When the times abandon you, they really won't say goodbye.

Source: 硅兔赛跑

Author | Eric Editor | 蔓蔓周

Image Source: Generated by 无界 AI

Some people may still remember the disruptive scene brought by GPT-4 released by OpenAI in March this year. At that time, the Chicago-Kent College of Law at the Illinois Institute of Technology in the United States stated that GPT-4 had passed the U.S. bar exam and ranked higher than 90% of the candidates.

This has caused many legal professionals to worry about whether AI will take away their jobs. What's even more worrying for many senior professionals is that the previous generation model GPT-3.5's performance in the exam was in the bottom 10%, which means that AI's capabilities are evolving very quickly, and their own competitive barriers may be easily broken by AI.

Just as many people were worried, capital had already entered the game.

Harvey is a startup that has only been established for 1 year, mainly selling AI-driven legal software.

According to Information, Harvey is in negotiations for financing, expecting to raise between 70 to 80 million US dollars, with a valuation of 700 million US dollars (about 5 billion RMB), more than 4 times the valuation announced in April this year. Leading this round of financing are venture capital firms Kleiner Perkins and Elad Gil, with other investors including Sequoia Capital and OpenAI Startup Fund.

In addition to Harvey, the financing of many "AI legal" startups is accelerating, indicating that capital continues to be optimistic about the "AI + legal" track. Will this trend really impact the positions of legal professionals?

8 months, valuation quadrupled

In 2022, Gabe Pereyra, a former artificial intelligence researcher at Meta Platforms, and Winston Weinberg, a former lawyer at O'Melveny & Myers, founded Harvey, dedicated to solving the huge workload faced by lawyers.

Specifically, Harvey's AI product is a large model customized for legal professionals, which can help lawyers analyze contracts, conduct due diligence, and generate recommendations based on data.

Therefore, when faced with various tedious tasks, lawyers can solve problems faster through Harvey, while providing more cost-effective solutions to clients, and they can also free themselves from tedious work and focus on areas such as maintaining client relationships that machines cannot replace.

In other words, Harvey is like providing lawyers with a more efficient assistant or intern.

So, what does capital see in Harvey? Naturally, it's the ability to make money.

Image Source: Harvey AI

Industry insiders have stated that Harvey's Annual Recurring Revenue (ARR) has jumped from 1 to 2 million US dollars in April this year to about 10 million US dollars in December. Considering the latest valuation of 700 million US dollars from the latest round of financing, Harvey's ARR valuation multiple is about 70. In comparison, OpenAI's new valuation reached 86 billion US dollars, with a valuation multiple of 66, indicating that capital has high expectations for Harvey.

In fact, Harvey has deep ties with OpenAI. Shortly after its founding, Harvey quickly received investment from OpenAI, becoming the fourth project supported by OpenAI. OpenAI founder Sam Altman also mentioned his expectations for the application of GPT-4 in legal scenarios in an interview.

Behind Harvey's rapid growth in revenue and valuation is mainly due to the creation of a large number of customers, including many well-known large enterprises, which creates huge potential for the future, something that capital is particularly interested in.

Management guru Drucker once said that the only purpose of a business is to create customers. Because customers are the fundamental driving force and source of a business's existence. Without customers, a business cannot survive and develop.

In February this year, Harvey signed its first corporate client, Allen & Overy, the seventh largest law firm in the world, with all 3,500 lawyers under its umbrella using Harvey's AI products. Then in April, PricewaterhouseCoopers became Harvey's second corporate client, with all 4,000 lawyers under its umbrella using Harvey's AI products.

In the first half of this year, Sequoia stated on its official blog that 15,000 law firms are in line to use Harvey's AI products, indicating Harvey's extremely high popularity.

Furthermore, Harvey does not just provide products and services to its clients, but has formed deeper cooperation with them, raising the expectations of capital once again.

In October, PricewaterhouseCoopers announced a strategic alliance with OpenAI and Harvey. This strategic alliance will use OpenAI's base models, Harvey's expertise in developing models for specific fields, and PricewaterhouseCoopers' deep industry knowledge to provide more diverse and personalized products and services for tax, legal, and human resources professionals.

As Harvey's reach in the legal industry continues to expand, it is expected that investment institutions will continue to pour capital into it.

Capital influx into the "AI + legal" track

In addition to Harvey, a considerable number of "AI + legal" companies are favored by capital.

In June this year, media giant Thomson Reuters acquired AI legal company Casetext for 650 million US dollars, making it one of the largest AI acquisitions this year. Casetext has been dedicated to the legal market for ten years, and later expanded into the AI field.

In September, AI legal research platform Paxton AI, which is dedicated to providing functions such as automatic document summarization and drafting, announced the completion of its seed round financing, with a financing scale of 6 million US dollars; in the same month, legal tech company Darrow announced the completion of a Series B financing of 35 million US dollars.

