's important to pay attention to the rotation and speculative trading of the above-mentioned sectors with significant gains.

IX. Global Market Macro Analysis Overview:

Last Friday, the three major US stock indexes fluctuated throughout the day, with the Dow hitting a new all-time high. At the close, the Dow rose by 0.15%, the Nasdaq rose by 0.35%, and the S&P fell by 0.01%. The stock market performed well, with the S&P 500 rising by 2.49%, the Dow rising by 2.92%, and the Nasdaq rising by 2.85% over the week, all hitting new highs for the year. In terms of style, the strong sectors last week were tech giants and mid-cap stocks, with semiconductors being the only sector showing both strong volume and price. The automotive, industrial, and financial sectors also showed strong gains. The yield on the 10-year US Treasury fell by 0.255% to close at 3.913%, with a spread of -54 basis points compared to the 2-year Treasury yield. This indicates an inverted yield curve, which is often a sign of an impending economic recession. The VIX panic index fell by 1.6%, and Brent crude oil rose by 0.33%. Spot gold has been on a continuous decline since May 2023, with a slight rebound since October 5th, 2023. Last Friday, it fell by 0.83% to $2019.4 per ounce. The US dollar index has been steadily declining from its high in October 2022, with a slight rebound. Last Friday, it rose by 0.63% to 102.59.

In Hong Kong, the Hang Seng Index led the gains, rising by 2.8% for the week. The Hang Seng Tech Index, Hang Seng China Enterprises Index, and MSCI China Index rose by 2.0%, 1.8%, and 1.6% respectively. In terms of sectors, real estate and information technology led the gains, rising by 5.0% and 3.4% respectively for the week, while transportation and consumer staples were the top decliners, falling by 1.2% and 1.0% respectively.

This week, the focus will be on major central banks and economic data globally. Specifically:

- The Bank of Japan will hold a policy meeting and press conference on Tuesday. The market expects the Bank of Japan to maintain interest rates but may lower economic and inflation expectations.

- The US will release economic data including November personal consumption expenditures and the core PCE price index. These data will reflect consumer confidence, spending, and inflation pressure in the US, which will have a significant impact on the Federal Reserve's monetary policy.

- In China, the People's Bank of China will announce the LPR quotation for November. This is an important rate after the PBOC's interest rate marketization reform. It is widely expected that the PBOC will maintain a stable LPR quotation and continue to implement a prudent monetary policy. In addition, Baidu will hold the 2023 Cloud Intelligence Conference to showcase its latest achievements and development direction in the field of artificial intelligence.

- In A-shares, the Shanghai Composite Index fell by 0.9% and fell below the integer mark once again. In terms of trading volume, investor sentiment continues to cool, with average daily turnover falling to around 800 billion yuan. Northbound funds continued to see net outflows, with a net outflow of about 18.6 billion yuan for the week. In terms of industry performance, the media, retail, and textile and apparel sectors performed well, while the food and beverage, power equipment, and non-ferrous metals sectors performed poorly.

The Red Sea merchant ships have been frequently attacked, and the conflict between Israel and Palestine has spilled over to international shipping. Recently, several international shipping companies have announced the suspension of navigation in the Red Sea due to attacks by Houthi forces in Yemen. Since the outbreak of the new round of conflict between Israel and Palestine, Houthi forces have frequently launched missile and drone attacks against Israel under the pretext of "supporting Palestine" and have attacked ships "associated with Israel" in the Red Sea. The tense situation in the Red Sea implies an increased risk of spillover from the Israel-Palestine conflict, which has affected international shipping.

As the conflict escalates, the four major shipping giants have suspended transportation in the Red Sea. Some analysts have pointed out that there is a risk of the closure of the Suez Canal, a major artery of shipping. Short-term freight rates for ships passing through the Suez Canal may soar, and alternative routes will increase global trade costs and delays.

In addition, Federal Reserve officials have stated that the possibility of a rate cut is not currently under discussion. Some believe it is too early to consider a rate cut in March next year. The Fed has instructed staff to begin formulating possible principles and thresholds for a rate cut, with expectations of two 25 basis point rate cuts in 2024, possibly in the third quarter, contingent on the progress of inflation expectations. Some officials do not rule out the possibility of a rate cut at the March meeting next year. European Central Bank policymakers do not expect any changes to the information on stable rates before the March meeting next year, indicating that a rate cut before June will be difficult.

X. Future Market Analysis:

In the hourly chart of BTC, since the decline last Monday, it has been oscillating around $40,000-$43,000, as predicted. After rebounding three times to around $43,365-$43,475, it has fallen back. It is currently running below the downward trend line since $44,700. It has broken the upward trend line since the low of $40,200, indicating a bearish short-term trend. The short-term resistance is around $41,800, and the extended position of the downward trend line is around $42,585. Without a breakthrough, it will continue to operate in a bearish manner and may continue to test the $40,200-$40,400 area. If it breaks the downward trend line, it may strengthen and test the higher resistance near $43,475. The future trend will depend on which direction the $40,200-$43,475 range breaks, and it's important to follow the trend accordingly.

Last week, the announcement of no rate hike by the Federal Reserve and the dovish stance of Chairman Powell had a significant impact, leading to increased market expectations of a rate cut by the Fed. Interest rate futures linked to the Fed's interest rate meeting show that the market is pricing in six rate cuts by the Fed by the end of next year, totaling 150 basis points. These changes in market sentiment led to a significant overnight decline in the US dollar, resulting in significant gains for assets priced in dollars, including the cryptocurrency market. After the expiration of options on Friday, the market saw a decline again.

From a daily perspective, last week was a week of oscillation and adjustment. The strong support below still refers to the upward trend line, which has now moved up to around $37,900 and will gradually move up to around $38,400 over time. A comprehensive judgment will be made based on the contact position of future candlesticks and trend lines.

Follow us: Old Li's Mortar

DC Research Institute

December 18, 2023

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。