Among many financing cases, one of the most eye-catching companies is EvenUp, because like Harvey, its rise is quite impressive.

Image Source: Facebook

In April this year, top Silicon Valley VC BVP led EvenUp's Series B financing with a valuation of 350 million US dollars, with Bain Capital participating in a portion. In the first quarter of this year, EvenUp's ARR was approximately 8.9 million US dollars, compared to last year's 1.7 million US dollars ARR, its revenue has grown at a rate of more than 5 times.

With a valuation of 350 million US dollars, it is nearly 40 times EvenUp's ARR, and its growth rate is comparable to Harvey's, having more than quadrupled from the 80 million US dollars valuation over a year ago.

According to The Information, EvenUp's Series B financing has attracted many VCs to compete, including Lightspeed Venture Partners, Insight Partners, Sapphire Ventures, and others, showing that capital is very interested in it.

EvenUp was founded in 2019, just four years ago. Its team has a very strong industry background, with its founder and CEO Rami Karabibar having worked at companies such as Bain & Company, and the other two co-founders, Raymond Mieszaniec and Saam Mashhad, also having experience in consulting and the legal industry. Its technical team members mainly come from Waymo, Affirm, Amazon, Uber, and its legal team members come from Norton Rose.

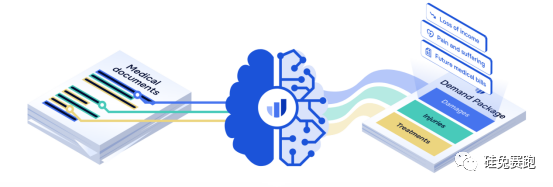

From a business perspective, EvenUp mainly focuses on the field of Personal Injury Claims, which in simple terms, uses AI to help lawyers with claims. For example, with EvenUp's AI product, lawyers only need to upload the plaintiff's information, and EvenUp's AI product will automatically generate a complete report, detailing loss details, injury details, and more.

In other words, a significant portion of the previously tedious claims work can now be completed by AI, greatly reducing the workload of lawyers.

Like Harvey, the rapid growth in revenue and valuation behind EvenUp also comes from the favor of obtaining a large number of customers. According to data released on its official website, EvenUp's products generate over 1,000 demand documents each month, and it has over 200 law firm clients using its products.

The market is determined by customers. At the same time, the market is a dynamic system, with customer needs and preferences constantly changing. Companies must continuously adapt to market changes, innovate, and improve products and services in order to achieve sustained growth and profitability in the market.

Although Harvey and EvenUp focus on different areas of "AI + legal," they have both gained customer recognition and achieved sustained rapid growth, earning the favor of capital.

AI, the natural assistant of law

This year, the AI industry has sparked a capital frenzy.

According to Crunchbase data, over a quarter of investments in U.S. startups this year have gone to AI-related companies. One important reason why AI can attract so much capital is its ability to combine with many industries, such as AI + biotech, AI + legal, AI + finance, and more. PricewaterhouseCoopers predicts that by 2030, AI will contribute $15.7 trillion to the global economy.

Among these, AI and law are naturally compatible.

Firstly, the legal industry has a very low tolerance for errors and requires very high standards for data processing. The reputation of some well-known law firms is built on not making mistakes when dealing with complex and critical issues, thereby gaining the trust of customers and establishing a good reputation over the long term. AI's efficient data processing and precise algorithms can meet this requirement.

Secondly, there is a large amount of repetitive document work in the work of legal professionals such as lawyers, including the processing of contracts, litigation documents, and other files, all of which can be handled by AI. At the same time, the strong knowledge and logic required in legal work are also suitable for AI large models to continuously learn and then quickly output answers, achieving cost reduction and efficiency improvement.

From 2000 to the present, the legal industry has already experienced three waves of technological waves, and many have tried to popularize AI throughout the industry, but in the past, AI did not develop to the level of maturity it has now, making it difficult to popularize and apply.

Today, the new generation of AI has much higher logical capabilities, able to quickly process unstructured information in the legal industry, allowing AI to make significant breakthroughs in some legal areas and better automate related issues.

It is not an exaggeration to say that at this stage, AI can already handle the work of a legal assistant. More and more lawyers have moved from watching to getting involved. In 2019, 56% of large enterprises believed that AI would become the backbone of the industry. Today, 51% of lawyers are already using AI.

By 2030, the global legal services market is expected to exceed a trillion dollars, with an annual growth rate of over 6%. Behind this, AI will play a huge driving force. At the same time, some basic legal positions are very likely to be replaced by AI.

When the times abandon you, they really won't say goodbye.

References:

- Legal AI Startup Harvey Valued at $700 Million in Round Co-Led By Kleiner (The Information)

- Elad Gil Leads Harvey's New Round of Financing, Valued at 700 Million US Dollars, with Sequoia USA and OpenAI (ForesightNews)

- AI is Reinventing the Legal Industry (NFX)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。